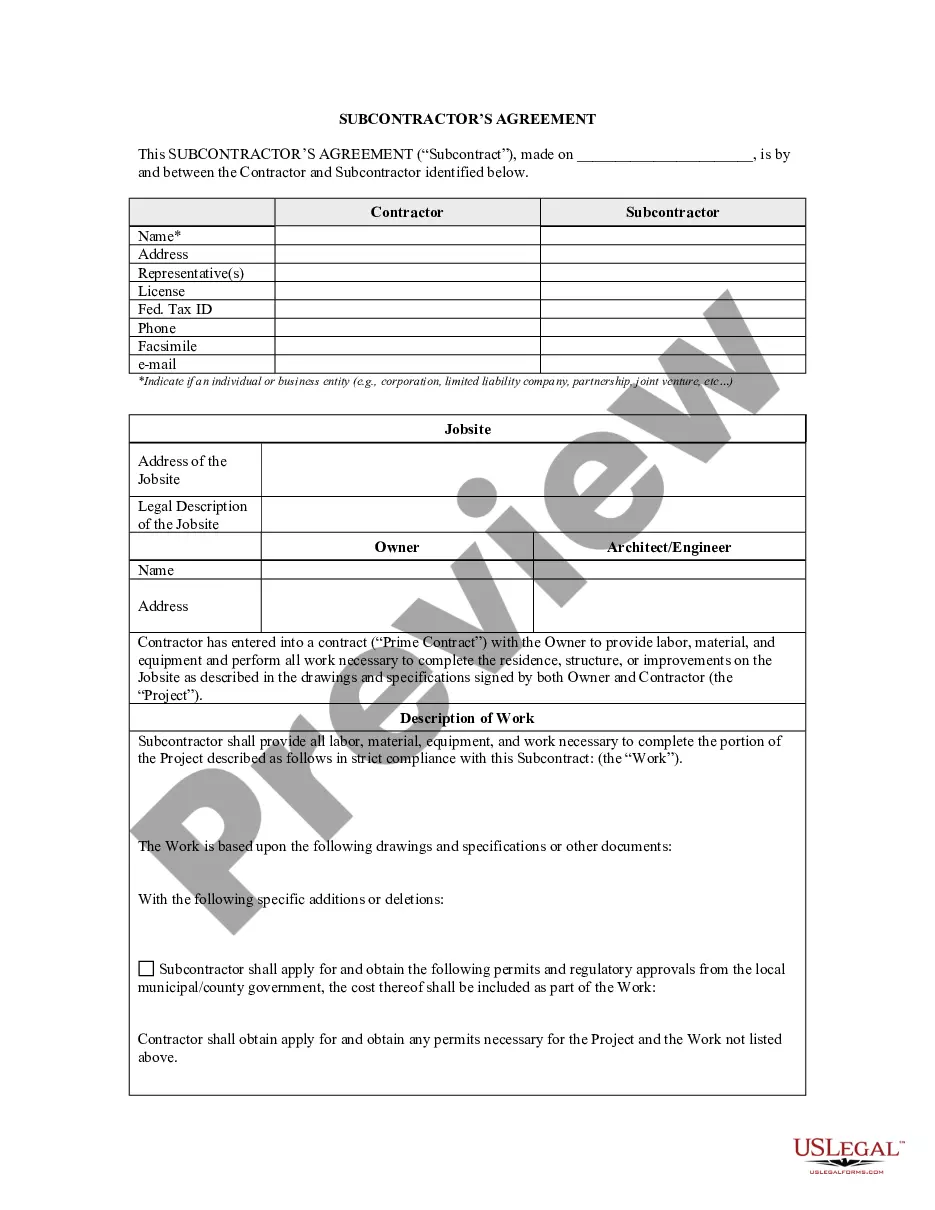

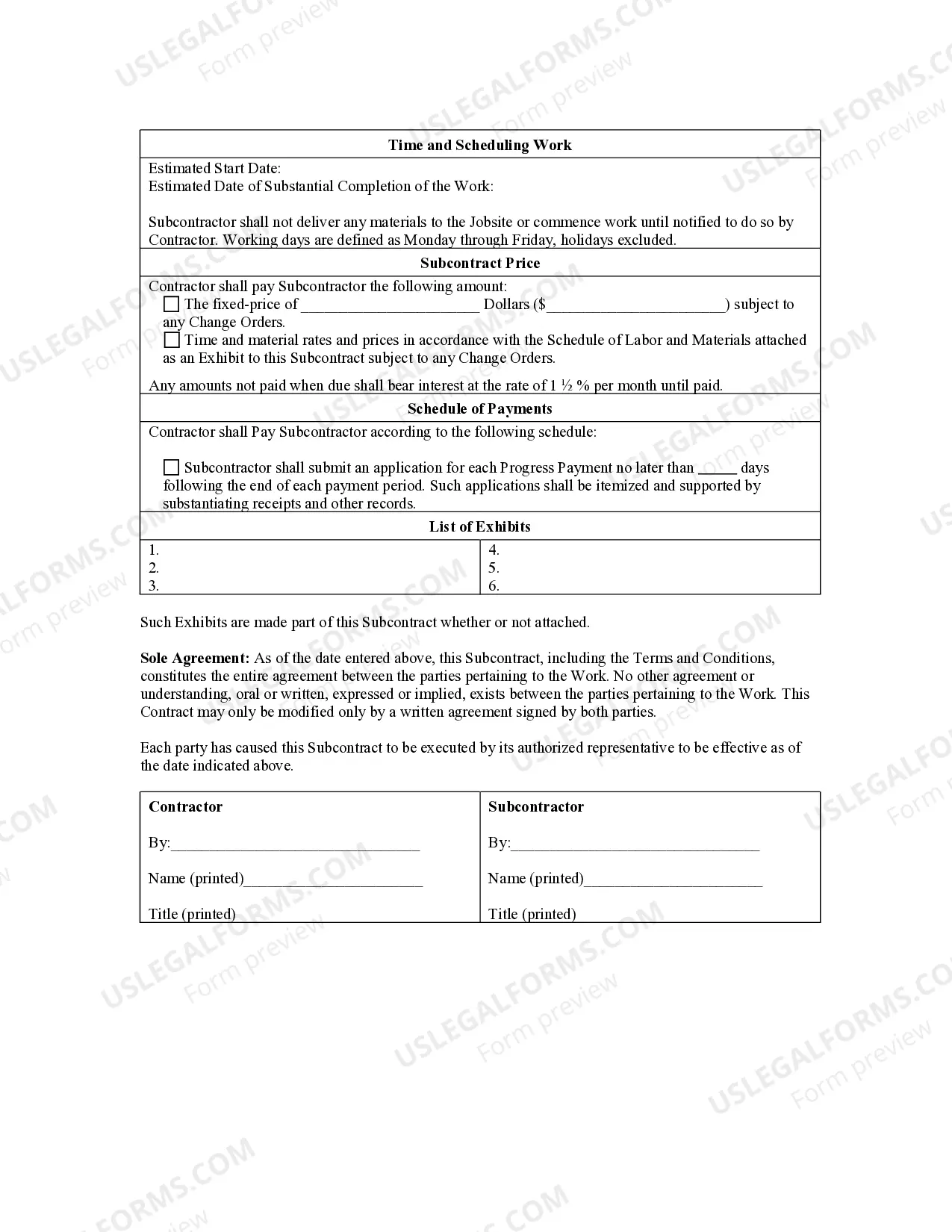

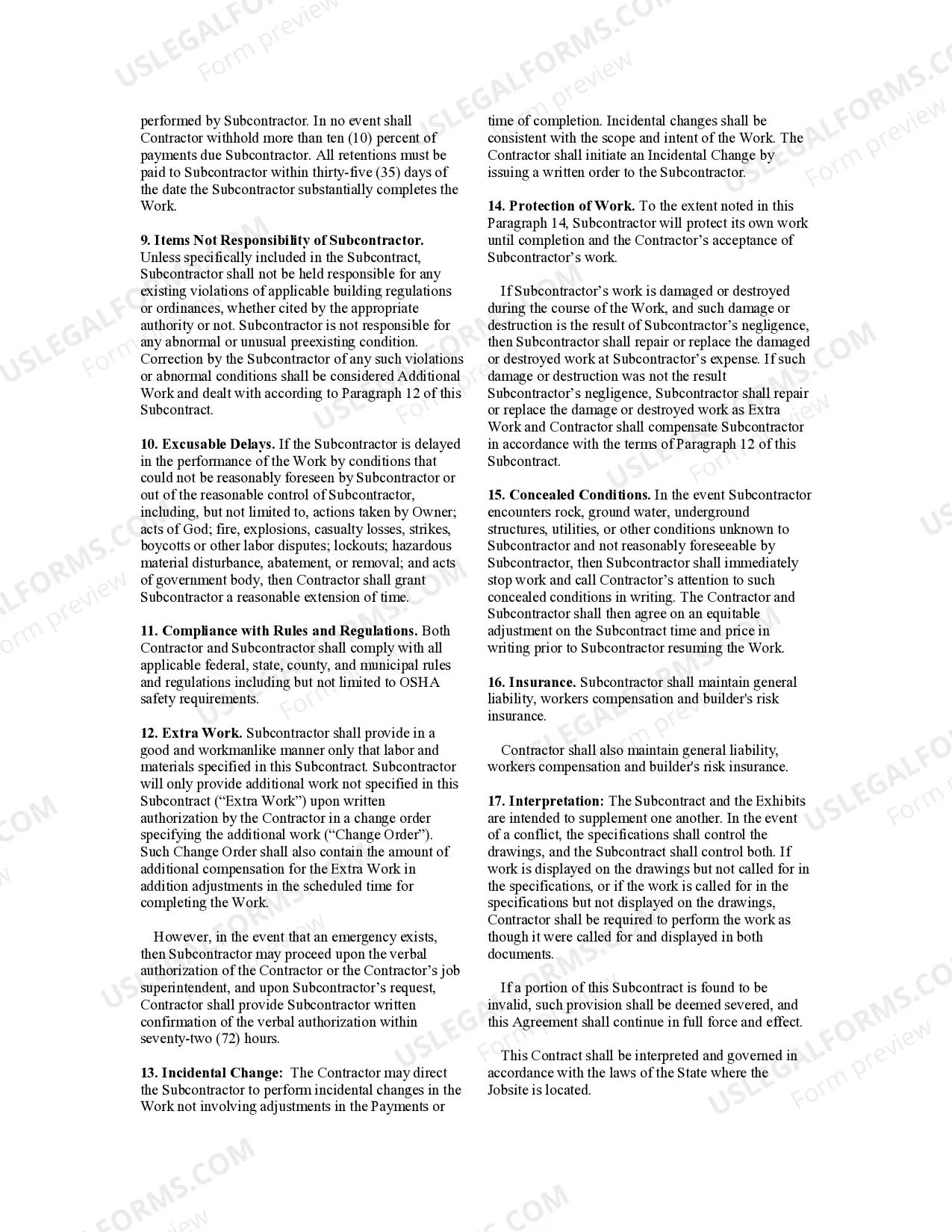

This state specific form addresses issues for subcontract work including: identifying the parties, identifying the jobsite, describing the work, scheduling the work, payment amount, payment schedule, change orders, contractor’s delay in commencing work, late payments, dispute resolution, excusable delay, concealed conditions, insurance, and contract interpretation.

Wisconsin Subcontractor's Agreement

Description

How to fill out Wisconsin Subcontractor's Agreement?

Out of the large number of services that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates before purchasing them. Its extensive library of 85,000 samples is categorized by state and use for efficiency. All the forms on the platform have been drafted to meet individual state requirements by qualified lawyers.

If you already have a US Legal Forms subscription, just log in, look for the template, hit Download and access your Form name in the My Forms; the My Forms tab keeps all of your downloaded documents.

Follow the guidelines listed below to obtain the form:

