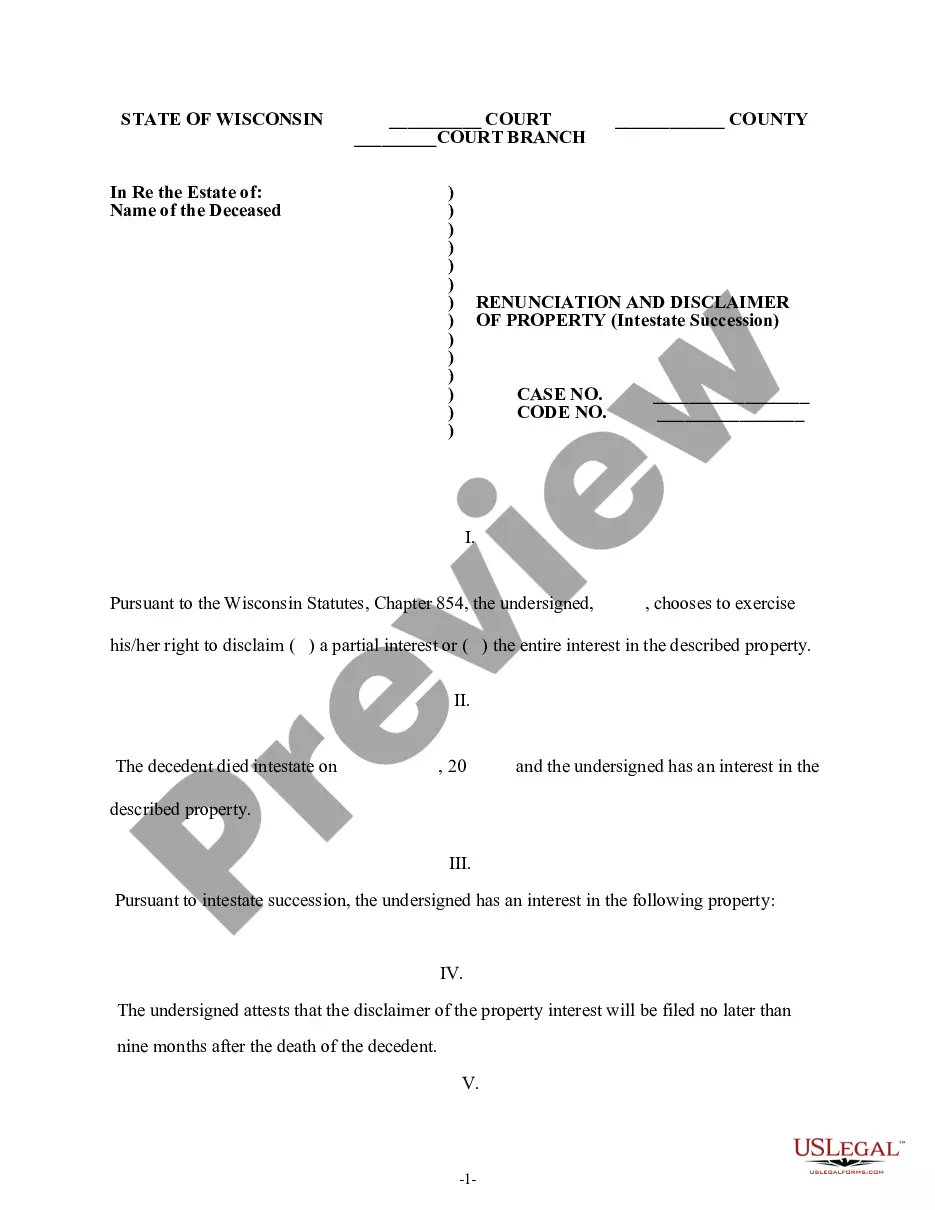

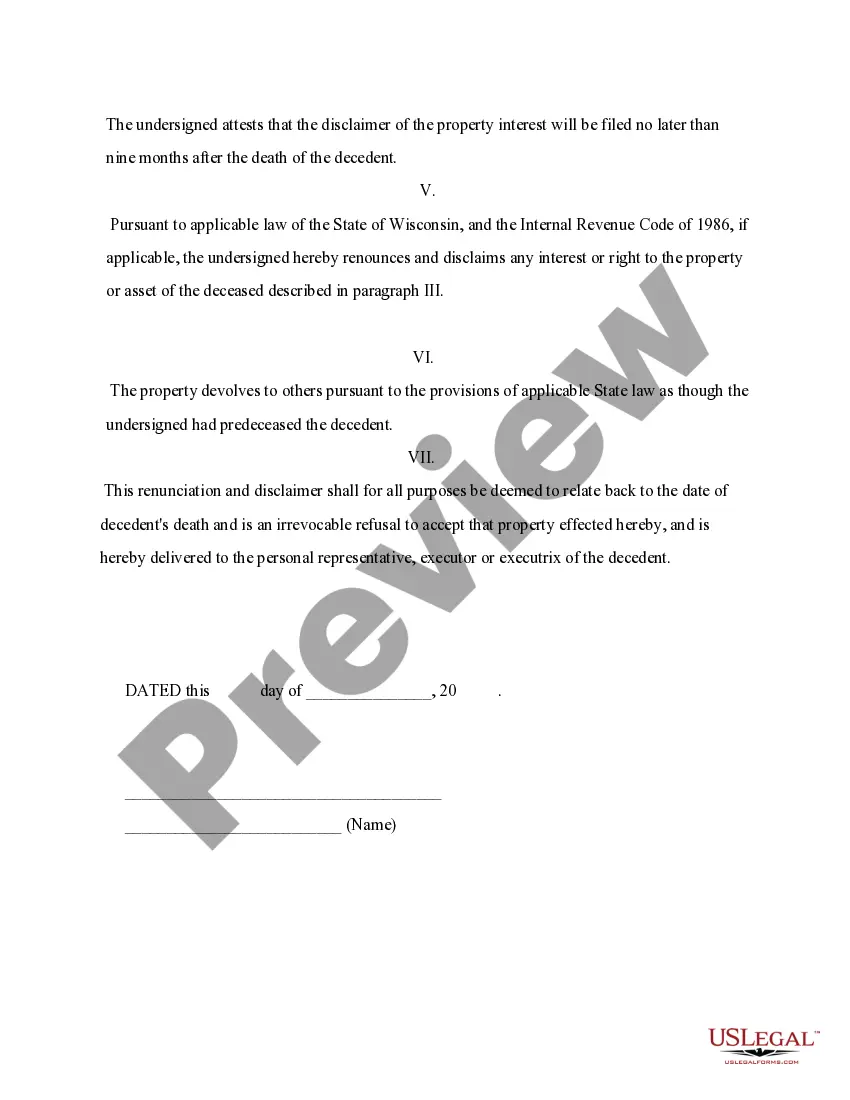

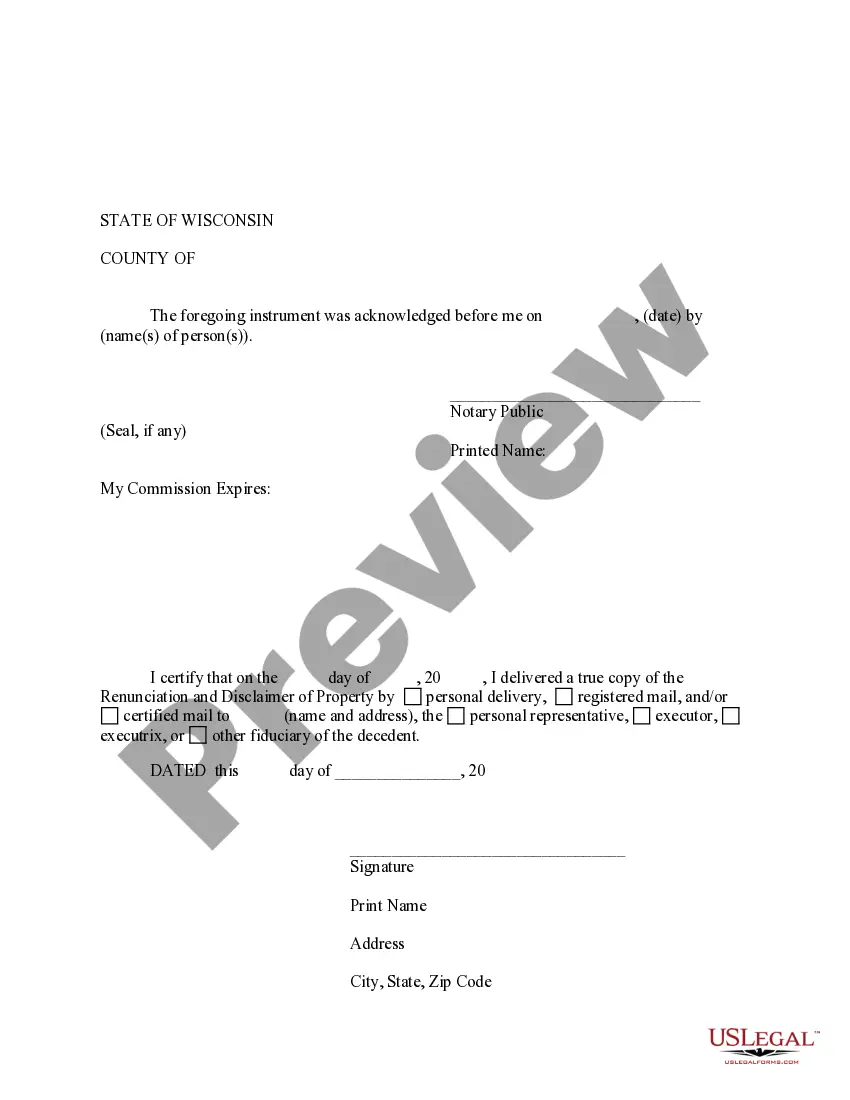

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through Intestate Succession, where the beneficiary gained an interest in the property upon the death of the decedent, but, has chosen to disclaim a portion of or the entire interest in the property pursuant to the Wisconsin Statutes, Chapter 854. The property will now pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment a certificate to verify the delivery of the documentation.

Wisconsin Renunciation And Disclaimer of Property received by Intestate Succession

Description Disclaimer Property Fillable

How to fill out Property Succession Agreement?

Out of the large number of platforms that provide legal templates, US Legal Forms provides the most user-friendly experience and customer journey when previewing forms prior to buying them. Its complete library of 85,000 templates is categorized by state and use for simplicity. All the forms available on the platform have been drafted to meet individual state requirements by licensed lawyers.

