Washington Letter regarding Wage Statement

Description

How to fill out Letter Regarding Wage Statement?

If you have to total, obtain, or produce authorized document web templates, use US Legal Forms, the biggest assortment of authorized kinds, that can be found on-line. Utilize the site`s simple and easy hassle-free lookup to get the paperwork you will need. Numerous web templates for company and individual functions are sorted by categories and suggests, or key phrases. Use US Legal Forms to get the Washington Letter regarding Wage Statement with a few mouse clicks.

If you are previously a US Legal Forms customer, log in to the profile and click the Obtain option to get the Washington Letter regarding Wage Statement. You can even gain access to kinds you formerly acquired from the My Forms tab of your respective profile.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for your right town/nation.

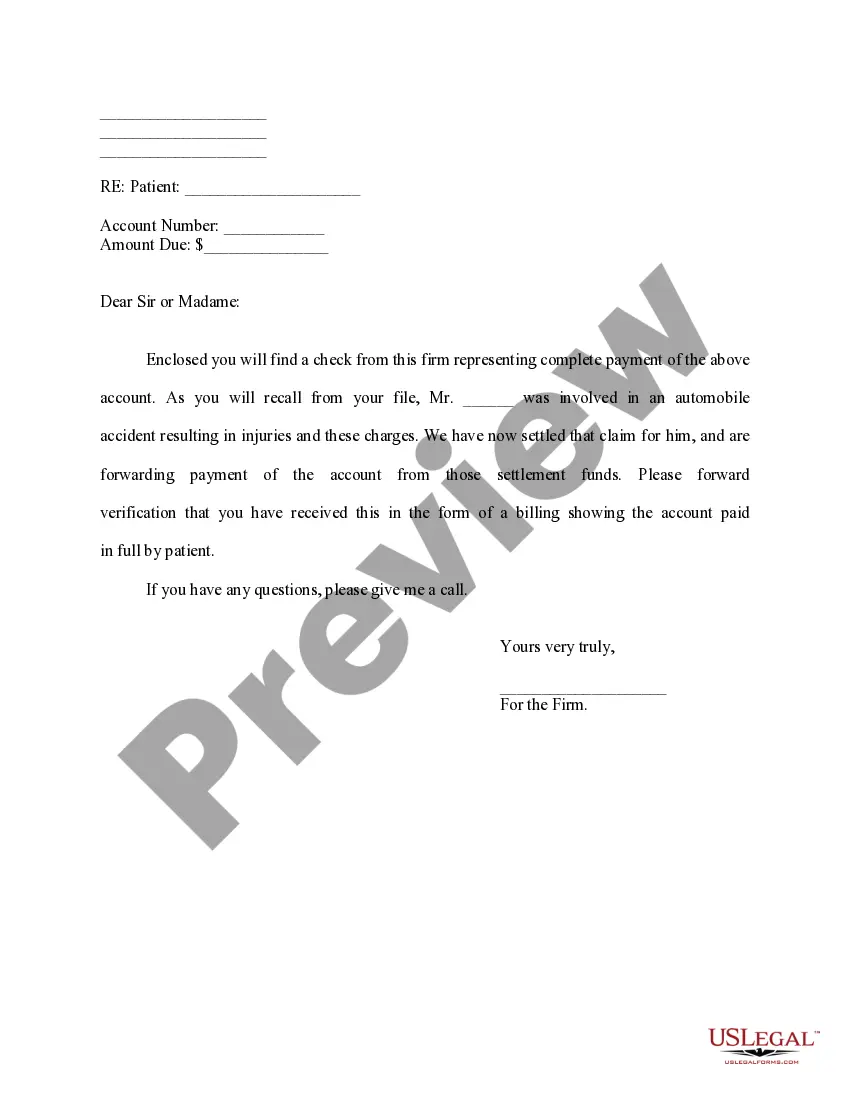

- Step 2. Utilize the Review option to examine the form`s articles. Do not forget about to see the outline.

- Step 3. If you are unhappy together with the form, use the Search field near the top of the display to discover other types of your authorized form format.

- Step 4. After you have found the form you will need, go through the Buy now option. Opt for the rates program you prefer and add your accreditations to sign up for an profile.

- Step 5. Procedure the deal. You should use your Мisa or Ьastercard or PayPal profile to finish the deal.

- Step 6. Choose the structure of your authorized form and obtain it in your product.

- Step 7. Total, modify and produce or indication the Washington Letter regarding Wage Statement.

Every single authorized document format you purchase is your own property for a long time. You have acces to each and every form you acquired in your acccount. Select the My Forms area and decide on a form to produce or obtain once again.

Remain competitive and obtain, and produce the Washington Letter regarding Wage Statement with US Legal Forms. There are thousands of expert and condition-particular kinds you can utilize for your personal company or individual requires.

Form popularity

FAQ

Qualifying criteria for WA State unemployment Under WA state law, you are eligible for benefits if you: Have worked for at least 680 hours in WA during the ?base year? (the first four of the last five completed calendar quarters) in a position included in WA's unemployment program.

If payment status is ?Pending,? your claim is being reviewed for eligibility. Check the Pending Issues tab for information. If payment status is ?Invalid,? it means you may not be eligible for benefits. Contact your employer's representative.

In the USA, Massachusetts, Washington and Minnesota are the states with the best payments, since the maximum amount is $1,015, $999 and $857, respectively.

Repeated inexcusable tardiness after warnings. Dishonesty related to your employment. Repeated and inexcusable absences. Violating the law or deliberate acts that provoke violence or illegal actions, or violating a collective bargaining agreement.

Qualifying criteria for WA State unemployment Under WA state law, you are eligible for benefits if you: Have worked for at least 680 hours in WA during the ?base year? (the first four of the last five completed calendar quarters) in a position included in WA's unemployment program.

You may request records from the Employment Security Department via email, phone, fax or mail. Phone: 844-766-8930 from a.m. to noon or 1 to p.m. Monday through Friday, except on state holidays. If you want to review records in person, you must email recordsdisclosure@esd.wa.gov to schedule an appointment.

You may qualify for unemployment benefits if we decide you quit for the following good-cause reasons: You quit to take another job. You became sick or disabled, or a member of your family became sick, disabled or died, and it was necessary for you to quit work.

Officers of for-profit corporations who provide services in Washington are automatically exempt from Unemployment Insurance, unless the employer specifically requests coverage. Submit a Voluntary Election Form to the Employment Security Department for optional corporate officer coverage.