Washington Assignment and Conveyance of Net Profits Interest

Description

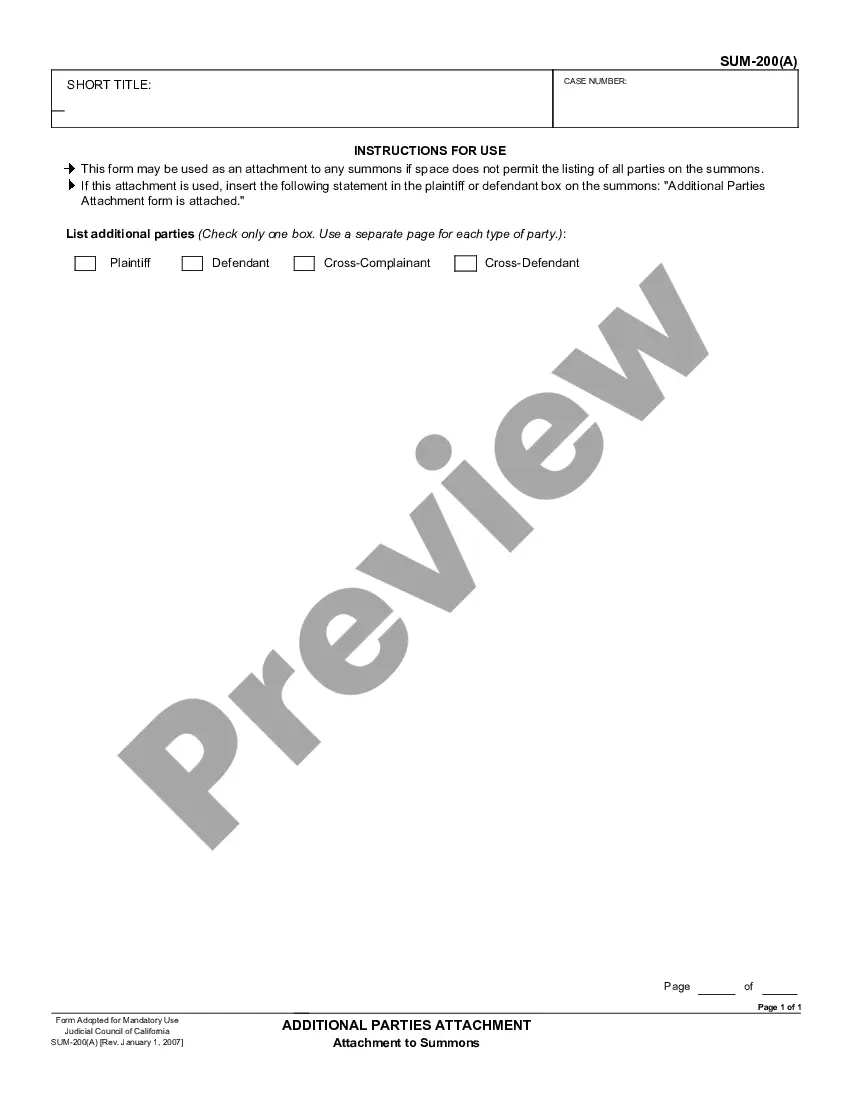

How to fill out Assignment And Conveyance Of Net Profits Interest?

If you need to full, acquire, or produce authorized papers layouts, use US Legal Forms, the largest assortment of authorized forms, that can be found on the Internet. Utilize the site`s easy and practical search to get the paperwork you want. Numerous layouts for organization and specific purposes are categorized by classes and claims, or key phrases. Use US Legal Forms to get the Washington Assignment and Conveyance of Net Profits Interest with a couple of clicks.

When you are previously a US Legal Forms customer, log in in your account and then click the Download button to have the Washington Assignment and Conveyance of Net Profits Interest. Also you can accessibility forms you in the past saved from the My Forms tab of your account.

If you work with US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for your appropriate town/country.

- Step 2. Make use of the Review option to examine the form`s articles. Do not neglect to read through the outline.

- Step 3. When you are unsatisfied with the kind, take advantage of the Lookup discipline towards the top of the screen to get other models of your authorized kind template.

- Step 4. Once you have found the form you want, click on the Acquire now button. Select the costs plan you favor and add your accreditations to sign up for the account.

- Step 5. Method the financial transaction. You should use your credit card or PayPal account to finish the financial transaction.

- Step 6. Choose the format of your authorized kind and acquire it on your system.

- Step 7. Complete, modify and produce or signal the Washington Assignment and Conveyance of Net Profits Interest.

Every single authorized papers template you acquire is your own property eternally. You have acces to every kind you saved within your acccount. Select the My Forms section and decide on a kind to produce or acquire once more.

Compete and acquire, and produce the Washington Assignment and Conveyance of Net Profits Interest with US Legal Forms. There are many professional and express-certain forms you can use for the organization or specific demands.

Form popularity

FAQ

A net profits interest is a non-operating interest that is created when the owner of a property leases out the property to another party for development and shares in the venture's profits. The risk to the owner in a net profits interest agreement is minimal as they do not share in the losses, only in the profits.

Example 1: Profits interest ? Let's say that the company is worth $1,000,000 and has $50,000 in annual profits. A worker with a 10% interest grant doesn't have any interest in the company's current market value, but they do have a 10% interest in annual profits, which equates to $5,000.

What Is a Profits Interest? A profits interest is a form of equity compensation used by limited liability companies to incentivize key employees and service providers to remain invested in the company's success.

A profits interest in an LLC is a legal form of equity and will make the recipient a partner or member of the LLC for tax purposes.

A capital interest is a type of equity commonly issued by LLCs, under which the member of the LLC contributes capital to the LLC and has an ownership interest. Unlike a capital interest, profits interests do not represent ownership in the LLC.

A profits interest represents an actual interest in the ownership of a partnership. As such, it differs from a stock option (another form of awarding an ownership stake), which grants to the holder a right to buy into a company at a time in the future.

A capital interest is a type of equity commonly issued by LLCs, under which the member of the LLC contributes capital to the LLC and has an ownership interest. Unlike a capital interest, profits interests do not represent ownership in the LLC.

What is a profits interest? A profits interest, also known as ?carried interest? or ?promote,? is an equity interest in the future appreciation of a partnership (or an LLC that is taxed as a partnership).