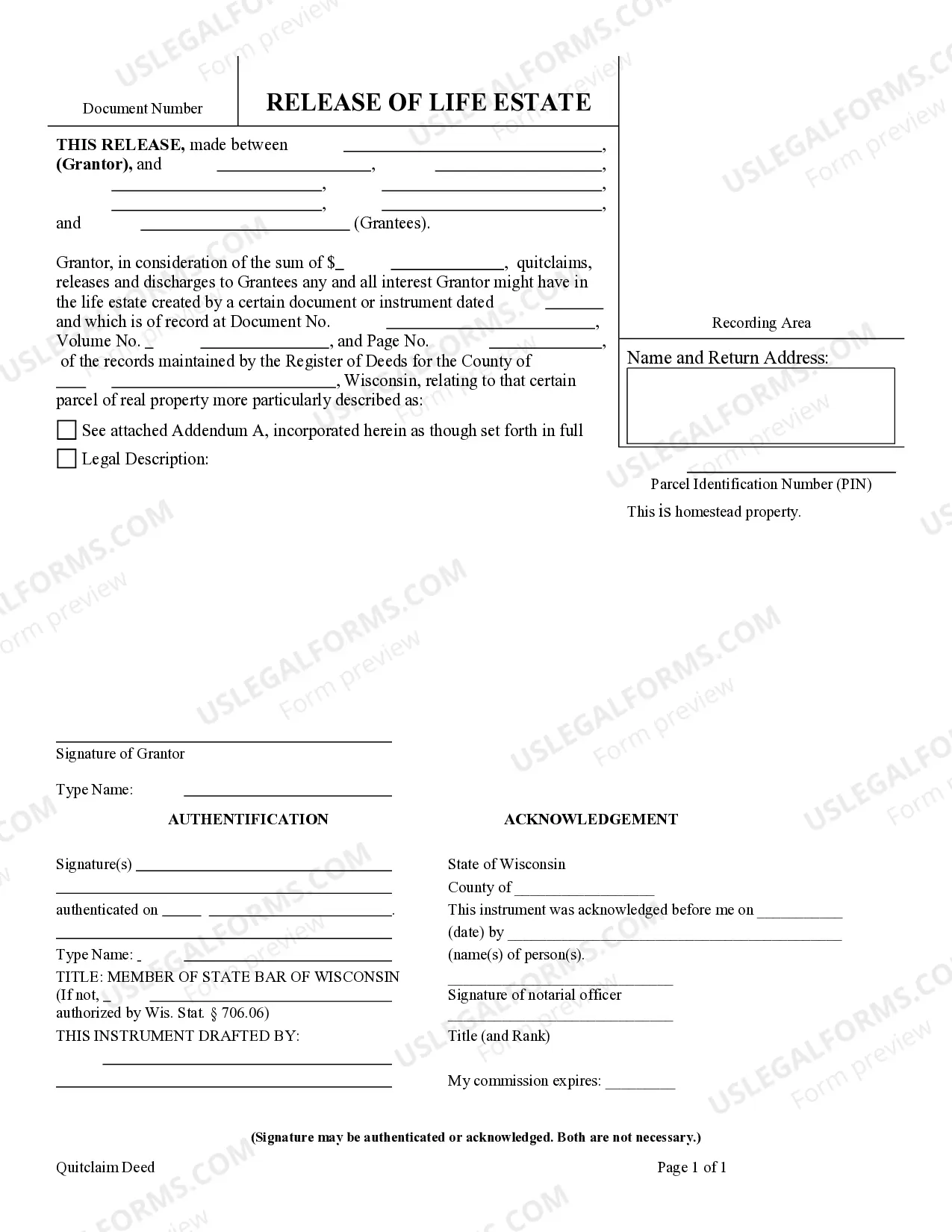

This form is a Release Deed releasing a life estate where the Grantor is an individual and and the Grantees are nine individuals. Grantor conveys and releases the described property interest to Grantees. This deed complies with all state statutory laws.

Wisconsin Release Deed - Life Estate - Individual to Nine Individuals

Description Deed Life Estate Form

How to fill out Deed Life Estate Form Sample?

Out of the great number of services that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates prior to buying them. Its comprehensive library of 85,000 samples is grouped by state and use for efficiency. All the documents on the platform have been drafted to meet individual state requirements by certified legal professionals.

If you have a US Legal Forms subscription, just log in, search for the template, click Download and obtain access to your Form name in the My Forms; the My Forms tab keeps all of your saved documents.

Keep to the tips below to get the form:

- Once you see a Form name, make certain it’s the one for the state you need it to file in.

- Preview the form and read the document description before downloading the template.

- Look for a new template using the Search engine in case the one you’ve already found is not correct.

- Click on Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

Once you’ve downloaded your Form name, you are able to edit it, fill it out and sign it with an web-based editor of your choice. Any document you add to your My Forms tab might be reused multiple times, or for as long as it continues to be the most updated version in your state. Our platform provides easy and fast access to templates that suit both legal professionals and their clients.

Deed Life Estate Sample Form popularity

Deed Life Estate Wisconsin Other Form Names

Life Estate Form Wisconsin FAQ

Pursuant to ' 2036(a) of the IRC, the transfer of a residence with a retained life estate permits the transferee of the residence to receive a full step up in his or her cost basis in the premises upon the death of the transferor, to its fair market value on the transferor's date of death.

With a life estate deed, both the Grantor and the Grantee own an interest in the property as soon as the deed is signed.However, a life estate deed is irrevocablethis means that if you convey your property to your children and reserve a life estate to yourself, you can't change your mind and take it back.

A life estate is a form of joint ownership that allows one person to remain in a house until his or her death, when it passes to the other owner. Life estates can be used to avoid probate and to give a house to children without giving up the ability to live in it.

To dissolve a life estate, the life tenant can give their ownership interest to the remainderman. So, if a mother has a life estate and her son has the remainder, she can convey her interest to him, and he will then own the entire interest in the property.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.

To determine the value of the resource the client disposed of, use this chart. Find the client's age in the Age column and then go to the column called Life Estate. Take the percentage listed here and multiply it by the TOTAL value of the real property. This will give you the value of the client's life estate interest.

What happens to a life estate after someone dies? Upon the life tenant's death, the property passes to the remainder owner outside of probate.They can sell the property or move into and claim it as their primary residence (homestead). Property taxes will not be reassessed.

A life estate is a form of joint ownership that gives a person (the life tenant) ownership rights in property during their lifetime. But when the life tenant dies, the remainder interest in the property goes to the beneficiary, also known as the remainderman.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.