Financing Statement Additional Party form for adding additional Debtors or Secured Parties to Financing Statements (Form UCC1) filed with the Washington filing office.

Washington UCC1 Financing Statement Additional Party

Description

How to fill out Washington UCC1 Financing Statement Additional Party?

Out of the multitude of services that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates before buying them. Its comprehensive library of 85,000 samples is categorized by state and use for efficiency. All the documents available on the platform have been drafted to meet individual state requirements by accredited legal professionals.

If you have a US Legal Forms subscription, just log in, look for the form, hit Download and get access to your Form name in the My Forms; the My Forms tab keeps all of your downloaded documents.

Keep to the guidelines below to obtain the form:

- Once you see a Form name, ensure it’s the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Look for a new sample using the Search engine in case the one you’ve already found isn’t appropriate.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the template.

After you have downloaded your Form name, you are able to edit it, fill it out and sign it with an online editor of your choice. Any document you add to your My Forms tab might be reused multiple times, or for as long as it continues to be the most updated version in your state. Our platform provides fast and easy access to templates that fit both attorneys and their clients.

Form popularity

FAQ

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

It should be noted that UCC financing statements filed now generally do not contain a grant of the security interest and generally are not signed or otherwise authenticated by the Debtor and therefore would not satisfy the requirement of a security agreement.

