A Washington Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes is a legal document used in the state of Washington to verify that the estate of a deceased individual has been fully administered and all assets have been transferred to the intended beneficiaries, known as devises. It also includes a statement regarding any outstanding debts and taxes owed by the estate. Keywords: Washington, affidavit, estate assets, distributed, devises, executor, estate representative, statement, debts, taxes. Types of Washington Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes: 1. Washington Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor This type of affidavit is used when the executor of the estate, the person appointed to administer the deceased's assets, declares that all assets have been distributed to the devises. It includes a detailed list of the assets transferred and attests to their complete and proper distribution. 2. Washington Affidavit That All the Estate Assets Have Been Distributed to Devises by Estate Representative This affidavit is used when an estate representative, such as an administrator or personal representative, who may have been appointed if there is no appointed executor, declares that all estate assets have been distributed to the devises. Similar to the previous type, it includes a comprehensive list of the transferred assets and confirms their proper distribution. 3. Washington Affidavit That All the Estate Assets Have Been Distributed to Devises with Statement Concerning Debts and Taxes This type of affidavit not only affirms the distribution of assets to devises but also includes a statement providing information about any outstanding debts and taxes that the estate may owe. It ensures that all liabilities have been addressed before the estate is considered fully administered. In summary, a Washington Affidavit That All the Estate Assets Have Been Distributed to Devises by Executor or Estate Representative with Statement Concerning Debts and Taxes is a legal document in the state of Washington used to verify the complete administration and distribution of an estate's assets to the intended beneficiaries. It serves as proof that all assets have been transferred appropriately and may also include details regarding any remaining debts and taxes.

Washington Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes

Description

How to fill out Washington Affidavit That All The Estate Assets Have Been Distributed To Devisees By Executor Or Estate Representative With Statement Concerning Debts And Taxes?

If you have to full, obtain, or printing authorized document templates, use US Legal Forms, the biggest collection of authorized types, that can be found on the Internet. Use the site`s easy and convenient research to get the paperwork you need. A variety of templates for business and individual uses are sorted by groups and suggests, or search phrases. Use US Legal Forms to get the Washington Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes in just a number of mouse clicks.

In case you are already a US Legal Forms customer, log in for your profile and click the Down load switch to find the Washington Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes. You can also accessibility types you earlier delivered electronically within the My Forms tab of the profile.

If you use US Legal Forms the very first time, follow the instructions beneath:

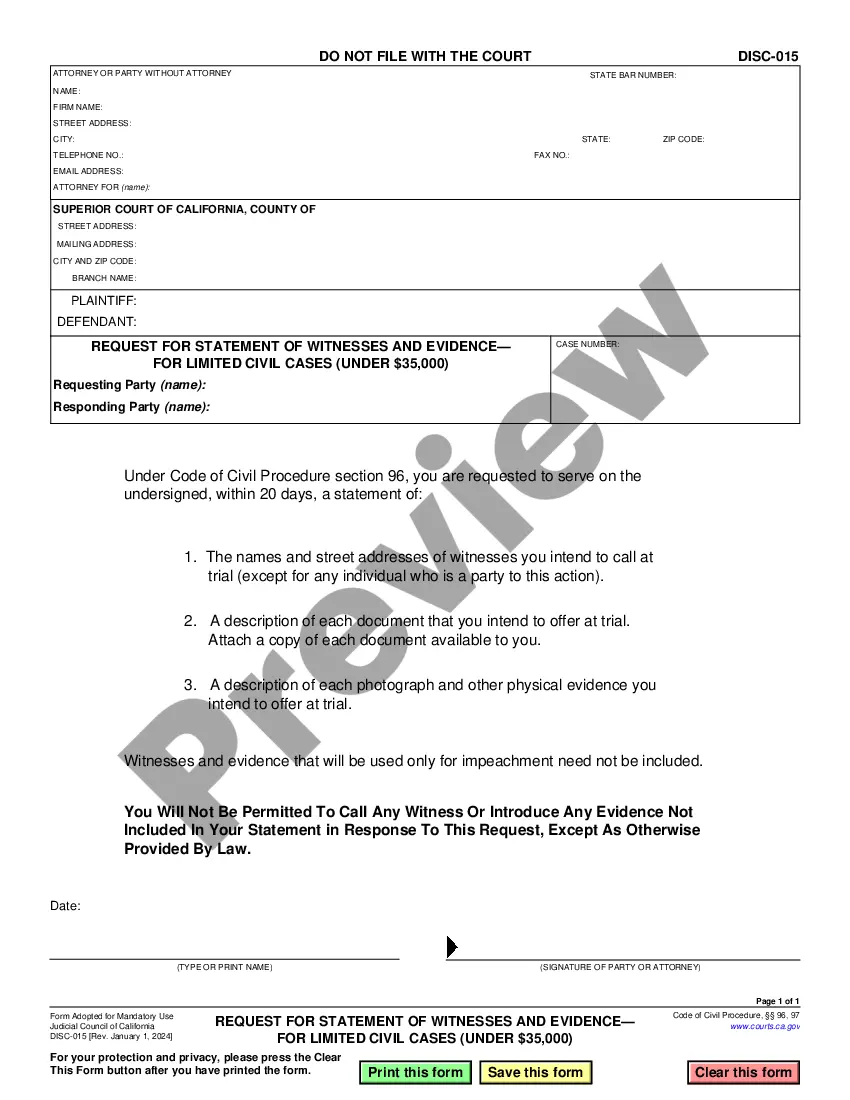

- Step 1. Ensure you have chosen the shape for that appropriate metropolis/nation.

- Step 2. Utilize the Preview choice to examine the form`s content. Don`t neglect to learn the description.

- Step 3. In case you are not happy together with the form, make use of the Search field near the top of the display to find other types from the authorized form web template.

- Step 4. Upon having located the shape you need, select the Acquire now switch. Select the costs program you like and include your credentials to register for the profile.

- Step 5. Approach the purchase. You can use your Мisa or Ьastercard or PayPal profile to complete the purchase.

- Step 6. Find the format from the authorized form and obtain it on the system.

- Step 7. Full, modify and printing or indicator the Washington Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes.

Every authorized document web template you get is the one you have forever. You might have acces to each form you delivered electronically within your acccount. Select the My Forms section and decide on a form to printing or obtain again.

Contend and obtain, and printing the Washington Affidavit That All the Estate Assets Have Been Distributed to Devisees by Executor or Estate Representative with Statement Concerning Debts and Taxes with US Legal Forms. There are many professional and status-specific types you can use for your personal business or individual requires.

Form popularity

FAQ

The ?Affidavit of Successor? may be used if the decedent left no will and the estate was not probated. Living heirs have certain rights ing to Washington State laws of Descent and Distribution. One heir may claim and distribute to other heirs with their written approval.

The Small Estate Affidavit. Washington law permits the use of a small estate affidavit in certain circumstances. Before using a small estate affidavit, you should first ask whether the deceased person had less than $100,000 in probate assets. If they did, you can probably use this process.

How to File (7 steps) Pay Debts. Wait Forty (40) Days. Prepare Affidavit. Notify Other Successors. Get It Notarized. Mail Notarized Copy. Collect the Assets. Free Washington Small Estate Affidavit Form - PDF - eForms eforms.com ? small-estate ? washington-small-esta... eforms.com ? small-estate ? washington-small-esta...

The Affidavit Lack of Probate (or ?No Probate?) is a factual confirmation which supports that the rightful heirs are entitled to their interest in the property after the passing of the Decedent. It is recognized in many Washington Counties as a way to clear the Decedent's name off title as an alternative to a probate.

Affidavit or Declaration Find a Notary Public, Take your document to the Notary, Recite the oath, Swear that the statements are true, Have the Notary sign the document, and will likely. Pay the Notary a fee for the service ?

Generally, nonprobate assets are those that will not pass to heirs or beneficiaries during probate, but will instead pass upon a person's death under a written instrument or arrangement other than the person's will. (Nonprobate assets given away using a super will are an exception.) Nonprobate Assets - Washington Wills wa-wills.com ? legal-library ? glossary ? nonprob... wa-wills.com ? legal-library ? glossary ? nonprob...

The ?Affidavit of Successor? may be used to claim a debt or personal property from any person or organization indebted to or having possession of any personal property belonging to a decedent. Please note this affidavit is only to be used to claim a debt or personal property. State of Washington Affidavit of Successor wa.gov ? resources ? payroll ? PRAffidavitof... wa.gov ? resources ? payroll ? PRAffidavitof...