Washington Partial Release of Lien on Leasehold Interest in Part of Lands Subject to Lease

Description

How to fill out Partial Release Of Lien On Leasehold Interest In Part Of Lands Subject To Lease?

US Legal Forms - one of many largest libraries of authorized kinds in America - gives a wide range of authorized file web templates you may down load or printing. While using site, you may get a large number of kinds for organization and specific functions, categorized by classes, suggests, or key phrases.You will find the latest types of kinds like the Washington Partial Release of Lien on Leasehold Interest in Part of Lands Subject to Lease in seconds.

If you currently have a membership, log in and down load Washington Partial Release of Lien on Leasehold Interest in Part of Lands Subject to Lease in the US Legal Forms local library. The Acquire option will show up on each and every kind you look at. You get access to all formerly saved kinds from the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, here are straightforward directions to help you started:

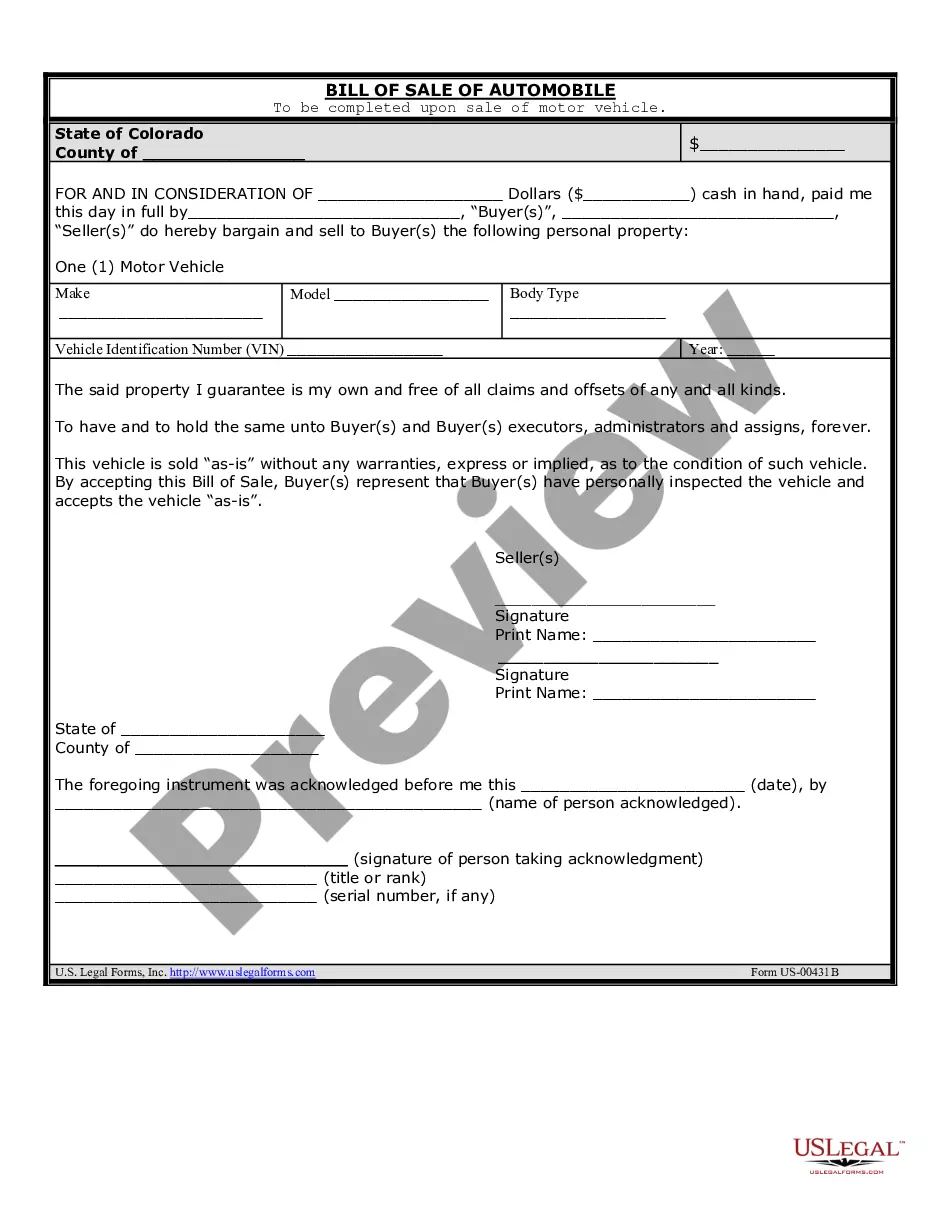

- Ensure you have selected the proper kind to your city/state. Select the Preview option to examine the form`s articles. Browse the kind information to actually have chosen the correct kind.

- In the event the kind doesn`t match your requirements, take advantage of the Search industry on top of the display screen to obtain the one which does.

- When you are satisfied with the form, validate your decision by visiting the Get now option. Then, pick the prices program you want and offer your accreditations to sign up for the profile.

- Method the deal. Make use of Visa or Mastercard or PayPal profile to accomplish the deal.

- Find the format and down load the form on your product.

- Make modifications. Complete, change and printing and sign the saved Washington Partial Release of Lien on Leasehold Interest in Part of Lands Subject to Lease.

Each and every template you put into your money does not have an expiration particular date and it is your own for a long time. So, if you wish to down load or printing yet another version, just go to the My Forms portion and click around the kind you need.

Get access to the Washington Partial Release of Lien on Leasehold Interest in Part of Lands Subject to Lease with US Legal Forms, probably the most comprehensive local library of authorized file web templates. Use a large number of skilled and state-certain web templates that meet up with your small business or specific demands and requirements.

