The Washington Form of Anti-Money Laundering Compliance Policy refers to the specific guidelines and regulations set forth by the state of Washington to combat money laundering activities effectively. This policy is designed to ensure that financial institutions operating within Washington adhere to the highest standards of anti-money laundering practices. By incorporating relevant keywords, such as "Washington," "anti-money laundering," and "compliance policy," we can provide an informative description of this policy. In Washington, the Form of Anti-Money Laundering Compliance Policy serves as a comprehensive framework for financial institutions to establish and maintain robust AML practices. It outlines the requirements, procedures, and guidelines that these institutions must follow to detect and prevent money laundering activities effectively. This policy aims to protect the integrity of the state's financial system and safeguard against illicit financial transactions. Under the Washington Form of Anti-Money Laundering Compliance Policy, financial institutions are obligated to implement risk-based procedures to identify and verify customers' identities, assess AML risks, and monitor transactions for suspicious activities. These procedures, often customized based on the institution's size and nature of business, are crucial in keeping up with the constantly evolving money laundering techniques. Additionally, financial institutions are required to implement a system of ongoing employee training and education to ensure all staff members are well-informed regarding anti-money laundering regulations and can promptly identify and report suspicious transactions. Regular internal audits and independent testing are also necessary to assess the effectiveness of the AML program and identify any deficiencies or areas for improvement. Several variations or types of Washington Form of Anti-Money Laundering Compliance Policy may exist based on the type of financial institution. For instance, there could be specific policies tailored for banks, credit unions, broker-dealers, insurance companies, and money service businesses. Each policy would outline the unique anti-money laundering obligations and procedures relevant to the respective financial institution's operations. Overall, the Washington Form of Anti-Money Laundering Compliance Policy plays a critical role in maintaining transparency, integrity, and adherence to regulatory standards within the financial industry in the state of Washington. By following the guidelines set forth in this policy, financial institutions can effectively combat money laundering, terrorist financing, and other illicit financial activities, ensuring a secure and stable financial system in Washington.

Washington Form of Anti-Money Laundering Compliance Policy

Description

How to fill out Washington Form Of Anti-Money Laundering Compliance Policy?

If you need to comprehensive, down load, or print out authorized papers templates, use US Legal Forms, the biggest assortment of authorized varieties, which can be found online. Utilize the site`s simple and easy handy look for to discover the documents you require. Numerous templates for company and person purposes are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to discover the Washington Form of Anti-Money Laundering Compliance Policy with a couple of click throughs.

Should you be presently a US Legal Forms customer, log in in your accounts and click the Acquire button to obtain the Washington Form of Anti-Money Laundering Compliance Policy. You can also entry varieties you formerly delivered electronically within the My Forms tab of your own accounts.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that correct town/region.

