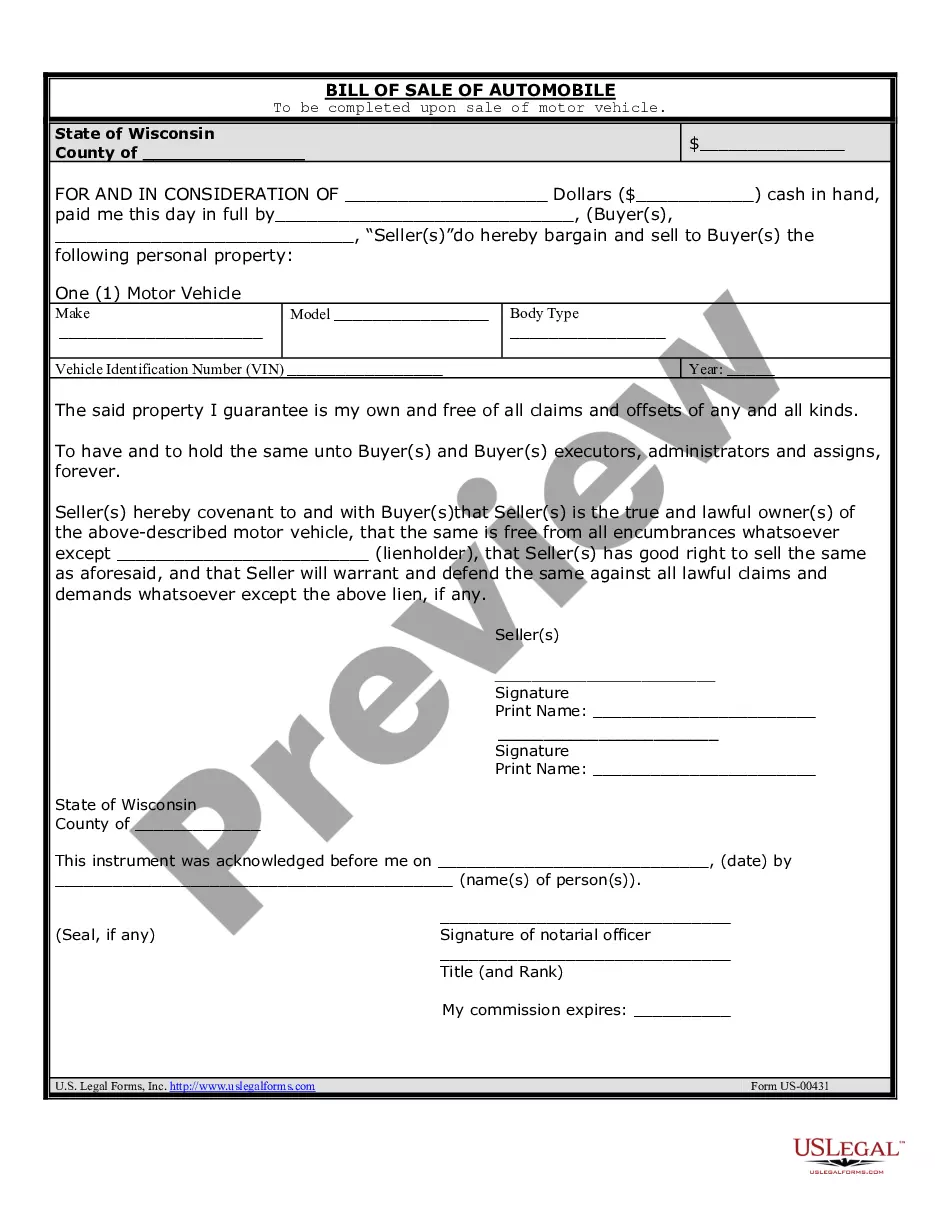

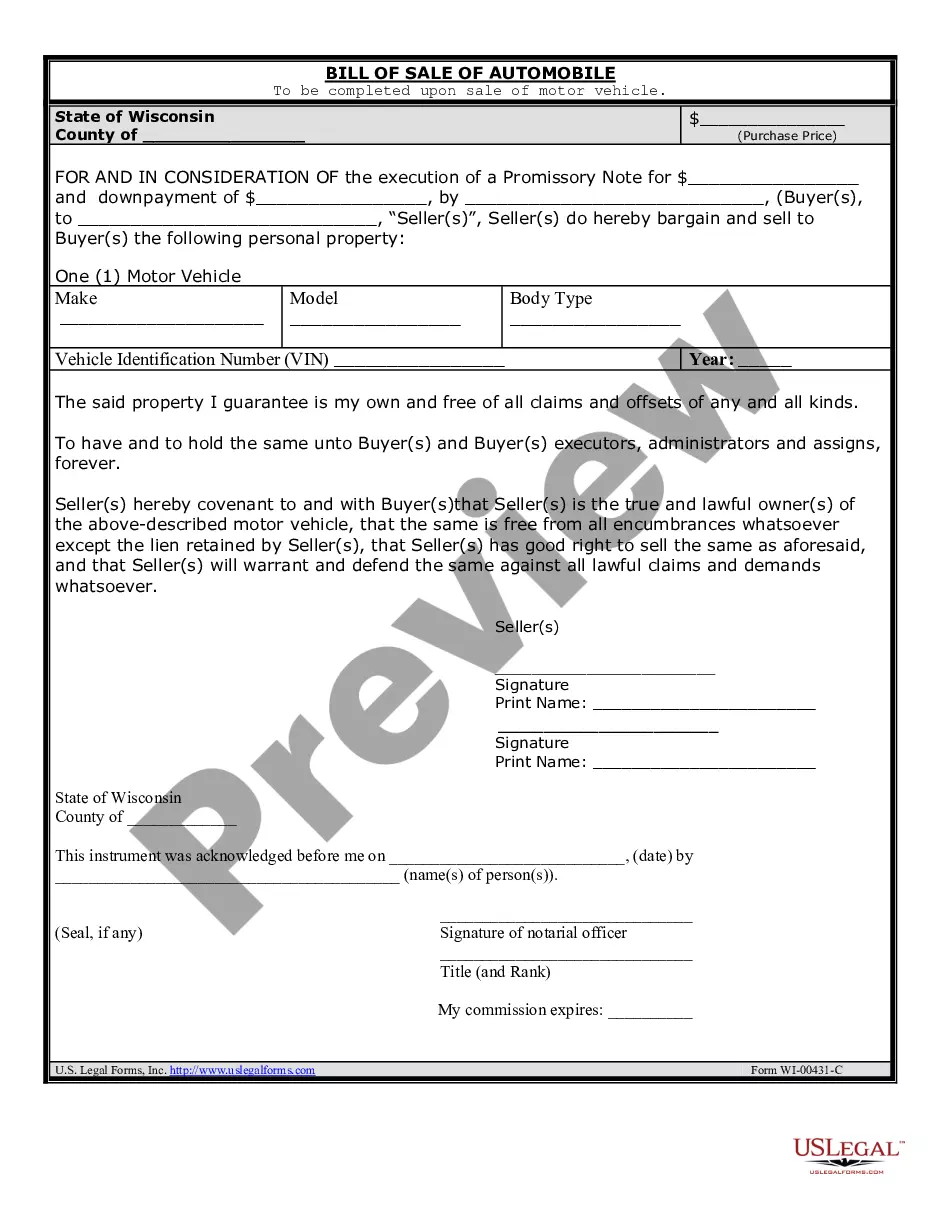

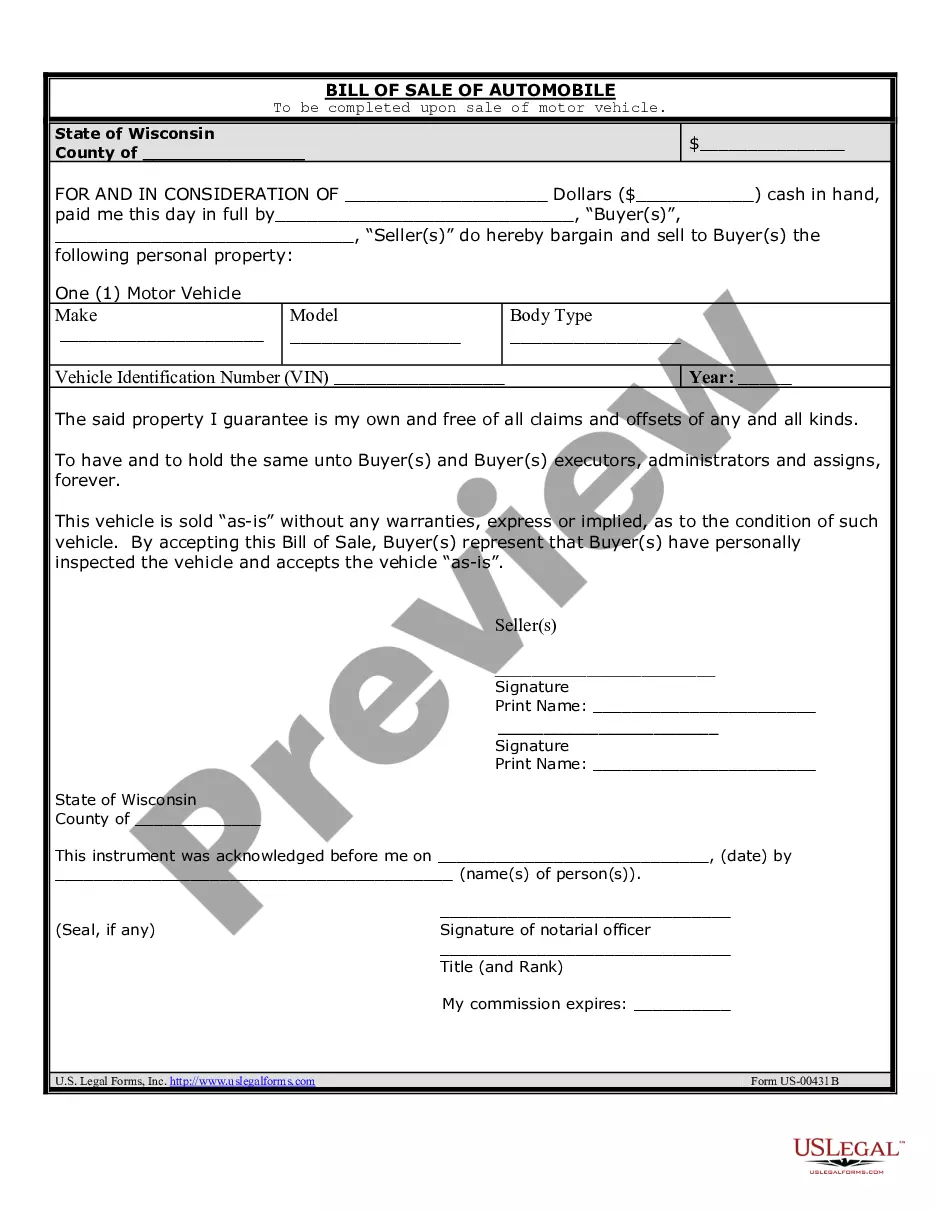

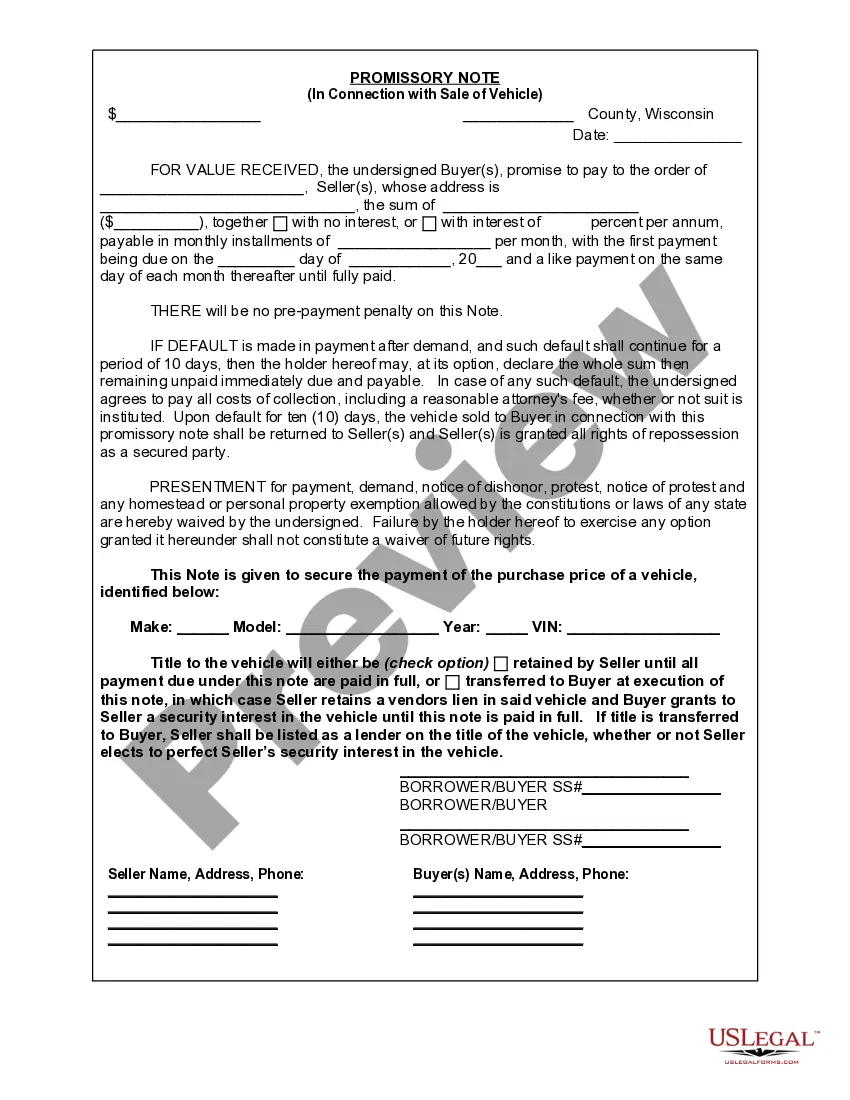

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Wisconsin Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Wisconsin Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Out of the large number of platforms that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms prior to buying them. Its comprehensive library of 85,000 templates is grouped by state and use for efficiency. All the forms available on the platform have already been drafted to meet individual state requirements by accredited legal professionals.

