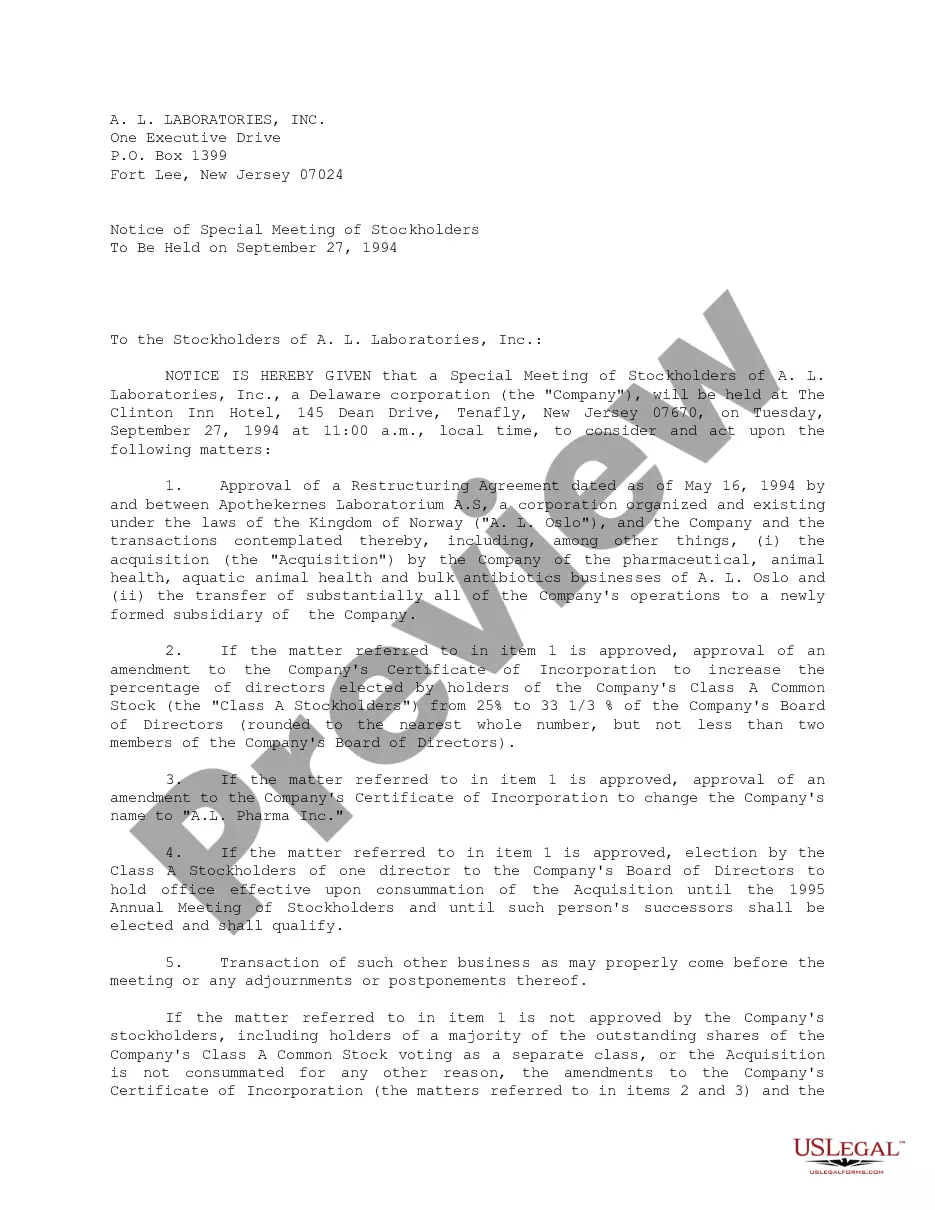

This complaint is for a plaintiff attorney who has been removed from the partnership of his former firm. The complaint requests an accounting of the former firm, stating that the plaintiff has been deprived of economic benefits rightfully due to him under the former partnership agreement, and also alleges egregious acts by his former partners.

Washington Alternative Complaint for an Accounting which includes Egregious Acts

Description

How to fill out Alternative Complaint For An Accounting Which Includes Egregious Acts?

Are you currently inside a situation in which you need documents for possibly enterprise or person reasons virtually every working day? There are tons of legitimate record layouts available on the net, but locating kinds you can rely isn`t simple. US Legal Forms gives a huge number of form layouts, like the Washington Alternative Complaint for an Accounting which includes Egregious Acts, which are written to satisfy federal and state demands.

When you are presently acquainted with US Legal Forms site and possess a merchant account, merely log in. Following that, you may down load the Washington Alternative Complaint for an Accounting which includes Egregious Acts web template.

