Washington Certificate of Cancellation of Certificate of Limited Partnership

Description

How to fill out Certificate Of Cancellation Of Certificate Of Limited Partnership?

Discovering the right authorized file format can be a have a problem. Needless to say, there are a lot of web templates accessible on the Internet, but how would you find the authorized develop you want? Use the US Legal Forms web site. The support delivers 1000s of web templates, including the Washington Certificate of Cancellation of Certificate of Limited Partnership, that you can use for business and private needs. Every one of the kinds are inspected by pros and satisfy federal and state specifications.

Should you be presently authorized, log in in your profile and click the Download option to get the Washington Certificate of Cancellation of Certificate of Limited Partnership. Use your profile to look through the authorized kinds you have acquired in the past. Proceed to the My Forms tab of your respective profile and acquire yet another duplicate of your file you want.

Should you be a new consumer of US Legal Forms, listed below are straightforward recommendations so that you can comply with:

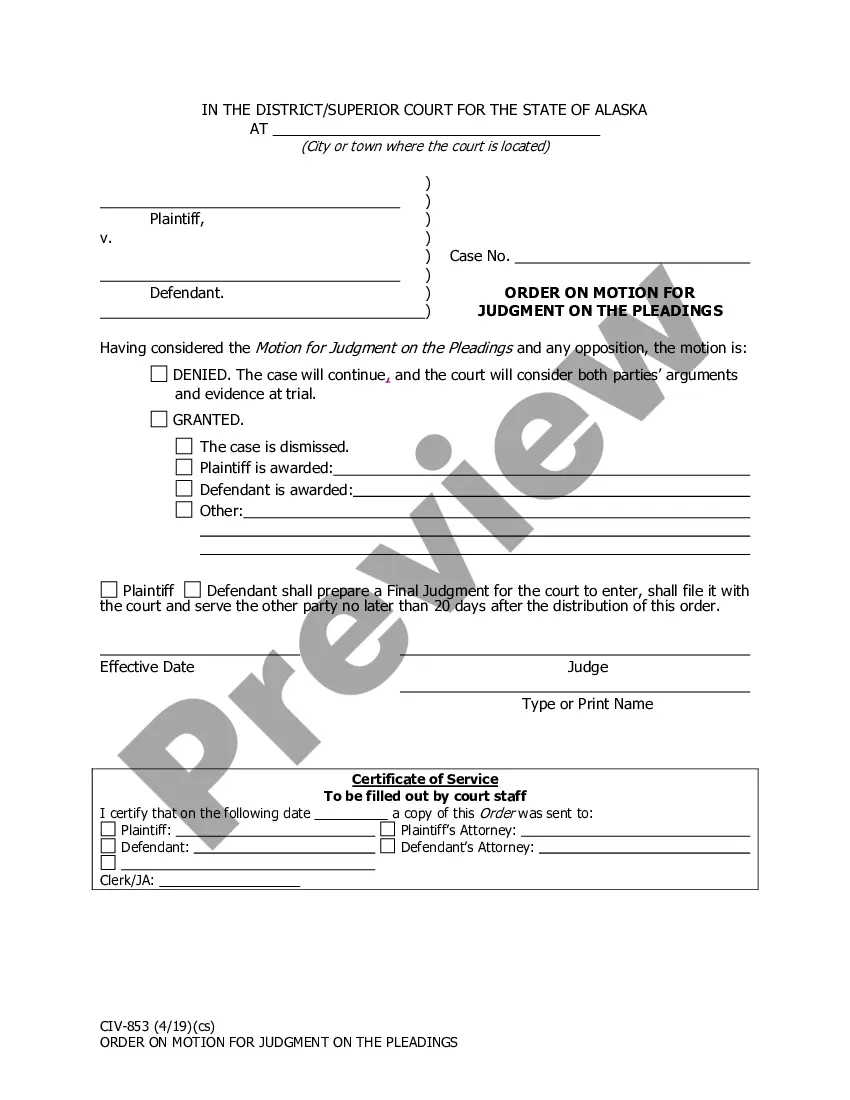

- Initial, make sure you have selected the appropriate develop for your personal metropolis/county. You can examine the form making use of the Review option and browse the form explanation to make certain this is basically the best for you.

- In case the develop is not going to satisfy your expectations, use the Seach area to find the right develop.

- Once you are sure that the form is acceptable, click the Acquire now option to get the develop.

- Pick the rates strategy you need and enter in the needed information and facts. Make your profile and buy an order utilizing your PayPal profile or credit card.

- Choose the data file structure and acquire the authorized file format in your product.

- Comprehensive, revise and printing and indicator the received Washington Certificate of Cancellation of Certificate of Limited Partnership.

US Legal Forms is definitely the largest collection of authorized kinds where you can find different file web templates. Use the service to acquire appropriately-produced files that comply with status specifications.

Form popularity

FAQ

An Initial report (also known in some states as Statements of Information), while not particularly glamorous, is sometimes required in order to keep your business in good standing.

7 Steps to Dissolving a Washington Corporation: Submit a Revenue Clearance Certificate Application. ... Wait for processing. ... Fill out Articles of Dissolution. ... Attach the certificate. ... Submit Articles of Dissolution. ... Wait for processing. ... Inform your registered agent.

A limited partnership cannot be dissolved by court decree. A limited liability limited partnership is a type of limited partnership. Devoting time, energy, and skill to partnership business is a partner's duty and is not a compensable service. On a partner's dissociation, the partner's duty of loyalty ends.

If you want to dissolve a Washington corporation, you must undertake a two-step process. You must first file with the Department of Revenue, which will confirm that you have paid all of your business taxes. Second, you must file with the Secretary of State, which will dissolve your Washington corporation.

Every Washington LLC must file an Initial Report. An Initial Report is simply your Washington LLC's 1st Annual Report. The Initial Report is due within 120 days of your Washington LLC being formed. Day 1 is the date that's stamped in your LLC approval, the ?Certificate of Formation ? Fulfilled?.

Every Washington LLC must file an Initial Report. An Initial Report is simply your Washington LLC's 1st Annual Report. The Initial Report is due within 120 days of your Washington LLC being formed. Day 1 is the date that's stamped in your LLC approval, the ?Certificate of Formation ? Fulfilled?.

Washington Initial Report Fee: $10 This report can be filed online via the Corporations and Charities Filing System or with a paper form. In addition to filing the $10 initial report, an annual report must be submitted at the end of your LLC's first year.

Initial reports are information updates due to the secretary of state after you form or register a business entity, such as an LLC, corporation, or nonprofit.