If you already have a US Legal Forms subscription, just log in, search for the form, click Download and gain access to your Form name from the My Forms; the My Forms tab keeps all your saved documents.

Stick to the tips listed below to obtain the form:

- Once you find a Form name, make sure it is the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Look for a new sample using the Search engine in case the one you’ve already found isn’t correct.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the template.

When you’ve downloaded your Form name, you may edit it, fill it out and sign it in an online editor of your choice. Any document you add to your My Forms tab might be reused many times, or for as long as it continues to be the most updated version in your state. Our platform provides easy and fast access to samples that fit both legal professionals as well as their clients.

Form popularity

FAQ

200b200bThe promissory note should contain: The car's VIN number, model, make and year of manufacture. The statement that the borrower promises to pay the lender a specific amount, how much each payment will be, the annual interest rate and when the loan will be completely repaid.

Date. The promissory note should include the date it was created at the top of the page. Amount. Loan terms. Interest rate. Collateral. Lender and borrower information. Signatures.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Debt Classification A promissory note is a type of written contract a lender uses for secured debts where the lender has collateral to seize in the event of default. It is more likely your car loan is a promissory note if you have a schedule of payments and a fixed interest rate spelled out on your loan document.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.

To transfer a promissory note, it must be negotiable and/or have a provision that allows and explains transfer. In addition, it must comply with state statutes governing promissory notes and assignments thereof. Create a Promissory Note Transfer Agreement.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.