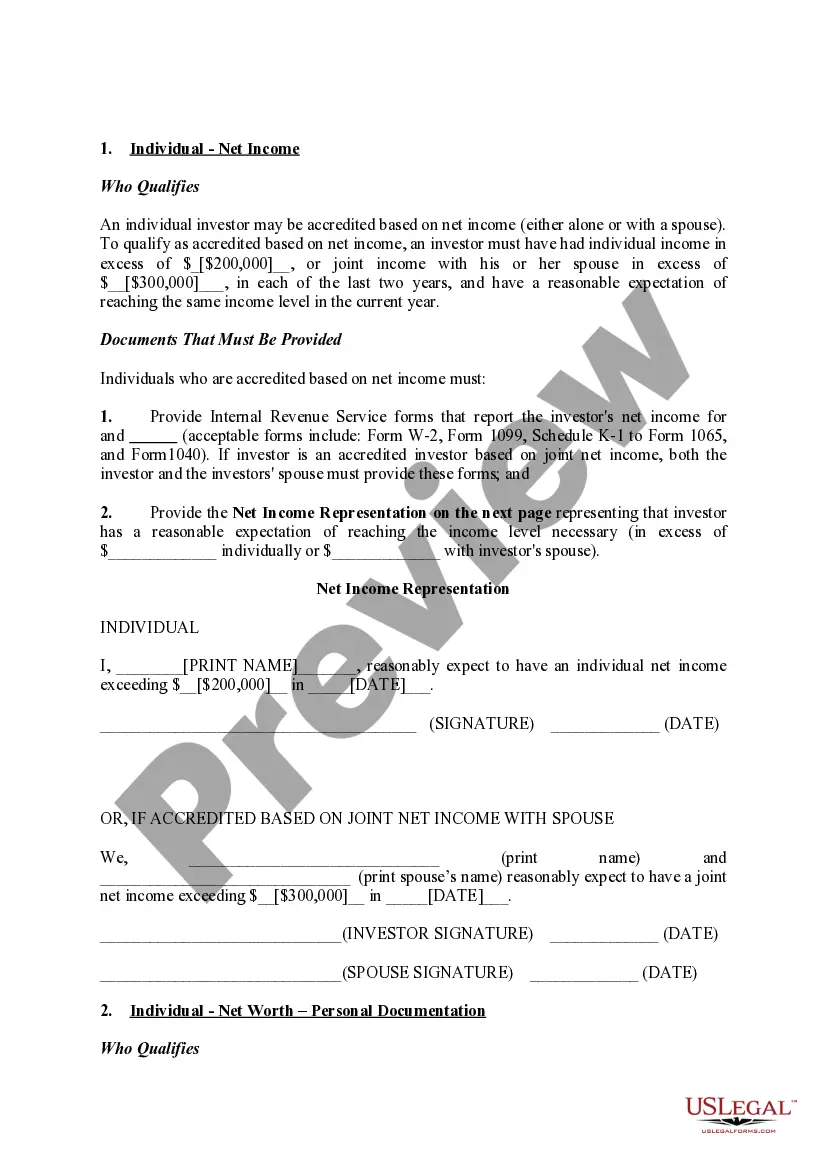

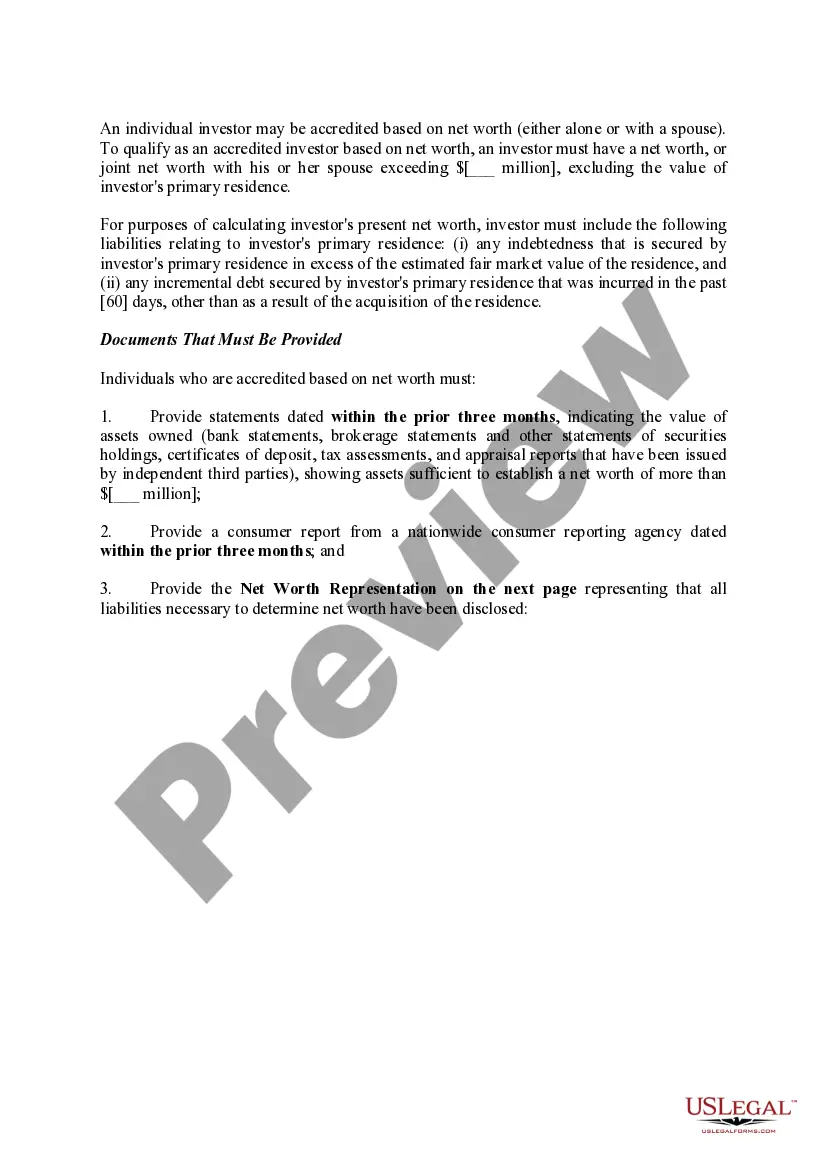

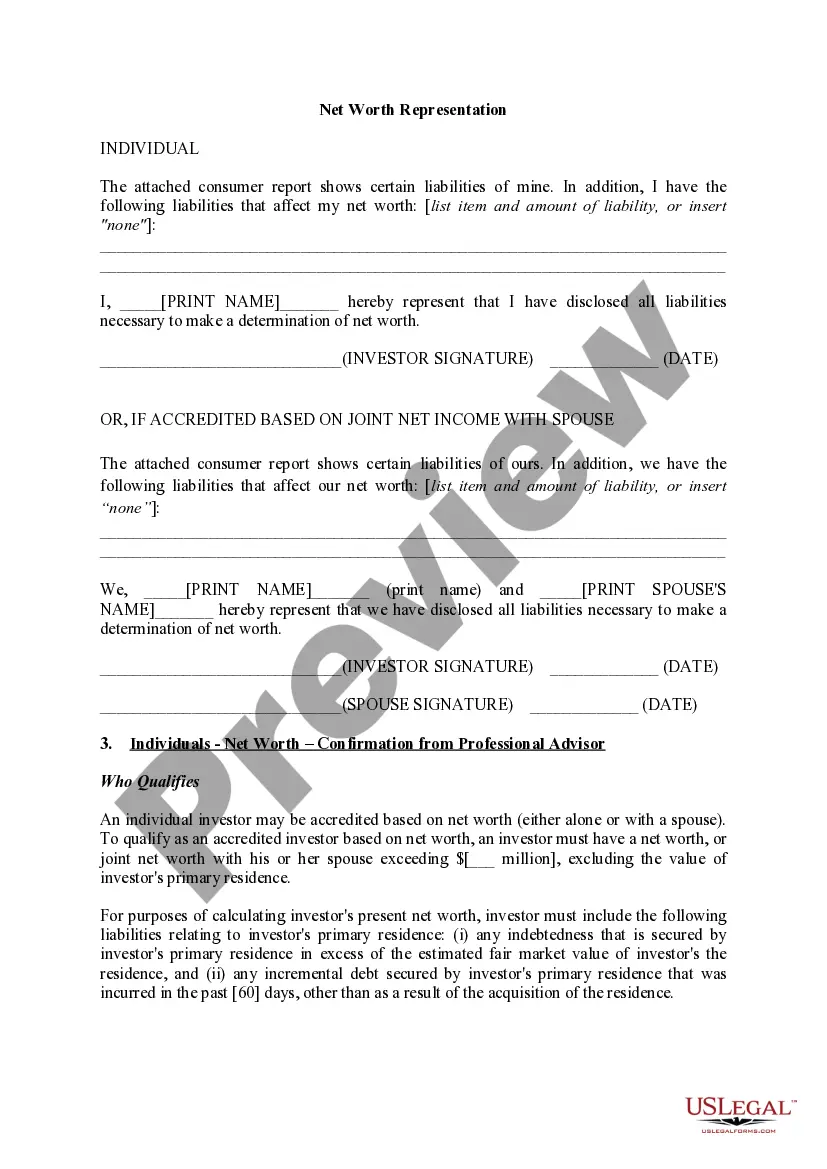

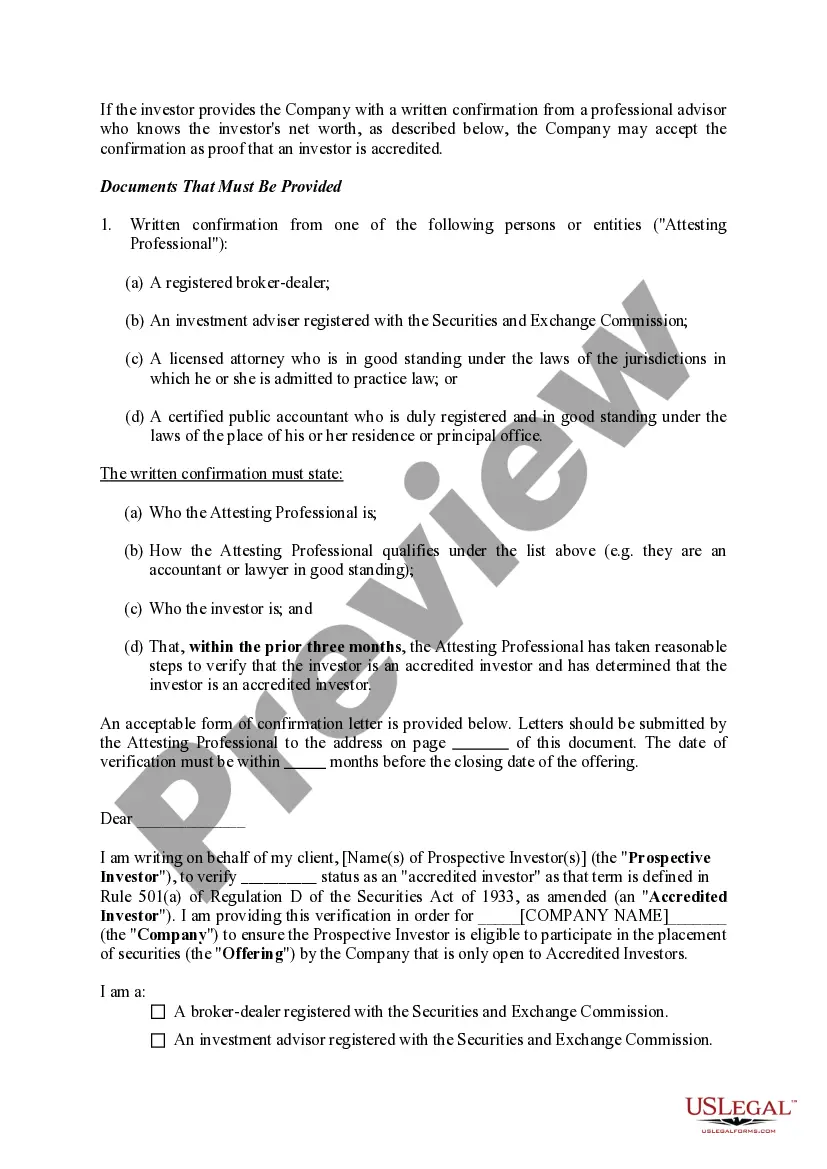

Title: Washington Documentation Required to Confirm Accredited Investor Status: A Detailed Overview Introduction: In the state of Washington, individuals seeking to confirm their accredited investor status must provide specific documentation to comply with relevant regulations. This article aims to provide a comprehensive understanding of the various types of documentation that may be required to establish accredited investor status in Washington. 1. Definition of an Accredited Investor: Before delving into the required documentation, it is crucial to define an accredited investor. In the context of securities regulations, an accredited investor is