Washington Due Diligence Review Summary is an essential part of the due diligence process in Washington state. This comprehensive document provides an in-depth analysis of a company's financial prospects, operational procedures, legal compliance, and potential risks and liabilities. It assists prospective buyers, investors, and lenders in making informed decisions by evaluating the target company thoroughly. The Washington Due Diligence Review Summary encompasses various crucial components, including financial statements, tax records, contracts, permits, licenses, litigation history, intellectual property rights, environmental impact assessments, employee information, and other relevant documentation. These documents are carefully examined to assess the company's financial health, operational efficiency, regulatory compliance, and overall market position. Different types of Washington Due Diligence Review Summary may exist based on the specific purpose or type of transaction: 1. Acquisition Due Diligence Review Summary: This type of summary is commonly conducted when a company intends to acquire another company, either through a merger or acquisition. The summary helps the acquiring company to identify any potential financial, operational, or legal risks associated with the target company before finalizing the deal. 2. Investment Due Diligence Review Summary: When individuals or firms intend to invest in a company, they conduct this summary to evaluate the investment's feasibility. The summary helps assess the company's financial stability, growth potential, competitive advantages, and potential return on investment (ROI). 3. Financial Due Diligence Review Summary: This specific summary primarily focuses on the financial aspects of the target company. It involves a comprehensive analysis of its financial statements, cash flows, balance sheets, profitability, debt structure, and key financial ratios. The financial due diligence review summary provides crucial insights into the company's financial performance, enabling investors or potential buyers to evaluate its monetary worth. 4. Legal Due Diligence Review Summary: Companies conducting mergers, acquisitions, or partnership agreements often include a legal due diligence review summary. This summary examines the target company's legal documentation to identify any potential legal risks, pending litigation, contractual obligations, regulatory compliance, intellectual property protection, and corporate governance practices. 5. Operational Due Diligence Review Summary: This summary focuses on evaluating the target company's operational procedures, supply chain management, production processes, inventory management, quality control, and overall operational efficiency. It aims to uncover any potential operational risks, bottlenecks, or areas for improvement that could impact the success of the transaction. In conclusion, Washington Due Diligence Review Summary refers to the detailed analysis of a company's financial, operational, and legal aspects to facilitate informed decision-making. Different types of summaries may exist, including acquisition due diligence, investment due diligence, financial due diligence, legal due diligence, and operational due diligence. Conducting a comprehensive due diligence review summary is crucial to mitigate risks, ensure compliance, and optimize investment opportunities for all stakeholders involved.

Washington Due Diligence Review Summary

Description

How to fill out Washington Due Diligence Review Summary?

If you need to complete, down load, or print authorized papers web templates, use US Legal Forms, the biggest assortment of authorized forms, that can be found on-line. Use the site`s simple and hassle-free lookup to discover the paperwork you require. Different web templates for enterprise and personal reasons are categorized by types and says, or keywords and phrases. Use US Legal Forms to discover the Washington Due Diligence Review Summary within a number of click throughs.

If you are presently a US Legal Forms customer, log in for your account and click the Down load button to obtain the Washington Due Diligence Review Summary. Also you can access forms you in the past saved in the My Forms tab of your respective account.

