Washington Storage Services Contract - Self-Employed

Description

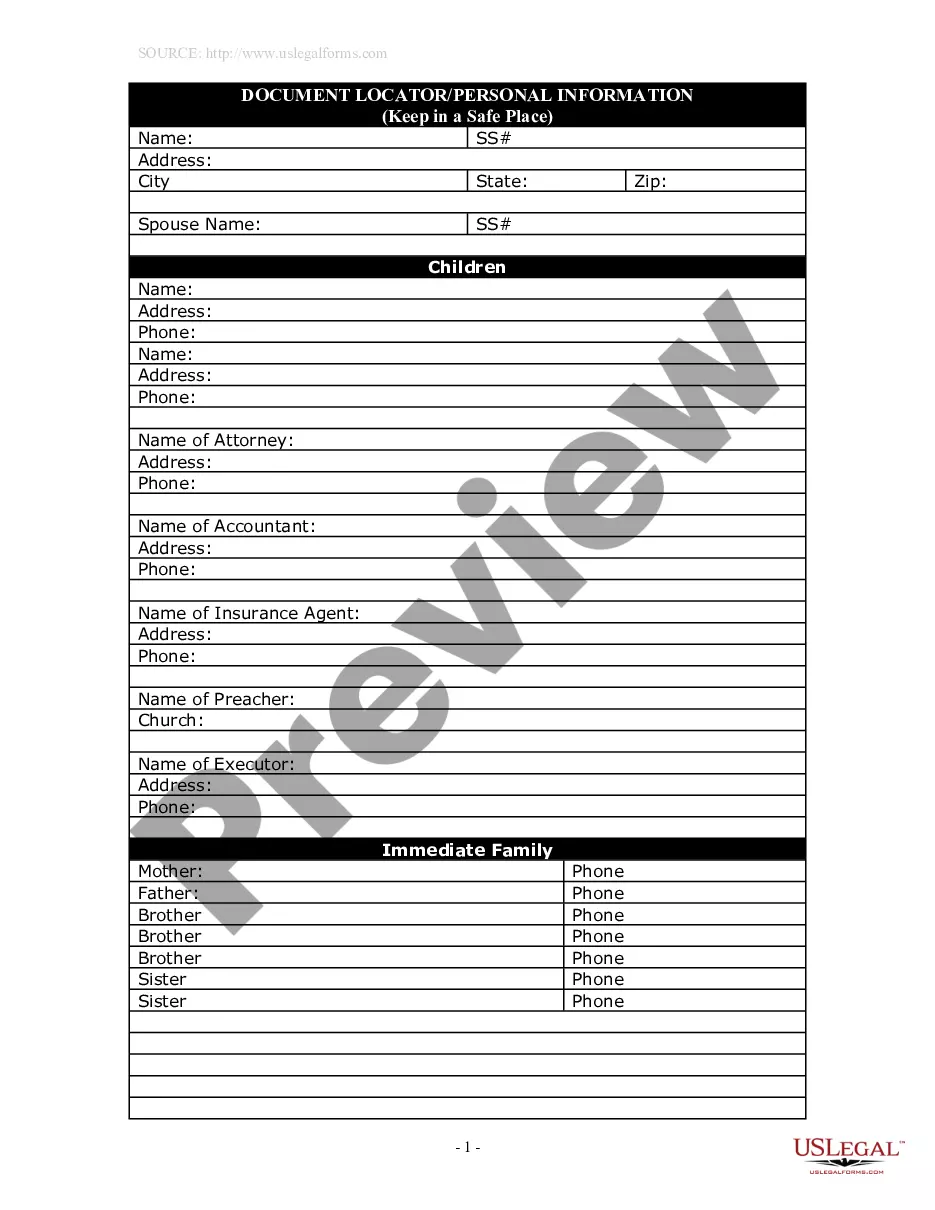

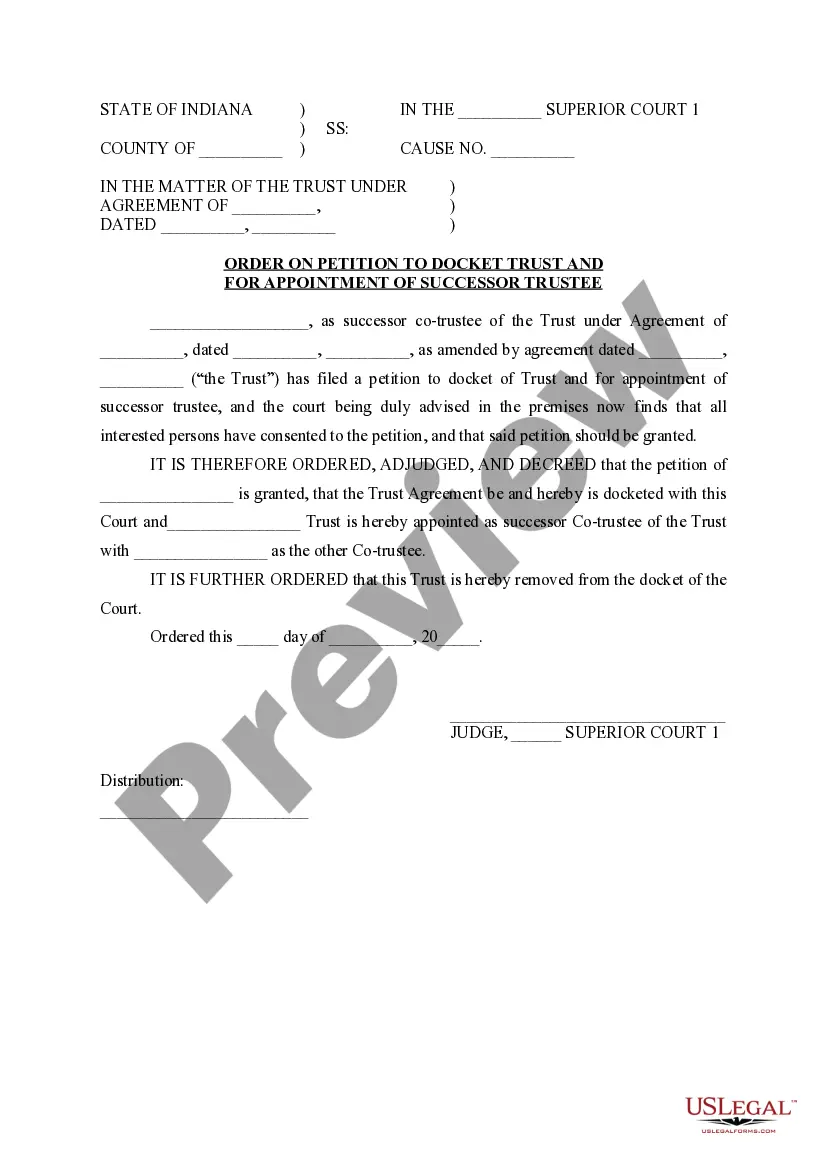

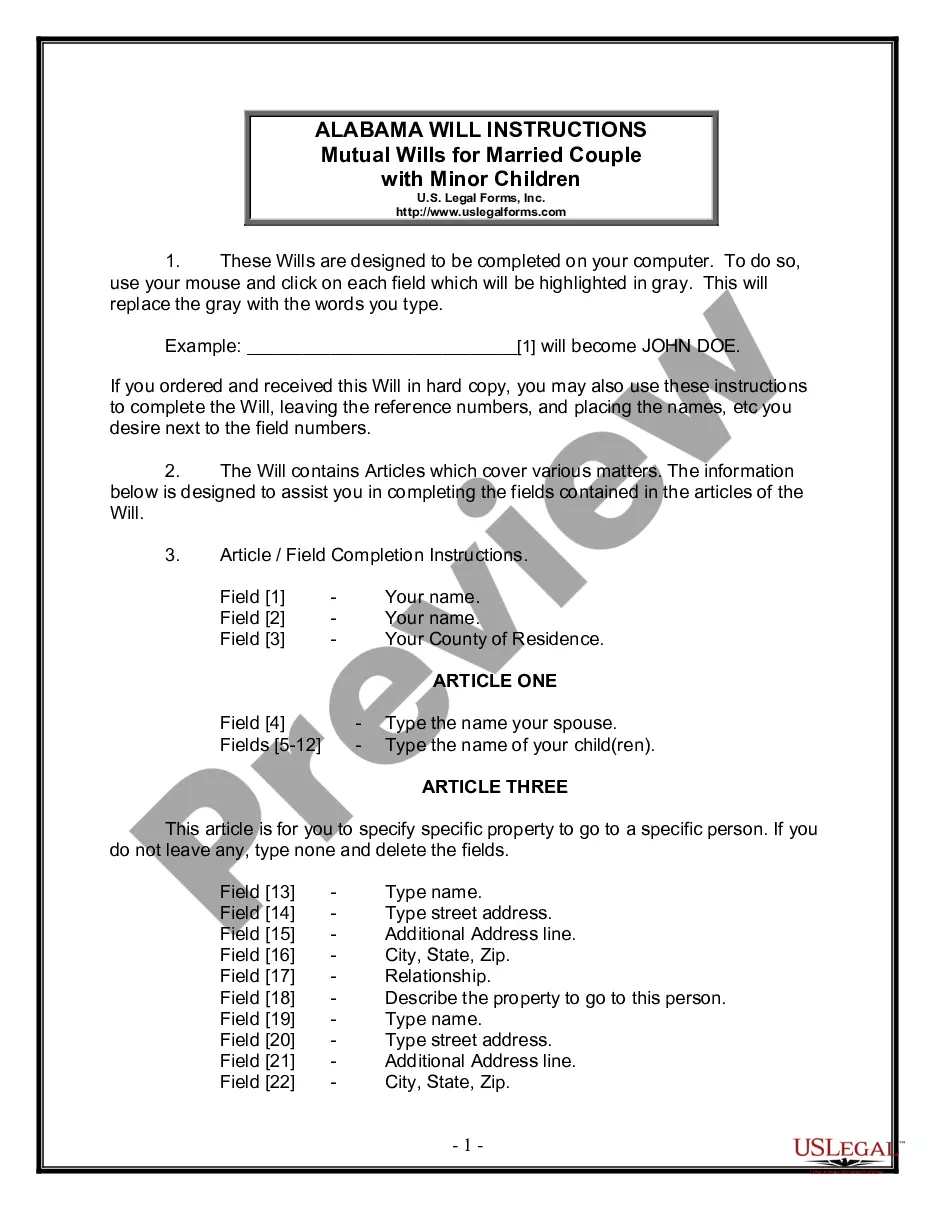

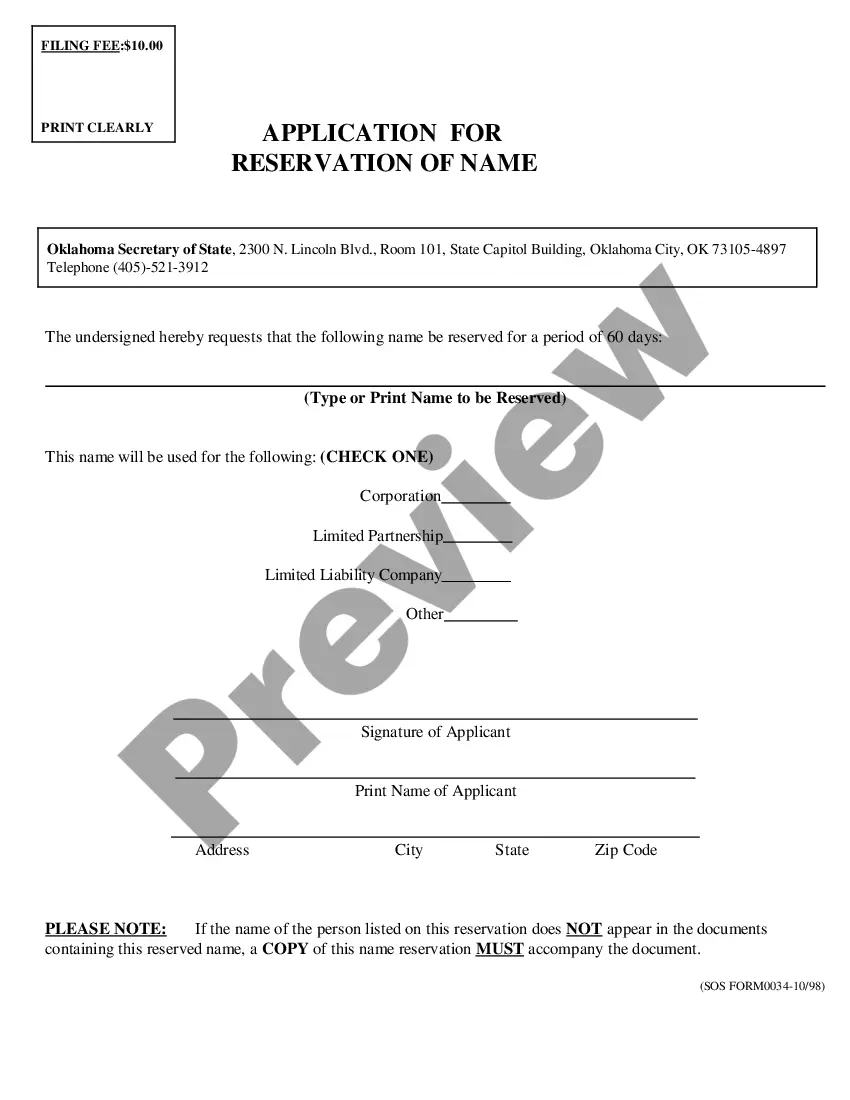

How to fill out Washington Storage Services Contract - Self-Employed?

Are you inside a situation in which you require paperwork for possibly company or specific reasons just about every working day? There are tons of legal file web templates available on the net, but finding types you can rely isn`t easy. US Legal Forms provides a large number of form web templates, much like the Washington Storage Services Contract - Self-Employed, that are written to fulfill federal and state specifications.

Should you be previously informed about US Legal Forms internet site and also have your account, just log in. Next, it is possible to download the Washington Storage Services Contract - Self-Employed web template.

If you do not have an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the form you will need and ensure it is to the correct area/county.

- Take advantage of the Review key to check the form.

