Washington Borrower Security Agreement regarding the extension of credit facilities

Description

How to fill out Borrower Security Agreement Regarding The Extension Of Credit Facilities?

If you have to total, acquire, or print out legitimate record templates, use US Legal Forms, the largest selection of legitimate kinds, that can be found on-line. Utilize the site`s simple and easy practical research to discover the papers you want. A variety of templates for organization and person reasons are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to discover the Washington Borrower Security Agreement regarding the extension of credit facilities with a few click throughs.

When you are currently a US Legal Forms client, log in for your account and then click the Download key to find the Washington Borrower Security Agreement regarding the extension of credit facilities. You can even access kinds you formerly saved inside the My Forms tab of the account.

Should you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Make sure you have selected the form for the correct town/region.

- Step 2. Use the Preview option to check out the form`s information. Do not forget about to read the description.

- Step 3. When you are unsatisfied using the develop, make use of the Search discipline on top of the display to get other versions of the legitimate develop template.

- Step 4. When you have discovered the form you want, go through the Acquire now key. Pick the prices plan you like and put your references to sign up to have an account.

- Step 5. Procedure the financial transaction. You can use your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Pick the structure of the legitimate develop and acquire it in your device.

- Step 7. Total, change and print out or indicator the Washington Borrower Security Agreement regarding the extension of credit facilities.

Every legitimate record template you buy is the one you have for a long time. You may have acces to every single develop you saved within your acccount. Select the My Forms segment and pick a develop to print out or acquire again.

Remain competitive and acquire, and print out the Washington Borrower Security Agreement regarding the extension of credit facilities with US Legal Forms. There are thousands of professional and state-certain kinds you can utilize for your personal organization or person needs.

Form popularity

FAQ

Seller financing (a.k.a. ?Seller Carryback?) is often used in residential and commercial real estate transactions. It is an extension of credit offered by the seller to help assist the buyer with paying the purchase price of the real estate being sold. A seller may carry all or a portion of the purchase price.

However, the do-it-yourself approach is perfectly acceptable and just as legally enforceable. Once you have both agreed on the terms, you may want to have the personal loan contract notarized or ask a third party to act as a witness during the signing.

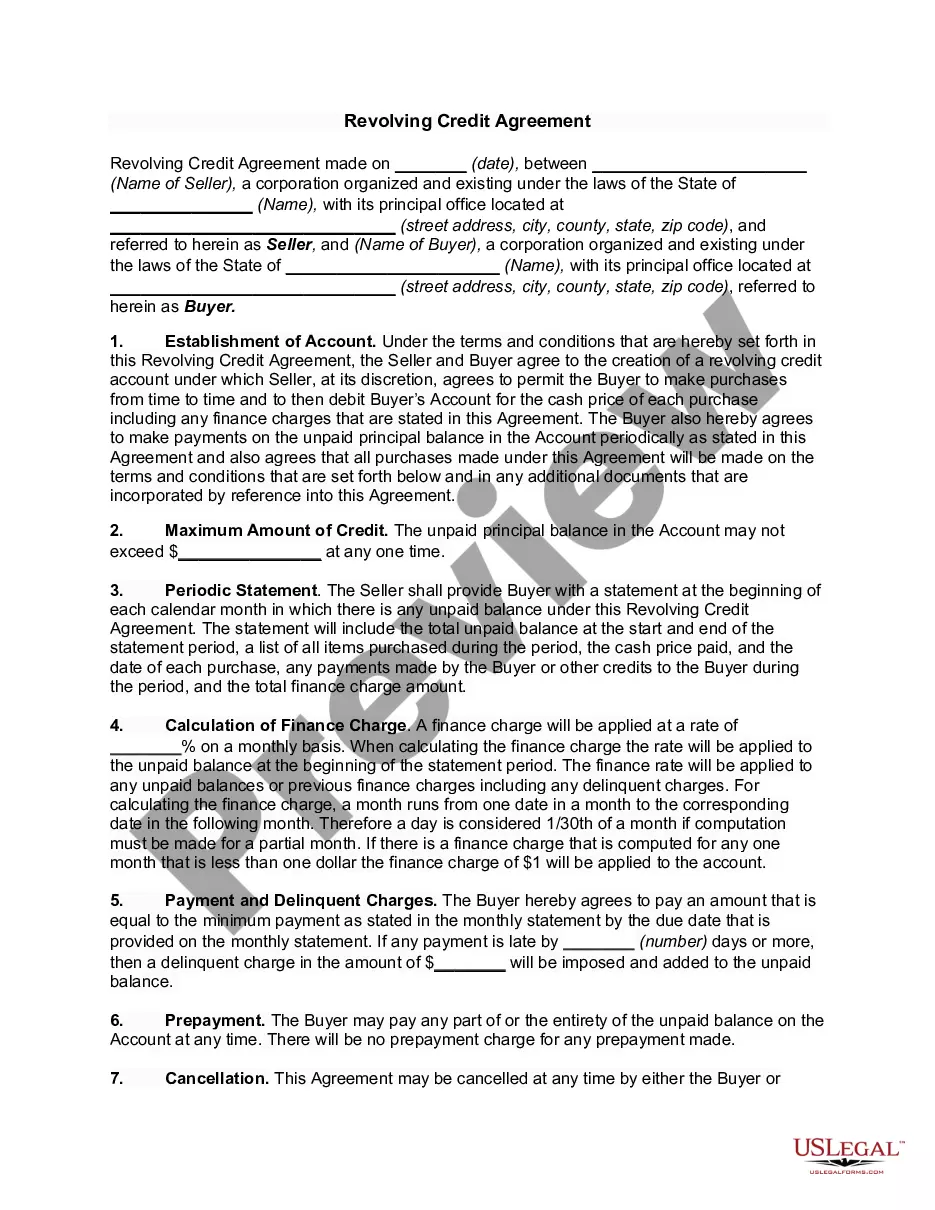

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

The purpose for which funds may be used. Loan funding mechanics, and applicable interest. Repayment obligations. Representations, warranties and undertakings.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

A loan extension agreement is a mutual agreement between a lender and borrower that extends the maturity date on a borrower's loan. Most commonly used when a borrower falls behind on payments, a loan extension agreement can restructure the loan payment schedule to get the borrower back on track.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.