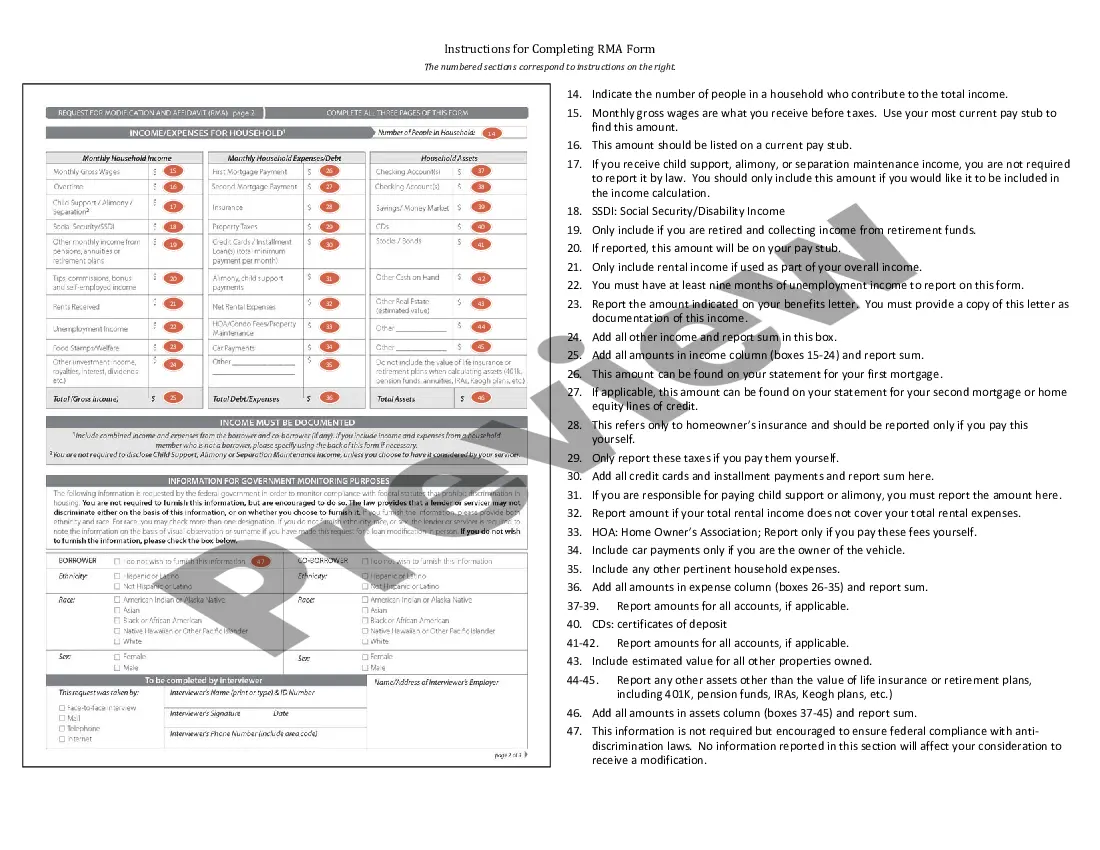

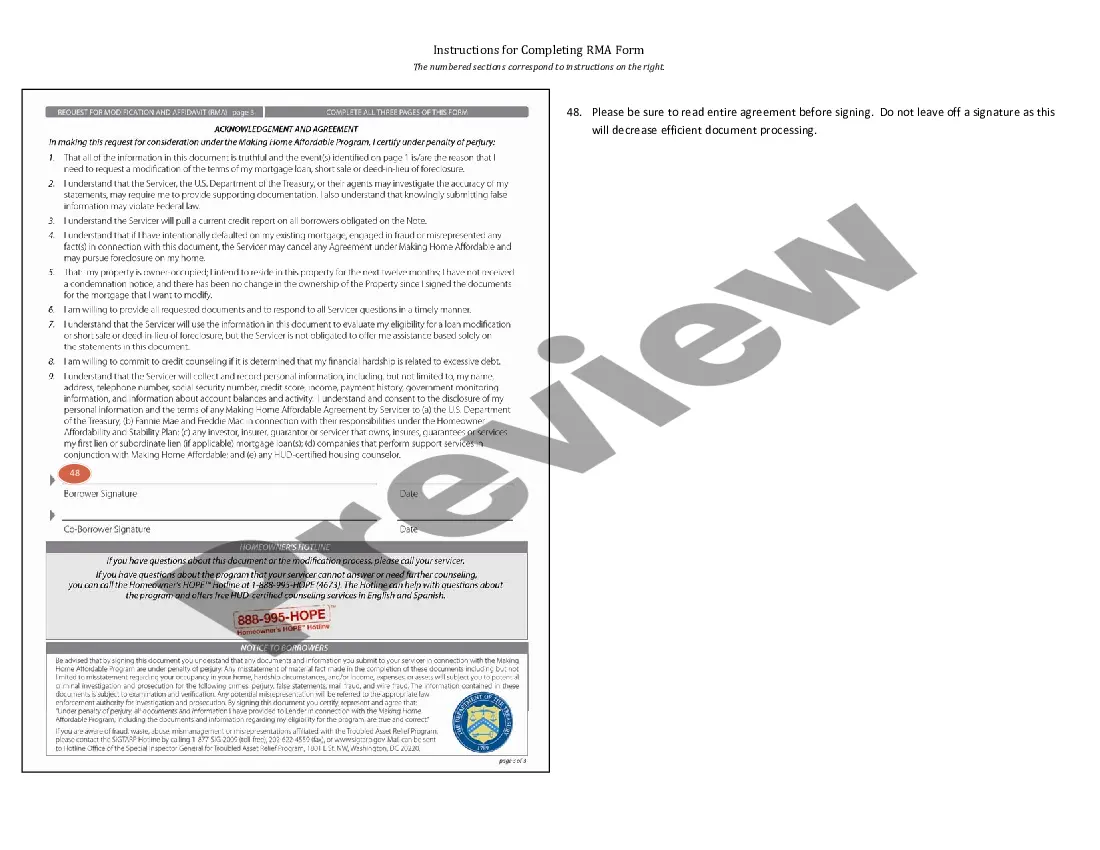

Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Washington Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

If you have to full, download, or printing lawful record web templates, use US Legal Forms, the most important selection of lawful types, that can be found on the web. Utilize the site`s simple and easy handy search to get the files you need. Various web templates for organization and individual uses are categorized by classes and says, or keywords and phrases. Use US Legal Forms to get the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form within a couple of click throughs.

In case you are currently a US Legal Forms buyer, log in for your profile and click the Download option to find the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form. You can also accessibility types you earlier acquired within the My Forms tab of the profile.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form to the appropriate metropolis/country.

- Step 2. Use the Review choice to look through the form`s content material. Never forget to read the description.

- Step 3. In case you are not happy with the kind, use the Look for area on top of the display to discover other models of your lawful kind design.

- Step 4. Upon having discovered the form you need, select the Get now option. Choose the rates plan you favor and put your accreditations to sign up to have an profile.

- Step 5. Method the purchase. You may use your credit card or PayPal profile to accomplish the purchase.

- Step 6. Select the formatting of your lawful kind and download it in your product.

- Step 7. Total, modify and printing or indication the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form.

Each lawful record design you buy is yours for a long time. You may have acces to every kind you acquired inside your acccount. Go through the My Forms segment and decide on a kind to printing or download once again.

Contend and download, and printing the Washington Instructions for Completing Request for Loan Modification and Affidavit RMA Form with US Legal Forms. There are thousands of skilled and status-distinct types you may use to your organization or individual needs.

Form popularity

FAQ

