Washington Clauses Relating to Dividends, Distributions: Explained In the state of Washington, there are specific provisions known as "Washington Clauses" that regulate how dividends and distributions are managed in corporate entities. These clauses ensure fairness and compliance with state laws, protecting the rights of shareholders and guiding businesses in their dividend and distribution practices. Here are three essential types of Washington Clauses relating to dividends and distributions: 1. Dividend Limitation Clause: Also known as the "Dividend Payment Clause," this provision sets restrictions on the maximum amount a corporation can distribute as dividends. It ensures that dividend payments are reasonable and protect the financial stability of the company. The clause may include various factors to consider, such as retained earnings, surplus, and any financial obligations. 2. Dividend Declaration Clause: The Dividend Declaration Clause outlines the requirements and procedures for declaring dividends. It provides guidelines on how and when a corporation can declare dividends, specifying the authority responsible for making such decisions, and the necessary corporate approvals. This clause is vital in maintaining transparency and accountability in the dividend declaration process. 3. Distribution Preference Clause: The Distribution Preference Clause defines the order and priority in which different classes of shareholders receive distributions. It establishes specific preferences or priorities for certain classes of stockholders, ensuring fair treatment and distribution of wealth among shareholders. This clause ensures that each shareholder class receives the appropriate proportion of distributions, based on the specific provisions outlined in the corporate bylaws. Overall, these Washington Clauses relating to dividends and distributions play a crucial role in maintaining the financial integrity and fairness in the corporate world of Washington. They uphold transparency, protect shareholders' rights, establish proper procedures, and help businesses make informed decisions regarding the distribution of profits. It is important for businesses to consult legal advisors or professionals experienced in Washington corporate law to ensure compliance with these clauses. Adhering to the Washington Clauses relating to dividends and distributions promotes good corporate governance practices while safeguarding the interests of all stakeholders involved.

