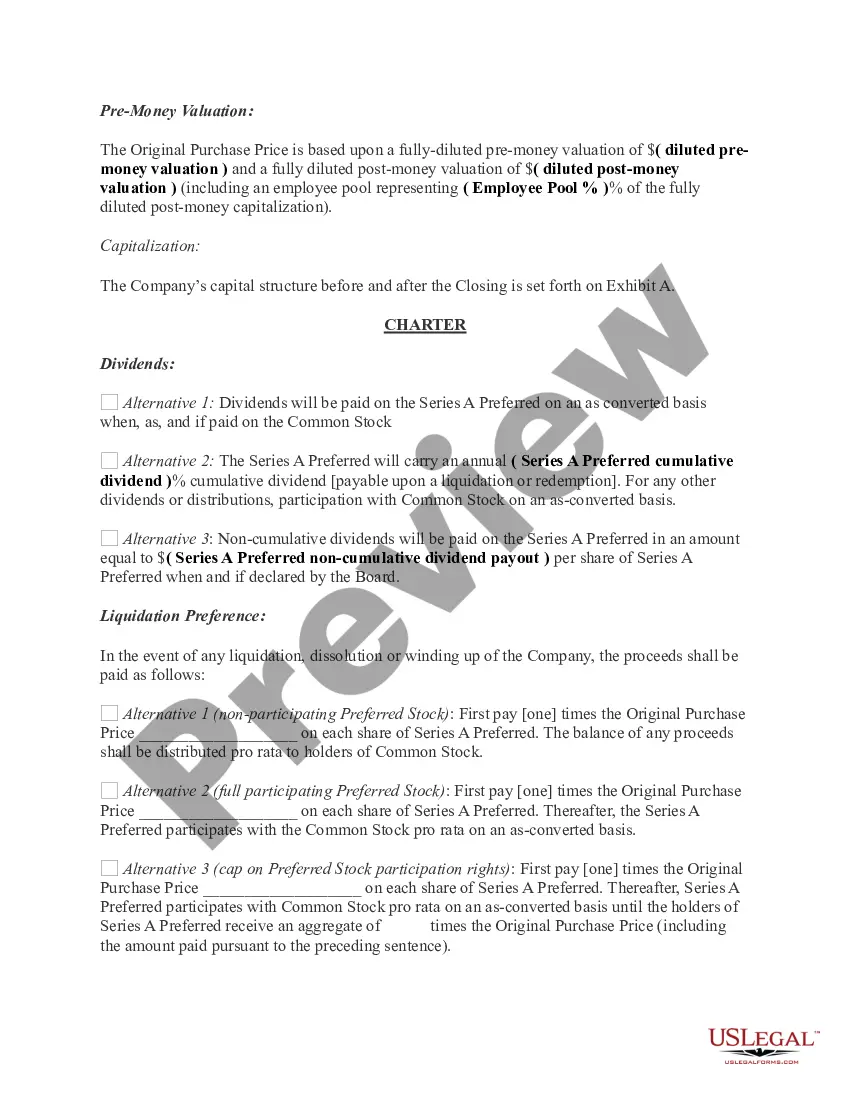

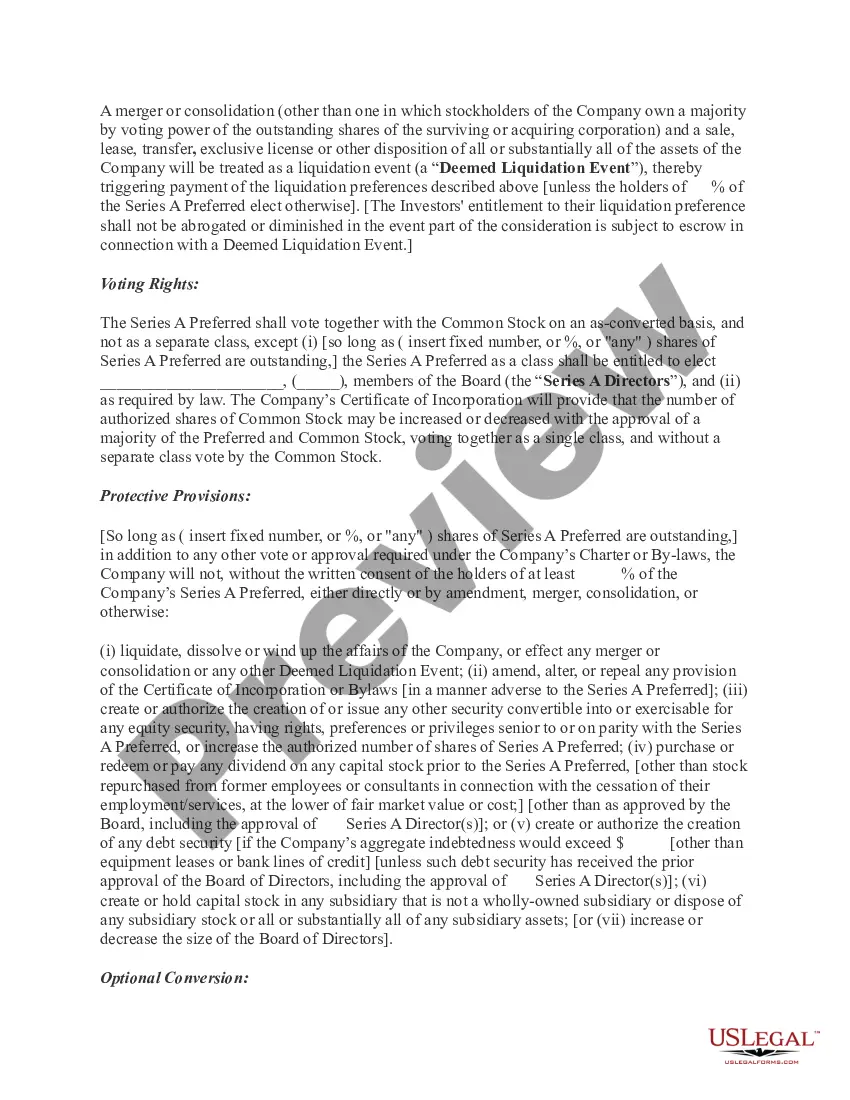

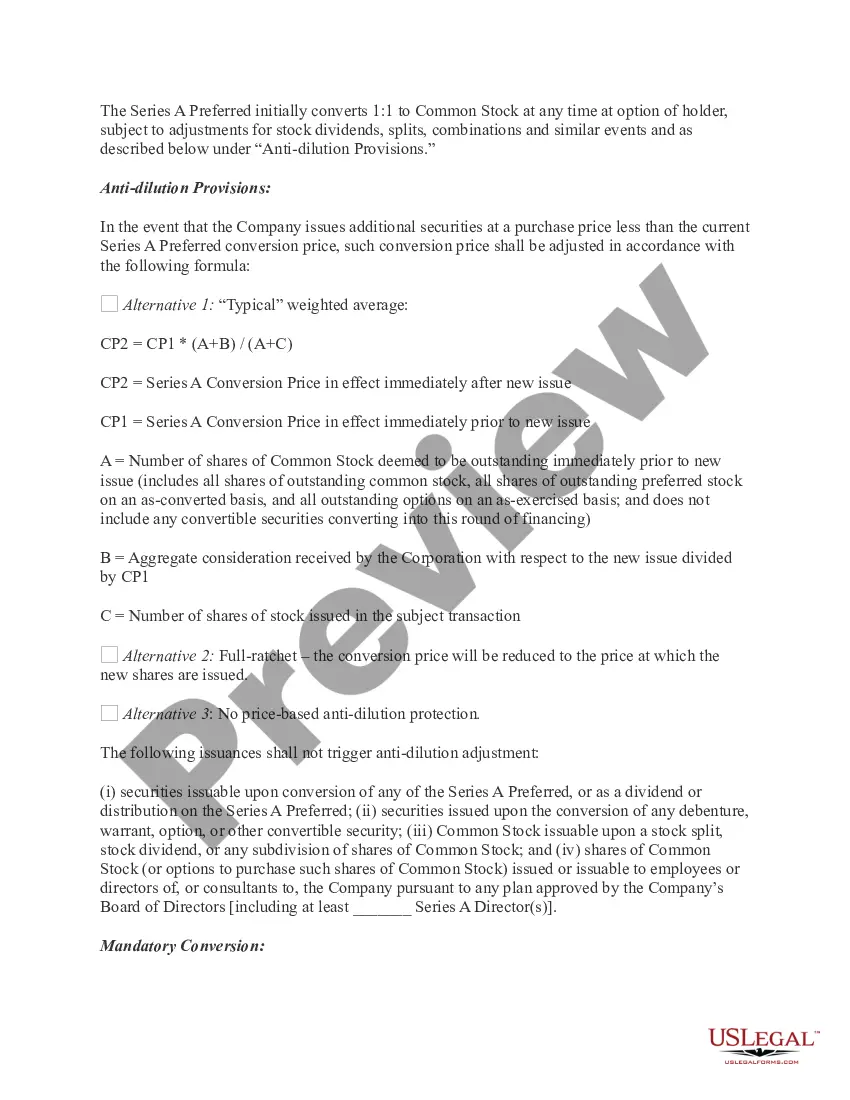

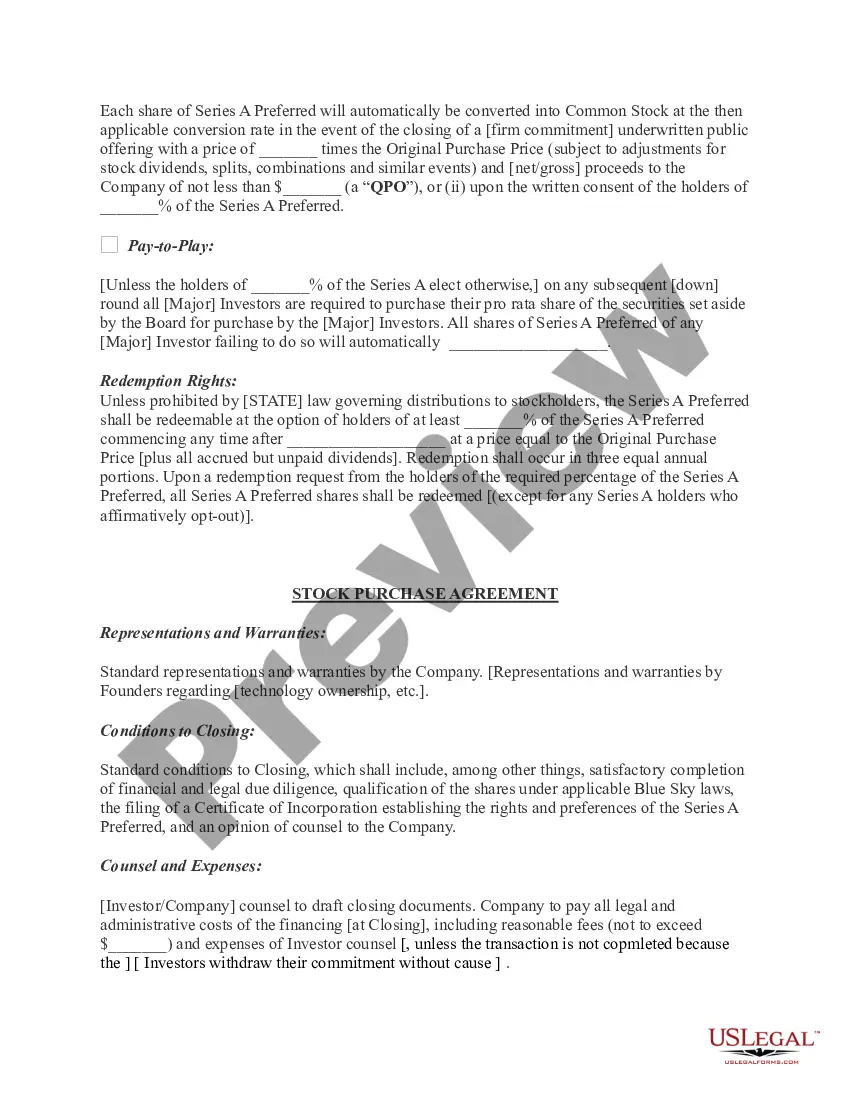

Washington Term Sheet — Series A Preferred Stock Financing of a Company is a legal document that outlines the terms and conditions of an investment in a company's preferred stock offering. This financing option is typically used by early-stage startups in Washington seeking growth capital to expand their operations. The Series A Preferred Stock financing is often the first significant round of funding for a company after seed and angel investments. It involves selling preferred shares to investors in exchange for capital infusion. These preferred shares have rights and preferences that give the investors certain advantages over common stockholders in the event of a liquidation event or exit. The Washington Term Sheet for Series A Preferred Stock Financing lays out the key provisions, terms, and expectations of the investment. It includes details such as: 1. Valuation: The pre-money valuation of the company, which determines the price per share and the ownership stake the investors will receive in exchange for their investment. 2. Investment amount: The total amount of investment being raised in the series A financing round. 