Washington Correction Assignment to Correct Amount of Interest: A Comprehensive Guide Introduction: The Washington Correction Assignment to Correct Amount of Interest is a legal process in the state of Washington that enables parties to correct inaccuracies or errors in the interest calculations within a particular contract, promissory note, or loan agreement. This assignment is designed to rectify any mistakes, such as miscalculations or omissions, related to the interest rates charged and ensures accurate financial agreements between parties involved. In Washington, there are a few types of Correction Assignments to Correct Amount of Interest, each addressing specific circumstances. Let's explore these types in detail: 1. Correction Assignment for Mortgage Loans: When mortgage loans are involved, it is crucial to have correct interest rates reflected in the loan agreement to avoid any disputes or discrepancies during the repayment period. The Washington Correction Assignment allows parties to rectify any incorrectly or incompletely calculated interest amounts on mortgage loans. This process facilitates clearer communication regarding the interest rate between the borrower, lender, and any other involved parties. 2. Correction Assignment for Commercial Contracts: In the realm of commercial contracts, including business loans, leases, or vendor agreements, it is imperative to have accurate interest calculations. The Washington Correction Assignment caters to these scenarios by providing a framework for correcting any interest-related errors. This not only streamlines financial transactions but also ensures fairness and transparency in contractual arrangements. 3. Correction Assignment for Personal Loans: Similar to mortgage loans, personal loans can also experience errors or discrepancies in the calculation of accrued interest. Through the Washington Correction Assignment, borrowers and lenders can rectify any inaccuracies in interest amounts, leading to enhanced clarity, efficiency, and the prevention of potential legal complications. Procedure for Washington Correction Assignment to Correct Amount of Interest: Irrespective of the type of loan or contract, the Washington Correction Assignment generally involves the following steps: 1. Identifying the Error: The party discovering the interest calculation mistake must inform the other party(s) involved. This step includes providing a comprehensive description of the error, along with supporting documentation. 2. Agreement and Consent: All parties to the original agreement must be in mutual agreement with the proposed correction of the interest amount. This step ensures that all participants are aware of the correction and approve its implementation. 3. Drafting the Correction Assignment: A written correction assignment is prepared, detailing the error and specifying the corrected interest amount. This document is typically drafted by legal professionals experienced in Washington's laws and regulations. 4. Signing and Execution: Once the correction assignment is drafted, all involved parties must sign it. Signatures indicate their acknowledgement and agreement to the corrected interest amount. This formalizes the correction, ensuring its validity. 5. Recording the Correction Assignment: To ensure transparency and legal recognition, the correction assignment must be recorded at the county recorder's office in the county where the property or agreement is located. This step safeguards parties from any potential future disputes. Conclusion: The Washington Correction Assignment to Correct Amount of Interest serves as an essential legal tool for rectifying interest calculation errors in various contractual and loan agreements. By addressing mistakes promptly and accurately, this assignment ensures transparency, fair dealings, and minimizes the risk of potential disputes. Whether it is for mortgage loans, commercial contracts, or personal loans, Washington provides a clear framework for parties to rectify mistakes and maintain the integrity of financial agreements.