Form popularity

FAQ

When can a lien be filed against you? A lien against a consumer must be filed within 90 days of work stoppage, or delivery of materials. Additional information regarding the timeline for filing liens may be found in RCW 60.04.

For the purposes of this section a chattel lien is a process by which a person may sell or take ownership of a vehicle when: (a) They provide services or materials for a vehicle at the request of the registered owner; and. (b) The person who provided the services and/or materials has not been compensated. WAC 308-56A-310: wa.gov ? wac wa.gov ? wac

The lien must be filed and recorded with the county recorder or auditor in the county in which the work was performed or the materials provided. If you do not file the lien within this timeframe, you lose your lien rights.

Chapters 60.04Mechanics' and materialmen's liens.60.10Personal property liens?Summary foreclosure.60.11Crop liens.60.13Processor and preparer liens for agricultural products.60.16Labor liens on orchards and orchard lands.23 more rows

?Upon payment and acceptance of the amount due to the lien claimant and upon demand of the owner or the person making payment, the lien claimant shall immediately prepare and execute a release of all lien rights for which payment has been made, and deliver the release to the person making payment.

Remember, tax liens always take the highest priority among other liens. If a mortgage lien exists on a property and a tax lien is created, the tax lien will take first priority even though it was created after the mortgage lien. 8 Flashcards - Quizlet quizlet.com ? 8-flash-cards quizlet.com ? 8-flash-cards

Ten years In the state of Washington, a judgment lien will remain attached to a person's property for ten years. The ability of a creditor to collect under a judgment lien can be affected by several factors. How Long are Judgments Good for in Washington? washingtoninjurylaw.com ? how-long-are-ju... washingtoninjurylaw.com ? how-long-are-ju...

If any supplier of materials, a worker or subcontractor is not paid, a lien may be filed against your property to force you to pay the debt. You could end up paying twice for the same work. Or worse, an unpaid lien could lead to foreclosure on your home. About Liens Washington State Department of Labor & Industries (.gov) ? problems-with-a-contractor ? abou... Washington State Department of Labor & Industries (.gov) ? problems-with-a-contractor ? abou...