Washington Clauses Relating to Dividends, Distributions

Description

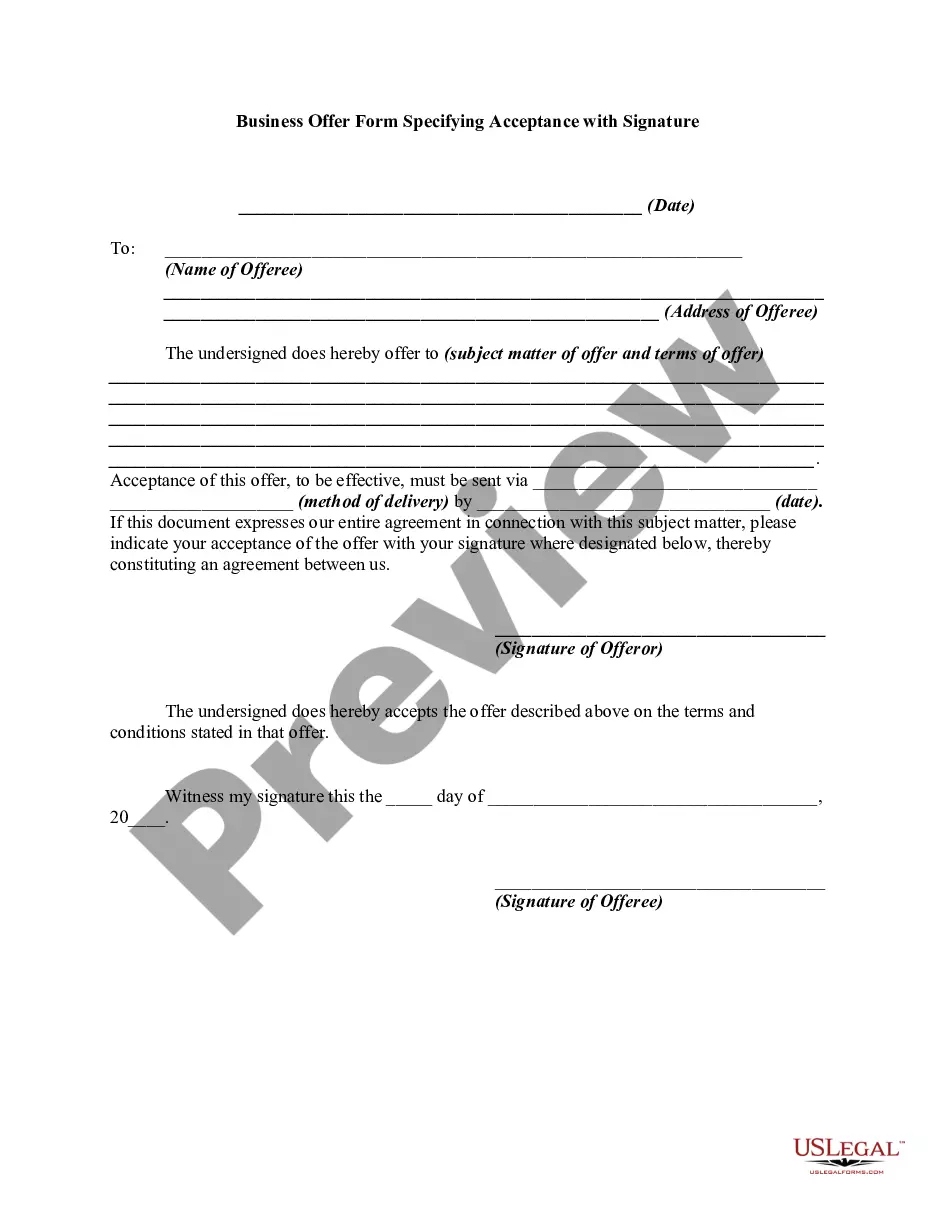

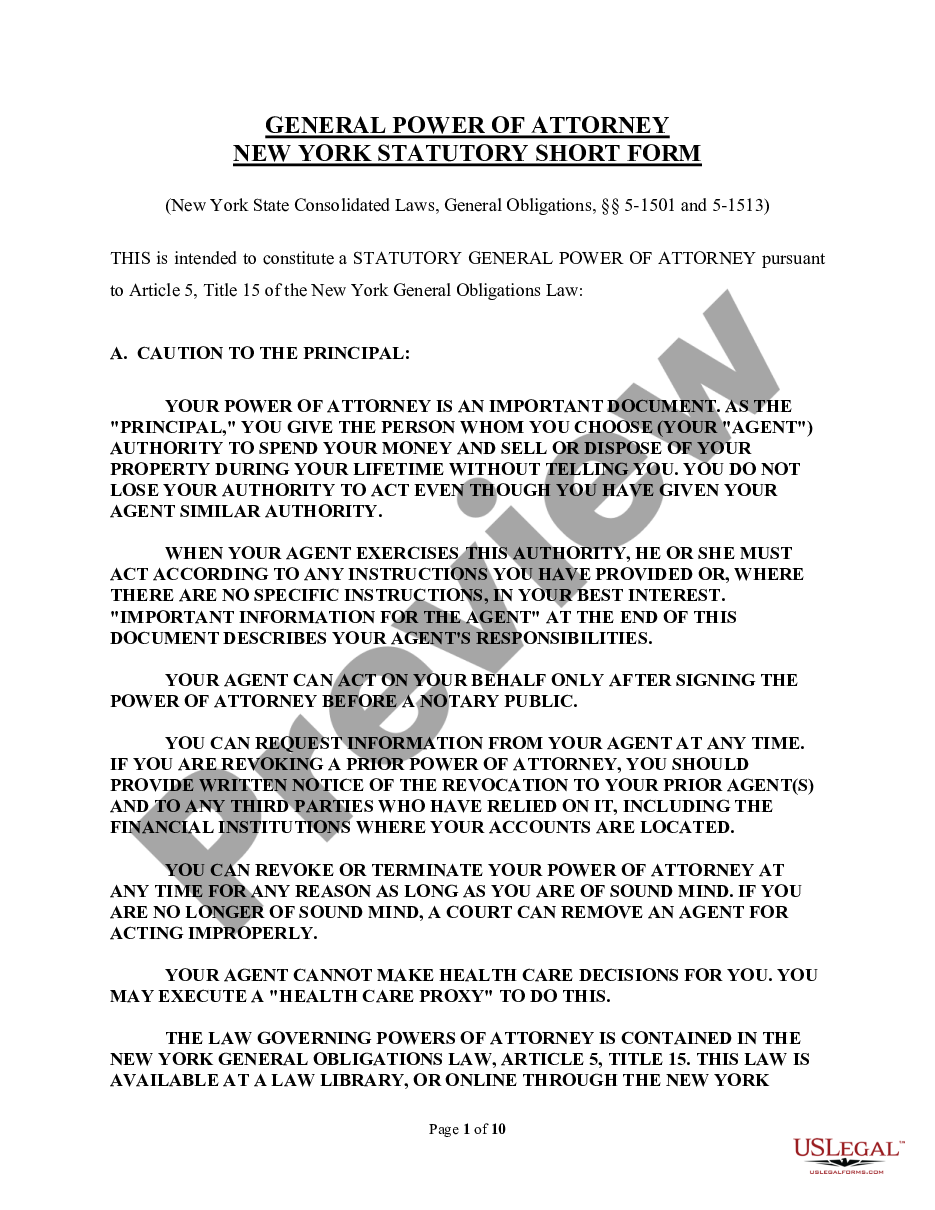

How to fill out Washington Clauses Relating To Dividends, Distributions?

If you need to comprehensive, download, or print out authorized file web templates, use US Legal Forms, the most important collection of authorized forms, that can be found online. Utilize the site`s simple and easy handy lookup to discover the paperwork you want. A variety of web templates for business and specific reasons are categorized by categories and claims, or key phrases. Use US Legal Forms to discover the Washington Clauses Relating to Dividends, Distributions with a handful of clicks.

In case you are already a US Legal Forms buyer, log in for your account and click the Acquire button to obtain the Washington Clauses Relating to Dividends, Distributions. You can even accessibility forms you previously downloaded in the My Forms tab of your account.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the shape for the appropriate town/land.

- Step 2. Use the Review solution to check out the form`s content material. Never neglect to see the information.

- Step 3. In case you are not happy together with the type, make use of the Search area towards the top of the display to discover other models in the authorized type template.

- Step 4. Upon having found the shape you want, click the Get now button. Select the prices program you prefer and put your accreditations to sign up for the account.

- Step 5. Method the purchase. You may use your Мisa or Ьastercard or PayPal account to perform the purchase.

- Step 6. Choose the file format in the authorized type and download it in your product.

