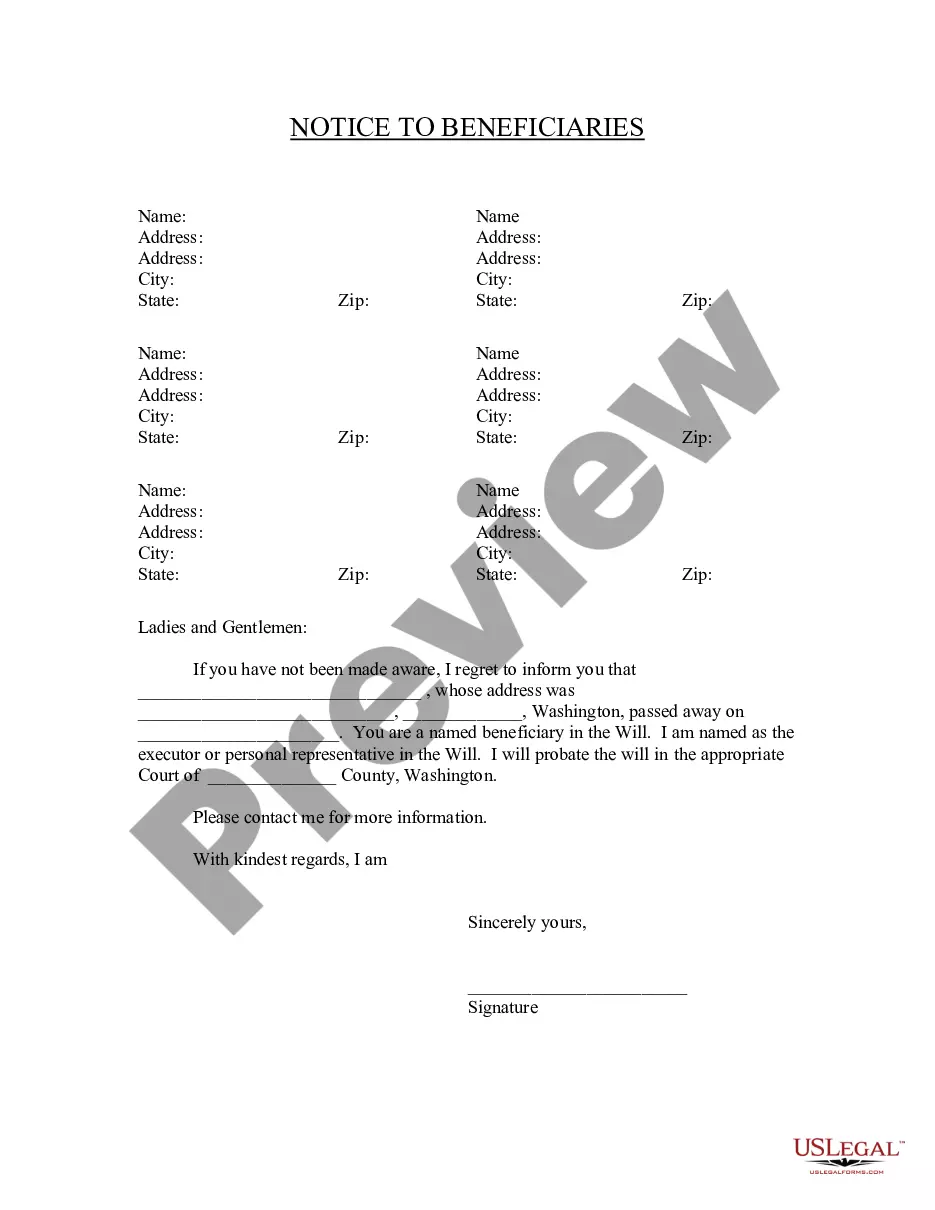

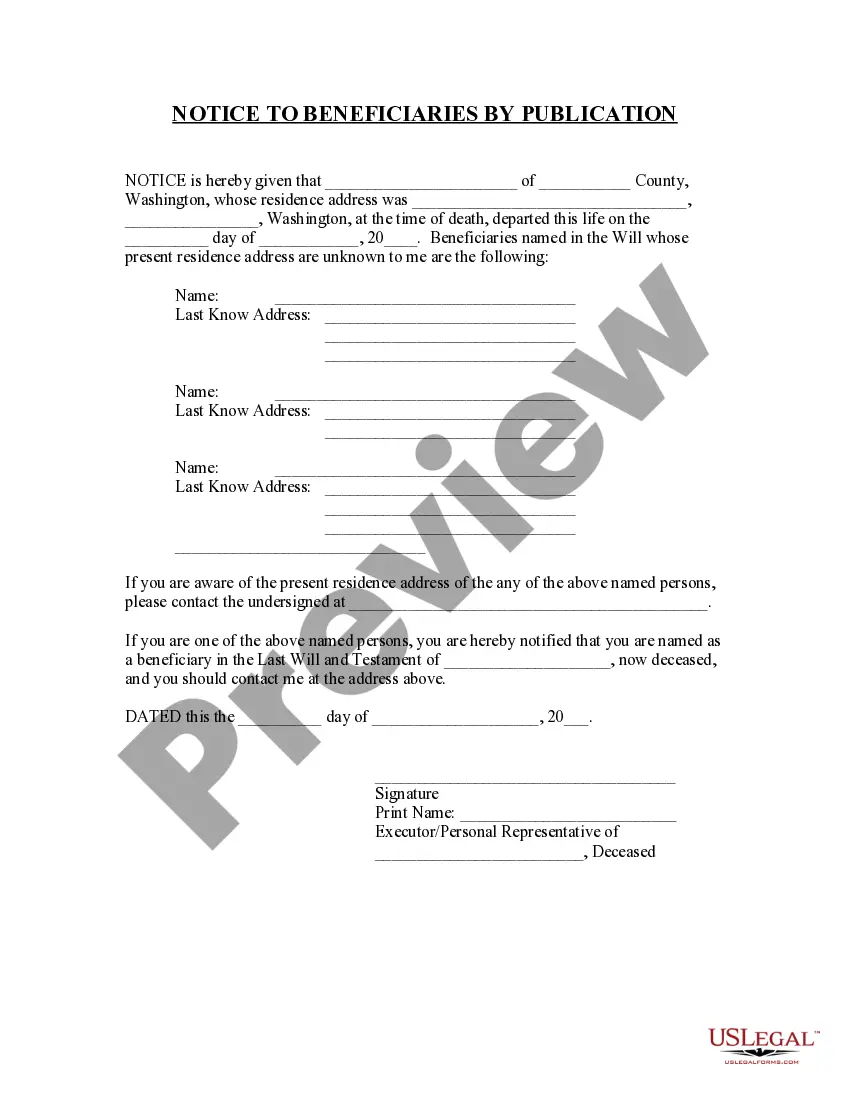

This Notice to Beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. A second notice is also provided for publication where the location of the beneficiaries is unknown.

Washington Notice to Beneficiaries of being Named in Will

Description

How to fill out Washington Notice To Beneficiaries Of Being Named In Will?

Out of the great number of platforms that offer legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing forms before buying them. Its extensive catalogue of 85,000 templates is grouped by state and use for efficiency. All of the documents on the service have already been drafted to meet individual state requirements by accredited legal professionals.

If you have a US Legal Forms subscription, just log in, search for the template, hit Download and gain access to your Form name in the My Forms; the My Forms tab keeps all your downloaded documents.

Stick to the guidelines listed below to obtain the form:

- Once you see a Form name, make certain it is the one for the state you need it to file in.

- Preview the template and read the document description before downloading the template.

- Search for a new template through the Search engine if the one you have already found isn’t appropriate.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the document.

Once you have downloaded your Form name, you are able to edit it, fill it out and sign it with an online editor that you pick. Any form you add to your My Forms tab can be reused many times, or for as long as it remains to be the most up-to-date version in your state. Our service provides quick and simple access to samples that suit both lawyers as well as their clients.

Form popularity

FAQ

