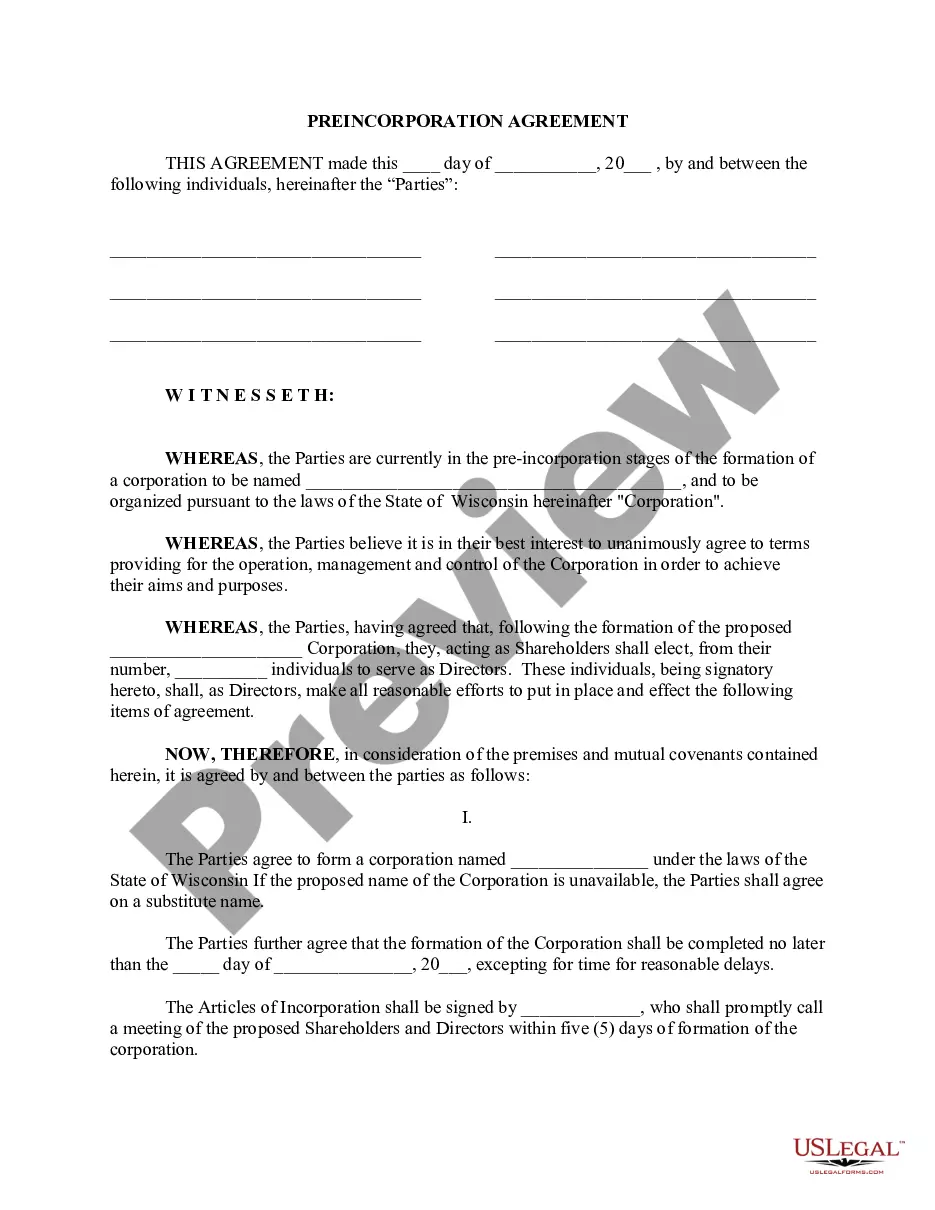

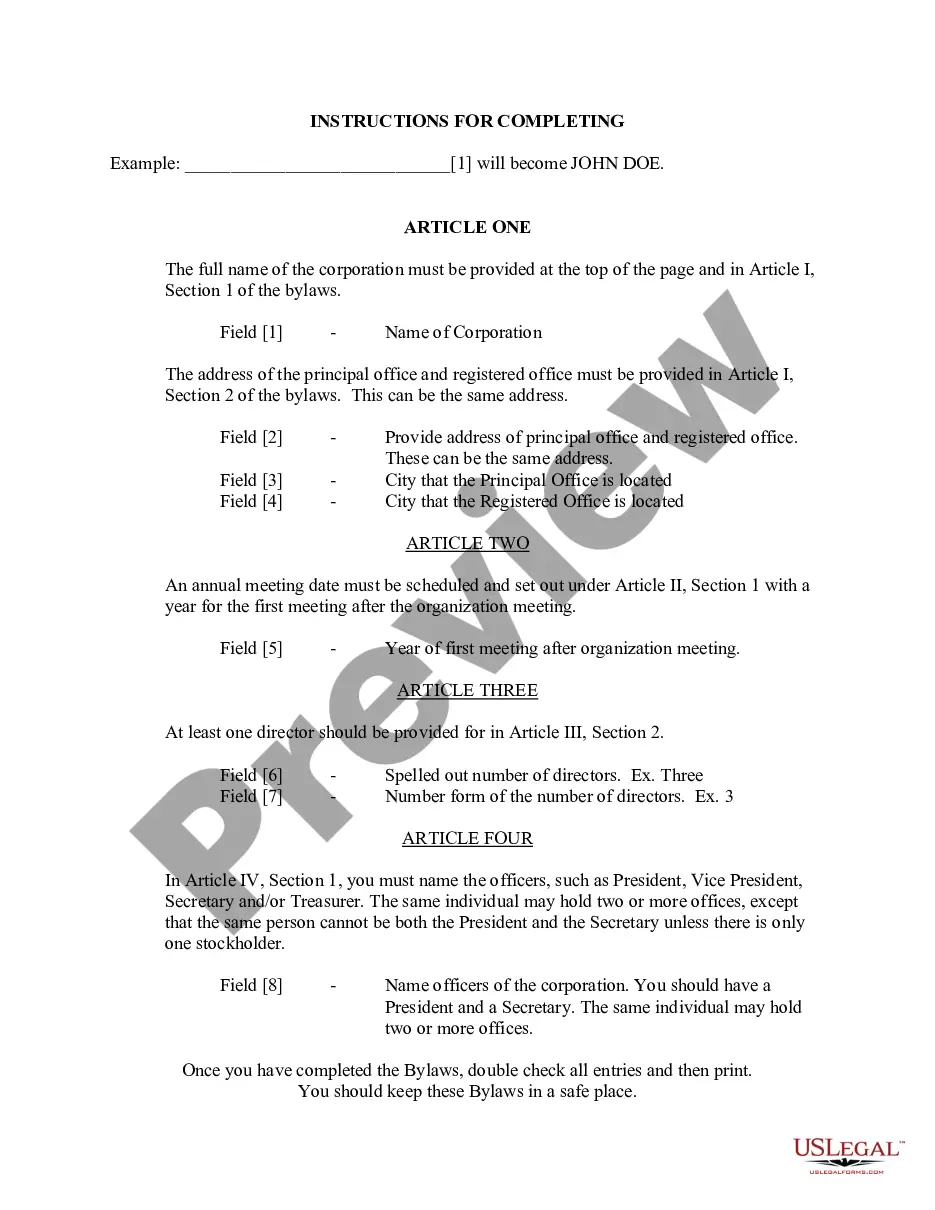

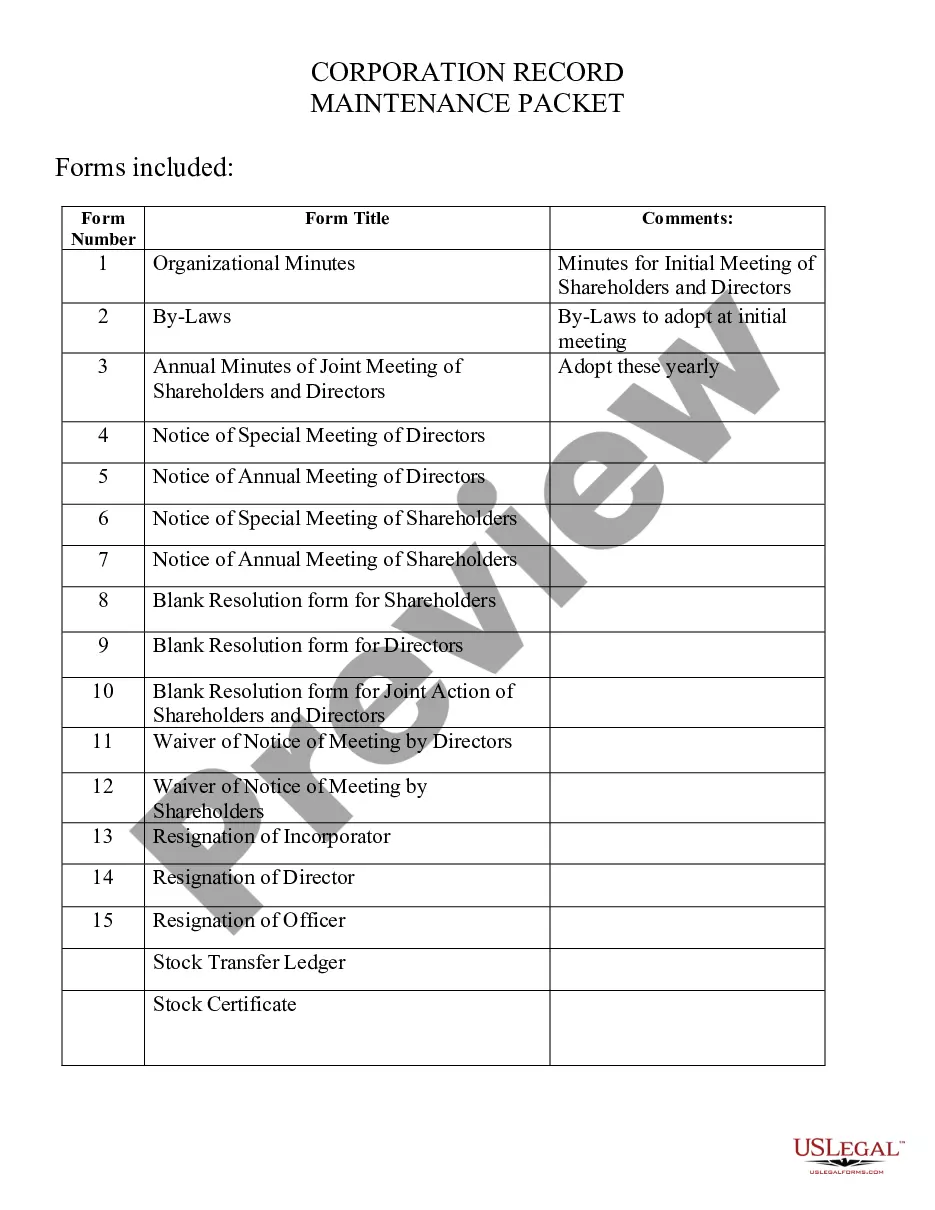

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Wisconsin Business Incorporation Package to Incorporate Corporation

Description

How to fill out Wisconsin Business Incorporation Package To Incorporate Corporation?

Out of the large number of platforms that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey while previewing templates prior to buying them. Its extensive library of 85,000 samples is grouped by state and use for simplicity. All the forms on the platform have already been drafted to meet individual state requirements by accredited legal professionals.

If you have a US Legal Forms subscription, just log in, look for the template, hit Download and gain access to your Form name in the My Forms; the My Forms tab keeps your saved forms.

Follow the tips listed below to get the document:

- Once you discover a Form name, make certain it’s the one for the state you really need it to file in.

- Preview the form and read the document description before downloading the sample.

- Look for a new template through the Search field in case the one you have already found is not appropriate.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

After you have downloaded your Form name, it is possible to edit it, fill it out and sign it with an online editor of your choice. Any form you add to your My Forms tab can be reused multiple times, or for as long as it continues to be the most up-to-date version in your state. Our service provides easy and fast access to templates that fit both lawyers and their clients.

Form popularity

FAQ

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

STEP 1: Name your Wisconsin LLC. STEP 2: Choose a Registered Agent in Wisconsin. STEP 3: File the Wisconsin LLC Articles of Organization. STEP 4: Create a Wisconsin LLC Operating Agreement. STEP 5: Get a Wisconsin LLC EIN.

