The Washington Stock Option Agreement between Northern Bank of Commerce and Cowling Ban corporation is a legally binding contract that outlines the terms and conditions regarding stock options granted by the Northern Bank of Commerce to Cowling Ban corporation. This agreement is crucial for facilitating the potential acquisition or merger between the two entities. Under this agreement, both parties agree to the terms and provisions related to the issuance, exercise, and termination of stock options. These stock options grant Cowling Ban corporation the right, but not the obligation, to purchase a specific number of shares of Northern Bank of Commerce stock at a predetermined price, within a specified time period. The primary purpose of this agreement is to provide Cowling Ban corporation with the opportunity to acquire a substantial ownership interest in Northern Bank of Commerce. This is often seen as an attractive incentive for Cowling Ban corporation as it allows them to align their interests with the future success and profitability of Northern Bank of Commerce. In addition to the general terms common to most stock option agreements, there might be different types of Washington Stock Option Agreements between Northern Bank of Commerce and Cowling Ban corporation, depending on the specific objectives and circumstances of the transaction. These types could include: 1. Incentive Stock Options (SOS): These are stock options that are granted with certain tax advantages to the option holder. They must meet specific criteria outlined by the Internal Revenue Service (IRS) to qualify as SOS. 2. Non-Qualified Stock Options (Nests): Unlike SOS, Nests do not offer the same tax advantages. However, they provide more flexibility in terms of eligibility and are often easier to administer. 3. Performance-Based Stock Options: This type of agreement provides stock options to Cowling Ban corporation based on achieving predetermined performance metrics or goals. For example, if Northern Bank of Commerce reaches a certain level of profitability or successfully completes certain strategic objectives, Cowling Ban corporation may be granted additional stock options. 4. Vesting Schedule: This type of agreement includes a vesting schedule that outlines the timeframe over which the granted stock options become exercisable. It may include specific milestones or time-based requirements that Cowling Ban corporation must meet before exercising their stock options. 5. Acceleration Clause: In certain circumstances, such as the occurrence of a change in control or merger, this clause allows for the immediate vesting or exercise of stock options, providing Cowling Ban corporation with potentially favorable financial opportunities. It is essential for both Northern Bank of Commerce and Cowling Ban corporation to seek legal advice and carefully review the specific terms and conditions within the Washington Stock Option Agreement to ensure compliance with relevant laws and regulations before entering into this agreement.

