Washington Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan: The Washington Retirement Plan Transfer Agreement is an essential document that facilitates the transfer of retirement plan assets for employees of Motorola, Inc. who are based in Washington state. This agreement ensures the smooth transition of retirement benefits from one plan to another, allowing employees to continue building their financial security during their retirement years. The Motorola, Inc. Pension Plan offers various types of retirement plans, each designed to meet the specific needs and preferences of employees. It is crucial to understand these distinct plan options when considering a transfer agreement. The different types of Washington Retirement Plan Transfer Agreements for the Motorola, Inc. Pension Plan include: 1. Defined Contribution Plan Transfer Agreement: This agreement ensures the transfer of assets from one defined contribution plan to another. Employees who have been contributing to a defined contribution plan can choose to transfer their retirement savings into a Washington-based plan for various reasons, such as better investment options, lower fees, or improved plan administration. 2. Defined Benefit Plan Transfer Agreement: This agreement governs the transfer of retirement benefits from a defined benefit plan to another. If an employee prefers to move their pension assets from the Motorola, Inc. Pension Plan to a different defined benefit plan within Washington, this agreement outlines the terms and conditions for such a transfer. It typically addresses the calculation and preservation of accrued benefits and ensures a seamless transition of pension funds. 3. 401(k) Plan Transfer Agreement: This agreement pertains to the transfer of funds from a 401(k) plan affiliated with Motorola, Inc. to another 401(k) plan within the state of Washington. Employees may choose to transfer their 401(k) funds to take advantage of better investment options, lower fees, or improved plan features, ensuring their retirement savings continue to grow in a plan that aligns with their needs. 4. Individual Retirement Account (IRA) Transfer Agreement: Motorola, Inc. employees may also consider transferring their pension assets into an Individual Retirement Account (IRA) within Washington state. This agreement outlines the transfer process, ensuring a smooth movement of funds from the Motorola, Inc. Pension Plan to an IRA, which provides increased flexibility and control over investment decisions during retirement. In summary, the Washington Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan enables employees to move their retirement funds from one plan to another within the state of Washington. Whether it is a defined contribution plan, defined benefit plan, 401(k) plan, or an Individual Retirement Account (IRA), each agreement provides clear guidelines on the transfer process, ensuring employees can make informed decisions to secure their financial future.

