Washington Design Agreement - Self-Employed Independent Contractor

Description

How to fill out Washington Design Agreement - Self-Employed Independent Contractor?

If you need to full, acquire, or printing lawful file templates, use US Legal Forms, the most important selection of lawful kinds, that can be found on the Internet. Take advantage of the site`s easy and practical look for to discover the papers you will need. Different templates for company and specific functions are sorted by categories and states, or keywords and phrases. Use US Legal Forms to discover the Washington Design Agreement - Self-Employed Independent Contractor in a number of clicks.

When you are already a US Legal Forms buyer, log in in your accounts and click the Download switch to obtain the Washington Design Agreement - Self-Employed Independent Contractor. You can even gain access to kinds you earlier acquired in the My Forms tab of your accounts.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for the proper town/land.

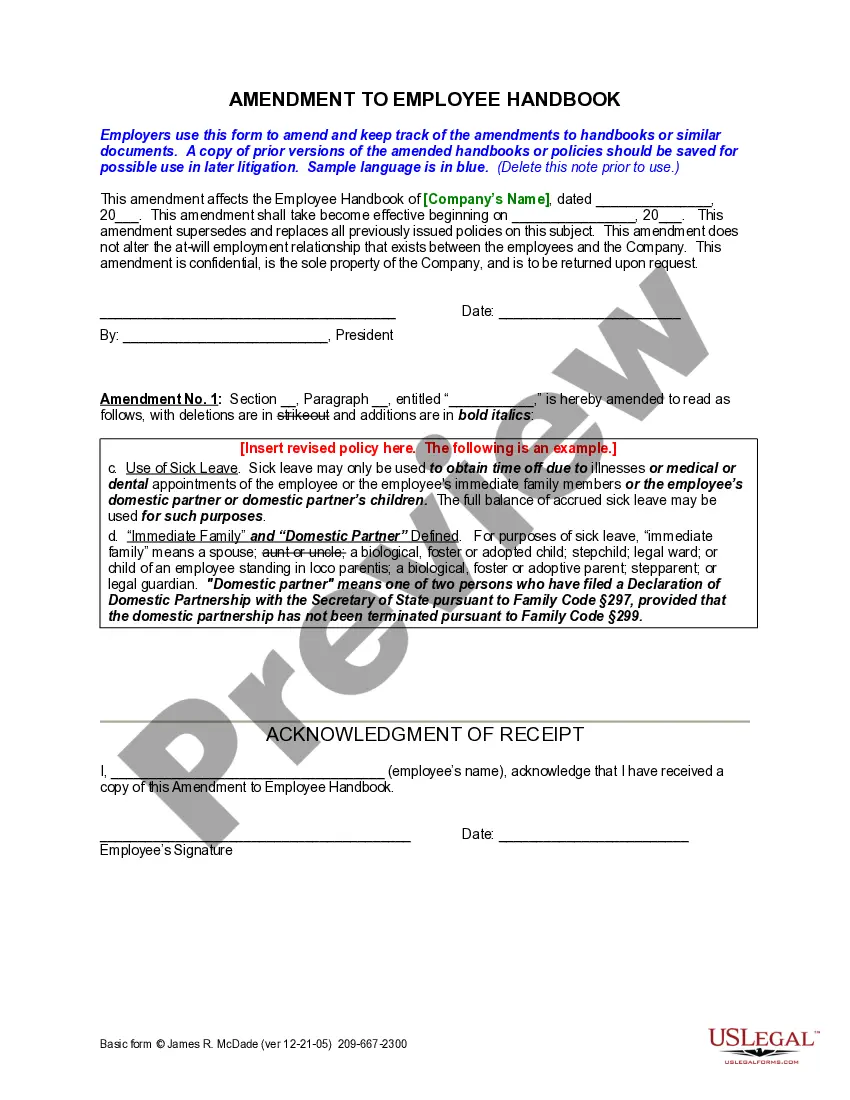

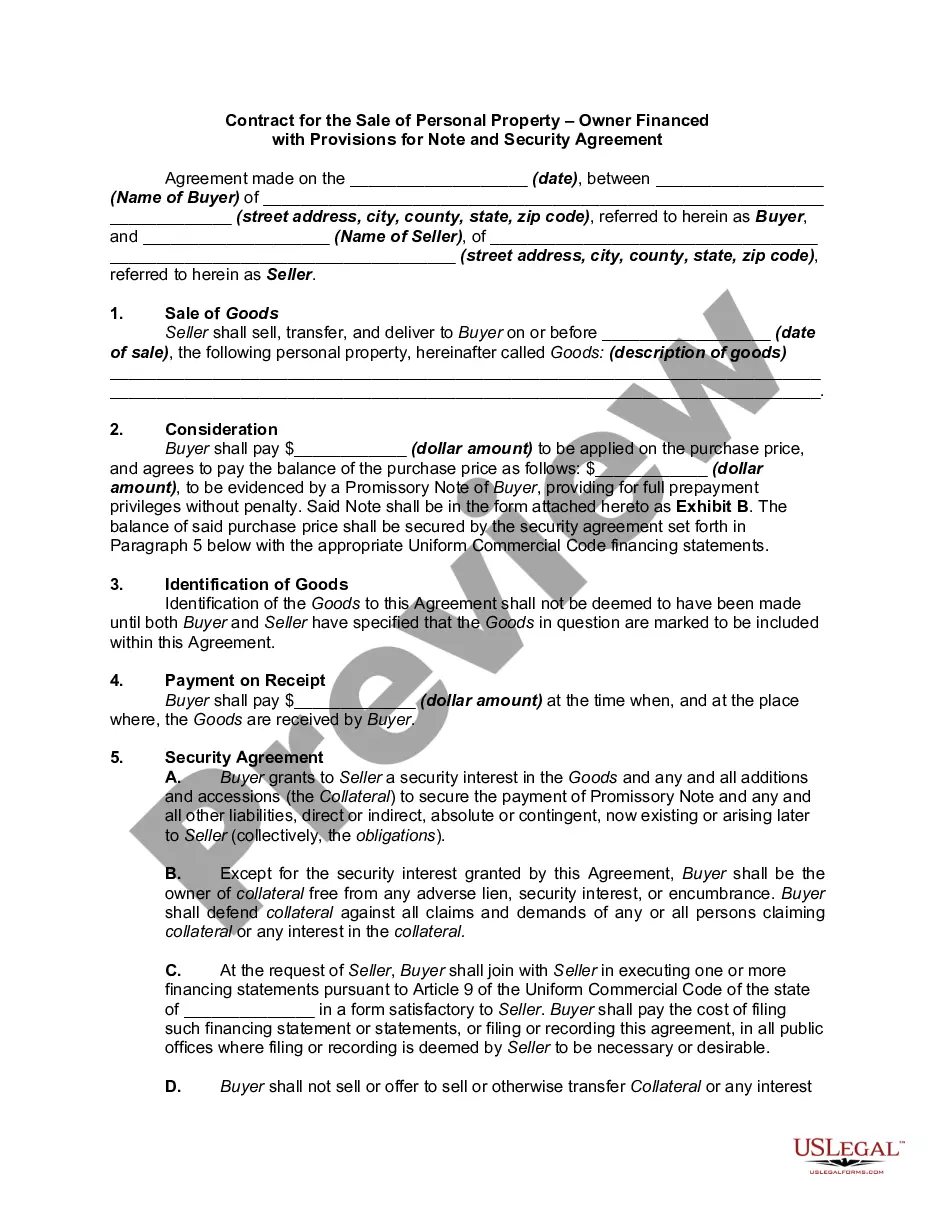

- Step 2. Use the Review method to examine the form`s content material. Do not forget to read through the outline.

- Step 3. When you are not satisfied using the develop, use the Look for industry near the top of the screen to find other models of the lawful develop web template.

- Step 4. Once you have located the shape you will need, click the Buy now switch. Opt for the prices strategy you prefer and add your credentials to register for an accounts.

- Step 5. Process the deal. You may use your credit card or PayPal accounts to accomplish the deal.

- Step 6. Select the format of the lawful develop and acquire it on your own gadget.

- Step 7. Full, modify and printing or indication the Washington Design Agreement - Self-Employed Independent Contractor.

