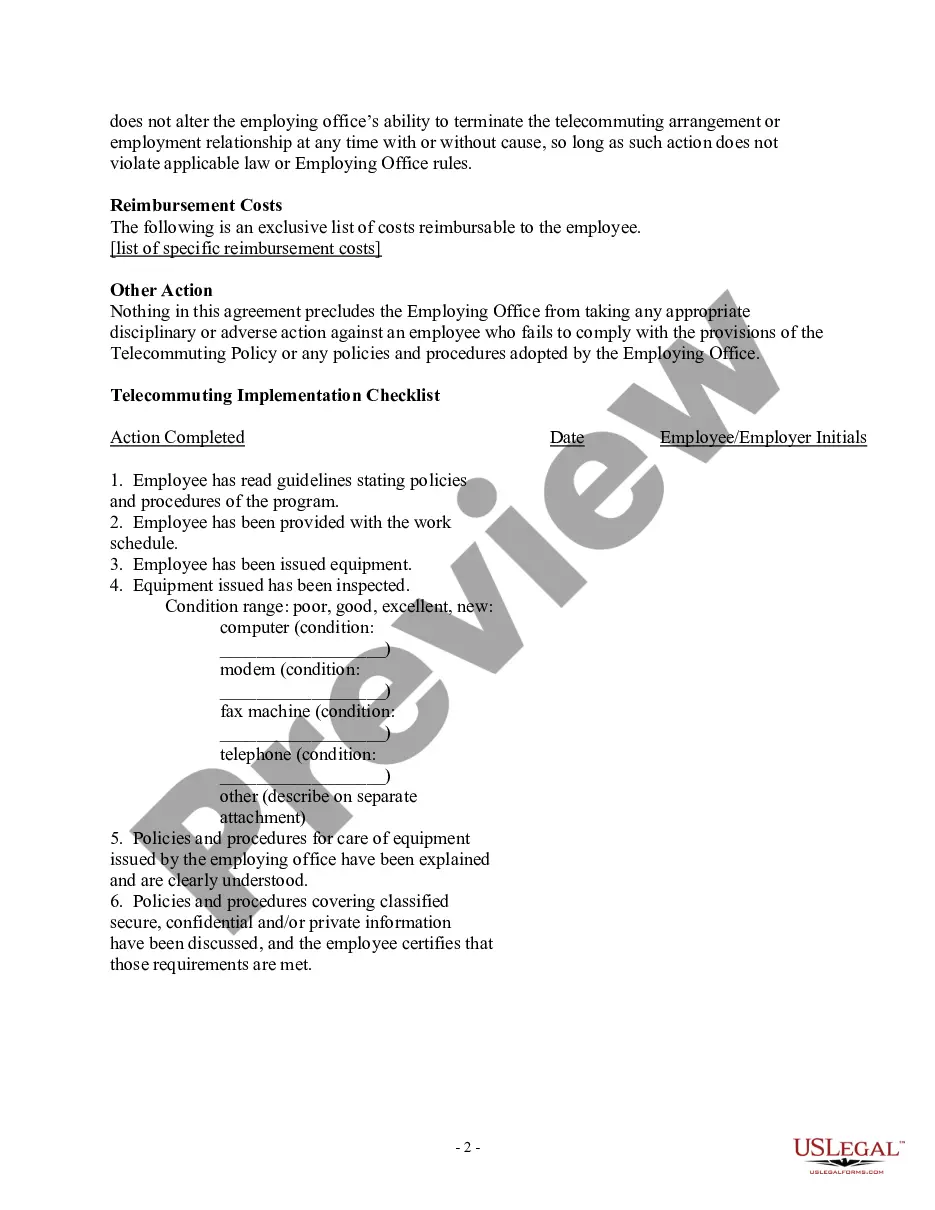

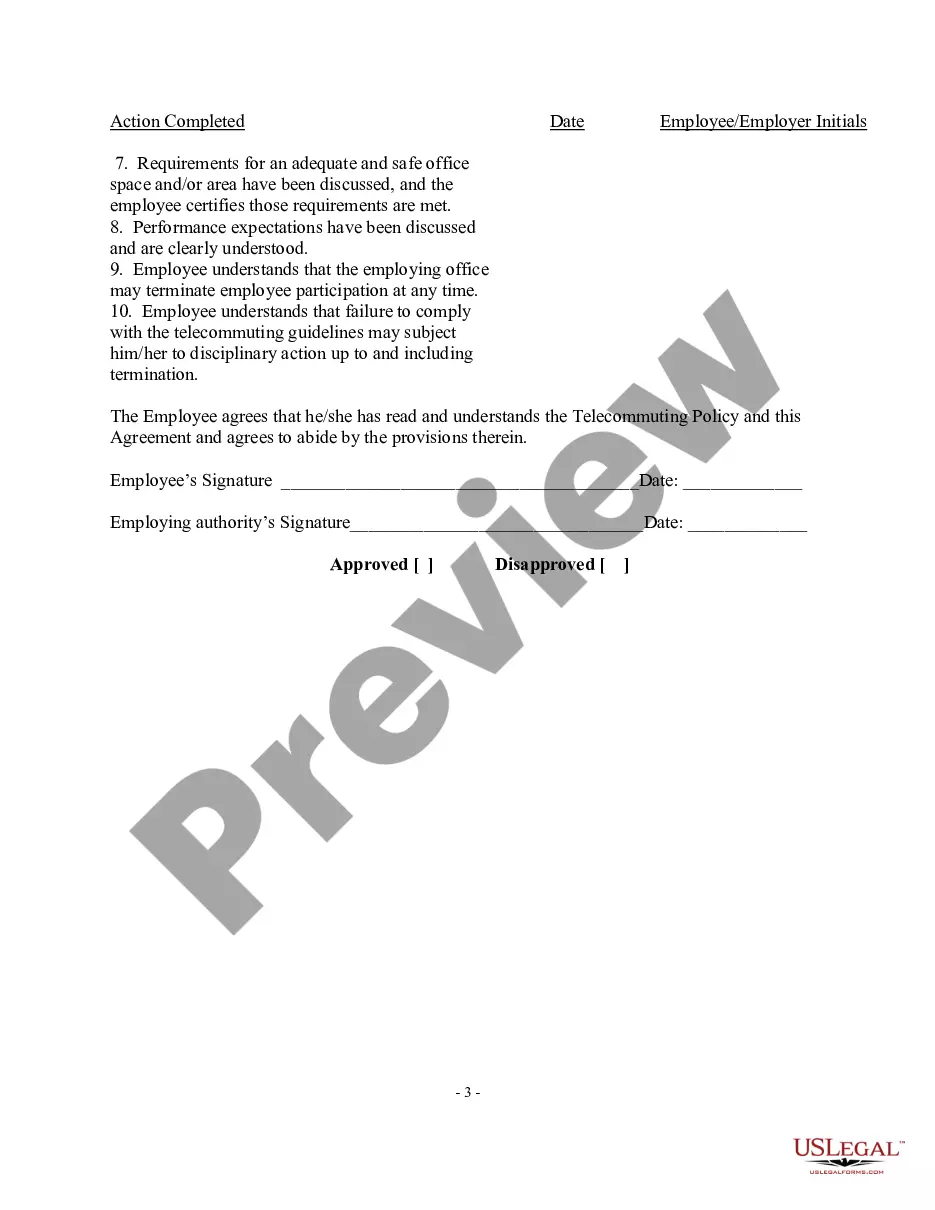

Washington Telecommuting Agreement is a legal contract that outlines the terms and conditions for employees to work remotely in the state of Washington. This agreement promotes telecommuting as an alternative way of working, emphasizing the importance of communication, productivity, and maintaining a positive work-life balance. Key provisions commonly included in a Washington Telecommuting Agreement include: 1. Purpose: Clearly defines the intent of the agreement, highlighting the employer's support for telecommuting and the employee's interest in working remotely. 2. Eligibility: Outlines the criteria for employees who are eligible for telecommuting, such as job position, performance record, and suitability of the role for remote work. 3. Work Schedule: Specifies the days and hours the employee will be expected to work remotely, outlining any flexibility allowed, core working hours, and any requirements for on-site attendance or meetings. 4. Equipment and Resources: Details the equipment, software, and resources provided by the employer necessary for the employee to perform their duties remotely. This may include laptops, internet connection, virtual private networks (VPNs), and other tools essential for remote work. 5. Confidentiality and Security: Establishes the employee's responsibility for ensuring the confidentiality and security of company information, data, and systems while working remotely. It may include requirements for data encryption, secure network connections, and secure storage of physical or digital files. 6. Communication Channels: Outlines the preferred methods of communication between the employee and the employer, including email, instant messaging, video conferencing, or any other collaborative tools necessary for effective remote work. 7. Performance and Evaluation: Sets expectations for the employee's performance and productivity while working remotely, including deadlines, goals, and Key Performance Indicators (KPIs). It may also include provisions for regular check-ins, progress reports, and performance evaluations. 8. Reimbursement: Addresses any expenses incurred by the employee while working remotely, such as internet or phone bills, home office equipment, or travel expenses. It specifies whether the employer will reimburse these costs and the process for seeking reimbursement. 