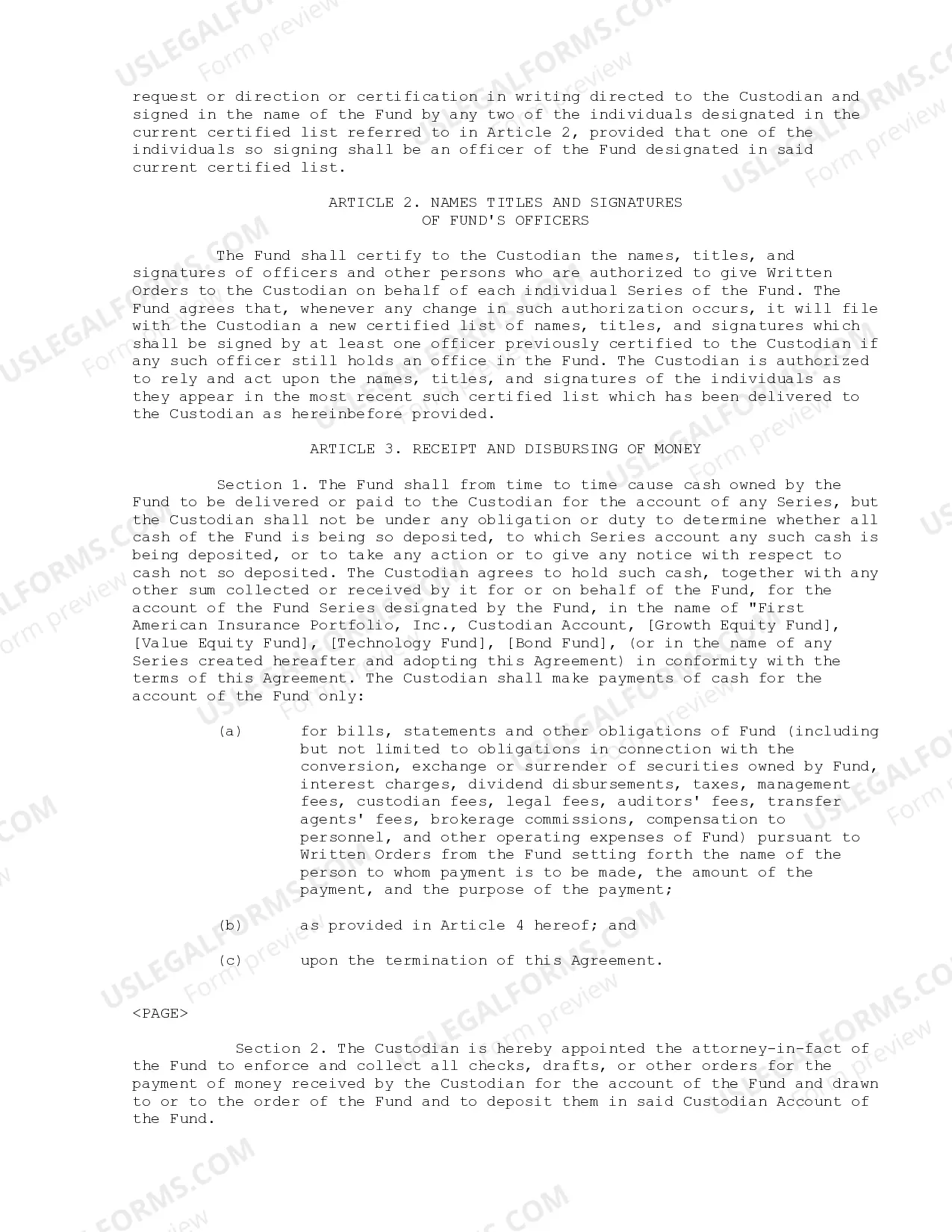

Washington Custodian Agreement typically refers to a legal contract entered into between a custodian and a third party entity, commonly a financial institution or a trust company, outlining the terms and condition of custodian services provided. This agreement establishes the rights and obligations of both parties involved in the safekeeping and management of assets held by the custodian. The Washington Custodian Agreement encompasses various details pertaining to the responsibilities of the custodian, the scope of services provided, compensation, termination clauses, and potential liability limitations. This agreement is essential for investors, businesses, and individuals seeking professional asset protection and management services. Some key components of a Washington Custodian Agreement may include: 1. Types of Assets: The agreement specifies the types of assets that the custodian will hold on behalf of the client. These may include securities (stocks, bonds, etc.), cash, certificates of deposit (CDs), mutual funds, or other financial instruments. 2. Custodian's Responsibilities: The agreement outlines the specific duties and obligations of the custodian, such as safekeeping the assets, processing transactions, managing income and dividends, and providing regular reports and statements to the client. 3. Fee Structure: The custodian agreement specifies the fees and charges for the services rendered, including custody fees, transaction fees, and any additional charges for specialized services like asset valuation or tax reporting. 4. Rights and Restrictions: The agreement details the client's rights, such as the ability to give instructions regarding the assets held in custody and access to account information. It also highlights any limitations imposed by the custodian, including restrictions on investments or potential conflicts of interest. 5. Termination Clause: This clause outlines the conditions under which either party can terminate the custodian agreement. It may include notice periods, agreement termination fees, or any other relevant provisions. Washington Custodian Agreements can vary depending on the specific circumstances and preferences of the parties involved. For instance, there may be distinct agreements designed for retirement accounts (e.g., Individual Retirement Accounts or 401(k) plans), custody accounts for minors, or specialized custodial services for institutional investors. In summary, a Washington Custodian Agreement is a legally binding contract that establishes the framework for the relationship between a custodian and a client, ensuring the safekeeping and management of assets. It is crucial to carefully review and understand all the terms and conditions outlined in the agreement before entering into a custodian-client relationship.