Every lawful file web template you get is the one you have for a long time. You might have acces to each develop you acquired with your acccount. Click on the My Forms section and select a develop to printing or acquire again.

Be competitive and acquire, and printing the Washington Design Agreement - Self-Employed Independent Contractor with US Legal Forms. There are many expert and express-specific kinds you can utilize for your personal company or specific requirements.

Form popularity

FAQ

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

Must pass 1 of the following 2 options: The individual:Is customarily engaged in an independently established trade, occupation, profession, or business, of the same nature as that involved in the contract of service.Has a principal place of business that is eligible for a business deduction for IRS purposes.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

As a contractor, this is most likely you. This means that you run your own business as an individual and you are self-employed. Being a sole trader gives you both complete control and responsibility. Your business assets and liabilities are not separate from your personal ones.

As an independent contractor, you are engaged in business in Washington. You must register with and pay taxes to the Department of Revenue (DOR) if you meet any of the following: You are required to collect sales tax. Your gross income equals $12,000 or more per year.

Do Independent Contractors Need A Business License In Washington State? If you are an independent contractor, you must register with the Department of Revenue unless you: Make less than $12,000 before expenses per year; Do not sell retail; Do not pay or collect any taxes.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

You need a license if you meet one or more of the following criteria: Your business requires city and state endorsements. You are doing business using a name other than your full name legal name. You plan to hire employees within the next 90 days.