Washington Special Meeting Minutes of Shareholders

Description

How to fill out Special Meeting Minutes Of Shareholders?

Are you currently inside a placement in which you need paperwork for sometimes company or specific purposes just about every day? There are a lot of legitimate document templates available on the net, but finding versions you can rely on is not simple. US Legal Forms provides 1000s of form templates, just like the Washington Special Meeting Minutes of Shareholders, which are published to meet state and federal requirements.

When you are already informed about US Legal Forms website and also have a merchant account, basically log in. Afterward, you can acquire the Washington Special Meeting Minutes of Shareholders template.

Should you not provide an accounts and would like to begin to use US Legal Forms, abide by these steps:

- Discover the form you want and make sure it is for that right area/state.

- Make use of the Review button to examine the form.

- Look at the information to ensure that you have chosen the right form.

- In the event the form is not what you`re looking for, take advantage of the Research area to discover the form that meets your requirements and requirements.

- Once you find the right form, click on Purchase now.

- Opt for the pricing plan you want, fill out the specified information and facts to produce your account, and pay for your order with your PayPal or charge card.

- Pick a hassle-free document formatting and acquire your version.

Find each of the document templates you may have purchased in the My Forms food list. You may get a additional version of Washington Special Meeting Minutes of Shareholders any time, if needed. Just go through the necessary form to acquire or printing the document template.

Use US Legal Forms, the most considerable collection of legitimate forms, to conserve some time and avoid errors. The service provides expertly made legitimate document templates which can be used for an array of purposes. Create a merchant account on US Legal Forms and commence creating your life easier.

