This office lease clause is used to respond to various changes that might occur within the tenant's office building or shopping center.

Washington Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share

Description

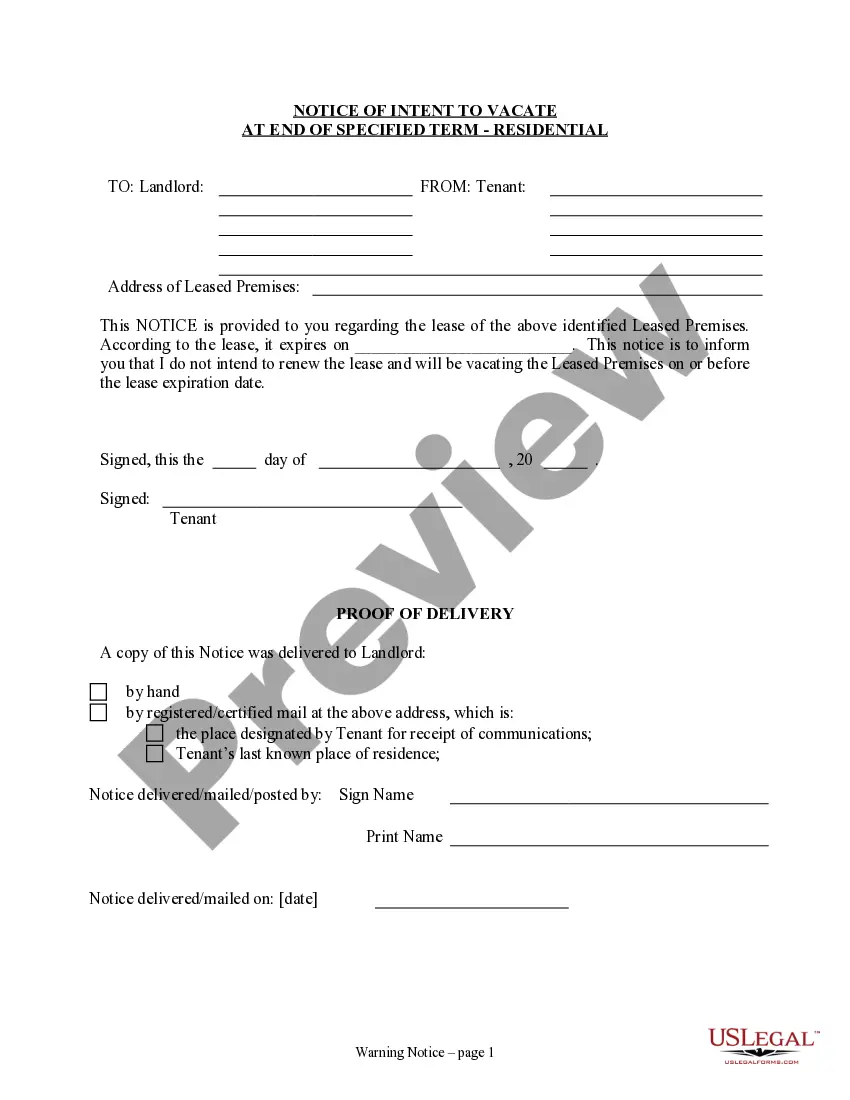

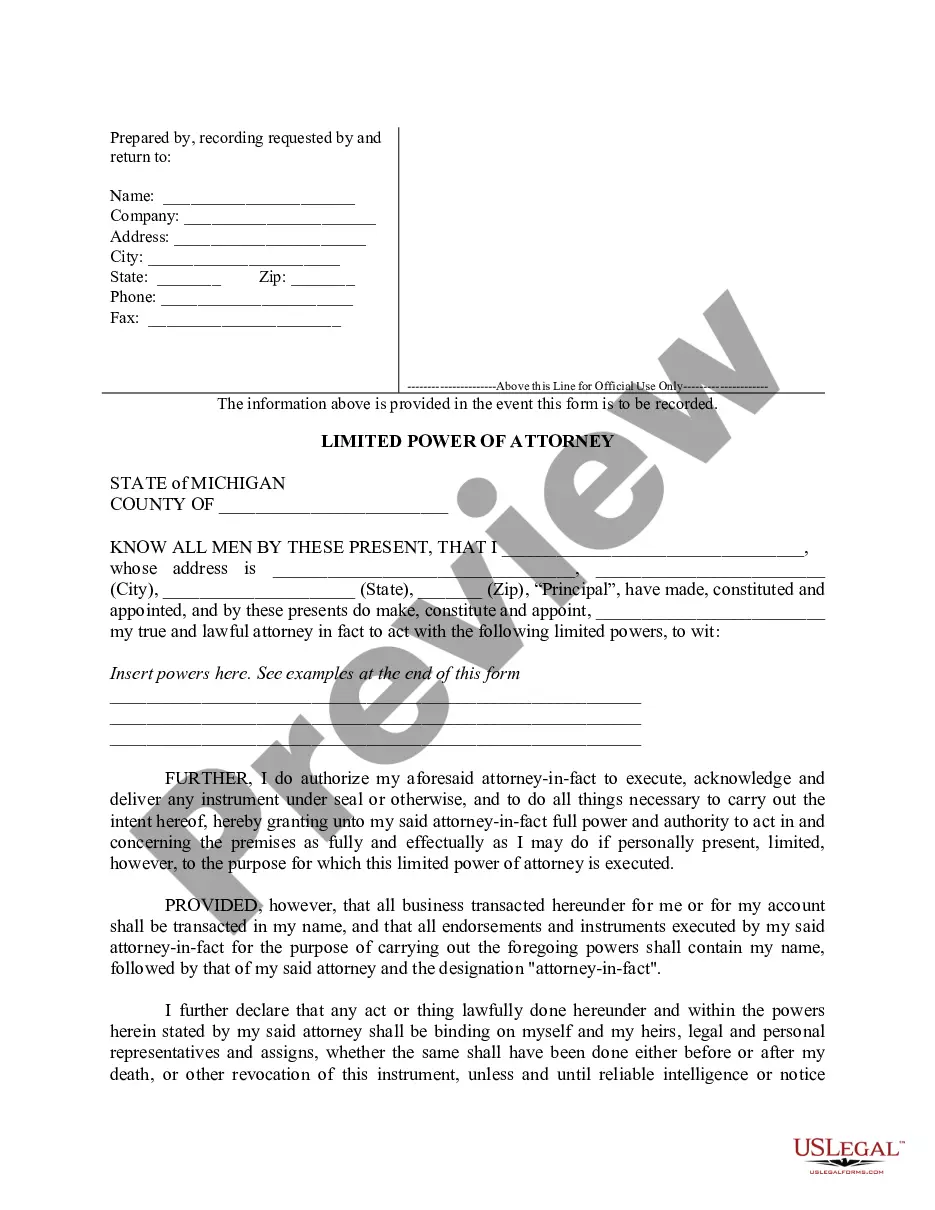

How to fill out Measurement Representations And Proportionate Share Adjustment Of Tenants Proportionate Tax Share?

If you have to total, acquire, or produce legal document layouts, use US Legal Forms, the largest collection of legal forms, which can be found on the web. Use the site`s easy and convenient research to discover the files you want. Numerous layouts for company and personal uses are sorted by categories and states, or key phrases. Use US Legal Forms to discover the Washington Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share in a few mouse clicks.

When you are previously a US Legal Forms customer, log in for your bank account and click on the Download switch to have the Washington Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share. You can also gain access to forms you formerly downloaded inside the My Forms tab of your bank account.

If you work with US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your proper metropolis/land.

- Step 2. Take advantage of the Preview option to check out the form`s content. Do not neglect to learn the description.

- Step 3. When you are unhappy with the type, make use of the Lookup area towards the top of the screen to discover other types in the legal type format.

- Step 4. After you have found the shape you want, select the Get now switch. Select the pricing program you favor and add your qualifications to sign up for the bank account.

- Step 5. Method the purchase. You can use your charge card or PayPal bank account to complete the purchase.

- Step 6. Choose the structure in the legal type and acquire it on the device.

