Washington Self-Employed Paving Services Contract is a legal agreement entered into between a self-employed paving contractor and a client seeking paving services in the state of Washington. This contract outlines the terms and conditions under which the contractor will provide their paving services to the client. Keywords: Washington, self-employed, paving services, contract, legal agreement, terms and conditions, contractor, client. The Washington Self-Employed Paving Services Contract is a binding document that ensures both parties have a clear understanding of their rights and obligations. It helps to establish a professional relationship and provides protection for both the contractor and the client. There may be different types of Washington Self-Employed Paving Services Contracts, depending on the scope and nature of the paving services provided. Some of these contracts can include: 1. Residential Paving Services Contract: This type of contract is specifically designed for paving projects related to residential properties, such as driveways, walkways, or patios. It outlines the specific details of the project, including the materials to be used, project timeline, and payment terms. 2. Commercial Paving Services Contract: This type of contract is tailored to paving projects for commercial properties, such as parking lots, industrial driveways, or business premises. It typically includes provisions related to safety regulations, traffic management, and coordination with other onsite activities. 3. Municipal Paving Services Contract: In some cases, self-employed paving contractors may enter into contracts with local municipalities or government entities. These contracts often involve larger-scale projects, such as road resurfacing, sidewalk construction, or infrastructure improvements. Regardless of the type of Washington Self-Employed Paving Services Contract, the agreement typically covers key aspects such as project description, pricing and payment terms, timeline, warranties, dispute resolution mechanisms, and responsibilities of each party involved. It is essential for both the contractor and the client to carefully review and negotiate the terms of the contract to ensure that they are mutually fair and reasonable. Seeking legal advice during contract development and signing is highly recommended protecting both parties' interests and avoid any potential disputes.