3. Liquidation preference and participation rights: Preferred shareholders are entitled to receive their investment back first upon a liquidation event, such as a sale or merger of the company. The term sheet specifies if the investors will receive the original investment amount (1x liquidation preference) or a multiple thereof. Participation rights determine if the investors can also participate in the remaining proceeds after receiving their liquidation preference. 4. Dividend preferences: The term sheet may outline whether the preferred stock carries a cumulative or non-cumulative dividend, and the rate at which dividends will be paid to preferred stockholders. 5. Conversion rights: Preferred stockholders may reserve the right to convert their preferred stock into common stock. The conversion ratio and any conversion triggers are detailed in the term sheet. 6. Board representation: The term sheet may specify if the investors will have the right to appoint a certain number of members to the company's board of directors. 7. Anti-dilution protection: Investors may be protected against dilution in case the company raises additional capital at a lower valuation. 8. Preemptive rights: The term sheet may grant investors the right to maintain their ownership percentage by participating in future equity rounds. 9. Voting rights: The term sheet may detail the preferred stockholders' voting rights on specific matters, such as changes to the company's articles of incorporation or major business decisions. 10. Governing law: In this case, as specified, it refers to the laws and regulations of Washington State, which will govern the terms and interpretation of the term sheet. It is worth mentioning that while the above descriptions encompass the general structure of a Washington Term Sheet — Series A Preferred Stock Financing, specific terms and provisions may vary depending on the negotiating power of the company and investors involved.

Washington Term Sheet - Series A Preferred Stock Financing of a Company

Description

How to fill out Washington Term Sheet - Series A Preferred Stock Financing Of A Company?

It is possible to spend several hours online attempting to find the legitimate papers design which fits the federal and state needs you will need. US Legal Forms supplies a large number of legitimate kinds which can be evaluated by specialists. It is simple to obtain or produce the Washington Term Sheet - Series A Preferred Stock Financing of a Company from your support.

If you currently have a US Legal Forms bank account, it is possible to log in and click the Download button. Following that, it is possible to complete, revise, produce, or indicator the Washington Term Sheet - Series A Preferred Stock Financing of a Company. Every single legitimate papers design you get is the one you have forever. To obtain an additional copy associated with a acquired kind, go to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms web site the very first time, follow the straightforward directions under:

- Initial, be sure that you have chosen the best papers design for the area/town of your liking. Look at the kind information to ensure you have selected the appropriate kind. If accessible, take advantage of the Preview button to check through the papers design at the same time.

- In order to locate an additional version from the kind, take advantage of the Research industry to discover the design that suits you and needs.

- Once you have discovered the design you need, just click Get now to continue.

- Pick the rates strategy you need, enter your qualifications, and register for a free account on US Legal Forms.

- Complete the deal. You may use your bank card or PayPal bank account to cover the legitimate kind.

- Pick the file format from the papers and obtain it in your system.

- Make changes in your papers if required. It is possible to complete, revise and indicator and produce Washington Term Sheet - Series A Preferred Stock Financing of a Company.

Download and produce a large number of papers templates using the US Legal Forms web site, which offers the greatest variety of legitimate kinds. Use expert and status-certain templates to tackle your company or individual demands.