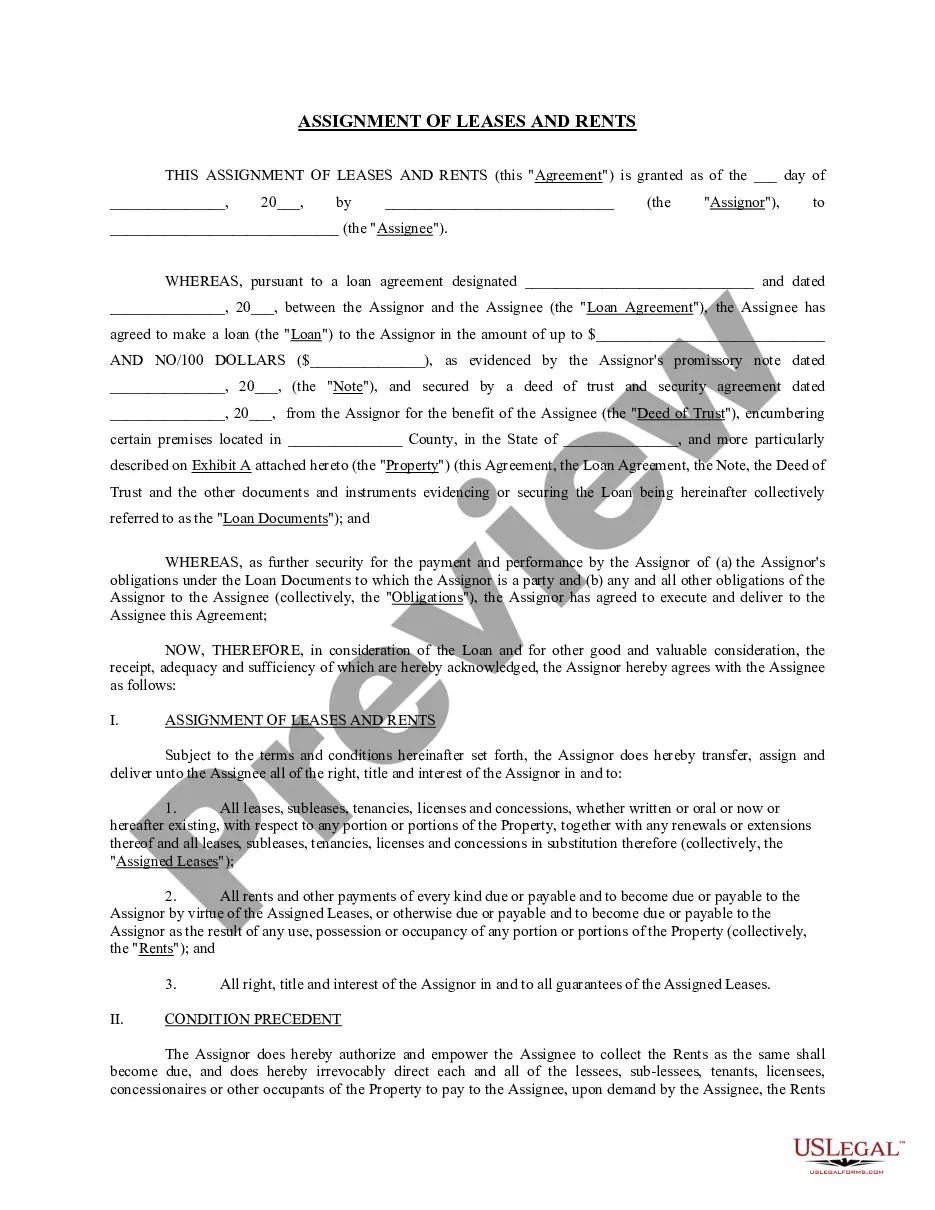

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a

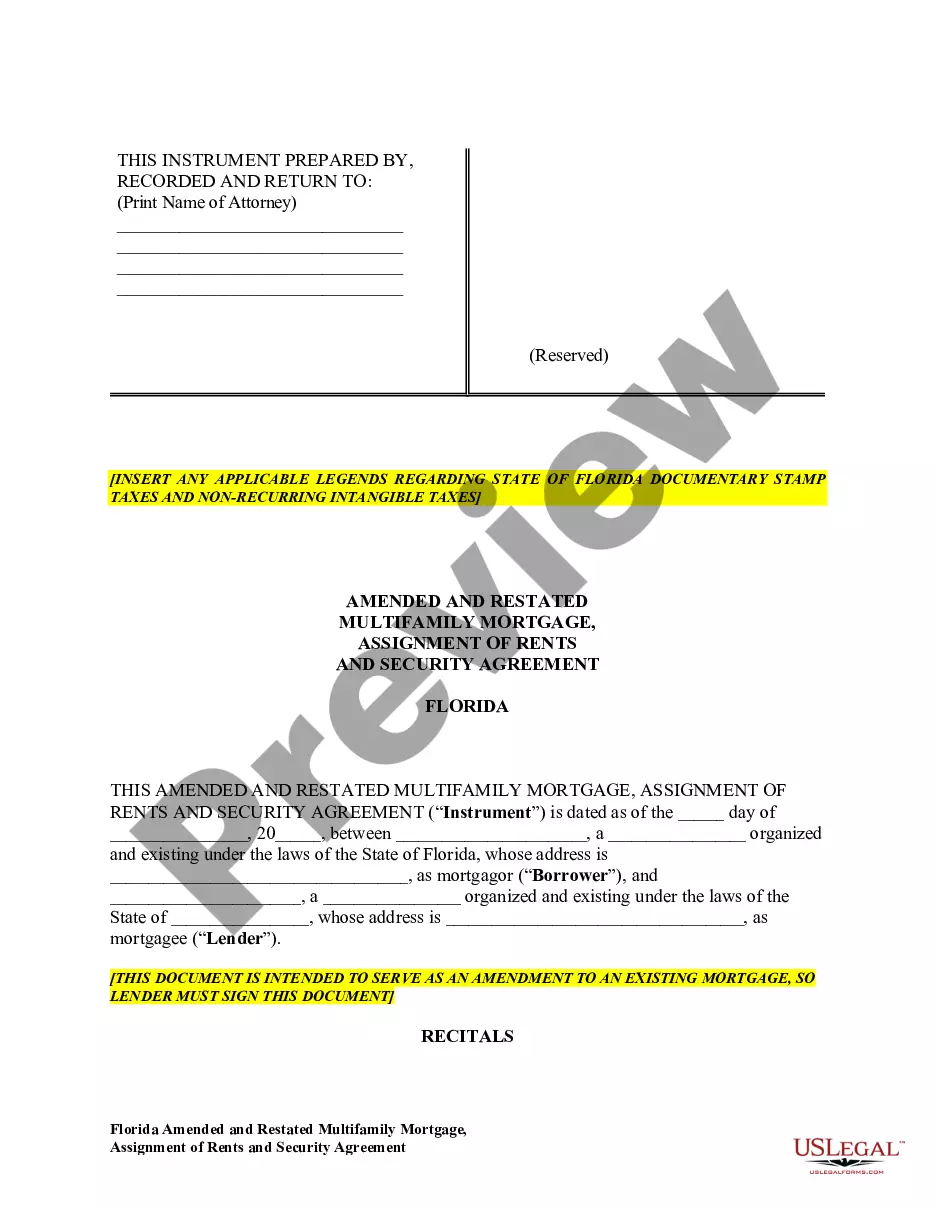

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.