Washington Exhibit C Accounting Procedure Joint Operations

Description

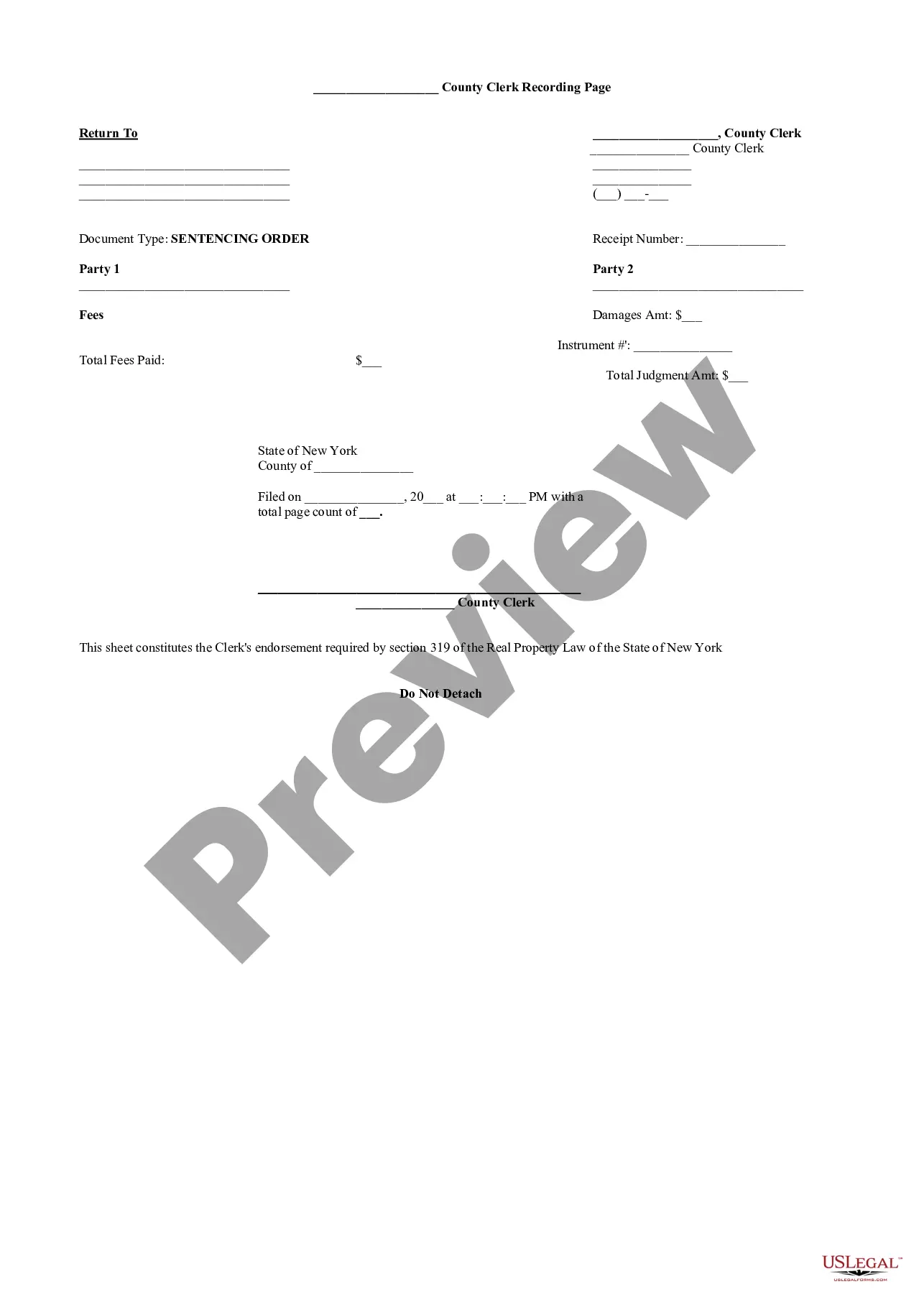

How to fill out Exhibit C Accounting Procedure Joint Operations?

You may devote hours on the web attempting to find the legal papers web template that suits the federal and state needs you require. US Legal Forms offers a huge number of legal kinds which can be analyzed by specialists. It is possible to download or print out the Washington Exhibit C Accounting Procedure Joint Operations from the assistance.

If you already possess a US Legal Forms account, you are able to log in and click the Obtain switch. Following that, you are able to comprehensive, change, print out, or indicator the Washington Exhibit C Accounting Procedure Joint Operations. Every single legal papers web template you buy is your own for a long time. To acquire an additional copy of the acquired form, visit the My Forms tab and click the corresponding switch.

If you use the US Legal Forms web site for the first time, keep to the easy instructions listed below:

- Initial, be sure that you have chosen the correct papers web template to the state/city of your liking. See the form information to ensure you have picked the right form. If readily available, make use of the Preview switch to check with the papers web template also.

- If you want to get an additional model in the form, make use of the Lookup discipline to discover the web template that meets your requirements and needs.

- After you have discovered the web template you want, simply click Acquire now to move forward.

- Choose the rates strategy you want, key in your credentials, and register for an account on US Legal Forms.

- Total the deal. You may use your bank card or PayPal account to pay for the legal form.

- Choose the formatting in the papers and download it for your system.

- Make alterations for your papers if required. You may comprehensive, change and indicator and print out Washington Exhibit C Accounting Procedure Joint Operations.

Obtain and print out a huge number of papers templates while using US Legal Forms site, that provides the biggest selection of legal kinds. Use specialist and condition-specific templates to deal with your business or person needs.

Form popularity

FAQ

A Joint Venture Account is an agreement whereby two or more parties join together to carry a specific business, venture or purpose for a specified period of time. Thus, there is joint control and the sharing of profits and losses is as per the agreed ratio.

The pronouncements that were issued by the Committee on Accounting Procedures were related to the issues faced in accounting and reporting by the organizations. This committee was established to set the standards related to accounting in the U.S.

JIB Accountants support a company's joint interest billing accounting functions. They accurately record expenditures, maintain joint interest division of interests, allocations and overhead contracts, and verify that joint interest owners are properly billed.

The majority of oil and gas operations globally are governed by joint ventures?complex business relationships in which companies pool capital, share risk, and transfer knowledge and best practices.

Joint venture accounting involves sharing of financial data relevant to enterprises that are engaged in a joint venture. Gain full visibility into capital and operating expenses using joint-venture software from SAP.

Accounting for the oil and gas industry involves documenting and summarizing financial transactions associated with the extraction, sale, and transport of minerals. These transactions include every economic activity that your business encounters, from drilling costs and production to the sale of commodities.