Washington Hardware, Locks And Screens Installation And Services Contract - Self-Employed

Description

How to fill out Washington Hardware, Locks And Screens Installation And Services Contract - Self-Employed?

Choosing the right authorized document format can be a battle. Naturally, there are plenty of themes available on the Internet, but how would you get the authorized type you need? Take advantage of the US Legal Forms internet site. The support delivers a large number of themes, for example the Washington Hardware, Locks And Screens Installation And Services Contract - Self-Employed, which can be used for enterprise and private requires. Every one of the types are checked by professionals and meet state and federal needs.

In case you are currently listed, log in to the accounts and click the Acquire option to obtain the Washington Hardware, Locks And Screens Installation And Services Contract - Self-Employed. Use your accounts to check with the authorized types you might have ordered earlier. Proceed to the My Forms tab of the accounts and obtain yet another version of the document you need.

In case you are a whole new customer of US Legal Forms, listed below are basic instructions for you to follow:

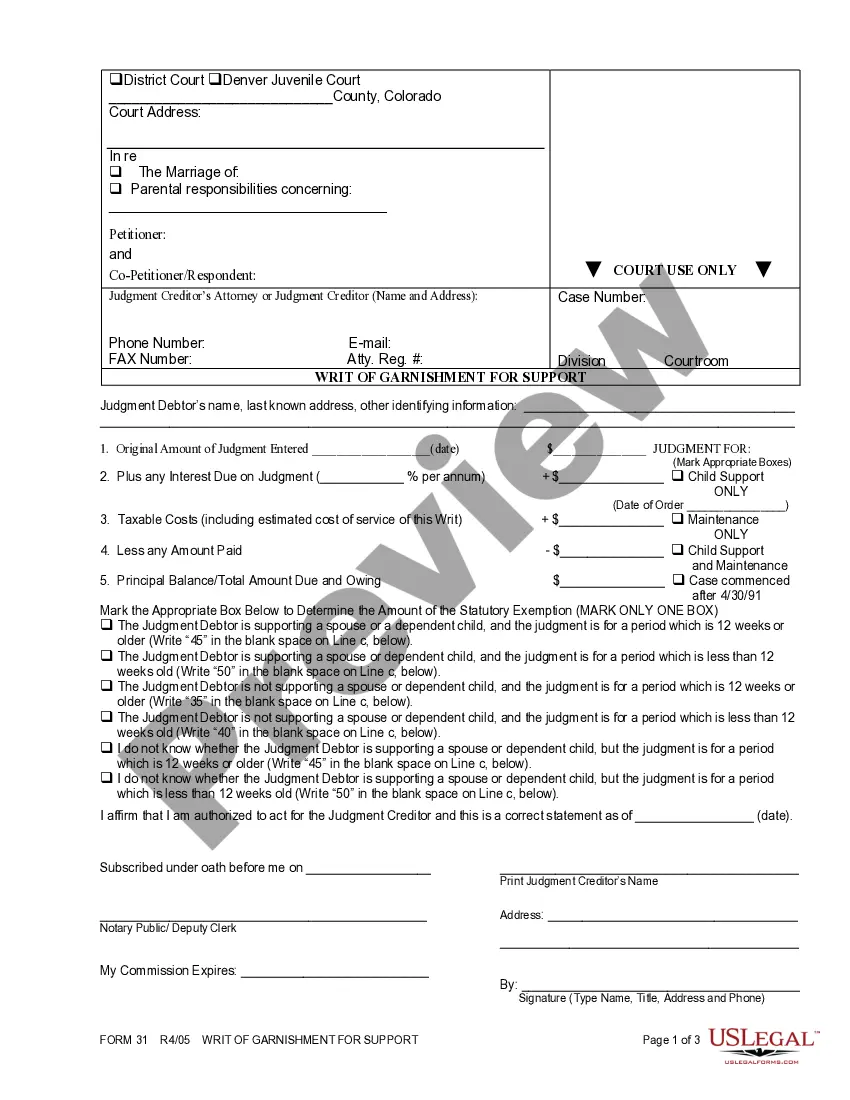

- Very first, make certain you have selected the right type for your personal area/state. You are able to check out the form utilizing the Review option and study the form information to ensure it is the best for you.

- When the type fails to meet your needs, utilize the Seach industry to obtain the correct type.

- Once you are positive that the form would work, click the Acquire now option to obtain the type.

- Pick the costs prepare you need and enter in the needed information and facts. Make your accounts and purchase an order utilizing your PayPal accounts or credit card.

- Select the file format and download the authorized document format to the device.

- Full, revise and printing and signal the acquired Washington Hardware, Locks And Screens Installation And Services Contract - Self-Employed.

US Legal Forms may be the greatest catalogue of authorized types in which you can discover various document themes. Take advantage of the service to download skillfully-produced files that follow status needs.

Form popularity

FAQ

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Before you hire an independent contractor, you need to have three important documents:A W-9 form with the person's contact information and taxpayer ID number,A resume to verify the person's qualifications, and.A written contract showing the details of the agreement between you and the independent contractor.More items...?

There are two main accounting methods that independent contractors can choose from when filing their first tax returns as a business.Cash basis is the most simple form of tax returns.Accrual basis will count your expenses and cash when it is earned, not when the money is received.

A 1099 employee is a contractor rather than a full-time employee. These employees may also be referred to as freelancers, self-employed workers, or independent contractors. If you are a business that is contracting 1099 employees, determine what type of work this individual will do for your business.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

How to Invoice as a ContractorIdentify the Document as an Invoice.Include Your Business Information.Add the Client's Contact Details.Assign a Unique Invoice Number.Add the Invoice Date.Provide Details of Your Services.Include Your Payment Terms.List the Total Amount Due.More items...

It seems obvious, but make sure that you include in the contract the contractor's name, physical address, phone number, insurance company and account and license numbers.

First up: Get your tax forms in orderStep 1: Ask your independent contractor to fill out Form W-9.Step 2: Fill out two 1099-NEC forms (Copy A and B)Ask your independent contractor for invoices.Add your freelancer to payroll.Keep records like a boss.Tools to check out:

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.