- Step 7. Comprehensive, modify and produce or indication the Washington Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share.

Each and every legal document format you purchase is your own for a long time. You have acces to each type you downloaded in your acccount. Go through the My Forms segment and choose a type to produce or acquire once again.

Remain competitive and acquire, and produce the Washington Measurement Representations and Proportionate Share Adjustment of Tenants Proportionate Tax Share with US Legal Forms. There are many expert and state-distinct forms you can utilize to your company or personal requires.

Form popularity

FAQ

Also known as tenant's pro rata share. The portion of a building occupied by the tenant expressed as a percentage. When a tenant is responsible for paying its proportionate share of the landlord's costs for the building, such as operating expenses and real estate taxes, the tenant pays this amount over a base year.

Lessee's Proportion means the proportion that the net lettable are of the Premises bears to the net lettable area of the Building, being the percentage in item 16 of the Reference Schedule (or any other corrected or recalculated percentage notified in writing by the Lessor to the Lessee from time to time).

How do landlords calculate the ?proportionate share?? Ordinarily, this is calculated based on the relative square footage occupied by each tenant. That makes sense for fixed costs such as taxes, insurance and common area utility costs.

Proportionate Share of Operating Expenses means a fraction equal to the total Gross Rentable Area of the Premises divided by the total Gross Rentable Area of the Building.

The pro-rata share is the percentage of expenses shared by the tenant for the shopping center or office building. In most leases, the pro-rata share is calculated as a fraction of the tenant's demised square footage divided by the total square footage of the shopping center or the building.