Form popularity

FAQ

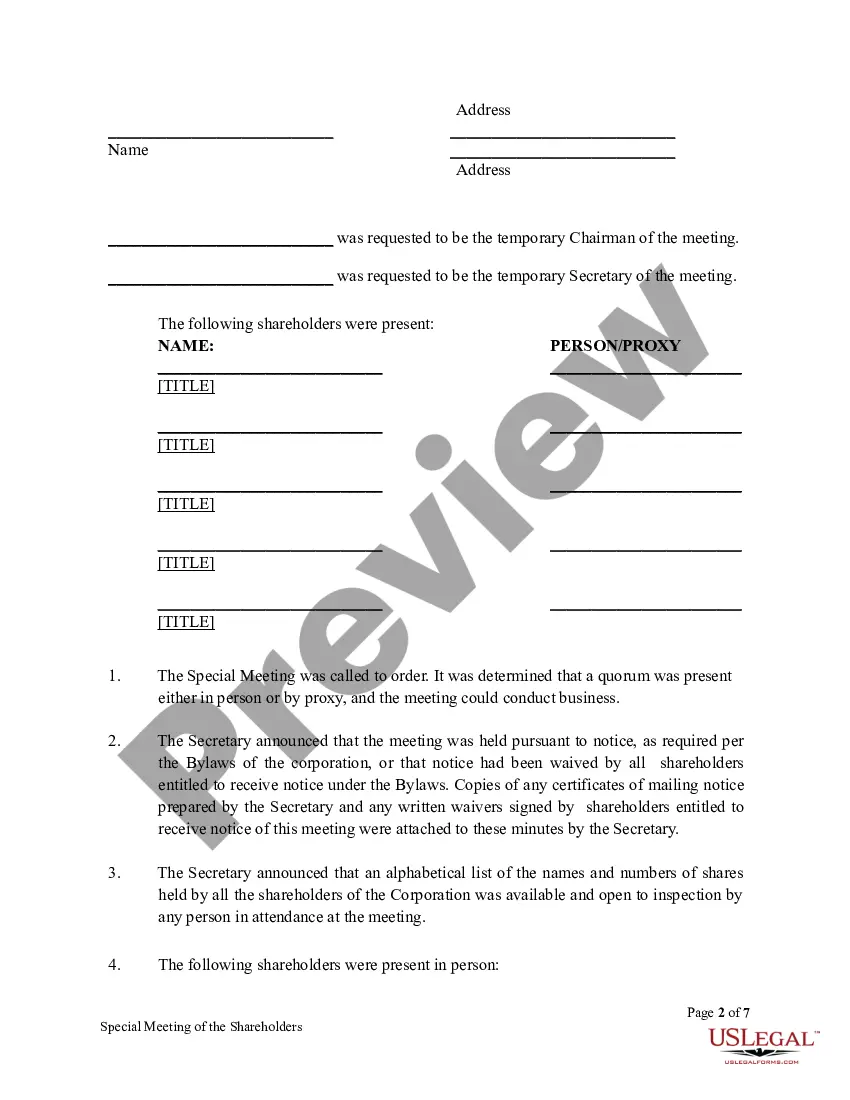

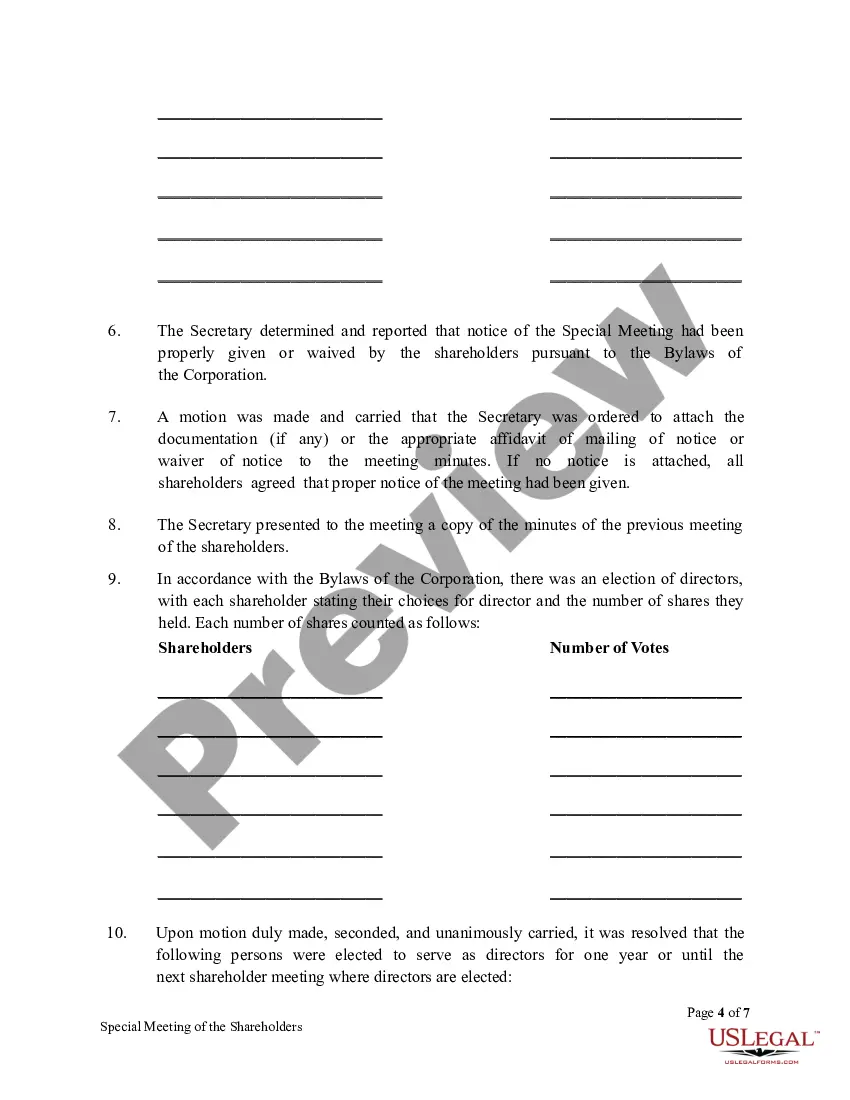

What should shareholders special meeting minutes include? Meeting Information: The date, location, and purpose of the meeting. Attendance: The names of the shareholders and any others who were present. ... Election of Meeting Chairperson and Secretary: The chairperson runs the meeting, and the secretary keeps the minutes.

Special Meeting means a special meeting of the holders of Voting Shares, called by the Board of Directors for the purpose of approving a supplement or amendment to this Agreement pursuant to Subsection 5.4(b); Annual Meeting means the annual meeting of the stockholders of the Company.

Noun. : a meeting held for a special and limited purpose. specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.

A special meeting allows shareholders to remove the current board of directors and elect a new board. The following is an explanation of the procedures for calling a special meeting of the shareholders. Enclosed are copies of documents, which you can use for your meeting.

An extraordinary general meeting (EGM) is a shareholder meeting called other than a company's scheduled annual general meeting (AGM). An EGM is also called a special general meeting or emergency general meeting.

Shareholders meeting minutes act as a written summary of all relevant discussions, votes, and resolutions during a specific shareholders' meeting. Many private and public companies must hold regular shareholders' meetings in order to satisfy regulatory requirements.

Requests to review minutes All members of an S corporation?that is, the shareholders, directors, and officers?are entitled to request a copy of the meeting minutes taken at any meeting. Such requests should not be taken lightly.

The corporation can allow others to call a special meeting, such as the BoD Chair, CEO, or yes, shareholders. The bylaws or CoI needs to specify this, though.

A special meeting allows shareholders to remove the current board of directors and elect a new board. The following is an explanation of the procedures for calling a special meeting of the shareholders. Enclosed are copies of documents, which you can use for your meeting.

How to write meeting minutes reports Make an outline. Prior to the meeting, create an outline by picking or designing a template. ... Include factual information. ... Write down the purpose. ... Record decisions made. ... Add details for the next meeting. ... Be concise. ... Consider recording. ... Edit and proofread.