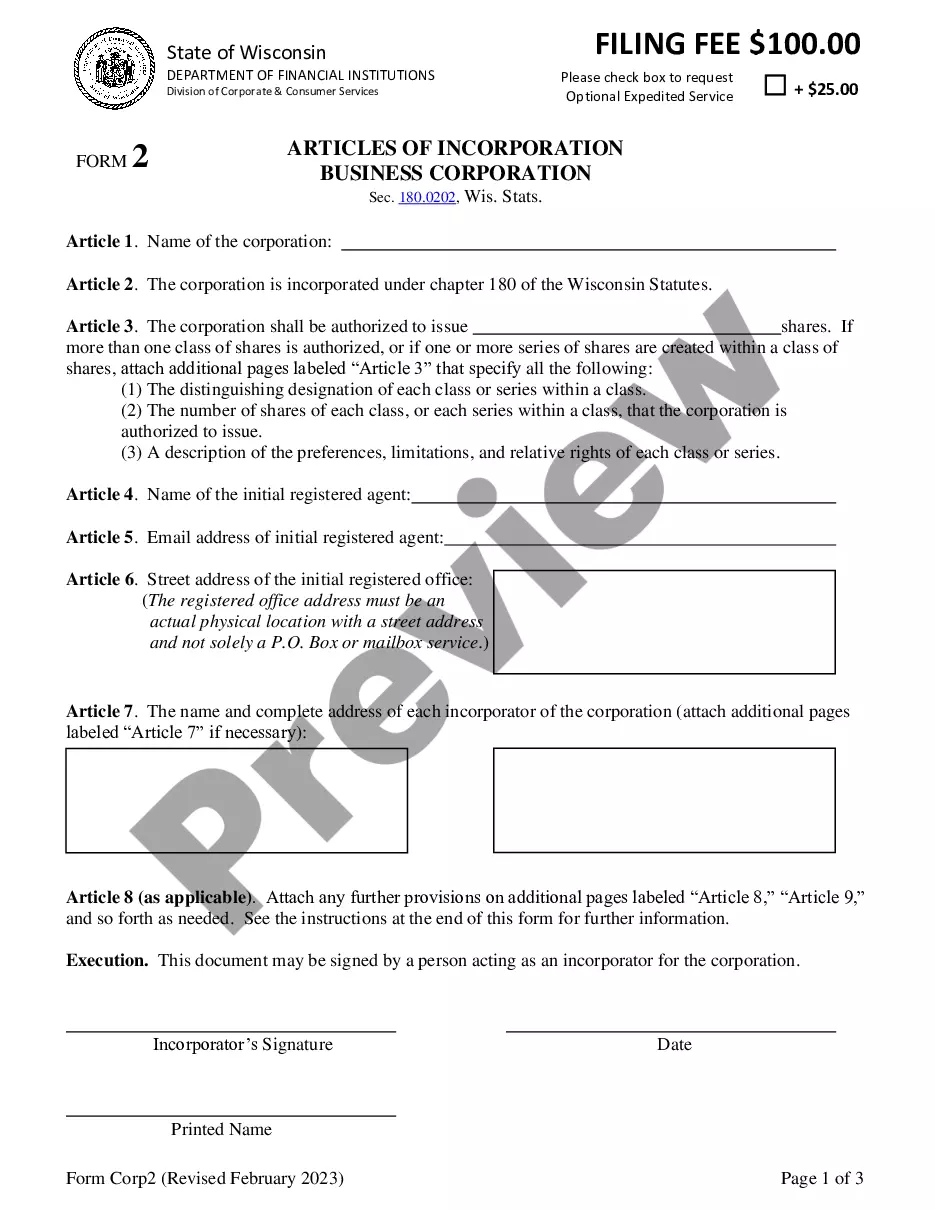

To form a corporation, you must file articles of incorporation with the Wisconsin Department of Financial Institutions and pay a filing fee. The corporation's existence begins on the date you file the articles.

How much does it cost to form an LLC in Wisconsin? The Wisconsin Department of Financial Institutions charges a $170 fee to file the Articles of Organization by mail and $130 to file online.

Because distributions are taxed at both the corporate and the shareholder level, C corporations and their shareholders often end up paying more in taxes than S corporations or LLCs.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).

In an LLC, individuals with an ownership share are called members. In a corporation, they are called shareholders. One of the advantages an LLC has over a corporation is that in many states, a creditor cannot collect a member's dividends, whereas in a corporation dividends can be collected from shareholders.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

LLC as an S Corporation: LLCs set up as S corporations file a Form 1120S but don't pay any corporate taxes on the income. Instead, the shareholders of the LLC report their share of income on their personal tax returns. This avoids double taxation.