Washington Custodian Agreement

Description

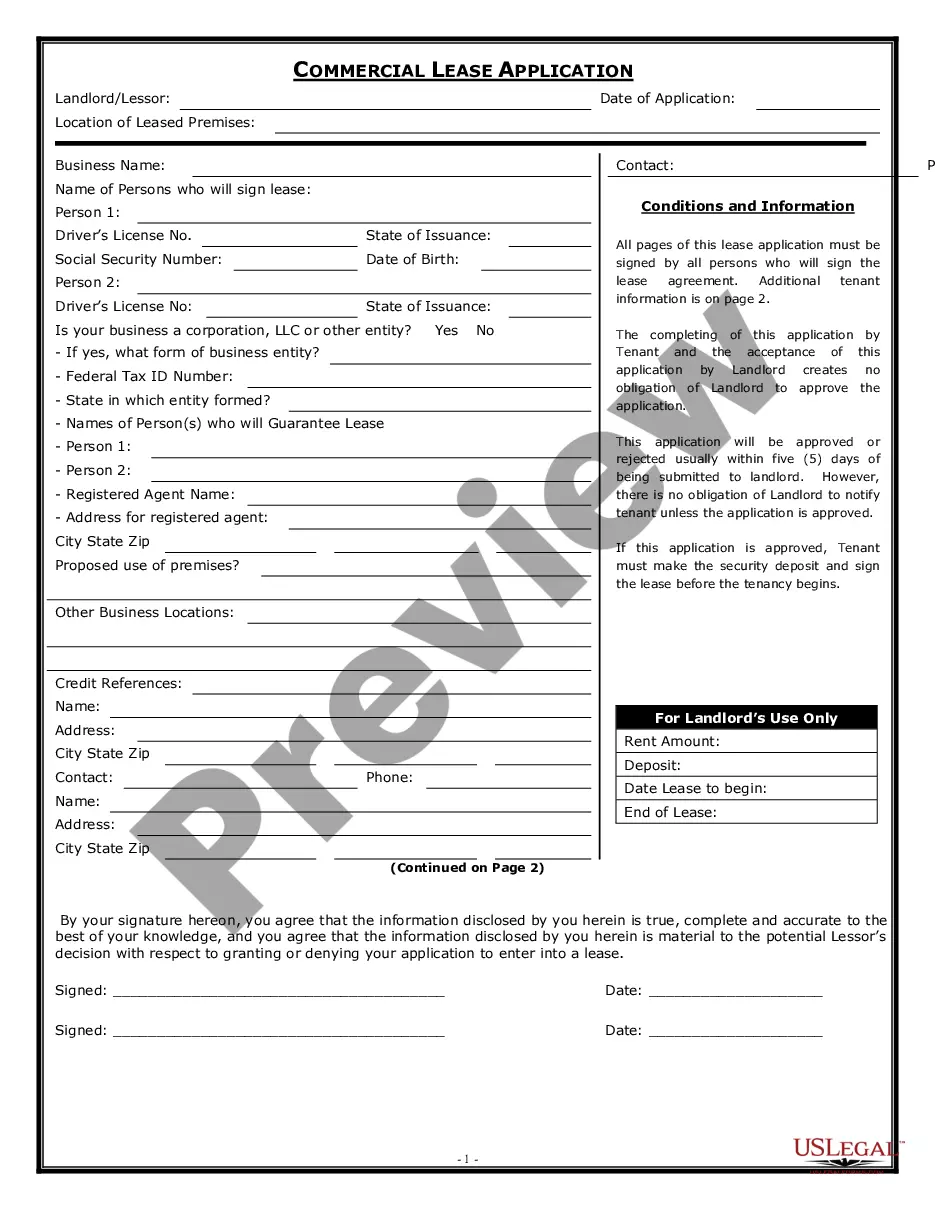

How to fill out Washington Custodian Agreement?

Discovering the right lawful record web template can be a struggle. Obviously, there are tons of layouts available on the Internet, but how would you get the lawful develop you want? Make use of the US Legal Forms internet site. The service gives thousands of layouts, for example the Washington Custodian Agreement, that can be used for company and private demands. All the types are checked out by experts and meet federal and state specifications.

If you are currently listed, log in for your account and click on the Down load option to have the Washington Custodian Agreement. Use your account to look with the lawful types you have purchased in the past. Visit the My Forms tab of the account and obtain an additional backup of the record you want.

If you are a fresh consumer of US Legal Forms, allow me to share simple directions that you can adhere to:

- Very first, be sure you have selected the appropriate develop for your personal city/area. You may check out the shape utilizing the Preview option and look at the shape explanation to guarantee it is the right one for you.

- In the event the develop fails to meet your expectations, use the Seach field to get the correct develop.

- When you are positive that the shape is proper, click on the Acquire now option to have the develop.

- Select the pricing strategy you desire and type in the needed information and facts. Build your account and pay for an order utilizing your PayPal account or charge card.

- Opt for the file formatting and down load the lawful record web template for your gadget.

- Complete, change and print out and signal the attained Washington Custodian Agreement.

US Legal Forms will be the biggest local library of lawful types in which you will find various record layouts. Make use of the service to down load professionally-manufactured paperwork that adhere to express specifications.