- See the outline to actually have selected the proper form.

- In case the form isn`t what you`re seeking, take advantage of the Search industry to obtain the form that meets your needs and specifications.

- When you obtain the correct form, click Get now.

- Select the prices plan you want, complete the desired information to produce your money, and pay money for the transaction making use of your PayPal or charge card.

- Choose a convenient document formatting and download your duplicate.

Discover all the file web templates you have purchased in the My Forms food selection. You can get a more duplicate of Washington Storage Services Contract - Self-Employed whenever, if possible. Just go through the necessary form to download or produce the file web template.

Use US Legal Forms, the most comprehensive collection of legal kinds, to save lots of efforts and steer clear of faults. The service provides professionally made legal file web templates which can be used for a variety of reasons. Produce your account on US Legal Forms and initiate generating your lifestyle a little easier.

Form popularity

FAQ

For businesses, rental expenditures for a storage facility are considered a tax deduction if the expense is ordinary and necessary for the business according to the Internal Revenue Service (IRS) rules.

While growth rates are projected to remain steady, the self-storage industry has a strong track record of a high return on investment for most facilities. From 2009 to 2018, self-storage facilities averaged an annual ROI of 16.9%. This number was higher than office, industrial, retail or apartments during that time.

A storage unit can be classified as rent and deducted as a business expense as long as it's a "reasonable, necessary, and ordinary" expense for your business. There are many ways to use your storage unit that qualify as a business expense.

Divide your net operating income (NOI) by the cap rate to calculate your property value. This reflects your income stream, which is an important consideration in determining a sale price for your self-storage facility.

As long as you're storing supplies or other equipment needed to run your business, you can write off your storage fees as a standard business expense deduction, and that's true even if you're a smaller corporation. There are self-employment tax deductions for storage units that you can claim.

You do not have to pay sales tax or use tax on storage containers (and other related equipment) that is rented to customers at the customer's location.

If you divide the existing square feet of storage by the population, you get 4.77 square feet per person. Assuming 8 square feet per person is the point of equilibrium, you can now calculate your demand.

Self-storage facilities can earn an average of $361,000 to $798,800 gross per year with the states of Maryland, Arkansas and New York earning the highest number of sales.

Market Overview The global self-storage market (hereafter referred to as the market studied) was valued at USD 48.02 billion in 2020 and is expected to reach a value of USD 64.71 billion by 2026, registering a CAGR of 5.45% over the forecast period, 2021-2026.

5 Practical, Proven Strategies for Making More Money in Self-...Use Management Software. Facility-management software should be a self-storage operator's best friend.Build a Quality Website.Train Your Staff.Create Ancillary Income.Regularly Raise Rates on Existing Tenants.