an individual or entity that meets certain criteria and is legally permitted to participate in certain investment opportunities that are not available to non-accredited investors. 2. Types of Washington Accredited Investor Documentation: The following are some common types of documentation that may be required to confirm accredited investor status in Washington: a. Income Verification: Many individuals demonstrate their accredited investor status by providing documentation of their income. This can include tax returns, W-2 forms, or other official income statements to assess the individual's annual income. b. Net Worth Verification: Another method to establish accredited investor status is by demonstrating an individual's net worth. This can be done by producing documentation, such as bank statements, brokerage statements, property valuations, or certificates of deposit. c. Prior Disclosures: Individuals may be required to disclose any previous investments in private offerings or knowledge and experience in financial and investment matters. These disclosures aim to showcase an individual's familiarity with the risks associated with private investments. d. Professional Certification: Certain professionals, such as lawyers, certified public accountants, and licensed financial advisors, may be automatically deemed accredited investors based on their professional credentials. Documentation validating their professional standing may be required. e. Relying on Third-Party Verifier: In certain cases, individuals may employ the services of third-party verifier, such as licensed attorneys or certified public accountants, to evaluate and confirm their accredited investor status. Documentation provided by this verifier will be necessary for compliance. f. Self-Certification: In Washington, individuals may also be allowed to self-certify their accredited investor status by signing an accredited investor certification document provided by the issuer or organization offering the investment opportunity. Conclusion: When seeking to establish accredited investor status in Washington, individuals must be prepared to provide relevant documentation based on income, net worth, professional certification, prior disclosures, or rely on third-party verifier. It is crucial to consult with legal and financial professionals to ensure compliance with Washington state regulations and properly confirm accredited investor status for investment opportunities.

