Washington Direction For Payment of Royalty to Trustee by Royalty Owners

Description

How to fill out Direction For Payment Of Royalty To Trustee By Royalty Owners?

Are you presently within a position where you will need documents for possibly company or individual reasons virtually every day? There are a variety of authorized papers themes available online, but finding ones you can trust isn`t easy. US Legal Forms delivers thousands of develop themes, much like the Washington Direction For Payment of Royalty to Trustee by Royalty Owners, that happen to be composed to meet federal and state specifications.

If you are already informed about US Legal Forms site and possess a merchant account, just log in. After that, you are able to obtain the Washington Direction For Payment of Royalty to Trustee by Royalty Owners format.

If you do not have an profile and want to begin to use US Legal Forms, adopt these measures:

- Discover the develop you will need and ensure it is for that proper town/region.

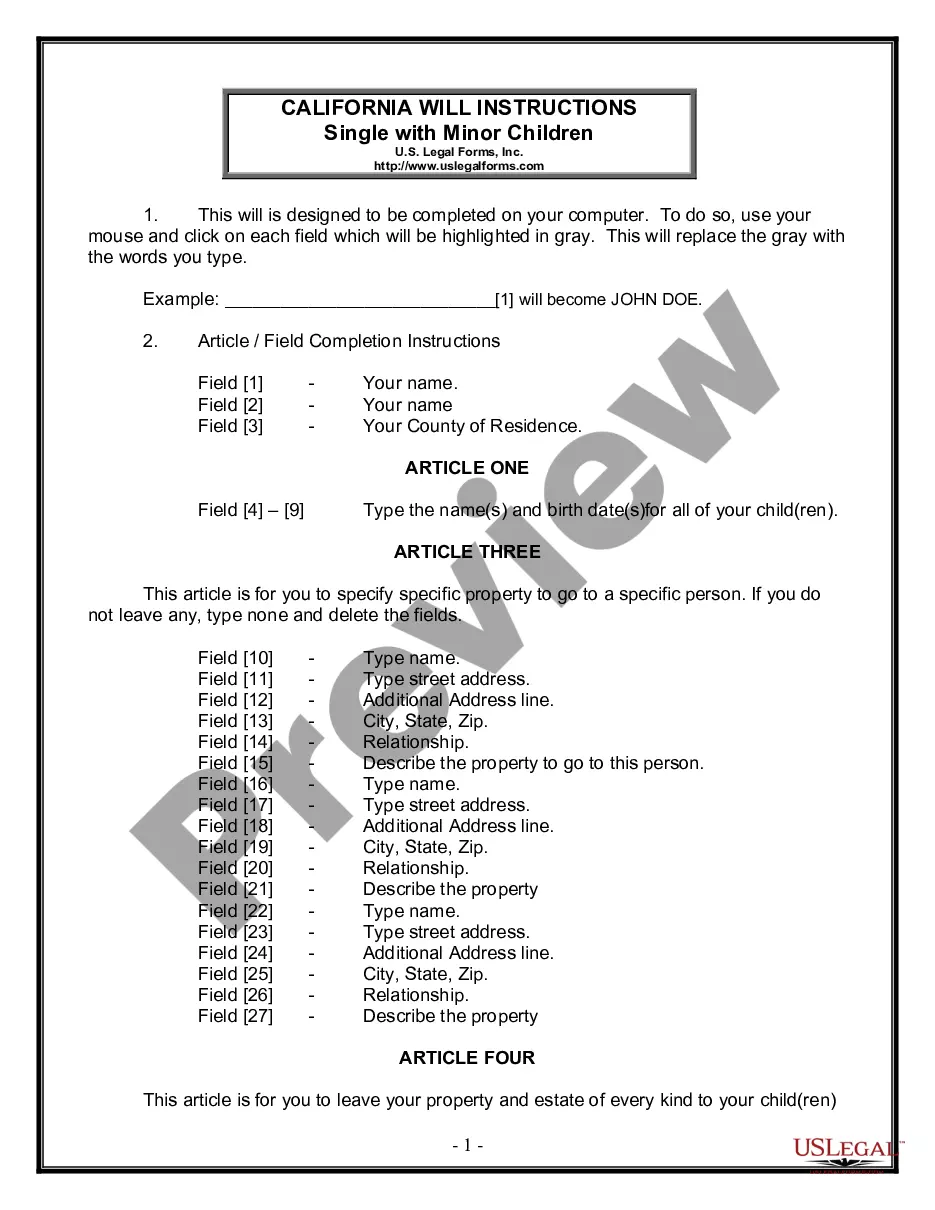

- Use the Review key to examine the shape.

- Browse the outline to ensure that you have selected the proper develop.

- In the event the develop isn`t what you are looking for, take advantage of the Look for industry to get the develop that suits you and specifications.

- Once you get the proper develop, just click Purchase now.

- Opt for the prices program you desire, fill in the required info to create your account, and purchase your order utilizing your PayPal or credit card.

- Choose a hassle-free document formatting and obtain your copy.

Get all of the papers themes you have bought in the My Forms menu. You may get a extra copy of Washington Direction For Payment of Royalty to Trustee by Royalty Owners at any time, if necessary. Just click on the needed develop to obtain or produce the papers format.

Use US Legal Forms, the most extensive assortment of authorized forms, to conserve time and prevent faults. The assistance delivers expertly created authorized papers themes which you can use for a variety of reasons. Generate a merchant account on US Legal Forms and initiate producing your daily life easier.