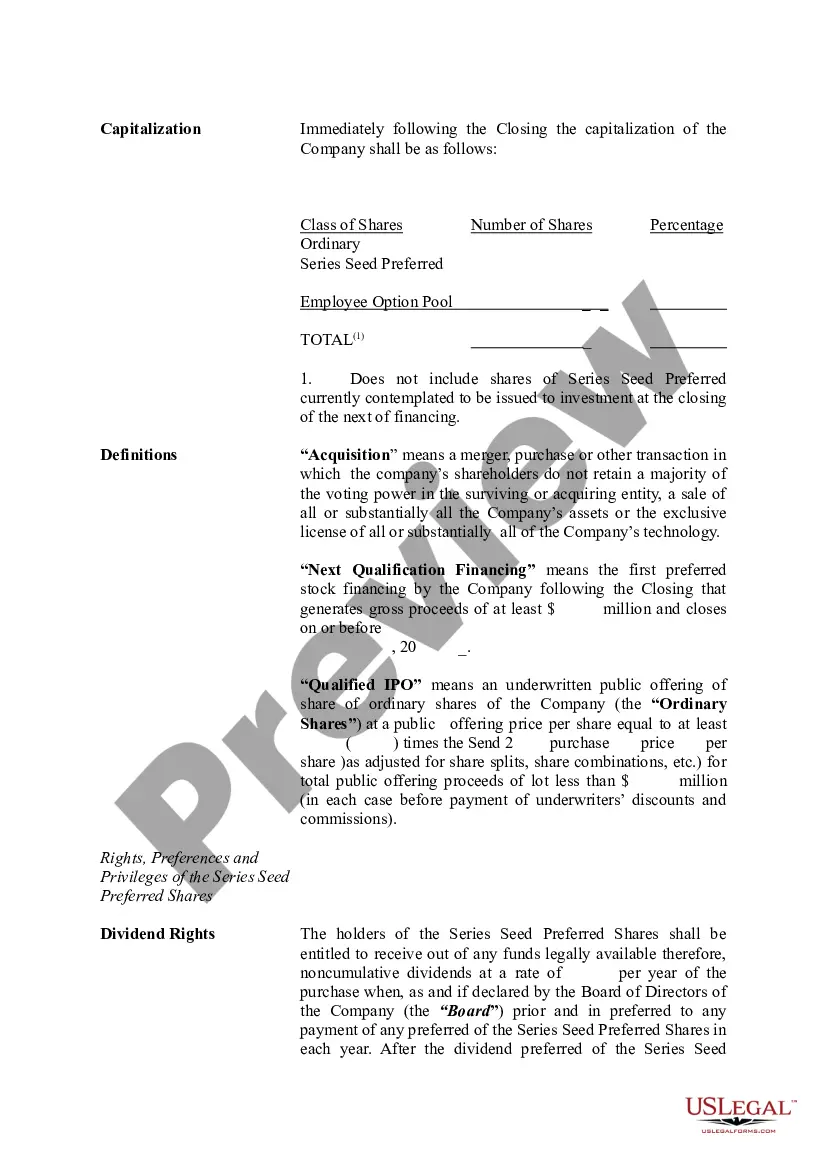

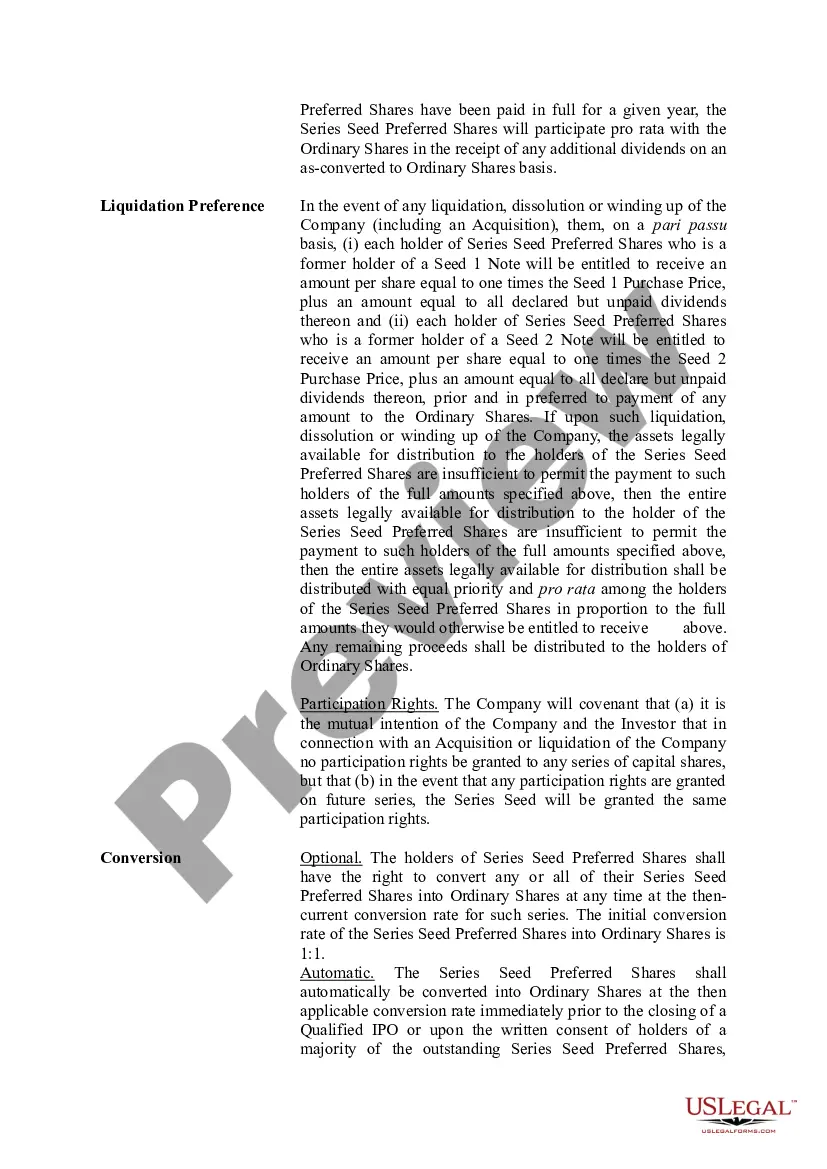

A term sheet is a legal document that outlines the key terms and conditions of an investment deal, including the rights and obligations of both the company seeking funding and the investors providing the capital. In Washington State, there are various types of term sheets available for companies, including the Washington Term Sheet — Series Seed Preferred Share. The Series Seed Preferred Share is a type of equity financing often used by early-stage startups seeking funding from angel investors or venture capital firms. It acts as a bridge between the initial funding obtained from friends and family or angel investors and later rounds of financing from institutional investors. The Washington Term Sheet — Series Seed Preferred Share typically includes important provisions such as: 1. pre-Roman Valuation: This term specifies the value of the company before the investment is made, which determines the percentage of ownership the investors will receive in exchange for their investment. 2. Investment Amount: The term sheet outlines the agreed-upon amount of capital that the investor will provide to the company. 3. Liquidation Preference: This provision states the order of priority for distributing funds in the event of a liquidation or sale of the company. Series Seed Preferred shareholders usually have a preference over common shareholders in receiving their investment back before any proceeds are distributed to other shareholders. 4. Dividends: The term sheet may include provisions for cumulative or non-cumulative dividends, which determine whether unpaid dividends accrue over time and if they must be paid before any other distributions can be made. 5. Conversion Rights: Series Seed Preferred shareholders often have the option to convert their preferred shares into common shares at a predetermined conversion ratio. This allows them to benefit from any potential upside if the company achieves significant growth or goes public. 6. Anti-Dilution Protection: This provision protects investors from future dilution caused by issuing stock at a lower valuation in subsequent funding rounds. It ensures that investors' percentage ownership remains intact even if the company raises additional capital at a lower valuation. 7. Board Seat and Voting Rights: The term sheet outlines whether the investors will have the right to appoint a representative to the company's board of directors and any other voting rights they may possess. 8. Rights of First Refusal and Co-Sale: These provisions enable investors to maintain their ownership percentage by granting them the right to participate in future equity offerings and the ability to sell their shares alongside the founders or other major shareholders if they decide to sell their holdings. 9. Founder Vesting: This term details the conditions under which founders' shares will vest over time, often through a four-year vesting schedule with a one-year cliff period. It's important to note that term sheets can vary from case to case, and specific terms may be negotiated depending on the unique circumstances of each investment deal. Before signing any term sheet, it is crucial for both parties to consult legal professionals to ensure a comprehensive understanding of the rights, obligations, and associated risks.