- Step 7. Full, change and print out or sign the Washington Clauses Relating to Dividends, Distributions.

Every authorized file template you get is yours forever. You might have acces to each type you downloaded in your acccount. Select the My Forms portion and select a type to print out or download once again.

Contend and download, and print out the Washington Clauses Relating to Dividends, Distributions with US Legal Forms. There are millions of specialist and condition-distinct forms you can use for your business or specific requirements.

Form popularity

FAQ

(19) "Parent" means the biological or adoptive parents of a child, or an individual who has established a parent-child relationship under RCW 26.26A.

01.410. (29) "Person" means an individual, corporation, business trust, estate, trust, partnership, limited liability company, association, joint venture, government, governmental subdivision, agency, or instrumentality, or any other legal or commercial entity.

(3) "Victim" means a person against whom a crime has been committed or the representative of a person against whom a crime has been committed.

(34) A "tenant" is any person who is entitled to occupy a dwelling unit primarily for living or dwelling purposes under a rental agreement.

Stockholders have a right to participate in the distribution of corporate assets in the form of dividends (if they are paid) and possibly through the sale of their holdings at a profit on the stock market.

(1) "Necessary" means that no reasonably effective alternative to the use of force appeared to exist and that the amount of force used was reasonable to effect the lawful purpose intended.