Washington Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

If you need to complete, obtain, or produce legitimate record layouts, use US Legal Forms, the most important variety of legitimate forms, that can be found on the web. Make use of the site`s simple and easy convenient search to discover the files you need. Numerous layouts for enterprise and specific functions are sorted by classes and states, or keywords. Use US Legal Forms to discover the Washington Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on in just a handful of mouse clicks.

If you are previously a US Legal Forms consumer, log in for your account and click the Obtain button to get the Washington Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on. You can even accessibility forms you formerly downloaded inside the My Forms tab of your account.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape to the correct metropolis/land.

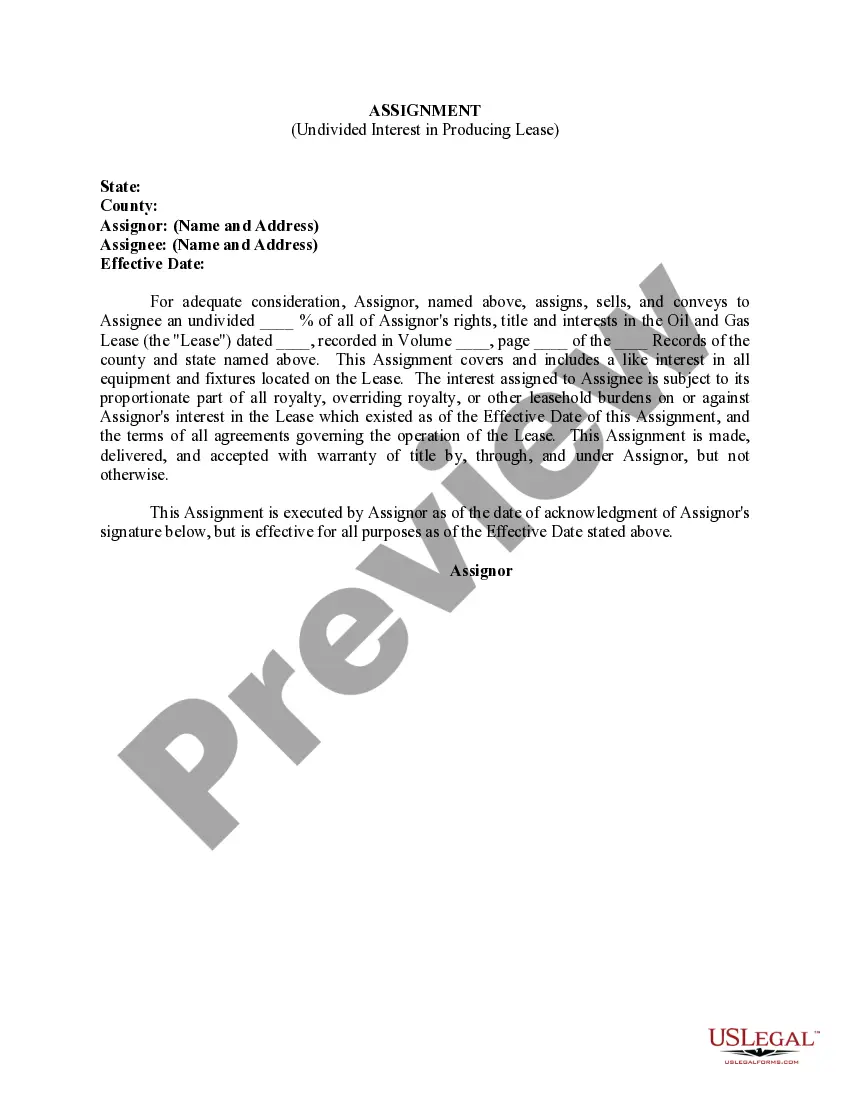

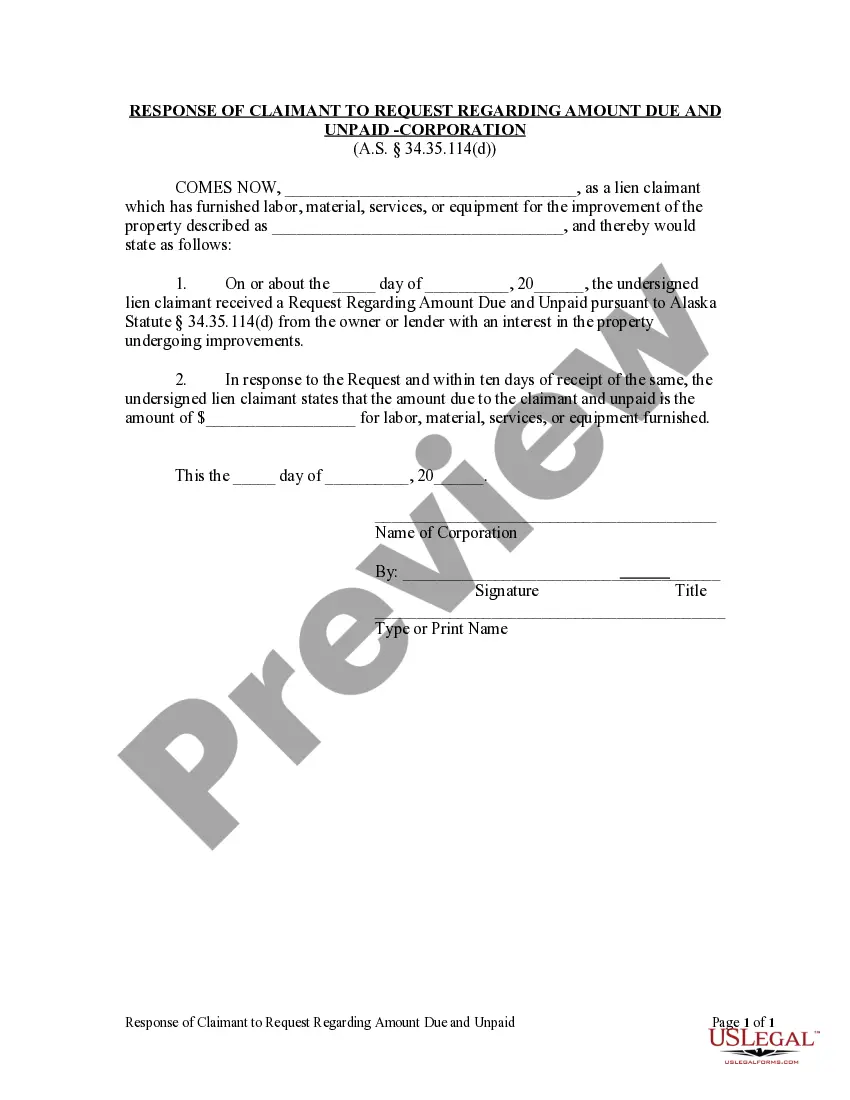

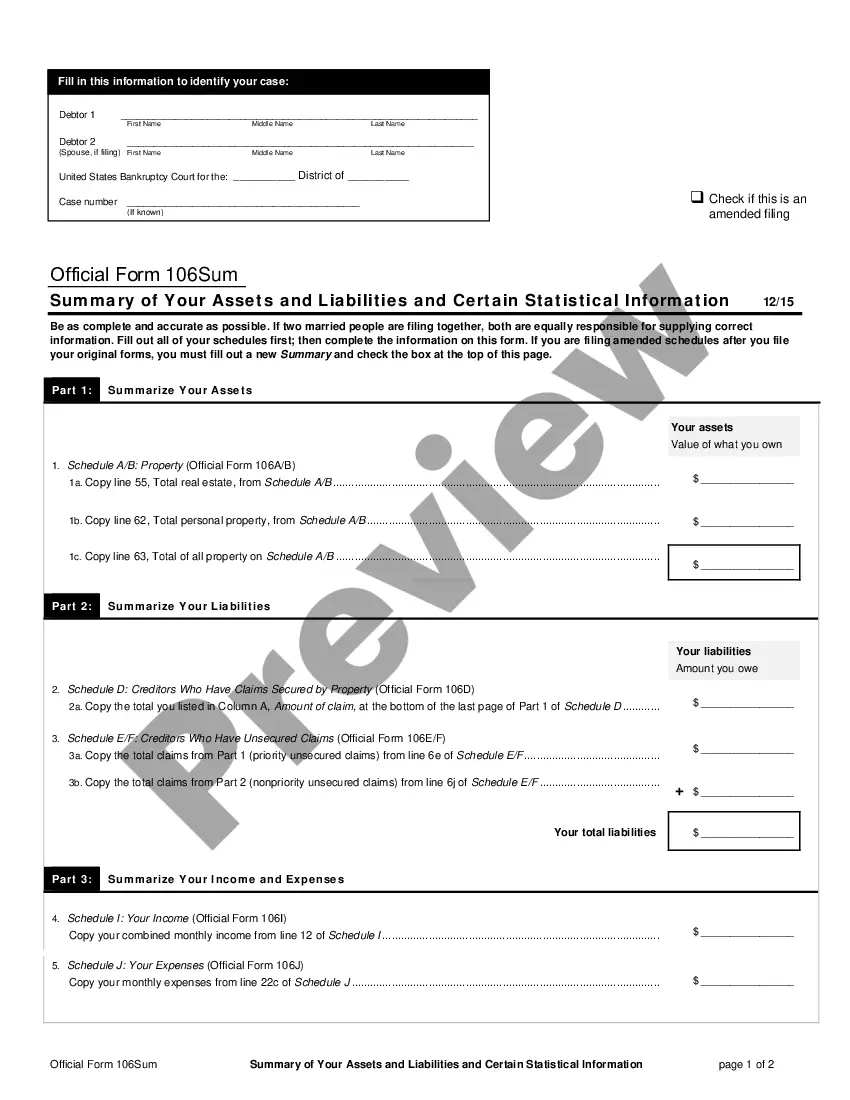

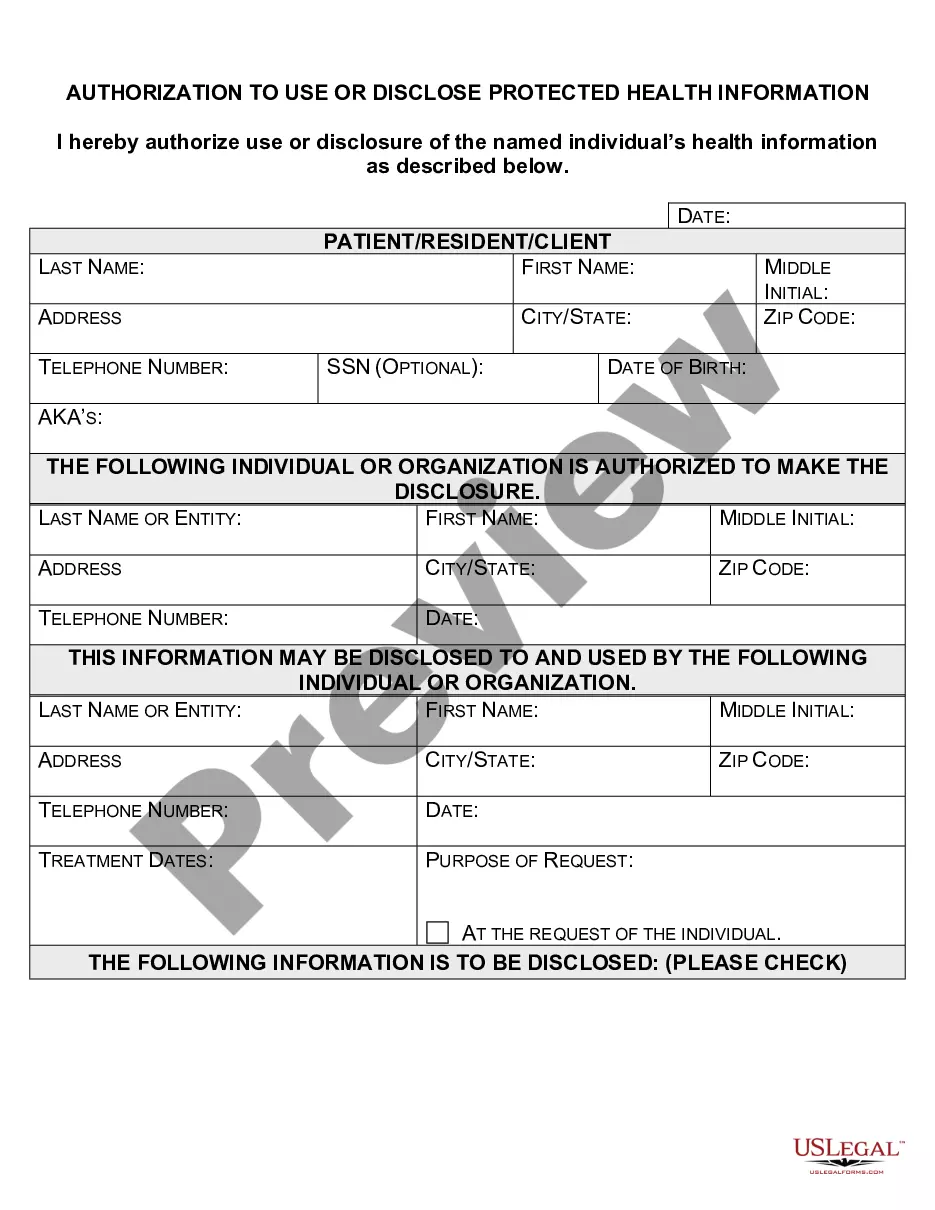

