Washington Request for Copy of Tax Form or Individual Income Tax Account Information is a process provided by the Washington State Department of Revenue to individuals who seek copies of their tax forms or information related to their individual income tax accounts. This request is essential for individuals who may have misplaced their tax forms or need access to their income tax account details for various purposes, such as filing tax returns, obtaining mortgage or loan approvals, or resolving tax-related disputes. To initiate the Washington Request for Copy of Tax Form or Individual Income Tax Account Information, individuals are required to follow a standardized procedure provided by the Washington State Department of Revenue. This procedure ensures that taxpayers can obtain accurate and authentic information regarding their tax forms and income tax accounts. Submitting a request typically involves downloading the official Washington Request for Copy of Tax Form or Individual Income Tax Account Information form from the Washington State Department of Revenue's website. The form can be filled out online or printed, filled manually, and then submitted via mail to the appropriate department. The form requires the individual's personal information, such as full name, Social Security number, address, contact information, and specific details related to the requested tax form or income tax account information. It is important to note that there may be different types of Washington Requests for Copy of Tax Form or Individual Income Tax Account Information, depending on the specific requirements and circumstances of the individual. Some commonly encountered forms may include: 1. Washington Request for Copy of State Income Tax Return: This form is used when individuals require a copy of their previously filed state income tax return. It is crucial for taxpayers to provide the correct tax year for which they require a copy. 2. Washington Request for Individual Income Tax Account Information: This form is used when individuals need access to specific details related to their income tax account, such as payment history, balances, or any notices or correspondences sent by the Washington State Department of Revenue regarding their tax account. 3. Washington Request for Copy of Tax Form for Amended Returns: This form is used when individuals want a copy of their amended income tax return. It is essential to provide accurate information regarding the tax year and any changes made to the original return. Regardless of the specific type of Washington Request for Copy of Tax Form or Individual Income Tax Account Information, it is crucial for individuals to provide accurate and complete information to expedite the processing of their request. The Washington State Department of Revenue aims to fulfill these requests promptly and efficiently to assist taxpayers in their tax-related matters.

Washington Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Washington Request For Copy Of Tax Form Or Individual Income Tax Account Information?

Are you currently in the placement where you require documents for both company or individual uses just about every time? There are a lot of legitimate document templates available online, but finding kinds you can rely isn`t easy. US Legal Forms delivers a huge number of kind templates, much like the Washington Request for Copy of Tax Form or Individual Income Tax Account Information, that are created in order to meet federal and state needs.

If you are already familiar with US Legal Forms internet site and possess your account, merely log in. After that, it is possible to download the Washington Request for Copy of Tax Form or Individual Income Tax Account Information web template.

Unless you offer an profile and need to start using US Legal Forms, abide by these steps:

