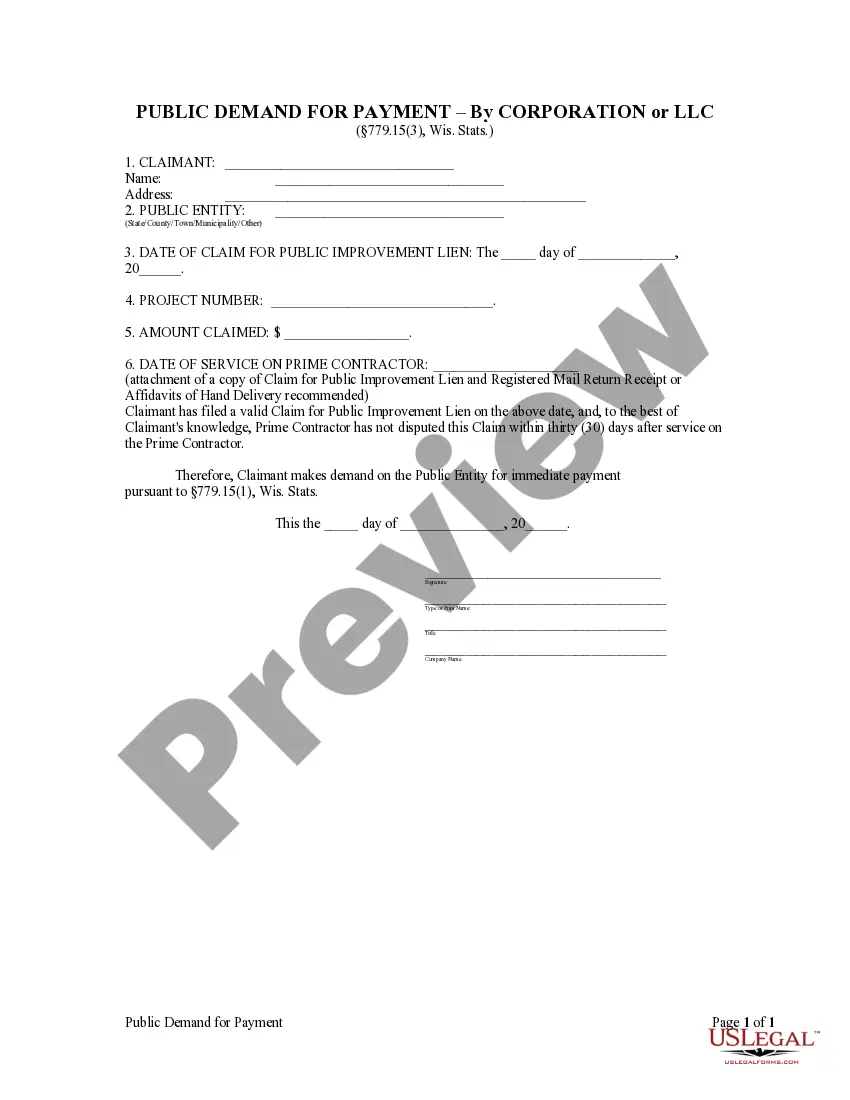

This Public Demand for Payment - Corporation is a form notice attached to a construction project. Every prime contractor who enters into a contract with the owner for a work of improvement on the owner's land and who has contracted or will contract with any subcontractors or materialmen to provide labor or materials for the work of improvement shall include in any written contract with the owner the notice required by this paragraph, and shall provide the owner with a copy of the written contract. If no written contract for the work of improvement is entered into, the notice shall be prepared separately and served personally or by registered mail on the owner or authorized agent within 10 days after the first labor or materials are furnished for the improvement by or pursuant to the authority of the prime contractor.

Wisconsin Public Demand for Payment by Corporation

Description

How to fill out Wisconsin Public Demand For Payment By Corporation?

Out of the multitude of platforms that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms before purchasing them. Its comprehensive catalogue of 85,000 samples is categorized by state and use for efficiency. All of the documents available on the service have already been drafted to meet individual state requirements by licensed legal professionals.

If you already have a US Legal Forms subscription, just log in, search for the form, press Download and get access to your Form name in the My Forms; the My Forms tab keeps your downloaded forms.

Stick to the guidelines listed below to get the form:

- Once you discover a Form name, ensure it’s the one for the state you need it to file in.

- Preview the form and read the document description just before downloading the template.

- Search for a new template via the Search engine in case the one you’ve already found is not appropriate.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

Once you’ve downloaded your Form name, you can edit it, fill it out and sign it with an web-based editor that you pick. Any document you add to your My Forms tab can be reused multiple times, or for as long as it remains to be the most updated version in your state. Our service provides quick and easy access to templates that fit both legal professionals as well as their clients.

Form popularity

FAQ

An LLC can achieve pass-through taxation status without any of those restrictions. LLCs also offer more income tax choices in how you are taxed. By default, LLCs enjoy pass-through taxation under IRS rules. However, by making an IRS election, you could have your LLC taxed as a C corporation or an S Corporation.

LLC owners must pay self-employment taxes for all income. S-corp owners may pay less on this tax, provided they pay themselves a "reasonable salary." LLCs can have an unlimited number of members, while S-corps are limited to 100 shareholders.

In an LLC, individuals with an ownership share are called members. In a corporation, they are called shareholders. One of the advantages an LLC has over a corporation is that in many states, a creditor cannot collect a member's dividends, whereas in a corporation dividends can be collected from shareholders.

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

Probably the most obvious advantage to forming an LLC is protecting your personal assets by limiting the liability to the resources of the business itself. In most cases, the LLC will protect your personal assets from claims against the business, including lawsuits.There is also the tax benefit to an LLC.

A limited liability company (LLC) is not a separate tax entity like a corporation; instead, it is what the IRS calls a "pass-through entity," like a partnership or sole proprietorship.The LLC itself does not pay federal income taxes, although some states impose an annual tax on LLCs.

Because distributions are taxed at both the corporate and the shareholder level, C corporations and their shareholders often end up paying more in taxes than S corporations or LLCs.