Washington Self-Employed Paving Services Contract

Description

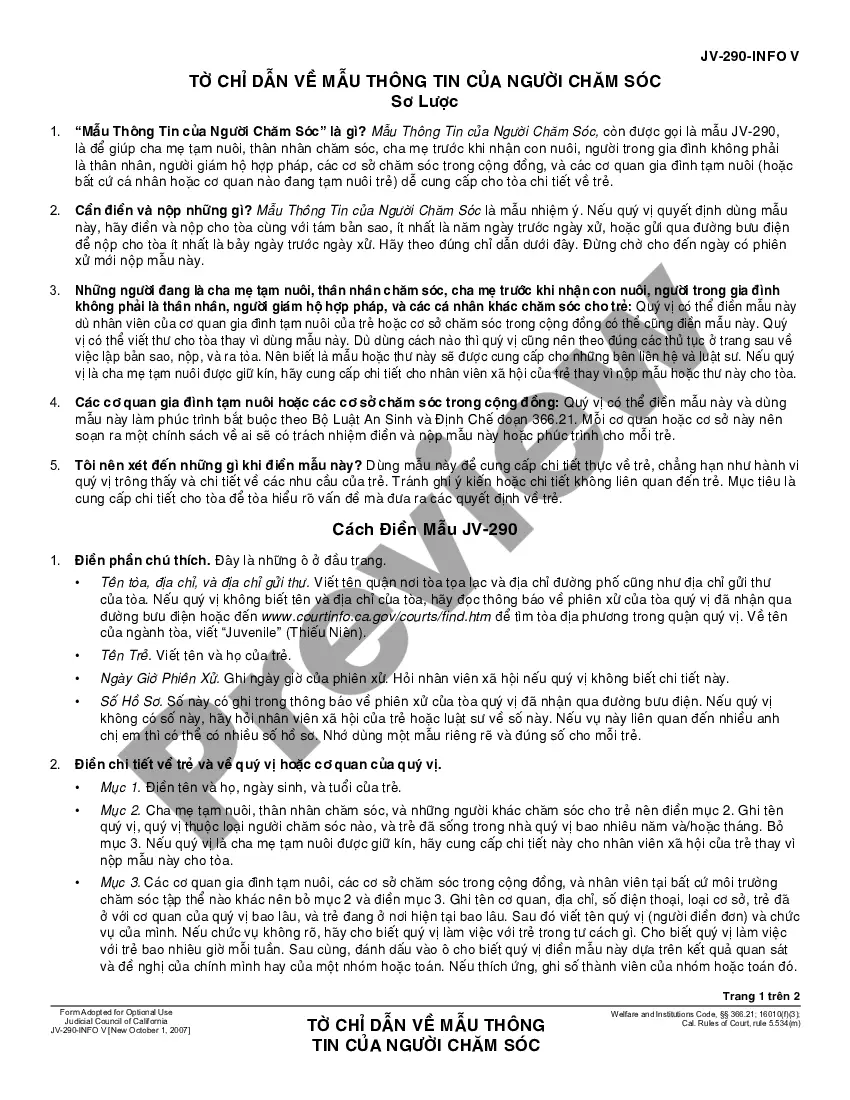

How to fill out Washington Self-Employed Paving Services Contract?

If you want to full, down load, or printing lawful record web templates, use US Legal Forms, the greatest selection of lawful kinds, that can be found on the Internet. Make use of the site`s simple and easy handy search to discover the paperwork you require. A variety of web templates for business and individual purposes are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to discover the Washington Self-Employed Paving Services Contract within a couple of clicks.

If you are previously a US Legal Forms client, log in in your accounts and then click the Download button to find the Washington Self-Employed Paving Services Contract. You can even entry kinds you in the past acquired from the My Forms tab of your respective accounts.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the form for that correct area/nation.

- Step 2. Use the Review method to examine the form`s content. Do not overlook to learn the explanation.

- Step 3. If you are unsatisfied with the kind, use the Search field towards the top of the monitor to find other models of your lawful kind format.

- Step 4. After you have found the form you require, select the Purchase now button. Pick the pricing plan you favor and put your references to sign up for the accounts.

- Step 5. Approach the transaction. You can use your Мisa or Ьastercard or PayPal accounts to accomplish the transaction.

- Step 6. Find the file format of your lawful kind and down load it on your own gadget.

- Step 7. Complete, revise and printing or indicator the Washington Self-Employed Paving Services Contract.

Each and every lawful record format you get is your own property permanently. You may have acces to each and every kind you acquired in your acccount. Select the My Forms portion and pick a kind to printing or down load once more.

Remain competitive and down load, and printing the Washington Self-Employed Paving Services Contract with US Legal Forms. There are many professional and status-certain kinds you can use for your business or individual requires.

Form popularity

FAQ

Do You Need a General Contractor's License in Washington State? Yes! Washington state imposes substantial penalties and fines on people who complete work for others without first obtaining a Washington state general contractor's license.

If you are an independent contractor, you must register with the Department of Revenue unless you: Make less than $12,000 before expenses per year; Do not sell retail; Do not pay or collect any taxes.

Can You 1099 Someone Without A Business? Form 1099-NEC does not require you to have a business to report payments for your services. As a non-employee, you can perform services. In your case, the payer has determined that there is no relationship between you and your employer.

Must pass 1 of the following 2 options: The individual:Is customarily engaged in an independently established trade, occupation, profession, or business, of the same nature as that involved in the contract of service.Has a principal place of business that is eligible for a business deduction for IRS purposes.

Legal methods you can use to avoid paying taxes include things such as tax-advantaged accounts (401(k)s and IRAs), as well as claiming 1099 deductions and tax credits. Being a freelancer or an independent contractor comes with various 1099 benefits, such as the freedom to set your own hours and be your own boss.

As an independent contractor, you are engaged in business in Washington. You must register with and pay taxes to the Department of Revenue (DOR) if you meet any of the following: You are required to collect sales tax. Your gross income equals $12,000 or more per year.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

What percent do independent contractors pay in taxes? The self-employment tax rate is 15.3%, of which 12.4% goes to Social Security and 2.9% goes to Medicare. Income tax obligations vary based on net business profits and losses, among other factors.