9. Termination and Modification: Outlines the conditions for terminating or modifying the telecommuting agreement, including notice periods, circumstances that may require the employee to return to working on-site, or changes to the terms of the agreement. Types of Washington Telecommuting Agreements can vary based on the specific needs and requirements of different industries, organizations, or individuals. Some common variations may include: 1. Full-time Telecommuting Agreement: This type of agreement allows an employee to work remotely on a full-time basis, completely replacing on-site work. The agreement sets clear expectations regarding work hours, availability, and job responsibilities. 2. Part-time Telecommuting Agreement: This agreement allows employees to work remotely for a portion of their regular work schedule while completing the remaining hours on-site. It outlines the specific days or hours the employee will work remotely and any requirements for on-site presence. 3. Temporary Telecommuting Agreement: This form of agreement is applicable when employees need to work remotely for a specific period, such as during emergencies, natural disasters, or unforeseen events. It defines the terms and duration of remote work during the temporary situation. 4. Hybrid Telecommuting Agreement: A hybrid agreement allows for a combination of telecommuting and on-site work, providing flexibility for employees. It typically specifies certain days or hours for remote work, and others for on-site collaboration or meetings. Washington Telecommuting Agreements aim to create a mutually beneficial arrangement between employers and employees by fostering productivity, flexibility, and a healthy work environment, while complying with state laws and regulations.

Washington Telecommuting Agreement

Description

How to fill out Telecommuting Agreement?

Are you in the situation where you will need files for possibly business or individual functions just about every day? There are a variety of legal papers layouts accessible on the Internet, but discovering kinds you can depend on is not simple. US Legal Forms provides thousands of type layouts, such as the Washington Telecommuting Agreement, that are composed in order to meet federal and state demands.

When you are presently acquainted with US Legal Forms internet site and get an account, simply log in. Next, you may obtain the Washington Telecommuting Agreement format.

Unless you offer an account and need to begin using US Legal Forms, follow these steps:

- Find the type you will need and ensure it is for that appropriate town/county.

- Make use of the Review option to examine the form.

- Browse the explanation to actually have selected the right type.

- If the type is not what you are seeking, use the Look for industry to get the type that suits you and demands.

- If you obtain the appropriate type, just click Buy now.

