The Washington Self-Employed Independent Welder Services Contract is a legally binding agreement between a self-employed independent welder and a client in the state of Washington. This contract outlines the terms and conditions under which the welder will provide their welding services to the client. Keywords: Washington, self-employed, independent welder, services contract. This type of contract typically includes important details such as the scope of work, payment terms, project timeline, warranties, and liability provisions. It is essential for both parties to fully understand and agree upon these terms to avoid any potential disputes or misunderstandings during the course of the welding project. There may be different types or variations of the Washington Self-Employed Independent Welder Services Contract based on the specific requirements of the project or the preferences of the involved parties. For instance, some contracts may be tailored for long-term collaborative projects, while others could be for short-term or one-time welding assignments. Additionally, there might be specific contracts for different welding specialties, such as MIG welding contracts, TIG welding contracts, or underwater welding contracts. These variations would outline the unique considerations, techniques, and safety protocols associated with each specific type of welding. Regardless of the type, a comprehensive Washington Self-Employed Independent Welder Services Contract should address important aspects like the scope and nature of the welding work, the agreed-upon compensation, materials and supplies necessary for the project, equipment ownership and usage rights, confidentiality clauses, dispute resolution mechanisms, and termination provisions. To ensure the legality and authenticity of the contract, it is advisable to consult with an attorney or a legal professional who can customize the agreement according to the specific needs of the self-employed independent welder and their client in Washington. This will help protect the interests, rights, and responsibilities of both parties involved in the welding project.

Washington Self-Employed Independent Welder Services Contract

Description

How to fill out Washington Self-Employed Independent Welder Services Contract?

Are you in the situation the place you need to have documents for sometimes company or personal uses virtually every working day? There are a variety of legitimate document layouts available online, but locating versions you can rely on is not simple. US Legal Forms gives a large number of type layouts, such as the Washington Self-Employed Independent Welder Services Contract, that happen to be published to meet state and federal needs.

In case you are already familiar with US Legal Forms site and possess your account, just log in. Following that, you can download the Washington Self-Employed Independent Welder Services Contract web template.

If you do not come with an bank account and wish to begin using US Legal Forms, adopt these measures:

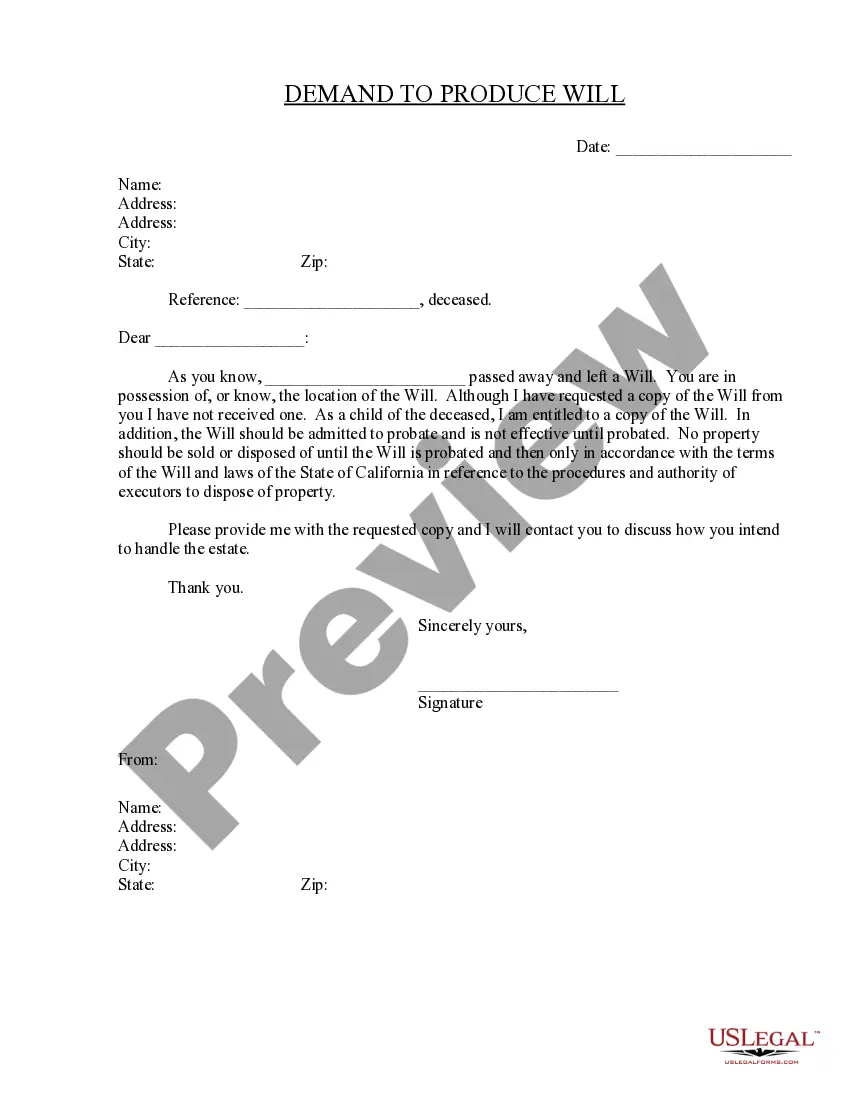

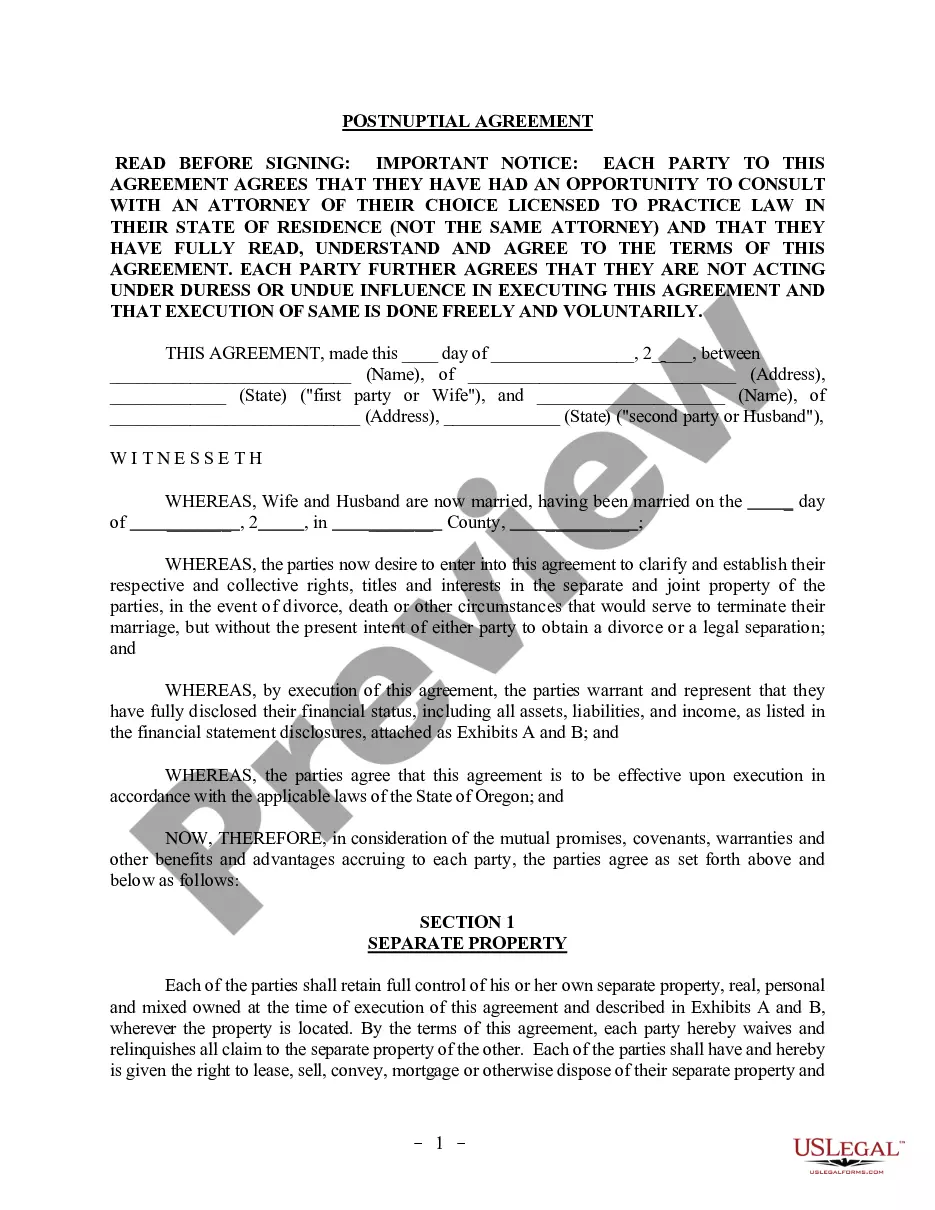

- Obtain the type you want and make sure it is for your appropriate city/county.

- Take advantage of the Preview key to analyze the form.

- See the outline to actually have selected the right type.

- In the event the type is not what you`re trying to find, utilize the Look for discipline to obtain the type that meets your needs and needs.

- Once you discover the appropriate type, simply click Acquire now.

- Choose the costs prepare you desire, submit the necessary information and facts to create your bank account, and purchase your order making use of your PayPal or charge card.

- Choose a convenient file file format and download your backup.

Locate all of the document layouts you possess purchased in the My Forms food selection. You may get a additional backup of Washington Self-Employed Independent Welder Services Contract whenever, if possible. Just click the required type to download or printing the document web template.

Use US Legal Forms, the most extensive collection of legitimate varieties, to conserve time and avoid faults. The services gives skillfully created legitimate document layouts that you can use for a selection of uses. Create your account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Registering your business Independent contractors must register with the Department of Revenue unless they: Make less than $12,000 a year before expenses; Do not make retail sales; Are not required to pay or collect any taxes administered by the Department of Revenue.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

As an independent contractor, you are engaged in business in Washington. You must register with and pay taxes to the Department of Revenue (DOR) if you meet any of the following: You are required to collect sales tax. Your gross income equals $12,000 or more per year.

Step-by-step guide to starting a business in WashingtonFile your formation document with the Secretary of State.Wait for processing and your UBI number.Submit your master Business License Application.Apply for other licenses and permits.File your Initial Report.Obtain a Federal Tax ID Number (EIN).More items...

Every independent contractor is a business owner. You run a business even if you are your only employee and you don't have a company name. There are significant differences, however, between a business that's just you as an independent contractor and running a company with employees and a registered name.

Do Independent Contractors Need A Business License In Washington State? If you are an independent contractor, you must register with the Department of Revenue unless you: Make less than $12,000 before expenses per year; Do not sell retail; Do not pay or collect any taxes.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

Must pass 1 of the following 2 options: The individual:Is customarily engaged in an independently established trade, occupation, profession, or business, of the same nature as that involved in the contract of service.Has a principal place of business that is eligible for a business deduction for IRS purposes.