Washington Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan

Description

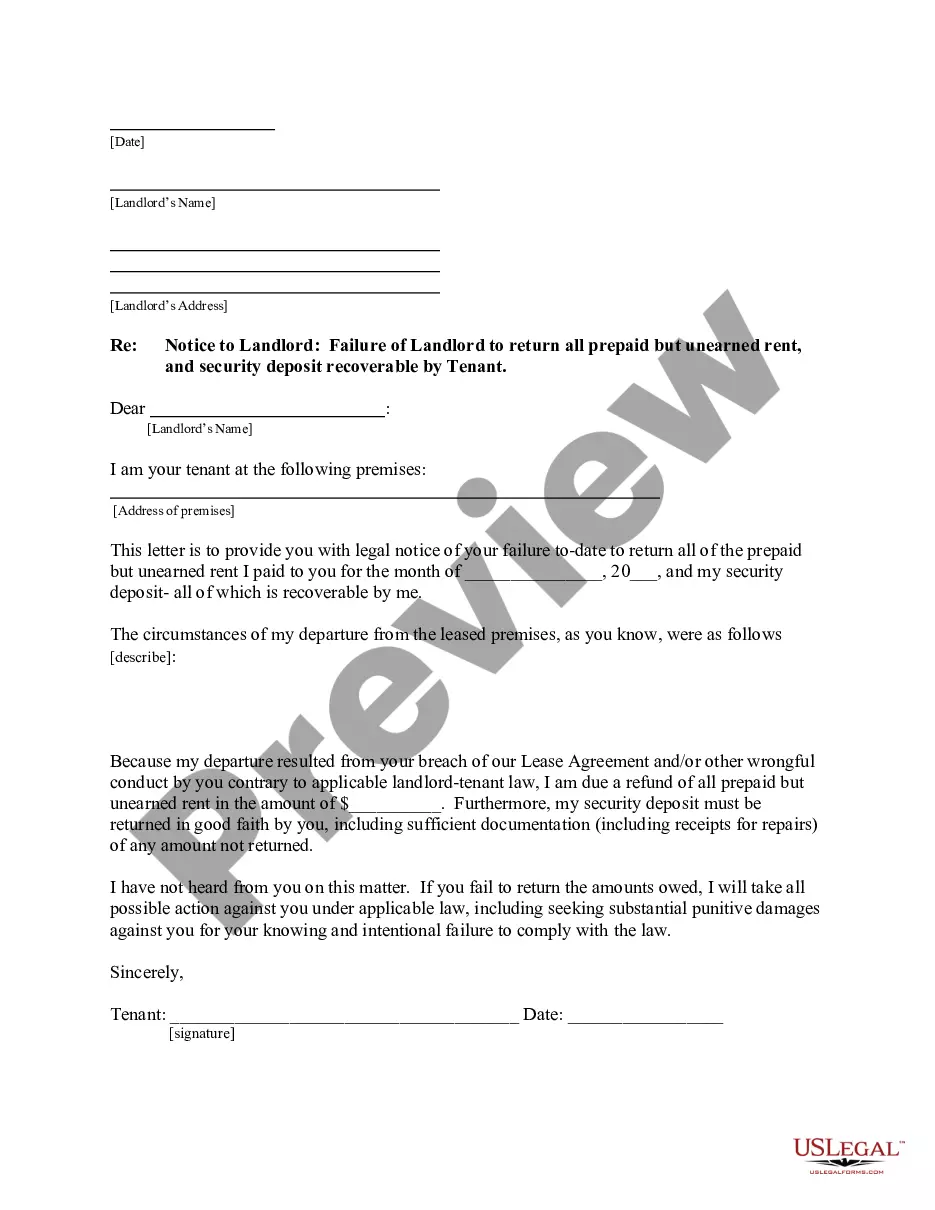

How to fill out Washington Retirement Plan Transfer Agreement For The Motorola, Inc. Pension Plan?

Choosing the best authorized file design can be quite a have a problem. Naturally, there are plenty of themes available on the net, but how do you find the authorized type you want? Use the US Legal Forms site. The support offers a huge number of themes, like the Washington Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan, that can be used for business and private requirements. Every one of the varieties are checked out by professionals and meet up with federal and state demands.

Should you be already registered, log in to the account and then click the Acquire key to get the Washington Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan. Utilize your account to check throughout the authorized varieties you possess acquired formerly. Proceed to the My Forms tab of your account and acquire another copy from the file you want.

Should you be a brand new consumer of US Legal Forms, listed below are straightforward instructions for you to comply with:

- Initially, make sure you have selected the appropriate type for the town/county. You are able to examine the shape making use of the Review key and browse the shape outline to make sure it will be the best for you.

- When the type is not going to meet up with your needs, make use of the Seach field to discover the appropriate type.

- Once you are certain the shape would work, select the Buy now key to get the type.

- Select the rates prepare you would like and enter in the necessary info. Design your account and buy your order using your PayPal account or bank card.

- Choose the document format and acquire the authorized file design to the product.

- Complete, edit and produce and indicator the received Washington Retirement Plan Transfer Agreement for the Motorola, Inc. Pension Plan.

US Legal Forms is definitely the most significant collection of authorized varieties where you can find different file themes. Use the company to acquire skillfully-produced files that comply with condition demands.

Form popularity

FAQ

If you leave the Plan before Normal Retirement Date you will have the option to leave the accumulated fund in the Motorola Pension Plan or transfer to an alternative pension arrangement. If you leave the Company you cannot continue to contribute to the Motorola Pension Builder.

You can transfer your pension fund to another pension scheme ? generally any time up to one year before the date when you are expected to start drawing retirement benefits. In some cases, it's also possible to transfer to a new pension provider after you've started to draw retirement benefits.

One popular method of transferring pension risk is for the pension plan providing institution to purchase annuities. Group annuities can be purchased from life insurance companies that offer pension annuity products. By purchasing annuities, the institution is transferring the pension risk to the insurance company.

Information: Most pensions can be transferred without exit penalties or charges, but it's important that you find out if any charges and penalties could be applied to your pension on transfer. Some charges are only applied to transfers early in the life of the pension scheme.

These days, it's a relatively simple process, although there are a few pension transfer rules you'll need to know. As your pension savings are invested, you'll need to sell the investments in your pension fund and turn your pot into cash.

There are two ways to move your old plan's balance to a new plan or to an IRA. You can: ask the old plan's trustee to directly transfer the balance to your new plan or an IRA, or. request a lump-sum distribution of the balance from the old plan and then deposit it into the new plan or IRA within 60 days.