- Once you see a Form name, ensure it is the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Search for a new sample through the Search engine if the one you have already found isn’t proper.

- Click Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

Once you have downloaded your Form name, you can edit it, fill it out and sign it with an web-based editor that you pick. Any document you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most updated version in your state. Our platform provides quick and easy access to samples that suit both lawyers as well as their customers.

Form popularity

FAQ

Subcontracting is the practice of assigning, or outsourcing, part of the obligations and tasks under a contract to another party known as a subcontractor. Subcontracting is especially prevalent in areas where complex projects are the norm, such as construction and information technology.

Scope of the Project. Timing for Completion: Duration of Work Clause. Payment and Billing Clause. Independent Contractor Notice. Non-Disclosure Agreement. Non-Complete Clause. Work for Hire Inclusion. Responsibilities for Insurance for Accidental Damages.

A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

Subcontractor agreements outline the responsibilities of each party, to ensure that if a claim were to arise, the responsible party is accountable. A subcontractor agreement provides protection to the company that hired the vendor or subcontractor by transferring the risk back to the party performing the work.

A subcontractor has a contract with the contractor for the services provided - an employee of the contractor cannot also be a subcontractor.

A subcontractor agreement is a contract between contractors or project managers and subcontractors. This solidifies any agreement between the two parties and assures work. Subcontractors should read the subcontractor agreement and assure specifics to protect themselves from unfair risk.

Start with procurement standards. Execute all subcontracts prior to starting your projects. Help those who help you. Award the job to the lowest fully qualified bidder. Use contract scope checklists. Make sure you have tight clauses. Meet to review the proposed subcontract.

Each subcontractor should complete Form W-9 before they begin any work. On the form, the subcontractor identifies their business structure type (sole proprietorship, corporation, etc.). Form W-9 also asks for the subcontractor's name and Taxpayer Identification Number (TIN).