Washington Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation

Description

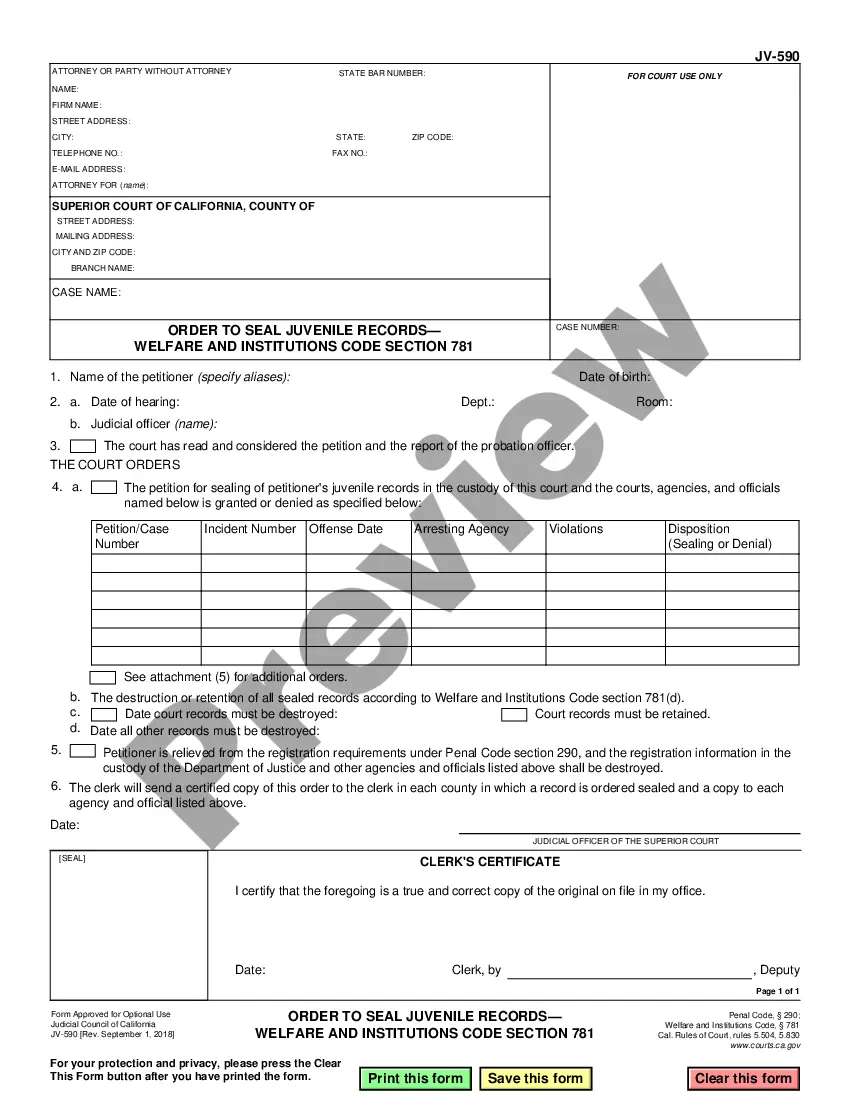

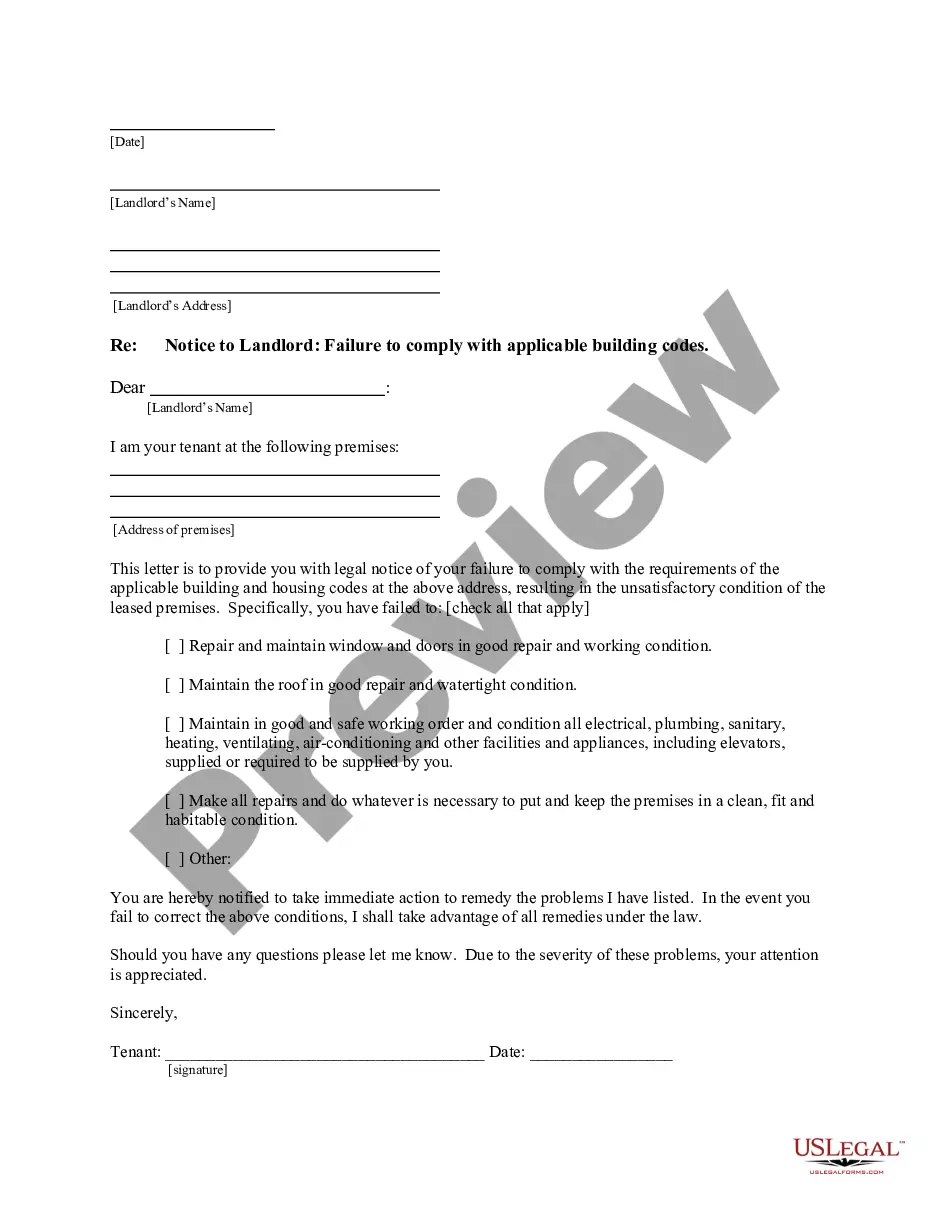

How to fill out Washington Stock Option Agreement Between Northern Bank Of Commerce And Cowlitz Bancorporation?

If you want to comprehensive, down load, or produce legal document templates, use US Legal Forms, the most important assortment of legal kinds, that can be found online. Utilize the site`s easy and handy search to find the documents you will need. A variety of templates for enterprise and specific functions are sorted by types and states, or keywords and phrases. Use US Legal Forms to find the Washington Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation within a handful of mouse clicks.

Should you be currently a US Legal Forms consumer, log in to the profile and click on the Down load option to get the Washington Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation. You can even entry kinds you earlier saved within the My Forms tab of the profile.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have chosen the form to the proper area/land.

- Step 2. Make use of the Preview solution to check out the form`s articles. Never neglect to read the explanation.

- Step 3. Should you be unsatisfied together with the type, use the Look for industry near the top of the screen to get other types of your legal type format.

- Step 4. After you have identified the form you will need, select the Purchase now option. Opt for the costs plan you like and include your accreditations to register to have an profile.

- Step 5. Method the transaction. You should use your Мisa or Ьastercard or PayPal profile to perform the transaction.

- Step 6. Find the file format of your legal type and down load it in your gadget.

- Step 7. Full, change and produce or indication the Washington Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation.

Each legal document format you buy is the one you have permanently. You have acces to every single type you saved within your acccount. Click on the My Forms area and choose a type to produce or down load once again.

Be competitive and down load, and produce the Washington Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation with US Legal Forms. There are many specialist and condition-particular kinds you can utilize for your personal enterprise or specific demands.