If you have a US Legal Forms subscription, just log in, search for the template, hit Download and access your Form name from the My Forms; the My Forms tab holds all of your downloaded forms.

Stick to the guidelines listed below to get the form:

- Once you find a Form name, make sure it’s the one for the state you need it to file in.

- Preview the template and read the document description before downloading the template.

- Look for a new sample using the Search field in case the one you’ve already found is not correct.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the document.

When you’ve downloaded your Form name, you can edit it, fill it out and sign it with an online editor that you pick. Any form you add to your My Forms tab can be reused many times, or for as long as it continues to be the most up-to-date version in your state. Our platform offers quick and easy access to templates that fit both legal professionals as well as their clients.

Renunciation Received Form Form popularity

Disclaimer Property Contract Other Form Names

Disclaimer Form Purchase FAQ

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

Next of kin meaning In the event of someone's death, next of kin may also be used to describe the person or people who stand to inherit the most. This is usually the spouse or civil partner, but it could also be their children or parents in certain circumstances.

Dying Without a Will in Wisconsin If there isn't a will, the court will appoint someone, usually a relative, financial institution, or trust company to fill the role of executor or personal representative.

The term usually means your nearest blood relative. In the case of a married couple or a civil partnership it usually means their husband or wife. Next of kin is a title that can be given, by you, to anyone from your partner to blood relatives and even friends.

Your mother's next of kin is her eldest child. The term "next of kin" is most commonly used following a death. Legally, it refers to those individuals eligible to inherit from a person who dies without a will. Surviving spouses are at the top of the list, followed by those related by blood.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

In Wisconsin, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).