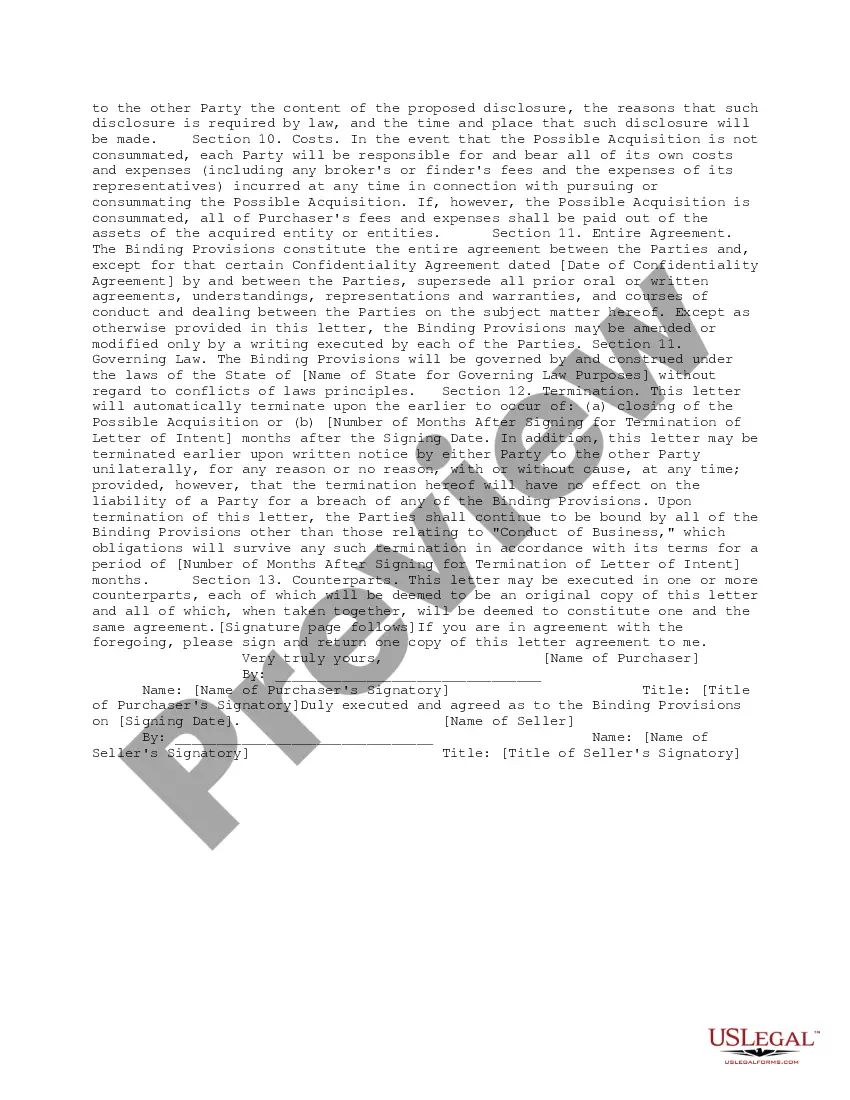

This is aletter of intent for stock acquisition. It can be used by the counsel for either the seller or purchaser and confirms the discussions to date between the seller and the purchaser. It discusses all matters in principal and binding agreements between the two parties.

Washington Simple Letter of Intent for Stock Acquisition is a legally binding document used in the state of Washington when two parties intend to engage in the acquisition of stock. This letter outlines the preliminary terms and conditions of the agreement, serving as a blueprint for further negotiations and due diligence. It reflects the mutual interest and intention to proceed with the transaction and signifies the commitment of both parties involved. The Washington Simple Letter of Intent for Stock Acquisition contains several essential elements that are crucial to the acquisition process. These elements include the identification of the buyer and seller, the amount and type of stock being acquired, the purchase price or valuation, and any relevant financing terms. Additionally, it may cover other important aspects like the desired closing date, any contingencies, and the intended structure of the transaction. There are various types of Washington Simple Letter of Intent for Stock Acquisition that may be used. Some commonly encountered types include: 1. Non-Binding Letter of Intent: This type of letter expresses the initial interest of the parties but does not create any binding obligations. It serves as a starting point for negotiations and allows both sides to explore potential terms before committing to a final agreement. 2. Binding Letter of Intent: In contrast to the non-binding version, this letter creates legal obligations for the parties involved. It signifies a higher level of commitment and is often used when the parties have reached a more advanced stage of negotiation and are confident in moving towards completion. 3. Letter of Intent with Exclusivity Provision: This type of letter includes a provision that grants one party the exclusive right to negotiate and finalize the stock acquisition for a certain period. It prevents the seller from engaging with other potential buyers during that timeframe, demonstrating the buyer's dedication and commitment to the deal. 4. Letter of Intent with Due Diligence Contingency: This version of the letter permits the buyer to conduct a thorough investigation of the seller's financial, legal, and operational aspects before finalizing the acquisition. It allows the buyer to assess any potential risks or liabilities associated with the stock being acquired. Regardless of the specific type utilized, the Washington Simple Letter of Intent for Stock Acquisition serves as a crucial preliminary agreement that embodies the parties' intentions and sets the stage for further negotiations. It provides a framework for the acquisition process, allowing both parties to proceed with confidence while protecting their interests.Washington Simple Letter of Intent for Stock Acquisition is a legally binding document used in the state of Washington when two parties intend to engage in the acquisition of stock. This letter outlines the preliminary terms and conditions of the agreement, serving as a blueprint for further negotiations and due diligence. It reflects the mutual interest and intention to proceed with the transaction and signifies the commitment of both parties involved. The Washington Simple Letter of Intent for Stock Acquisition contains several essential elements that are crucial to the acquisition process. These elements include the identification of the buyer and seller, the amount and type of stock being acquired, the purchase price or valuation, and any relevant financing terms. Additionally, it may cover other important aspects like the desired closing date, any contingencies, and the intended structure of the transaction. There are various types of Washington Simple Letter of Intent for Stock Acquisition that may be used. Some commonly encountered types include: 1. Non-Binding Letter of Intent: This type of letter expresses the initial interest of the parties but does not create any binding obligations. It serves as a starting point for negotiations and allows both sides to explore potential terms before committing to a final agreement. 2. Binding Letter of Intent: In contrast to the non-binding version, this letter creates legal obligations for the parties involved. It signifies a higher level of commitment and is often used when the parties have reached a more advanced stage of negotiation and are confident in moving towards completion. 3. Letter of Intent with Exclusivity Provision: This type of letter includes a provision that grants one party the exclusive right to negotiate and finalize the stock acquisition for a certain period. It prevents the seller from engaging with other potential buyers during that timeframe, demonstrating the buyer's dedication and commitment to the deal. 4. Letter of Intent with Due Diligence Contingency: This version of the letter permits the buyer to conduct a thorough investigation of the seller's financial, legal, and operational aspects before finalizing the acquisition. It allows the buyer to assess any potential risks or liabilities associated with the stock being acquired. Regardless of the specific type utilized, the Washington Simple Letter of Intent for Stock Acquisition serves as a crucial preliminary agreement that embodies the parties' intentions and sets the stage for further negotiations. It provides a framework for the acquisition process, allowing both parties to proceed with confidence while protecting their interests.