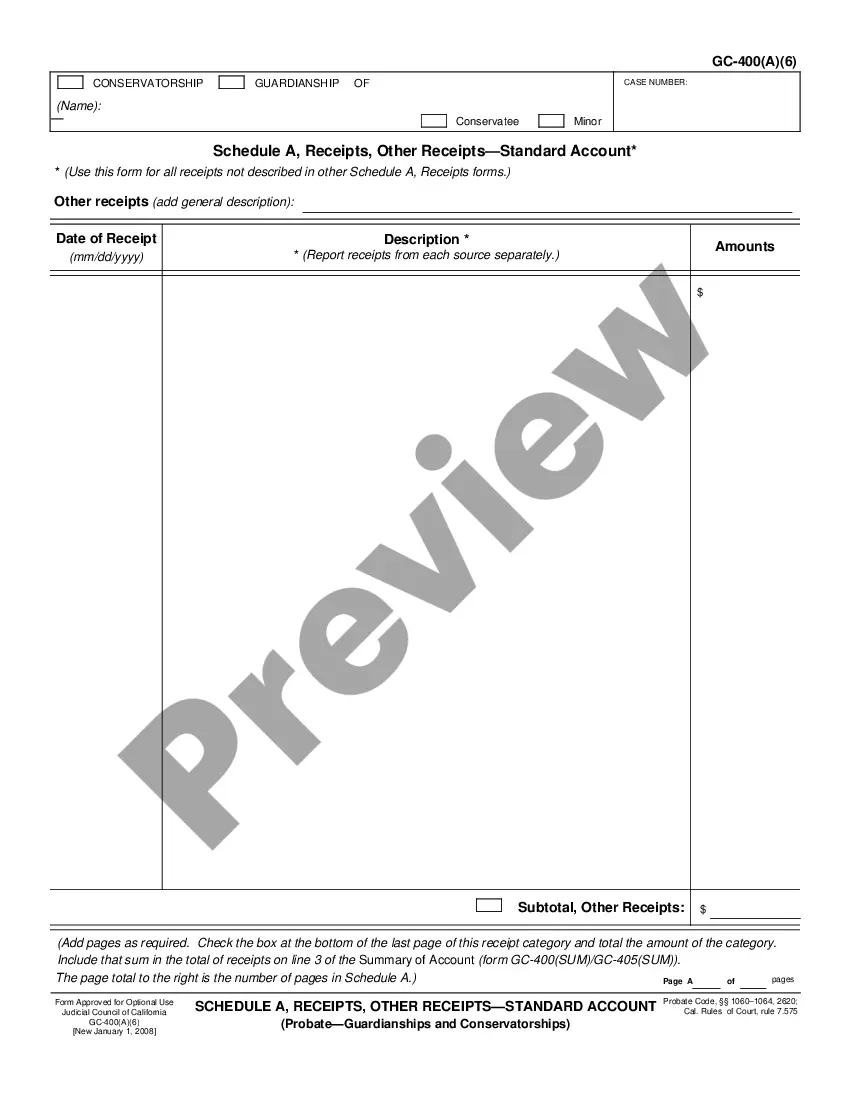

- Obtain the kind you require and ensure it is for that right city/area.

- Utilize the Preview switch to analyze the form.

- Read the description to ensure that you have chosen the appropriate kind.

- In case the kind isn`t what you`re seeking, utilize the Look for field to obtain the kind that fits your needs and needs.

- Whenever you discover the right kind, simply click Purchase now.

- Pick the rates program you want, complete the required information to generate your bank account, and pay for the transaction using your PayPal or bank card.

- Select a hassle-free document structure and download your version.

Locate all of the document templates you possess bought in the My Forms food list. You can aquire a extra version of Washington Request for Copy of Tax Form or Individual Income Tax Account Information any time, if needed. Just click the necessary kind to download or produce the document web template.

Use US Legal Forms, one of the most extensive assortment of legitimate forms, to save efforts and avoid errors. The assistance delivers professionally manufactured legitimate document templates that can be used for a selection of uses. Produce your account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

You can request copies of your IRS tax returns from the most recent seven tax years. To obtain copies of your tax return from the IRS, download file Form 4506 from the IRS website, complete it, sign it, and mail it to the appropriate IRS address. As of 2023, the IRS charges $43 for each return you request.

Income tax forms: The State of Washington does not have a personal or corporate Income Tax. Warning: to protect against the possibility of others accessing your confidential information, do not complete these forms on a public workstation.

Washington Tax Rates, Collections, and Burdens Washington does not have a typical individual income tax but does levy a 7.0 percent tax on capital gains income. Washington does not have a corporate income tax but does levy a gross receipts tax.

Personal computer users may download forms and publications from the IRS Web site at .irs.gov/forms_pubs/index.html.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Use Form 4506 to request a copy of your tax return. You can also designate (on line 5) a third party to receive the tax return.

Requesting an IRS tax transcript online If you have an online IRS account, you can simply log in to your account and navigate to the "Tax Records" tab. There you'll be able to select, view or download the tax transcript you need.

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.