Washington Correction Assignment to Correct Amount of Interest

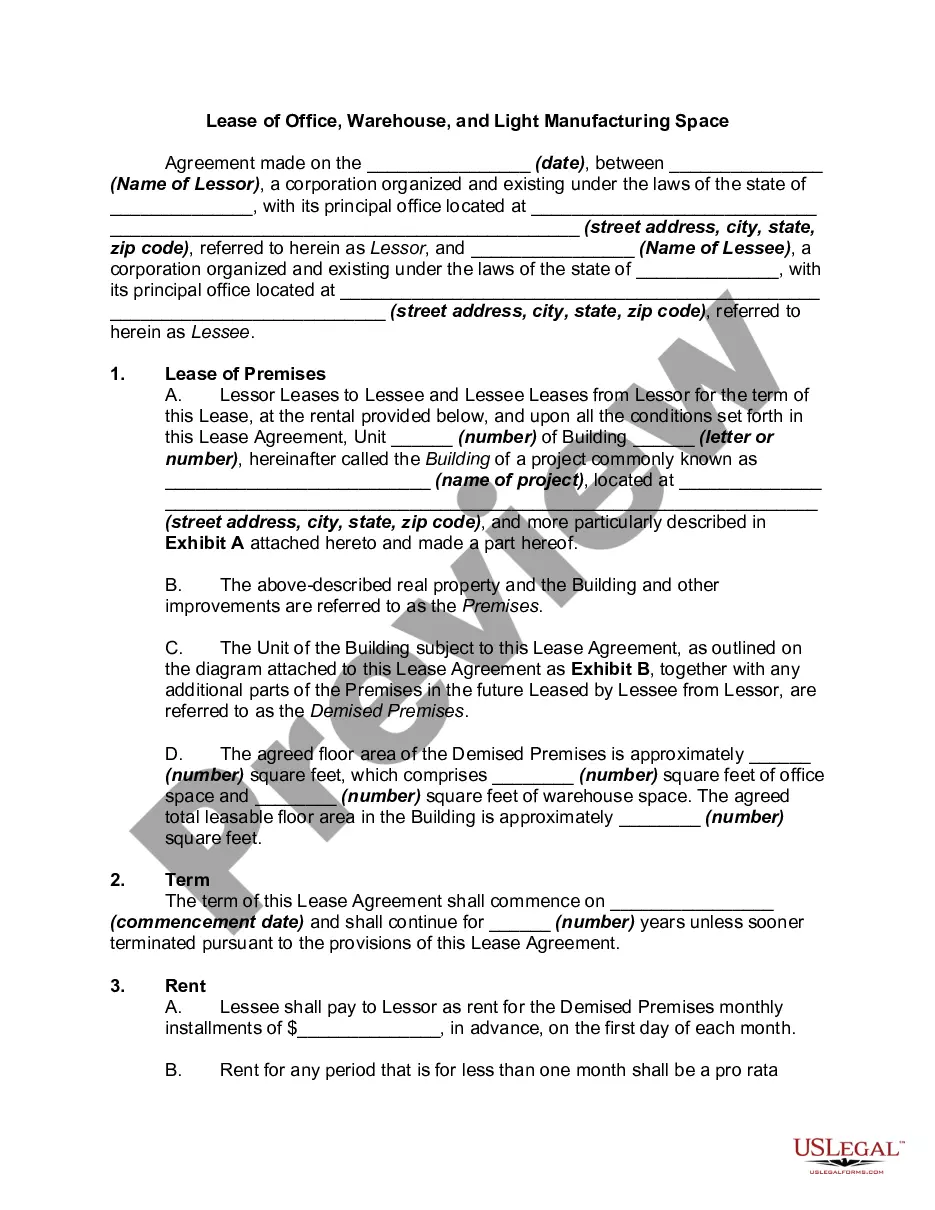

Description

How to fill out Washington Correction Assignment To Correct Amount Of Interest?

Finding the right authorized papers design might be a struggle. Of course, there are a lot of web templates available on the net, but how can you discover the authorized form you need? Utilize the US Legal Forms site. The support gives thousands of web templates, such as the Washington Correction Assignment to Correct Amount of Interest, that you can use for business and personal requirements. Every one of the varieties are inspected by experts and fulfill federal and state specifications.

If you are currently authorized, log in in your bank account and click the Acquire key to obtain the Washington Correction Assignment to Correct Amount of Interest. Make use of bank account to appear throughout the authorized varieties you have acquired formerly. Proceed to the My Forms tab of the bank account and obtain one more version from the papers you need.

If you are a whole new customer of US Legal Forms, here are straightforward instructions that you can adhere to:

- Very first, make certain you have chosen the correct form to your area/area. You are able to look through the shape while using Preview key and read the shape outline to ensure it will be the right one for you.

- If the form fails to fulfill your preferences, make use of the Seach area to discover the correct form.

- When you are certain that the shape is proper, select the Acquire now key to obtain the form.

- Choose the prices program you want and enter the necessary information. Build your bank account and pay money for the order with your PayPal bank account or Visa or Mastercard.

- Select the data file file format and obtain the authorized papers design in your product.

- Full, modify and produce and signal the acquired Washington Correction Assignment to Correct Amount of Interest.

US Legal Forms is definitely the biggest library of authorized varieties in which you can see various papers web templates. Utilize the service to obtain appropriately-made papers that adhere to state specifications.