This office lease provision states that the definitions of terms for taxes on buildings and atriums and the land on which such buildings are located including all sidewalks, plazas, streets and land adjoining to such buildings, and all replacements thereof, and constituting a part of the same tax lot or lots.

Washington Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes

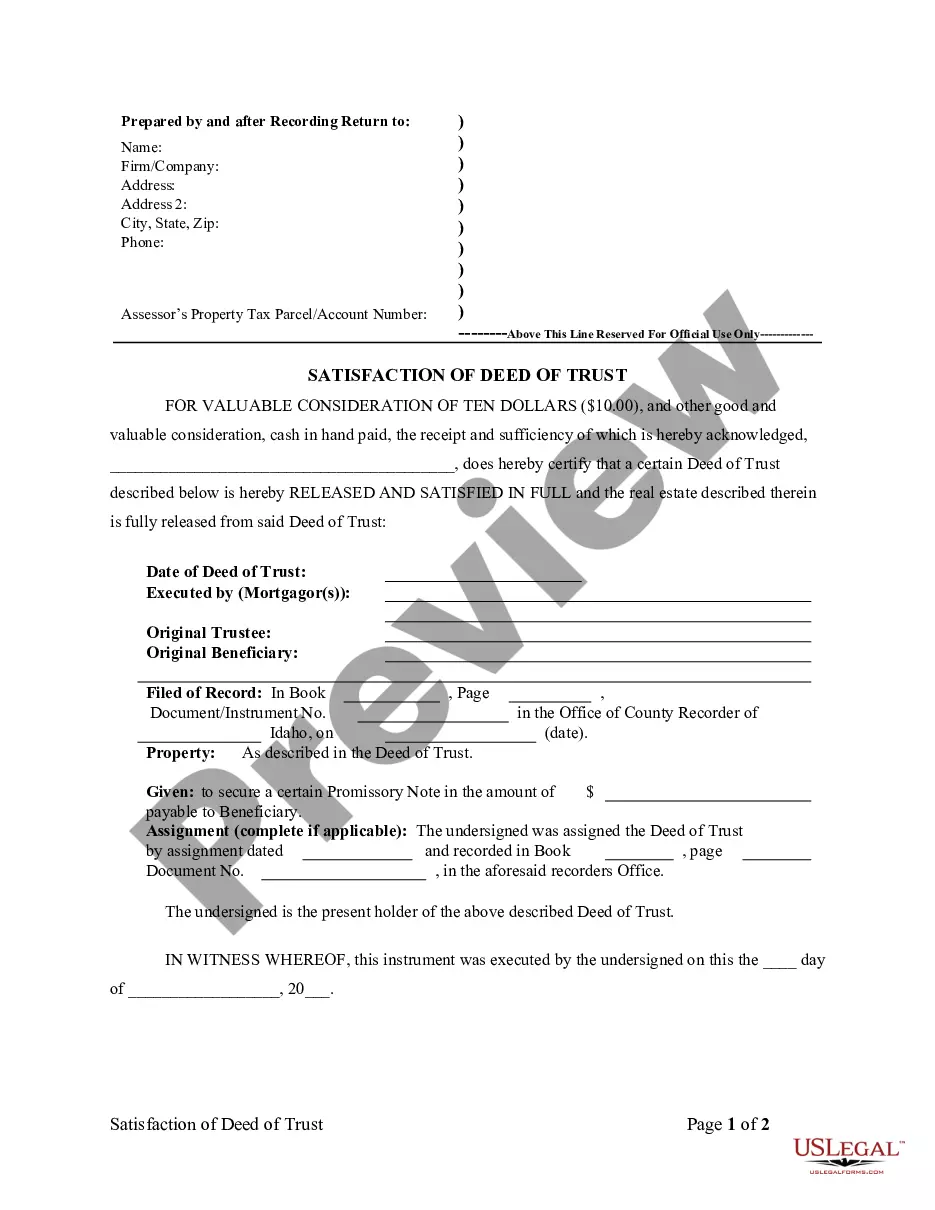

Description

How to fill out Provision Defining The Taxable Components Falling Into The Escalation Definition Of Taxes?

If you need to full, download, or print legitimate file web templates, use US Legal Forms, the greatest selection of legitimate kinds, which can be found on the web. Utilize the site`s simple and easy hassle-free look for to obtain the paperwork you need. Various web templates for business and specific uses are categorized by groups and says, or keywords and phrases. Use US Legal Forms to obtain the Washington Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes in a handful of mouse clicks.

Should you be already a US Legal Forms client, log in to your bank account and click on the Obtain key to obtain the Washington Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes. Also you can accessibility kinds you formerly downloaded from the My Forms tab of your bank account.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have selected the form to the correct metropolis/country.

- Step 2. Utilize the Review option to examine the form`s content. Do not forget about to learn the outline.

- Step 3. Should you be unhappy with the develop, utilize the Search industry at the top of the monitor to discover other models from the legitimate develop design.

- Step 4. After you have located the form you need, click the Acquire now key. Select the costs plan you favor and add your accreditations to register on an bank account.

- Step 5. Approach the purchase. You can use your Мisa or Ьastercard or PayPal bank account to complete the purchase.

- Step 6. Choose the format from the legitimate develop and download it in your system.

- Step 7. Complete, change and print or indicator the Washington Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes.

Each legitimate file design you acquire is your own property eternally. You have acces to every develop you downloaded within your acccount. Go through the My Forms segment and choose a develop to print or download once more.

Compete and download, and print the Washington Provision Defining the Taxable Components Falling into the Escalation Definition of Taxes with US Legal Forms. There are many professional and status-certain kinds you can use for your personal business or specific demands.

Form popularity

FAQ

Which Are the Tax-Free States? As of 2023, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.

Here's what you need to know about Washington's new income tax: Watch it grow. The income tax bill passed by the Legislature is narrowly focused, on capital gains income, with exemptions including real estate and the first $250,000 of income. As the law now stands, taxes are due and payable for the first time in 2023.

No income tax in Washington state Washington state does not have a personal or corporate income tax. However, people or businesses that engage in business in Washington are subject to business and occupation (B&O) and/or public utility tax.

Washington's constitution never mentions income taxes in so many words, but it contains a uniformity clause that puts strict limits on property tax. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services.

ASC 740 governs how companies recognize the effects of income taxes on their financial statements under U.S. GAAP. State income taxes are generally a deductible expense in the federal income tax calculation.

Passed by the 2021 Washington State Legislature, ESSB 5096 (RCW 82.87) created a 7% tax on any gain in excess of $250,000 in a calendar year from the sale or exchange of certain long-term capital assets such as stocks, bonds, business interests, or other investments and tangible assets.

Washington does not have a typical individual income tax but does levy a 7.0 percent tax on capital gains income. Washington does not have a corporate income tax but does levy a gross receipts tax.

In Washington, a 0.58 percent payroll tax to fund a mandatory long-term care insurance program will take effect July 1, 2023, following litigation that resulted in various legislative changes and delays.