Washington Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Washington Term Sheet - Series Seed Preferred Share For Company?

It is possible to invest hrs online looking for the authorized file format that fits the federal and state specifications you will need. US Legal Forms gives thousands of authorized types which are evaluated by professionals. It is simple to acquire or print the Washington Term Sheet - Series Seed Preferred Share for Company from my service.

If you have a US Legal Forms bank account, you may log in and then click the Acquire switch. Following that, you may complete, change, print, or indicator the Washington Term Sheet - Series Seed Preferred Share for Company. Every authorized file format you buy is the one you have for a long time. To get an additional version of the obtained kind, visit the My Forms tab and then click the related switch.

Should you use the US Legal Forms web site the first time, adhere to the basic instructions below:

- Initially, make sure that you have selected the proper file format to the area/metropolis of your liking. Browse the kind outline to ensure you have picked the right kind. If offered, use the Review switch to appear with the file format too.

- If you want to locate an additional edition in the kind, use the Lookup area to get the format that fits your needs and specifications.

- When you have located the format you want, click Get now to proceed.

- Pick the pricing plan you want, type in your accreditations, and sign up for an account on US Legal Forms.

- Total the purchase. You should use your charge card or PayPal bank account to pay for the authorized kind.

- Pick the structure in the file and acquire it to your product.

- Make alterations to your file if necessary. It is possible to complete, change and indicator and print Washington Term Sheet - Series Seed Preferred Share for Company.

Acquire and print thousands of file themes using the US Legal Forms web site, which offers the biggest selection of authorized types. Use professional and state-certain themes to handle your small business or specific needs.

Form popularity

FAQ

Series Seed will generally be issued as preferred stock. This is the order of payments made to various classes of stockholders in the event that the business is liquidated and there is cash available for distribution to the stockholders.

Letters of intent and term sheets are very similar. Both documents outline an agreement that two or more parties expect to make. A letter of intent, as the name implies, is written in the form of a letter whereas a term sheet is more often a list of the important parts of the anticipated contract or agreement.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises.

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.

A term sheet is commonly used in mergers and acquisitions, investments, and complex financial talks where clarity on deal structure is critical. Whereas, an MoU is commonly used when it is critical to establish mutual objectives and responsibilities.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).