Should you not provide an profile and want to start using US Legal Forms, abide by these steps:

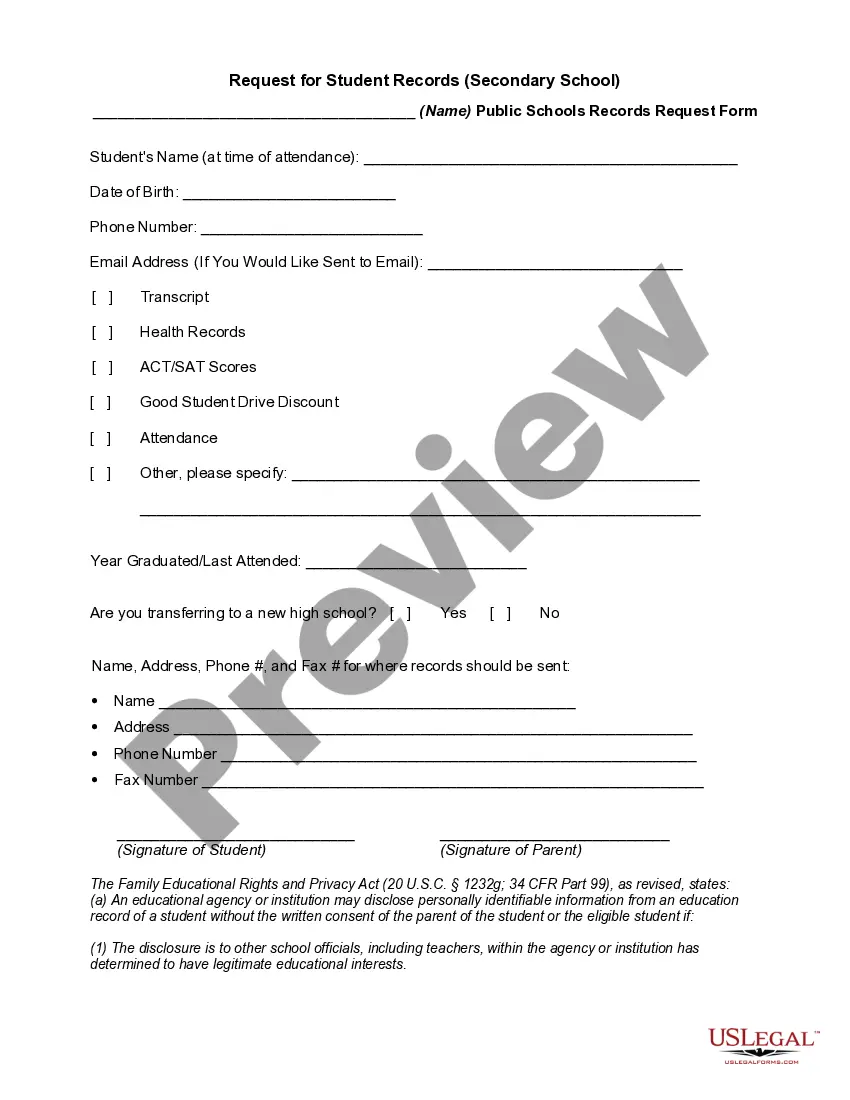

- Find the form you need and ensure it is for that appropriate city/area.

- Take advantage of the Preview option to check the form.

- Browse the explanation to actually have selected the appropriate form.

- In case the form isn`t what you are trying to find, take advantage of the Look for discipline to obtain the form that fits your needs and demands.

- Once you find the appropriate form, click Buy now.

- Opt for the costs strategy you want, fill out the desired info to generate your money, and pay money for your order using your PayPal or charge card.

- Decide on a convenient paper format and down load your copy.

Get all of the record layouts you have bought in the My Forms menus. You may get a additional copy of Washington Alternative Complaint for an Accounting which includes Egregious Acts whenever, if necessary. Just select the needed form to down load or print the record web template.

Use US Legal Forms, probably the most considerable variety of legitimate kinds, to conserve efforts and avoid mistakes. The support gives expertly manufactured legitimate record layouts which you can use for a range of reasons. Generate a merchant account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

The Washington State Board of Accountancy is a consumer protection agency that initially qualifies and continues to monitor the professional performance and ethical behavior of Certified Public Accountants (CPAs), CPA-Inactive certificateholders, CPA firms, and non-licensee CPA firm owners, serving individual and ...

If an accountant fails to exercise care and competence in performing and reporting on his auditing, accounting, tax, or management service engagements?he commits ordinary negligence. And he may be held liable for the damages resulting to his client.

The following represent the most common allegations made against CPAs and accounting firms: Negligence and incompetence. Fraud, deceit, and misrepresentation in the practice of public accountancy. Failing to perform services in ance with professional standards. Criminal convictions.

Statutory liability: CPAs have statutory liability under both federal and state securities laws. Statutory liability provides cover for defense costs, fines and penalties charged against the firm. Under statutory law, an auditor can be held civilly or criminally liable.

Only a CPA has met the professional and legal requirements to complete a review of financial statements and provide an official accountant's review report.

In all 50 states, accountants shall cannot provide legal advice to their clients. As such, an accountant cannot answer questions relating to interpretation or application of tax statutes, administrative regulations and rulings, court decisions, or general law.

Failing to document important information is a common mistake that often leads to lawsuits. If it is not in writing, it may be presumed later in a court of law that it didn't happen. Juries expect CPAs to document important events, advice, and client decisions.