How to get a loan modificationGather information about your financial situation. You'll need to give your lender or servicer everything from tax returns to pay stubs to demonstrate you're experiencing financial hardship and are unable to make your monthly mortgage payments.Plan out your case.Contact your servicer.

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include: Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term.

A loan modification agreement is a long-term solution. A loan modification may involve a reduced interest rate, a longer period to repay, a different type of loan, or any combination of these.

The loan modification processTalk to your servicer. Communicate with your servicer.Utilize the 90-day right to cure If a servicer or lender claims you are in default, they must give you a written notice.Organize your documents.Understand what a modification can and cannot do.Reporting issues with mortgage servicers.

The loan modification application process varies from lender to lender; some require proof of hardship, and others require a hardship letter explaining why you need the modification. If you're denied a loan modification, you can file an appeal with your mortgage servicer.

In most instances, a recorded modification will not be necessary. However, in some circumstances, a recorded modification may be required to ensure that the lender is protected.

Whether the mortgage loan modification agreement will need to be recorded in the public records after it is executed, and. an address to which the executed mortgage loan modification agreement should be returned.

Lenders will often report a loan modification to credit bureaus as a type of settlement or adjustment to the terms of the loan. If it shows up as not fulfilling the original terms of your loan, that can have a negative effect on your credit.

Qualifying for a Loan ModificationYou have to be suffering a financial hardship.You have to show you cannot afford your current mortgage payments.You have to be able to show that you can stay current on a modified payment schedule.The property has to be your primary residence to qualify for a HAMP modification.

Under federal law, some but not all mortgages include a right of rescission, which gives the borrower 3 business days following the signing of a loan document package to review the terms of the transaction and cancel the transaction.