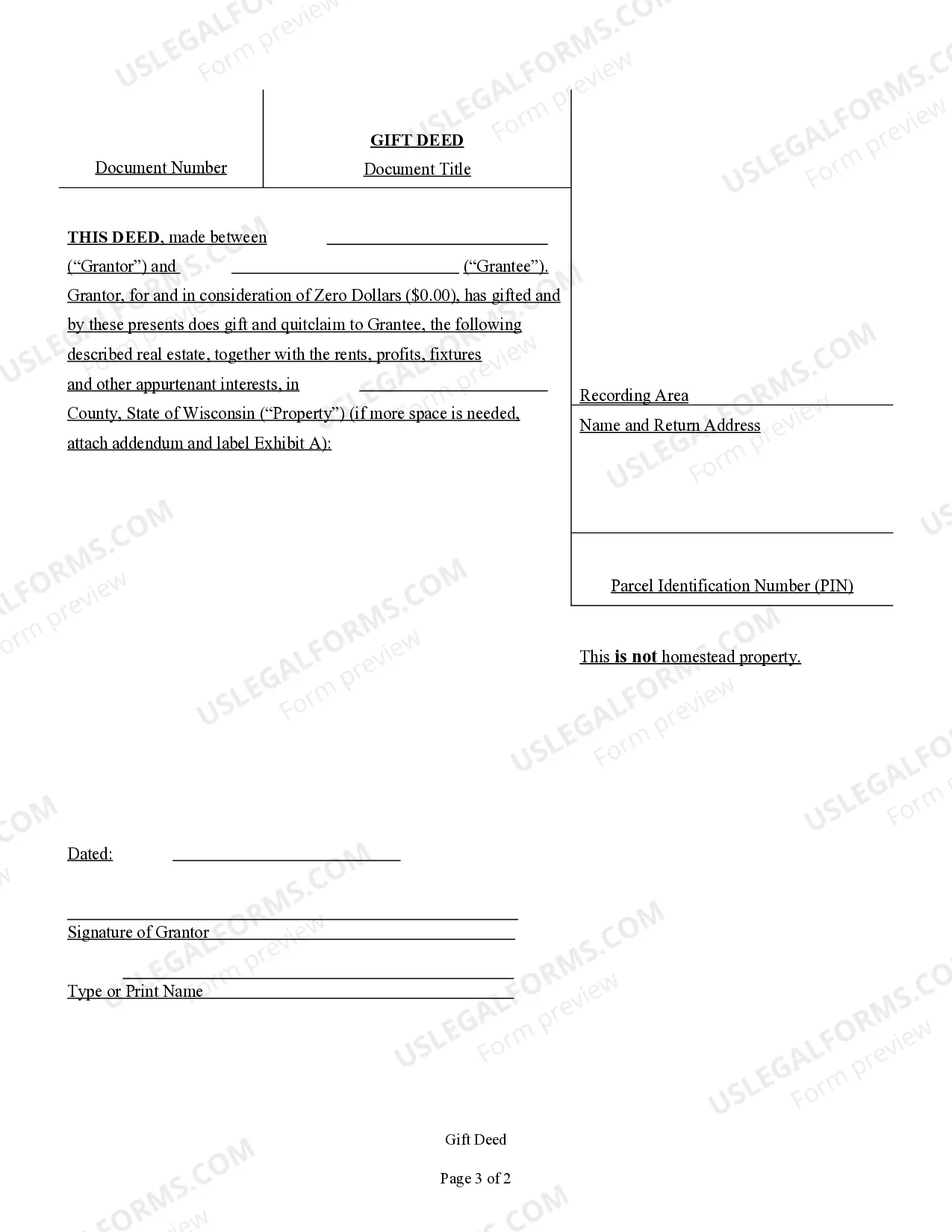

This form is a Gift Deed where the Grantor is an individual and the Grantee is an Individual. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Wisconsin Gift Deed - Individual to Individual

Description

How to fill out Wisconsin Gift Deed - Individual To Individual?

Out of the large number of services that provide legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms before purchasing them. Its comprehensive catalogue of 85,000 samples is grouped by state and use for efficiency. All the forms available on the service have already been drafted to meet individual state requirements by accredited legal professionals.

If you already have a US Legal Forms subscription, just log in, search for the form, click Download and access your Form name from the My Forms; the My Forms tab keeps your saved forms.

Keep to the guidelines below to obtain the document:

- Once you see a Form name, make certain it is the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Look for a new sample using the Search engine in case the one you have already found isn’t correct.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

Once you’ve downloaded your Form name, it is possible to edit it, fill it out and sign it with an web-based editor that you pick. Any document you add to your My Forms tab can be reused multiple times, or for as long as it remains the most up-to-date version in your state. Our platform provides fast and easy access to templates that fit both legal professionals and their clients.

Form popularity

FAQ

Think about IHT implications potentially exempt transfer Be aware of the rules on gifts with reservation of benefit You will no longer be the legal owner of the property. Risk from outside parties. Don't forget capital gains tax.