- Step 2. Utilize the Preview solution to check out the form`s content material. Don`t overlook to see the outline.

- Step 3. If you are unhappy using the type, use the Search area on top of the display screen to get other types of your legitimate type web template.

- Step 4. When you have found the shape you need, go through the Get now button. Choose the costs strategy you like and put your qualifications to sign up on an account.

- Step 5. Method the deal. You can use your credit card or PayPal account to perform the deal.

- Step 6. Select the format of your legitimate type and obtain it on the gadget.

- Step 7. Complete, modify and produce or signal the Washington Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on.

Every single legitimate record web template you acquire is your own property for a long time. You possess acces to each type you downloaded in your acccount. Go through the My Forms segment and select a type to produce or obtain yet again.

Be competitive and obtain, and produce the Washington Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on with US Legal Forms. There are many specialist and express-certain forms you can utilize to your enterprise or specific demands.

Form popularity

FAQ

Restricted stock units are considered income once vested, and a portion of the shares is withheld to pay income taxes. The employee then receives the remaining shares and has the right to sell them.

Restricted stock refers to an award of stock to a person that is subject to conditions that must be met before the stockholder can exercise the right to transfer or sell the stock. It is commonly issued to corporate officers such as directors and senior executives.

RSUs resemble restricted stock options conceptually but differ in some key respects. RSUs represent an unsecured promise by the employer to grant a set number of shares of stock to the employee upon the completion of the vesting schedule.

Factors to Consider When Deciding Between RSA and RSU Grants Tax Implications: RSAs allow for Section 83(b) elections, which could be beneficial for employees expecting the stock to appreciate significantly. RSUs are generally more straightforward in terms of taxation, as they are taxed at the time of vesting.

Restricted stock refers to unregistered shares of ownership in a corporation that are issued to corporate affiliates, such as executives and directors. Restricted stock is non-transferable and must be traded in compliance with special Securities and Exchange Commission (SEC) regulations.

Restricted stocks are unregistered shares the holder cannot transfer until certain conditions are met. In contrast, unrestricted stocks are not subject to such restrictions for ownership transferability.

The merits of Stock Options vs RSUs primarily depends on the stage of the company. Stock Options are usually better for both employee and employer at an early stage company. For a later stage company, RSUs are usually better for both.

Restricted stock (also called letter stock or section 1244 stock) is usually awarded to company directors and other high-level executives, whereas restricted stock units (RSUs) are typically awarded to lower-level employees. Restricted stock tends to have more conditions and restrictions than an RSU.