Washington Investors Rights Agreement

Description

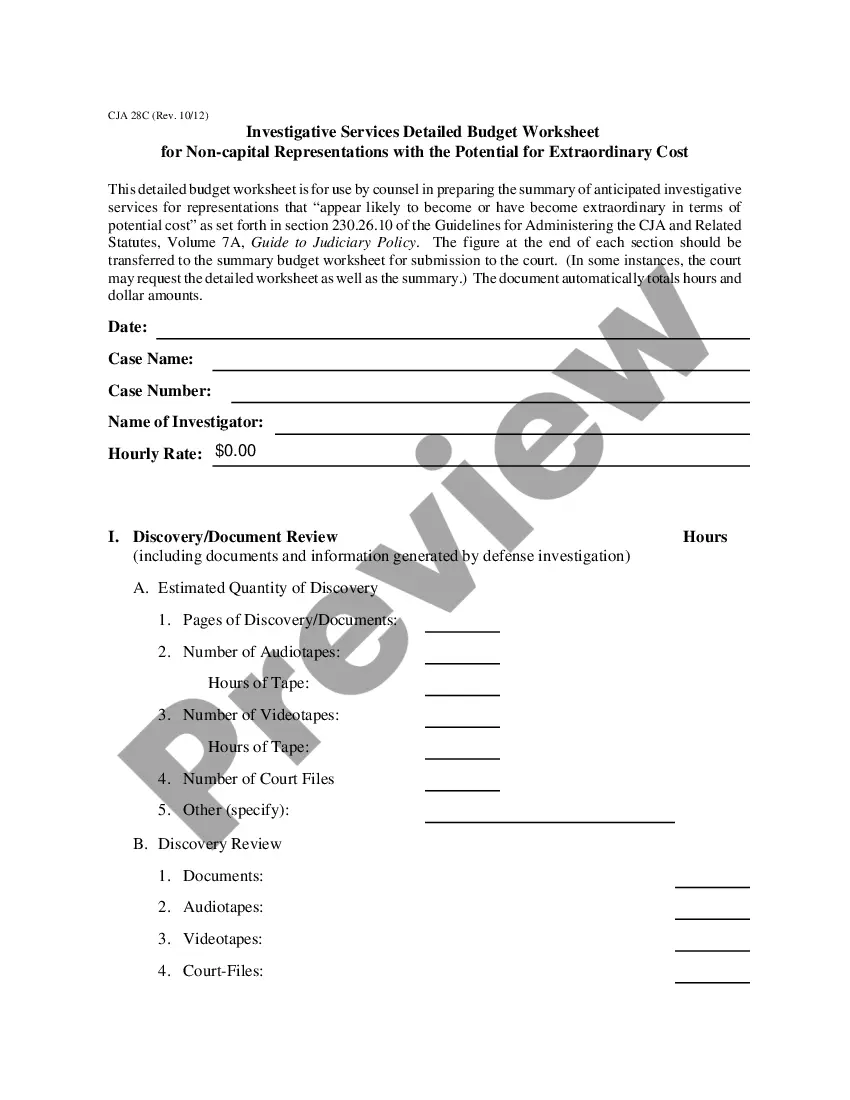

How to fill out Investors Rights Agreement?

You are able to commit several hours on-line trying to find the lawful papers format that suits the federal and state needs you require. US Legal Forms offers a large number of lawful kinds which can be reviewed by pros. It is possible to obtain or produce the Washington Investors Rights Agreement from our service.

If you have a US Legal Forms accounts, you are able to log in and then click the Download option. Following that, you are able to complete, change, produce, or indication the Washington Investors Rights Agreement. Every lawful papers format you purchase is your own for a long time. To obtain one more copy for any obtained form, go to the My Forms tab and then click the related option.

If you use the US Legal Forms site for the first time, follow the straightforward guidelines listed below:

- First, make sure that you have chosen the correct papers format for the state/area that you pick. See the form explanation to make sure you have selected the proper form. If offered, use the Preview option to look with the papers format too.

- In order to locate one more edition of the form, use the Lookup area to get the format that fits your needs and needs.

- After you have located the format you desire, just click Get now to move forward.

- Pick the rates strategy you desire, type in your references, and register for an account on US Legal Forms.

- Full the deal. You can use your credit card or PayPal accounts to purchase the lawful form.

- Pick the structure of the papers and obtain it to your device.

- Make changes to your papers if necessary. You are able to complete, change and indication and produce Washington Investors Rights Agreement.

Download and produce a large number of papers templates while using US Legal Forms web site, that provides the biggest selection of lawful kinds. Use professional and state-distinct templates to deal with your organization or personal demands.