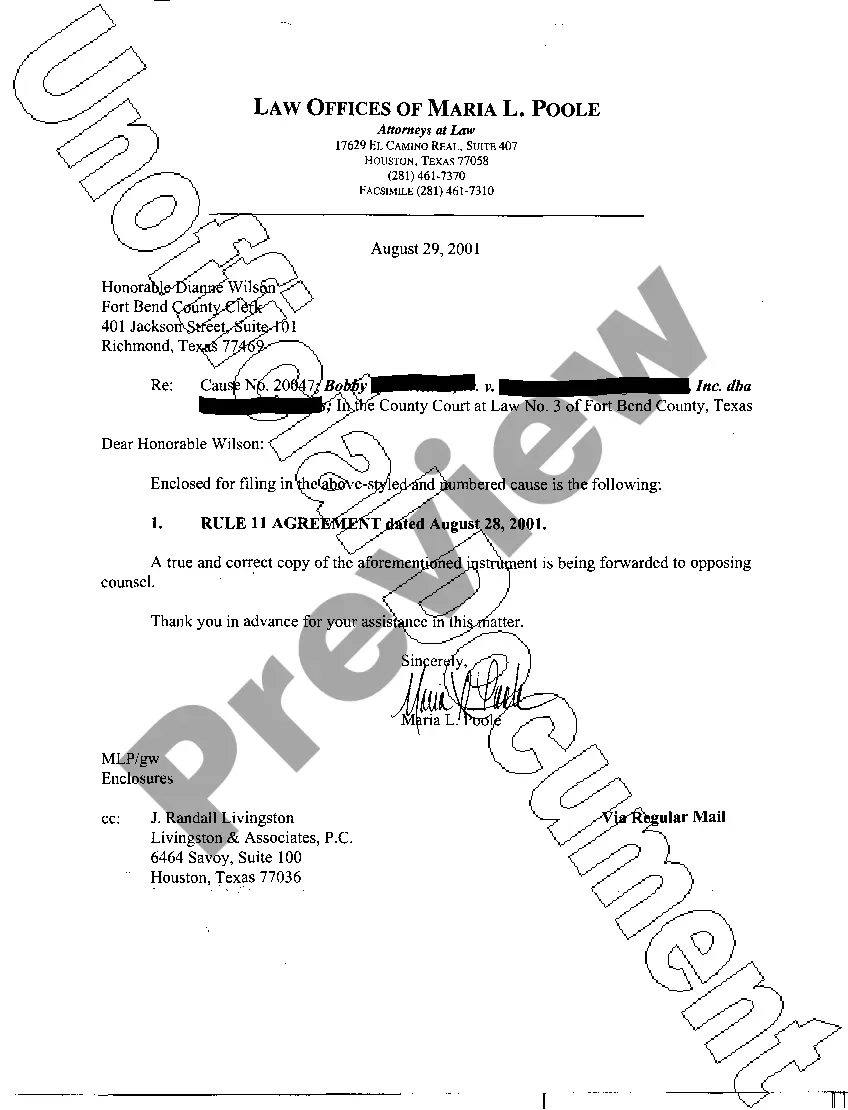

- Step 2. Make use of the Preview method to look through the form`s articles. Never forget to read through the explanation.

- Step 3. Should you be not happy together with the type, use the Search area on top of the display to find other variations in the authorized type web template.

- Step 4. Once you have discovered the form you require, go through the Buy now button. Select the pricing program you choose and include your qualifications to sign up on an accounts.

- Step 5. Approach the purchase. You may use your bank card or PayPal accounts to accomplish the purchase.

- Step 6. Select the structure in the authorized type and down load it in your gadget.

- Step 7. Full, modify and print out or sign the Washington Form of Anti-Money Laundering Compliance Policy.

Each and every authorized papers web template you purchase is yours eternally. You have acces to every single type you delivered electronically within your acccount. Click the My Forms portion and pick a type to print out or down load yet again.

Be competitive and down load, and print out the Washington Form of Anti-Money Laundering Compliance Policy with US Legal Forms. There are thousands of expert and condition-specific varieties you can use to your company or person requirements.

Form popularity

FAQ

The Anti-Money Laundering (AML) process consists of regulations, laws, and policies for limiting and combating money laundering activities and crimes. Financial Institutions and banks need to follow Anti-Money Laundering regulations.

The firm's AML procedures should clearly articulate the firm's day-to-day process. For example, when onboarding a new client, it should state what identification documents are acceptable, what is an acceptable proof of address, what forms need to be completed, what searches and checks need to be done?etc.

The program must include appropriate risk-based procedures for conducting ongoing customer due diligence, including (i) understanding the nature and purpose of customer relationships for the purpose of developing a customer risk profile; and, (ii) conducting ongoing monitoring to identify and report suspicious ...

This guide contains the steps to developing an effective compliance program: Appoint an AML compliance officer (AMLCO)? ... Conduct employee training. ... Perform risk assessment. ... Develop internal policies and procedures. ... Detect suspicious activity and report it. ... Organize independent audits.

An anti-money laundering (AML) compliance program helps businesses, including traditional financial institutions?as well as those entities identified in government regulations, such as money-service businesses and insurance companies?uncover suspicious activity associated with criminal acts, including money laundering ...

How to develop an AML program: a step-by-step guide Appoint an AML compliance officer (AMLCO)? ... Conduct employee training. ... Perform risk assessment. ... Develop internal policies and procedures. ... Detect suspicious activity and report it. ... Organize independent audits.

The Four (4) Pillars Of BSA/AML Compliance PILLAR #1. DESIGNATION OF A COMPLIANCE OFFICER. PILLAR #2. DEVELOPMENT OF INTERNAL POLICIES, PROCEDURES AND CONTROLS. PILLAR #3. ONGOING, RELEVANT TRAINING OF EMPLOYEES. PILLAR #4. INDEPENDENT TESTING AND REVIEW. CONCLUSION.

Anti-Money Laundering Form (RIGHT TO BUY)