Washington Self-Employed Independent Contractor Chemist Agreement

Description

How to fill out Washington Self-Employed Independent Contractor Chemist Agreement?

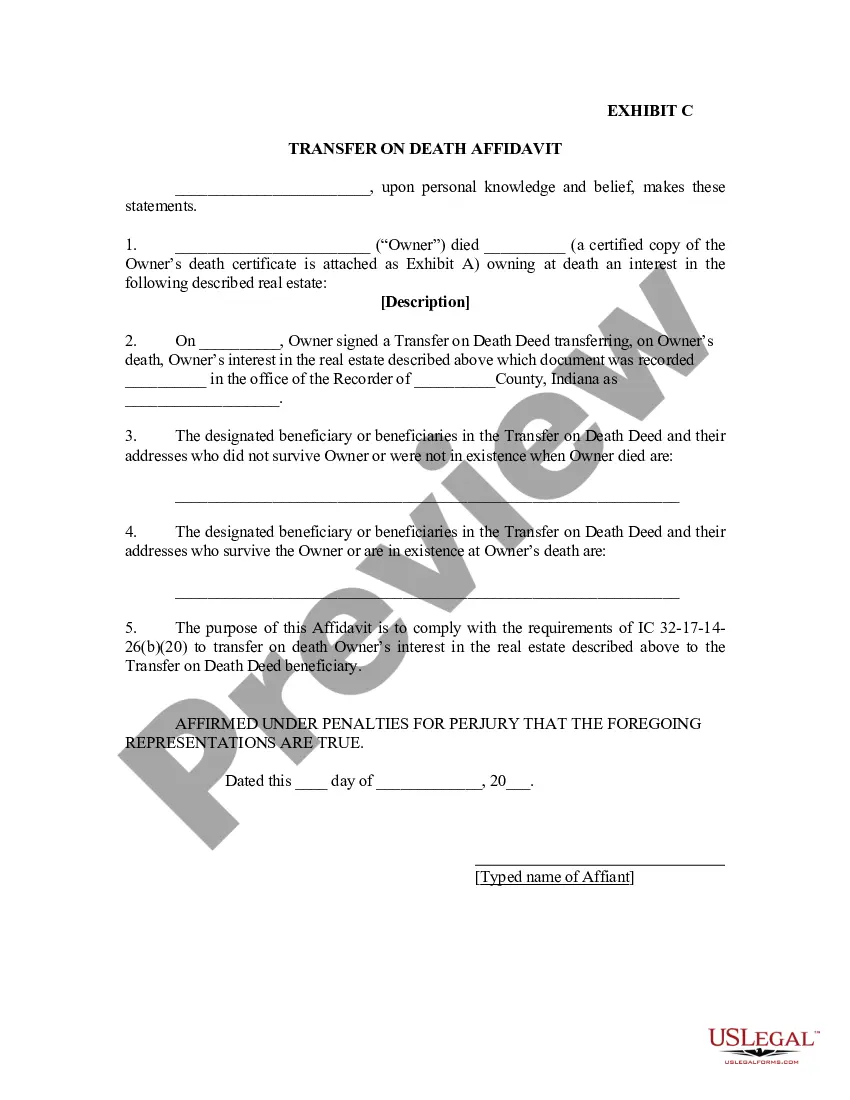

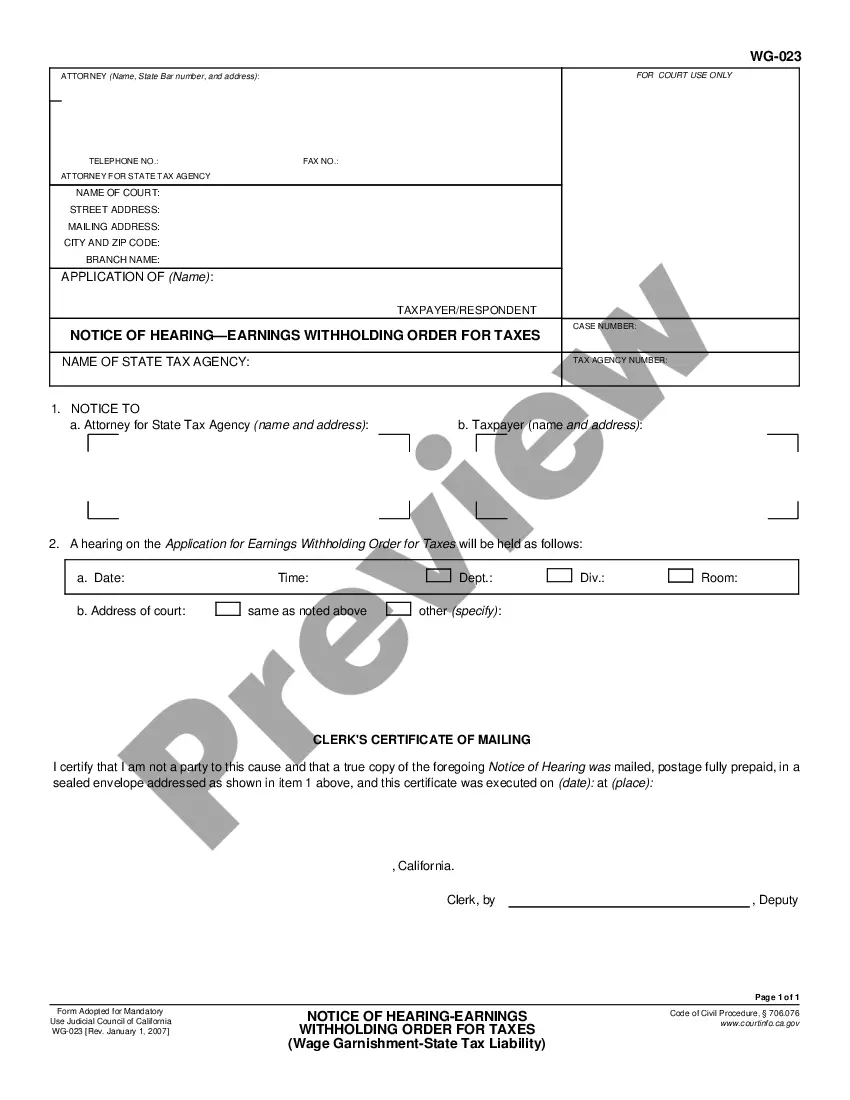

Are you within a position where you will need files for sometimes business or individual reasons just about every day time? There are a lot of lawful document web templates available online, but getting versions you can rely isn`t easy. US Legal Forms provides 1000s of develop web templates, much like the Washington Self-Employed Independent Contractor Chemist Agreement, that happen to be published to fulfill federal and state demands.

Should you be currently informed about US Legal Forms website and also have your account, merely log in. After that, you may acquire the Washington Self-Employed Independent Contractor Chemist Agreement template.

Should you not come with an bank account and need to begin to use US Legal Forms, adopt these measures:

- Get the develop you need and ensure it is for that correct city/region.

- Use the Review button to analyze the form.

- See the outline to actually have chosen the proper develop.

- In the event the develop isn`t what you are looking for, make use of the Look for industry to discover the develop that meets your requirements and demands.

- When you discover the correct develop, just click Get now.

- Opt for the pricing prepare you desire, fill in the specified information and facts to make your account, and pay money for the order making use of your PayPal or Visa or Mastercard.

- Select a practical paper structure and acquire your duplicate.

Find every one of the document web templates you have bought in the My Forms menus. You may get a additional duplicate of Washington Self-Employed Independent Contractor Chemist Agreement anytime, if needed. Just click on the essential develop to acquire or print the document template.

Use US Legal Forms, the most considerable selection of lawful varieties, in order to save efforts and prevent mistakes. The support provides appropriately manufactured lawful document web templates which you can use for an array of reasons. Generate your account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

The Washington State Business License is required by virtually all businesses in Washington. The Washington state Business License Application and a $19 fee are all that is required to obtain your license. The application process can be done online or by mail.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Contractors can also be self-employed, but they perform tasks on a contractual basis, rather than selling any products or rolling, bookable services. For example, a plumber would work for a client according to an agreed, one-off contract.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.