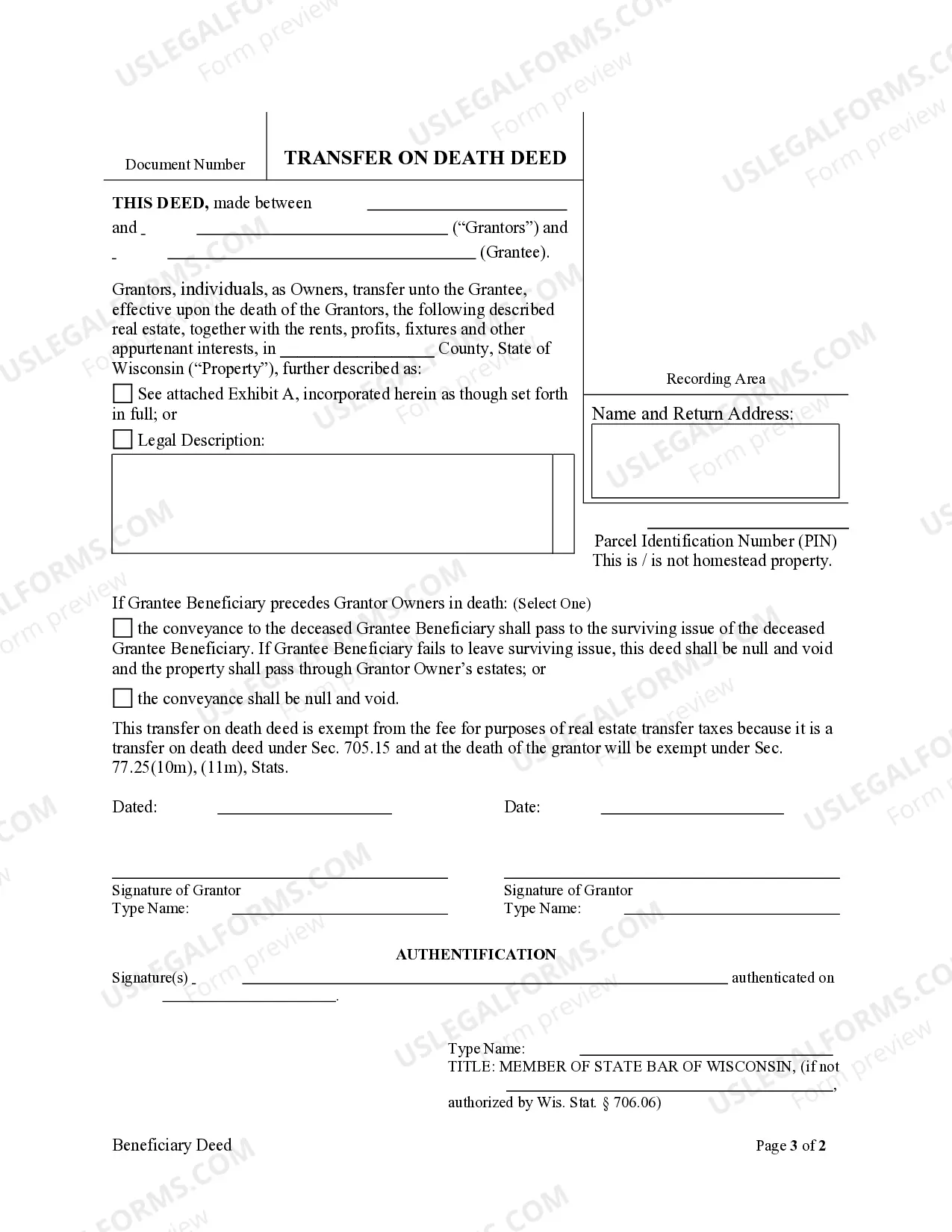

Wisconsin Transfer on Death Deed or TOD - Beneficiary Deed from Two Individuals to an Individual

Understanding this form

The Transfer on Death Deed, also known as a TOD or Beneficiary Deed, allows property owners to transfer real estate to a designated beneficiary upon their death. This specific form is designed for two grantors transferring property to a single grantee beneficiary. The most significant feature of this deed is its revocability; grantors can change their minds about the transfer at any time prior to their deaths. This deed is compliant with state laws and must be recorded before the grantors pass away to be effective.

Key parts of this document

- Information regarding the grantors (the individuals transferring the property).

- Details about the grantee beneficiary (the individual receiving the property).

- Description of the property being transferred, including its legal description.

- Revocation clause allowing grantors to cancel the deed prior to death.

- Instructions on the recording of the deed to ensure its validity.

Situations where this form applies

This Transfer on Death Deed should be used when two individuals who own property wish to designate another individual to inherit that property upon their deaths. It is an effective estate planning tool for those wanting to avoid probate while retaining control of the property during their lifetime. This form is particularly beneficial for couples seeking to ensure their assets transfer smoothly to their chosen beneficiary without legal complications after their death.

Intended users of this form

- Couples who jointly own real estate and want a specific single beneficiary to inherit it.

- Individuals looking for a simple way to pass on property without going through probate.

- Those who may want to retain control over the property during their lifetime while ensuring it's transferred according to their wishes upon death.

Steps to complete this form

- Identify the grantors by entering their full names.

- Specify the grantee beneficiary's full name and relationship to the grantors.

- Enter a complete legal description of the property being transferred.

- Review the revocation clause and ensure it aligns with the grantors' intentions.

- Both grantors need to sign and date the form, then arrange for the deed to be recorded with the appropriate county office.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Mistakes to watch out for

- Failing to record the deed before the death of the grantors.

- Not providing a complete and accurate legal description of the property.

- Neglecting to verify that all grantors have signed the deed.

- Overlooking changes to the beneficiary designation if circumstances change.

Why complete this form online

- Easy access and convenience of downloading the form from anywhere at any time.

- Ability to complete the form digitally, ensuring legibility and accuracy.

- Peace of mind knowing the form has been created based on current legal requirements.

Legal use & context

- The Transfer on Death Deed is a legally recognized document in Wisconsin for transferring property upon death.

- It allows grantors to maintain control of their property until their death, making it a flexible estate planning tool.

- Failure to record the deed or adhere to state-specific regulations may render the deed ineffective.

Quick recap

- The Transfer on Death Deed allows for property transfer upon death without going through probate.

- This deed is revocable during the grantors' lifetimes, providing flexibility.

- Proper completion and recording of the deed are essential for its legality and effectiveness.

Form popularity

FAQ

Wisconsin's Transfer on Death Deed. Wisconsin's Transfer on Death Deed (TOD Deed) allows for the non-probate transfer of real property upon death. This seemingly simple law, Wisconsin Statute 705.15, can be used as a powerful estate planning tool, in the right circumstances.

The amount that's in a TOD account at the time of your death is not taxable under federal law to the person who receives the account, although it may be taxable to your estate. If your beneficiary or the account are in a state with an inheritance tax, he may have to pay that.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

An account holder may choose to list both of their children as equal beneficiaries. However, an account holder can also choose to list individuals in unequal amounts. For example, you could designate a primary beneficiary to receive 50 percent of the funds and two secondary beneficiaries who receive 25 percent each.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

TOD account holders can name multiple beneficiaries and divide assets any way they like.However, the beneficiaries have no access or rights to a TOD account while its owner is alive. Those beneficiaries can also be changed at any time, so long as the TOD account holder is deemed mentally competent.