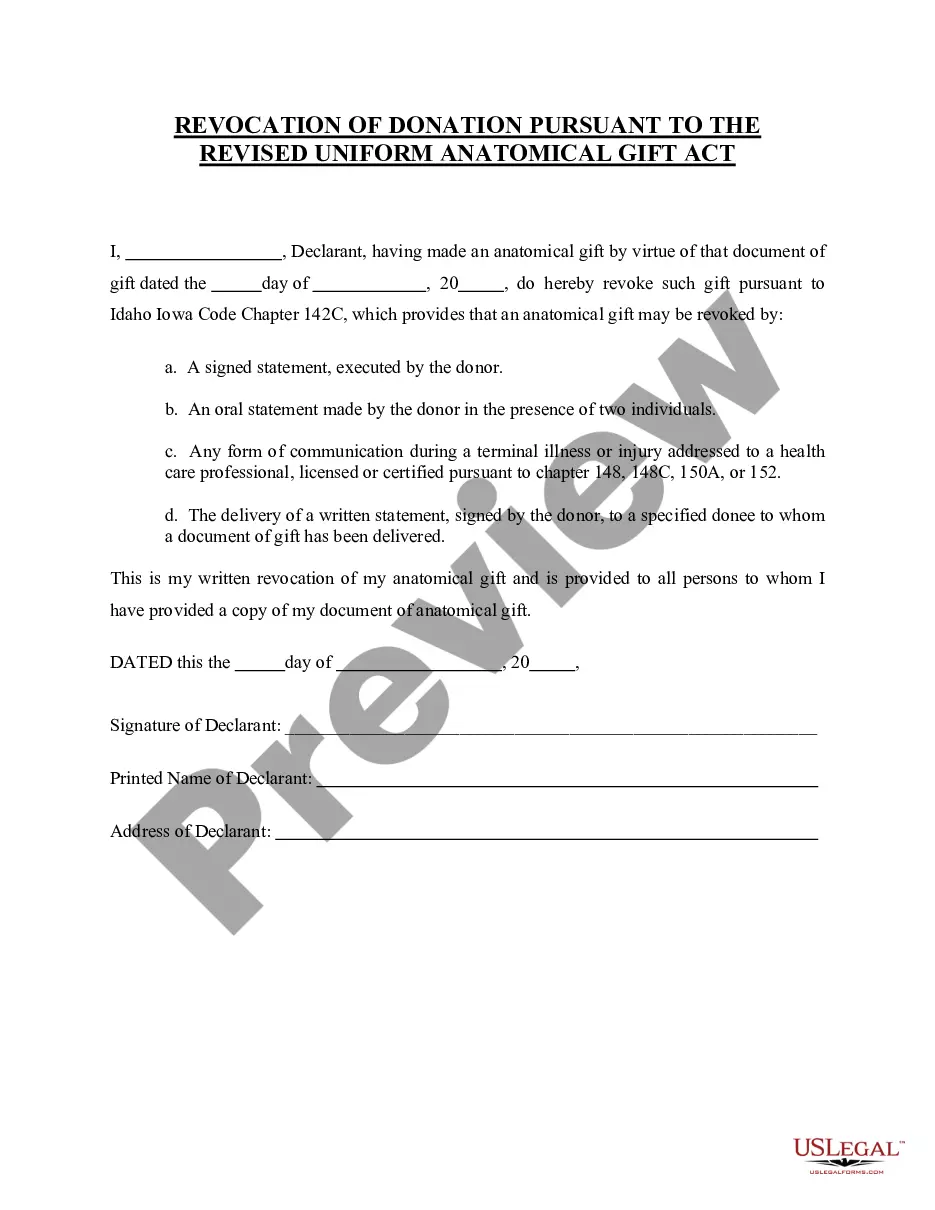

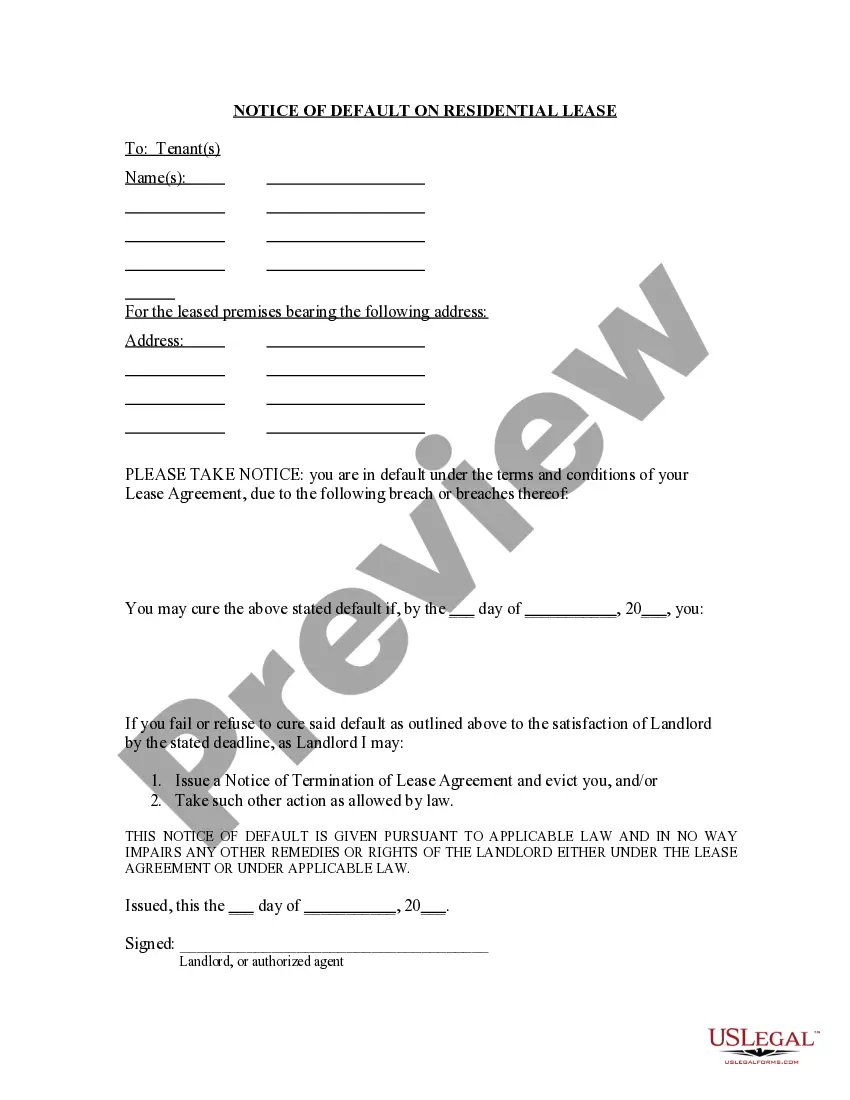

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape to the proper city/region.

- Step 2. Make use of the Preview option to look through the form`s information. Never forget to see the information.

- Step 3. If you are unhappy with all the kind, use the Research area towards the top of the screen to discover other versions of the authorized kind template.

- Step 4. When you have found the shape you require, go through the Get now button. Pick the rates strategy you choose and include your accreditations to register for an account.

- Step 5. Process the financial transaction. You may use your credit card or PayPal account to finish the financial transaction.

- Step 6. Select the structure of the authorized kind and down load it on the device.

- Step 7. Complete, change and print or signal the Washington Due Diligence Review Summary.

Each and every authorized papers template you purchase is your own property for a long time. You may have acces to every kind you saved within your acccount. Click on the My Forms portion and decide on a kind to print or down load yet again.

Compete and down load, and print the Washington Due Diligence Review Summary with US Legal Forms. There are millions of specialist and condition-distinct forms you can utilize to your enterprise or personal needs.

Form popularity

FAQ

Thus, an IT due diligence is the process of reviewing and evaluating the target's IT strategy, IT architecture, application portfolio, infrastructure, IT procedures and security, IT organisation and IT financials.

Due diligence is an investigation, audit, or review performed to confirm facts or details of a matter under consideration. In the financial world, due diligence requires an examination of financial records before entering into a proposed transaction with another party.

In conclusion, due diligence is a crucial component in a myriad of fields, particularly where significant financial transactions or agreements are involved.

The Framework is based on three pillars: 1) the State duty to protect human rights, 2) the corporate responsibility to respect human rights and 3) access to remedy where human rights are violated. In relation to the second pillar, the Guiding Principles recommend human rights due diligence as a central approach.

A due diligence check involves careful investigation of the economic, legal, fiscal and financial circumstances of a business or individual. This covers aspects such as sales figures, shareholder structure and possible links with forms of economic crime such as corruption and tax evasion.

Due diligence documents are the research and analysis of a company or organization done in preparation for a business transaction (such as a corporate merger or purchase of securities). Due diligence documents typically include the following categories; legal, financial, sales and marketing, and human resources.

A due diligence check involves careful investigation of the economic, legal, fiscal and financial circumstances of a business or individual. This covers aspects such as sales figures, shareholder structure and possible links with forms of economic crime such as corruption and tax evasion.

A due diligence report should capture these key elements. Executive summary, company overview, purpose, due diligence (financial, legal, operational, commercial, market, environmental and regulatory), insurance and risk management, growth prospects and recommendations.