The Washington Amendment to Trust Agreement is a legal document that outlines and governs the terms and conditions between Polaris Industries, Inc. and Fidelity Management Trust Company. This agreement serves as a modification or addition to an existing trust agreement and is specific to the state of Washington. The Washington Amendment to Trust Agreement solidifies the partnership between Polaris Industries, Inc., a renowned manufacturer of power sports vehicles, and Fidelity Management Trust Company, a reputable financial institution. This agreement demonstrates the parties' commitment to abide by the laws and regulations imposed by the state of Washington. Some key aspects that the Washington Amendment to Trust Agreement might cover include: 1. Trust Amendment: The primary purpose of this agreement is to make changes to an existing trust agreement between Polaris Industries, Inc. and Fidelity Management Trust Company. It outlines the specific modifications that are to be made, such as adding or removing trustees, adjusting the distribution terms, or amending investment strategies. 2. Fiduciary Duties: The Washington Amendment emphasizes the fiduciary responsibilities of the involved parties. This refers to the duty to act in the best interests of the trust's beneficiaries and exercise due diligence when making financial decisions. 3. Distribution of Assets: The agreement may define the rules and procedures for distributing assets held within the trust. It may specify how and when distributions should occur and the factors that should be considered in determining the amounts. 4. Investment Guidelines: The Washington Amendment to Trust Agreement could include provisions regarding the investment strategies to be followed. It may outline the types of investments that are permitted or restricted, risk tolerance levels, and performance evaluation criteria. 5. Reporting and Accounting: The agreement may require Fidelity Management Trust Company to provide regular reports to Polaris Industries, Inc., detailing the financial status of the trust and any transactions made. This ensures transparency and accountability between the parties. It's important to note that the specific types of Washington Amendments to Trust Agreement can vary depending on the specific circumstances and needs of Polaris Industries, Inc. and Fidelity Management Trust Company. Therefore, other types or variations of this agreement may exist based on the parties' preferences and goals. Overall, the Washington Amendment to Trust Agreement strengthens the partnership between Polaris Industries, Inc. and Fidelity Management Trust Company within the state of Washington, providing a framework for trust management, investment strategies, and distribution guidelines.

Washington Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company

Description

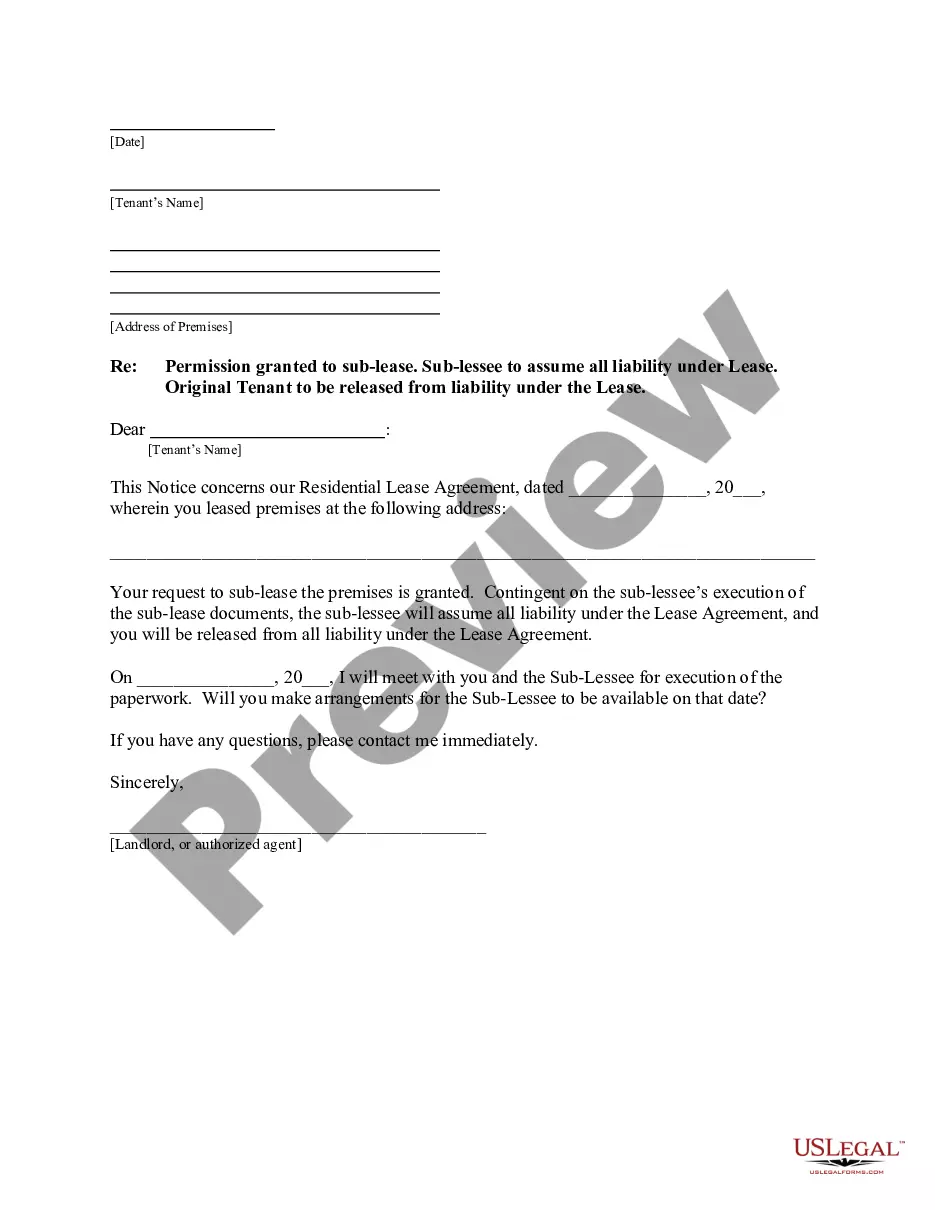

How to fill out Washington Amendment To Trust Agreement Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Company?

You may invest several hours on the Internet looking for the legal record design that suits the state and federal needs you will need. US Legal Forms gives 1000s of legal types that happen to be analyzed by experts. You can easily obtain or print out the Washington Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company from the services.

If you currently have a US Legal Forms accounts, you can log in and click the Obtain switch. After that, you can comprehensive, edit, print out, or signal the Washington Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company. Each and every legal record design you get is your own forever. To have one more duplicate associated with a obtained develop, proceed to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms website the first time, adhere to the basic recommendations below:

- First, ensure that you have chosen the correct record design to the state/metropolis of your choosing. See the develop explanation to make sure you have picked the correct develop. If available, make use of the Preview switch to look through the record design too.

- In order to discover one more edition from the develop, make use of the Search area to get the design that suits you and needs.

- After you have located the design you would like, just click Get now to carry on.

- Select the prices plan you would like, key in your references, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You may use your bank card or PayPal accounts to purchase the legal develop.

- Select the structure from the record and obtain it in your device.

- Make alterations in your record if needed. You may comprehensive, edit and signal and print out Washington Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company.

Obtain and print out 1000s of record layouts while using US Legal Forms Internet site, which offers the most important collection of legal types. Use skilled and state-specific layouts to tackle your company or individual demands.