- Select the rates strategy you would like, submit the required details to make your bank account, and pay money for your order using your PayPal or credit card.

- Choose a hassle-free file format and obtain your copy.

Find each of the papers layouts you possess bought in the My Forms food list. You can obtain a more copy of Washington Telecommuting Agreement any time, if necessary. Just go through the necessary type to obtain or printing the papers format.

Use US Legal Forms, probably the most extensive assortment of legal varieties, to conserve efforts and steer clear of errors. The services provides appropriately created legal papers layouts which you can use for a range of functions. Produce an account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

In certain cases, a reciprocity agreement may protect workers from taxes in different states. Not all states levy a state income tax. In 2020, employees are free from state taxes in Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Generally speaking, when you pay a remote employee, you pay the local taxes in the state where the employee works. If your employee works in the same state your company is registered in, you'll withhold state income taxes and pay state unemployment insurance (SUI) tax in this state.

Some reasons may include: Reducing workplace distractions. Allowing you to be more comfortable and therefore more creative. Eliminating the daily commute. Reducing environmental impacts. Allowing you to work whenever you want. Optimizing your time.

That means they are subject to the same federal and state laws regarding wages, overtime, breaks, and paid time off. If you work for an employer based in a different state, your rights as a remote worker are generally determined by the laws in the state where you reside.

During the negotiation, try these seven strategies: Ask for a conversation. ... Highlight similarities to in-person work. ... Focus on benefits to your employer. ... Recall your contributions. ... Offer solutions. ... Compromise if necessary. ... Suggest a trial period.

You'll file as a resident for the state where you live, and if the work state withholds taxes, you'll file a nonresident return for the state where you work.

THE REMOTE-WORK TAX RULE The rule is, if a nonresident receives W-2 wages for work performed out of state, even if it's from a California employer, the income is not subject to California income taxes.

State Tax Obligations A worker may have tax obligations in any state where they reside and possibly the state where their employer's worksite is located. A permanent remote worker will file their personal income taxes in their state of residence, whether they are a W-2 employee or a 1099-NEC independent contractor.