Outright gift First, offset the amount of the gift by using your $15,000 annual gift-tax exclusion. Remember it is $15,000 per donor per donee (gift recipient). So if you and your spouse make a joint gift to both your child and his spouse, you can offset $60,000 of the home's value (4 x $15,000) for gift tax purposes.

You may be able to transfer your interest in the property through a quitclaim deed, where you relinquish all ownership of the property to someone else. Your lender may also agree to add another name to the mortgage. In this case, someone else would be able to legally make payments on the mortgage.

To sign over property ownership to another person, you'll use one of two deeds: a quitclaim deed or a warranty deed.

To transfer a property as a gift, you need to fill in a TR1 form and send it to the Land Registry, along with an AP1 form. If either side is not using a Solicitor or Conveyancer, an ID1 form will also be needed.

The Takeaway. California doesn't enforce a gift tax, but you may owe a federal one. However, you can give up to $15,000 in cash or property during the 2019 and 2020 tax years without triggering a gift tax return.

Put your full name, as shown on your original deed, and your current address. Fill in the grantee section of the deed. The grantee is the recipient, so enter your full name and the name of your spouse, followed by your addresses. Put "as husband and wife" after your names.

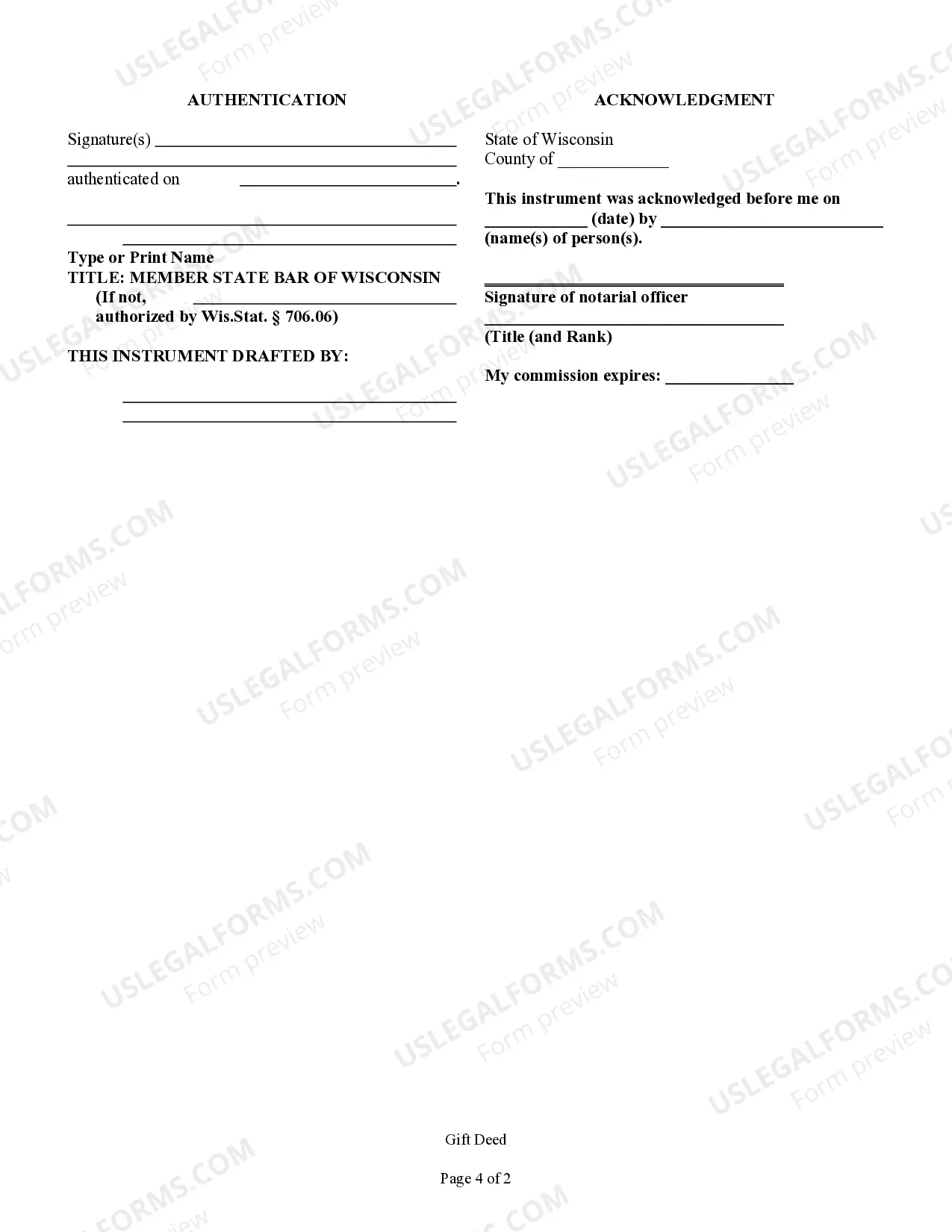

Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

Living in the House Moving into the house is one way to avoid capital gains. Tax law exempts $250,000 on the sale of your personal home, or $500,000 if you're married and file jointly. You must own the house for two of the five years before you sell and live in it for two of the five years.