Washington Documentation Required to Confirm Accredited Investor Status

Description

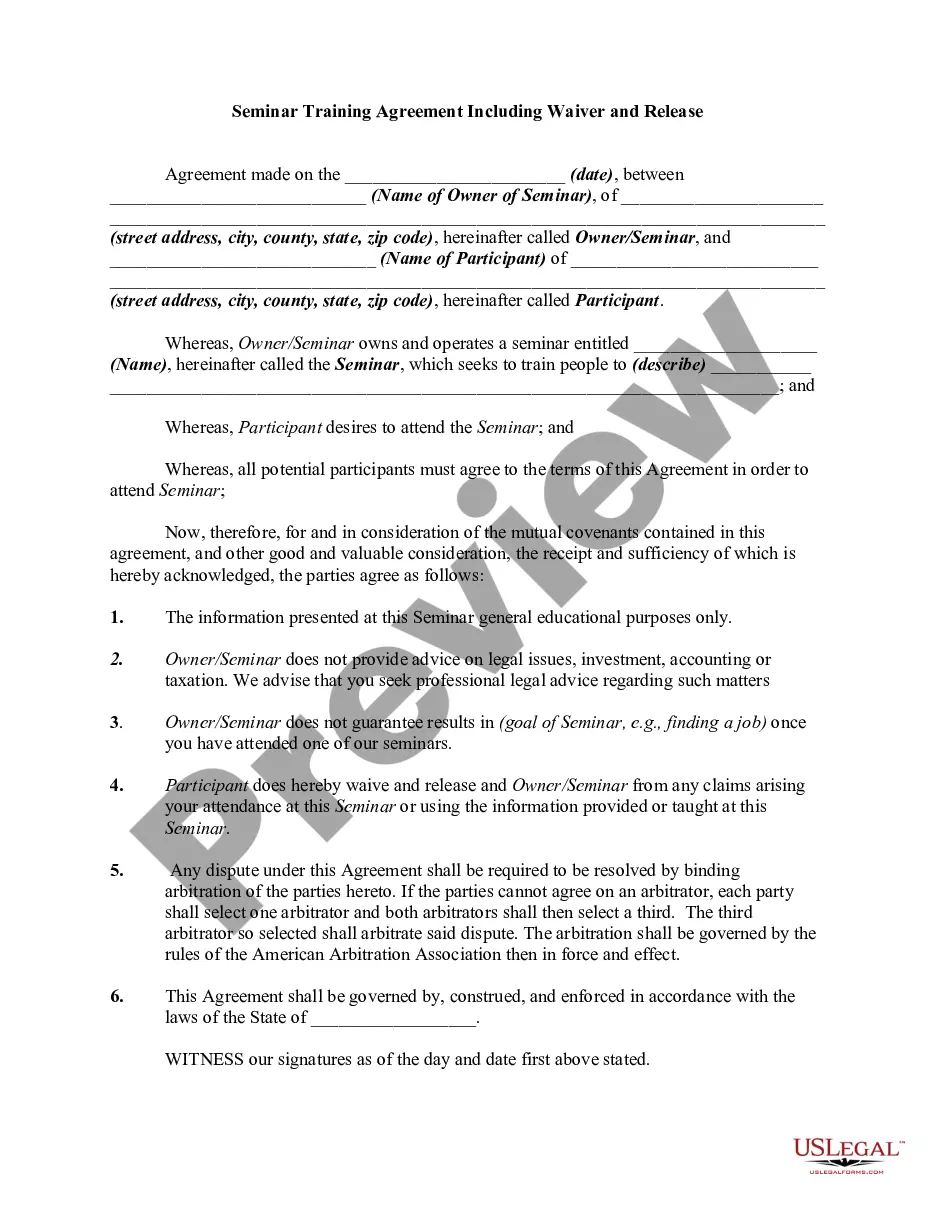

How to fill out Washington Documentation Required To Confirm Accredited Investor Status?

Choosing the best legitimate document web template might be a struggle. Needless to say, there are a lot of templates available online, but how do you discover the legitimate develop you require? Utilize the US Legal Forms site. The assistance offers thousands of templates, such as the Washington Documentation Required to Confirm Accredited Investor Status, which can be used for organization and personal requires. Every one of the types are checked out by experts and meet up with federal and state needs.

When you are presently authorized, log in for your profile and then click the Download button to find the Washington Documentation Required to Confirm Accredited Investor Status. Utilize your profile to look throughout the legitimate types you possess bought previously. Go to the My Forms tab of the profile and acquire yet another duplicate of your document you require.

When you are a fresh customer of US Legal Forms, here are easy instructions for you to comply with:

- Initially, ensure you have chosen the appropriate develop for the area/county. You may examine the shape making use of the Preview button and read the shape information to make sure it will be the best for you.

- If the develop is not going to meet up with your needs, take advantage of the Seach field to get the right develop.

- Once you are certain that the shape is acceptable, go through the Purchase now button to find the develop.

- Select the pricing strategy you need and enter in the necessary information and facts. Make your profile and buy the order with your PayPal profile or Visa or Mastercard.

- Pick the document formatting and acquire the legitimate document web template for your device.

- Comprehensive, revise and printing and signal the obtained Washington Documentation Required to Confirm Accredited Investor Status.

US Legal Forms will be the largest catalogue of legitimate types that you can find a variety of document templates. Utilize the company to acquire professionally-manufactured files that comply with state needs.