Call the probate court to obtain the name and phone number of the executor, if you cannot obtain it from family members. Ask the executor of the will whether you are a beneficiary in your relative's will. Ask for a copy of the will so you can verify the information he provided.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements. 4feff This is relatively rare.

Can I appoint a beneficiary as my executor? Yes, your executor may also be a beneficiary to your estate. In fact, if you are leaving everything to your spouse or adult children who are capable of managing their finances, it is a natural choice to appoint your spouse or one or more of your children as your executor(s).

As an heir, you are entitled to a copy of the Will, whether you are named as a beneficiary or not. If there is a probate estate, then you should receive a copy of the Will. If you do not, you can always get it from the court. If there is no probate estate, then the Will is not going to do anything.

As Executor, you should notify beneficiaries of the estate within three months after the Will has been filed in Probate Court. For beneficiaries of assets that are not included in the will (and therefore do not pass through Probate) there are no specific notification requirements.

The person named as the Executor in the Will (or the Administrator if there is no Will) is responsible for contacting all of the Beneficiaries. This person should promptly notify everyone who has an interest in the Estate, advising what their entitlement is, to avoid any confusion later on in the process.

A trustee is required by law to notify beneficiaries of a trust upon the settlor's death. The settlor is the person who created the trust. The trustee has 60 days from the settlor's death to provide the notification to the beneficiaries.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.