Washington Journalist - Reporter Agreement - Self-Employed Independent Contractor

Description

How to fill out Washington Journalist - Reporter Agreement - Self-Employed Independent Contractor?

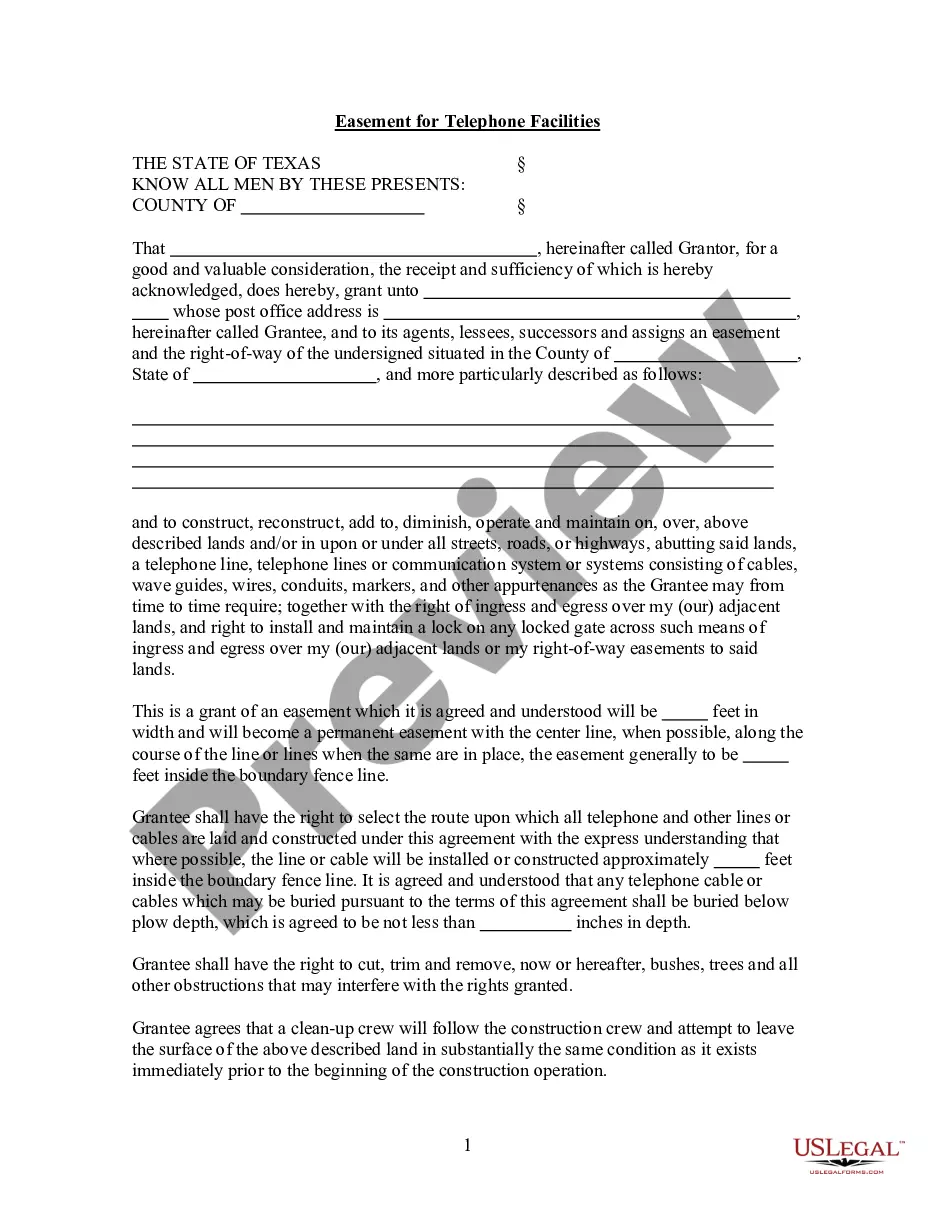

Are you currently in the placement where you will need files for sometimes organization or person functions virtually every time? There are a variety of lawful file layouts available on the net, but discovering versions you can rely on isn`t simple. US Legal Forms provides thousands of kind layouts, much like the Washington Journalist - Reporter Agreement - Self-Employed Independent Contractor, that happen to be written in order to meet federal and state needs.

When you are currently familiar with US Legal Forms web site and also have your account, basically log in. Afterward, you can obtain the Washington Journalist - Reporter Agreement - Self-Employed Independent Contractor template.

If you do not come with an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Find the kind you want and ensure it is to the proper metropolis/state.

- Make use of the Preview switch to analyze the shape.

- See the description to actually have chosen the proper kind.

- In the event the kind isn`t what you`re seeking, use the Look for area to discover the kind that meets your needs and needs.

- Whenever you find the proper kind, just click Acquire now.

- Pick the rates prepare you desire, complete the desired information and facts to produce your bank account, and buy your order utilizing your PayPal or charge card.

- Pick a practical file format and obtain your copy.

Find all the file layouts you might have bought in the My Forms food selection. You may get a extra copy of Washington Journalist - Reporter Agreement - Self-Employed Independent Contractor at any time, if required. Just go through the necessary kind to obtain or print out the file template.

Use US Legal Forms, the most substantial variety of lawful varieties, to save lots of some time and prevent errors. The assistance provides skillfully produced lawful file layouts that you can use for an array of functions. Generate your account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

For many of the more than 16 million self-employed individuals in the United States, the answer to this question is probably 'both. ' All sole proprietors are, by definition, self-employed. But not all self-employed persons are sole proprietors.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The difference between the two designations is how they earn income: Independent contractors do specific tasks for clients for a set fee. Sole proprietors may do contract work, but may also have other revenue streams, like selling their own products to customers.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

An independent contractor is someone who works for someone else, but not as an employee. The primary difference between an independent contractor and a sole proprietor is that an independent contractor usually provides a service rather than a product.

The difference between the two designations is how they earn income: Independent contractors do specific tasks for clients for a set fee. Sole proprietors may do contract work, but may also have other revenue streams, like selling their own products to customers.

More info

Piquette Research Editing Research/Analysis Publishing Technology Reporting Ethics Trust Tech Tools Business Work Web Applications Data Entry Posted by: Gary at 10:50 AM.