Form popularity

FAQ

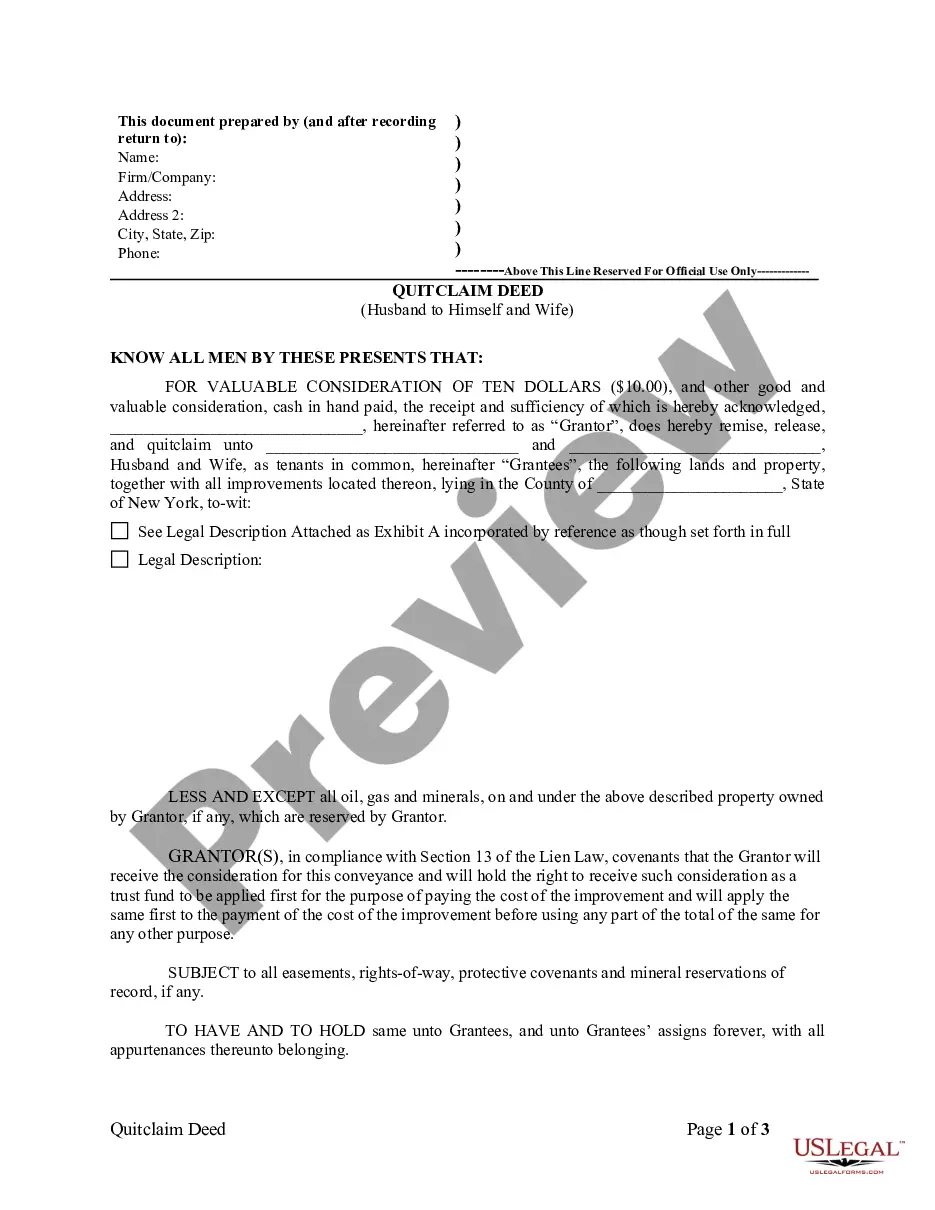

What to include in an investor agreement. A well-executed agreement should include the basics, such as names and addresses, the amount and purpose of the investment, and each party's signatures. In addition, when drafting an investor agreement, the Kumar Law Firm said to be concise and not leave room for ambiguity.

While an investment agreement sets forth a contract for individuals wanting to purchase ownership in a company, a shareholders agreement outlines a new shareholder's rights over the company. Investment Agreement vs Shareholders Agreement - Zegal Zegal ? Articles ? Consulting Zegal ? Articles ? Consulting

What is a Shareholders' Agreement? A shareholders' agreement is an arrangement among the shareholders of a company. It contains provisions regarding the operation of the company and the relationship between its shareholders. A shareholders' agreement is also known as a stockholders' agreement. Shareholders' Agreement - Overview, How It Works, Characteristics corporatefinanceinstitute.com ? resources ? equities corporatefinanceinstitute.com ? resources ? equities

A Shareholders Agreement is usually created when the company brings on external investors. A Founders Agreement focuses on the roles and responsibilities of the founders. It also sets out the equity allocation and who can decide what. It typically also addresses vesting and leaver arrangements for the founders. Founders Agreement vs Shareholders Agreement - Clara clara.co ? founders-agreement-vs-shareholders-... clara.co ? founders-agreement-vs-shareholders-...

An investor rights agreement (IRA) is a typical document negotiated between a venture capitalist (VC) and other concerns providing capital financing to a startup company. It provides the rights and privileges afforded these new stockholders in the company.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller. Difference b/w Shareholders and Share Purchase Agreement companiesnext.com ? blog ? difference-bet... companiesnext.com ? blog ? difference-bet...

Key elements of an investment agreement #1 Introduction and background information. This section provides a comprehensive description of the investment contract, including the names and legal entities of the parties involved. ... #4 Investment amount and payment terms. ... #7 Termination and exit provisions.

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights. Investor Rights Agreement (IRA) | Dallas & Austin Business Lawyers velawood.com ? glossary-term ? investor-rights-a... velawood.com ? glossary-term ? investor-rights-a...

An investor rights agreement (IRA) is a typical document negotiated between a venture capitalist (VC) and other concerns providing capital financing to a startup company. It provides the rights and privileges afforded these new stockholders in the company. Investor Rights Agreement | UpCounsel 2023 UpCounsel ? investor-rights-agreement UpCounsel ? investor-rights-agreement

An investment agreement generally covers the terms of the investment by the investor into the company. It documents a one-off transaction between the investor and the company. In contrast, a shareholders agreement governs the rights and responsibilities of all the shareholders and the company going forwards. Investment vs Shareholders Agreement | LegalVision NZ legalvision.co.nz ? corporations ? investment-vs-s... legalvision.co.nz ? corporations ? investment-vs-s...