Washington Release of Liens for Vendor's Lien and Deed of Trust Lien

Description

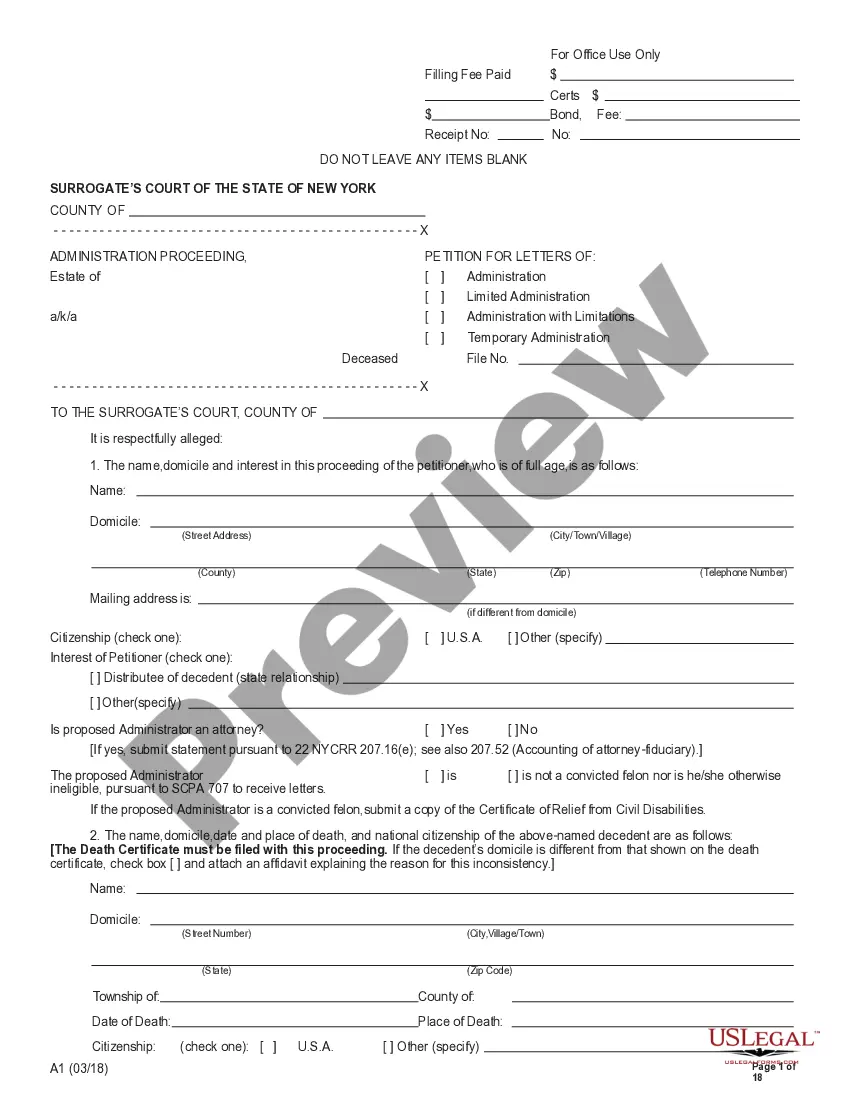

How to fill out Release Of Liens For Vendor's Lien And Deed Of Trust Lien?

Choosing the best legal papers template could be a struggle. Of course, there are tons of web templates available on the Internet, but how do you obtain the legal type you want? Take advantage of the US Legal Forms website. The support gives a large number of web templates, including the Washington Release of Liens for Vendor's Lien and Deed of Trust Lien, which you can use for business and private demands. All the forms are checked out by pros and satisfy state and federal needs.

If you are presently listed, log in to the bank account and click the Down load switch to have the Washington Release of Liens for Vendor's Lien and Deed of Trust Lien. Make use of bank account to appear with the legal forms you may have ordered in the past. Check out the My Forms tab of your own bank account and get another backup of your papers you want.

If you are a new customer of US Legal Forms, allow me to share simple instructions that you can comply with:

- Initially, ensure you have selected the right type for your personal metropolis/region. It is possible to examine the shape utilizing the Preview switch and browse the shape explanation to make certain it is the right one for you.

- When the type fails to satisfy your expectations, use the Seach area to find the appropriate type.

- Once you are sure that the shape is proper, select the Purchase now switch to have the type.

- Pick the pricing strategy you want and type in the essential info. Make your bank account and pay money for the order using your PayPal bank account or charge card.

- Opt for the document formatting and acquire the legal papers template to the product.

- Full, edit and produce and signal the received Washington Release of Liens for Vendor's Lien and Deed of Trust Lien.

US Legal Forms will be the largest collection of legal forms that you will find various papers web templates. Take advantage of the company to acquire expertly-produced paperwork that comply with status needs.

Form popularity

FAQ

Senior liens are those with the highest priority (often, but not always, the first lien recorded on a property), to be paid back in full before other liens are paid.

?Upon payment and acceptance of the amount due to the lien claimant and upon demand of the owner or the person making payment, the lien claimant shall immediately prepare and execute a release of all lien rights for which payment has been made, and deliver the release to the person making payment.

Mechanics' and materialmen's liens. Chattel liens. Personal property liens?Summary foreclosure. Crop liens.

The kind of liens that can directly affect your personal property include mortgage, judgment, attachment, estate tax, Federal tax, bail bond, municipal utility and vendor's liens but can also include corporate franchise tax (if you own a business), mechanic's or vendee's (if you work in the building industry).

If any supplier of materials, a worker or subcontractor is not paid, a lien may be filed against your property to force you to pay the debt. You could end up paying twice for the same work. Or worse, an unpaid lien could lead to foreclosure on your home.

You must file the lien foreclosure action in a court that has jurisdiction over the property where you supplied materials or work. You will likely need to consult an attorney to file a foreclosure action. Such actions are expensive and time-intensive so make every effort to settle the matter first!

In the state of Washington, a judgment lien will remain attached to a person's property for ten years. The ability of a creditor to collect under a judgment lien can be affected by several factors.

If the lienholder is out of business Petition a Washington State superior court or district court to have us remove the lienholder and issue you a clear title. You'll need to show the court proof that you've paid the lienholder in full.