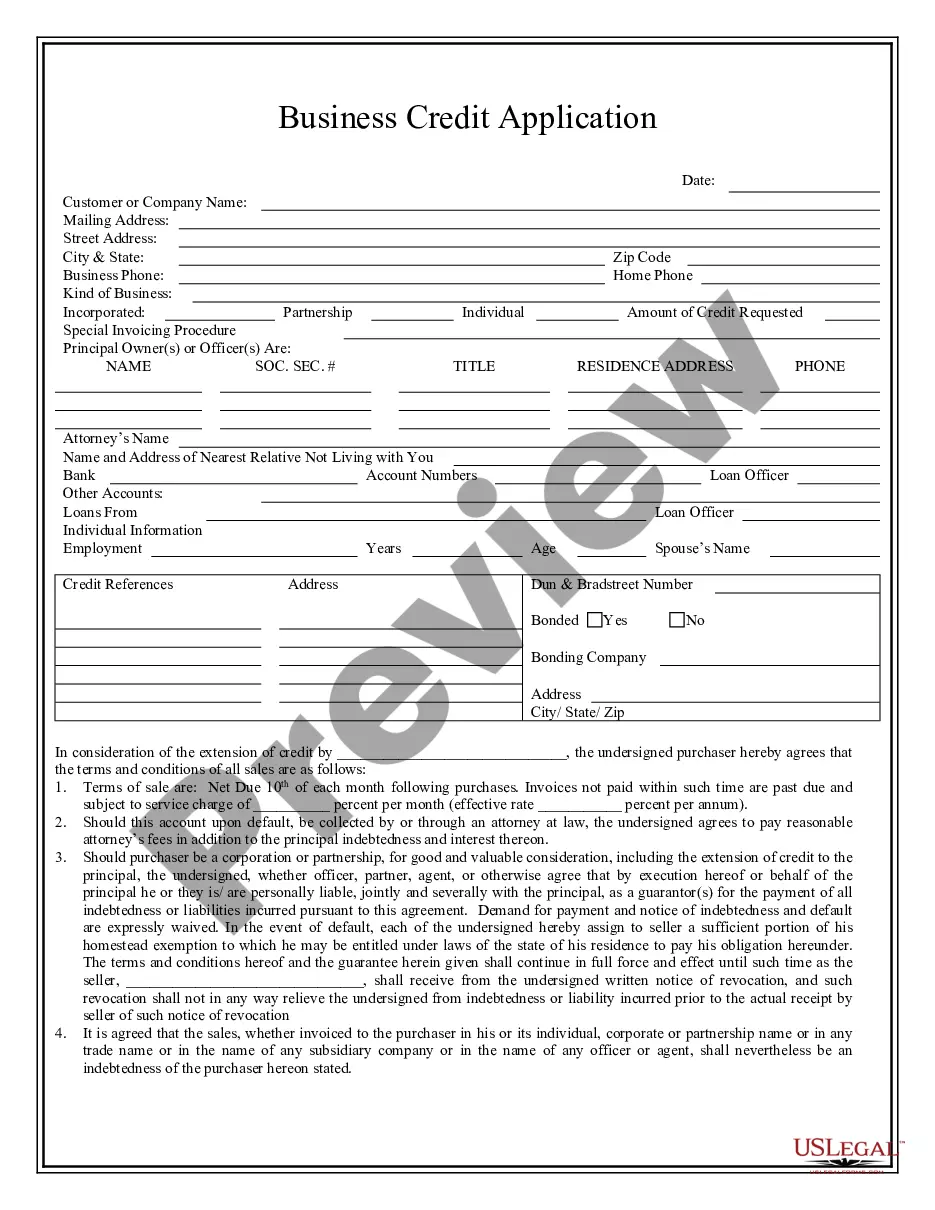

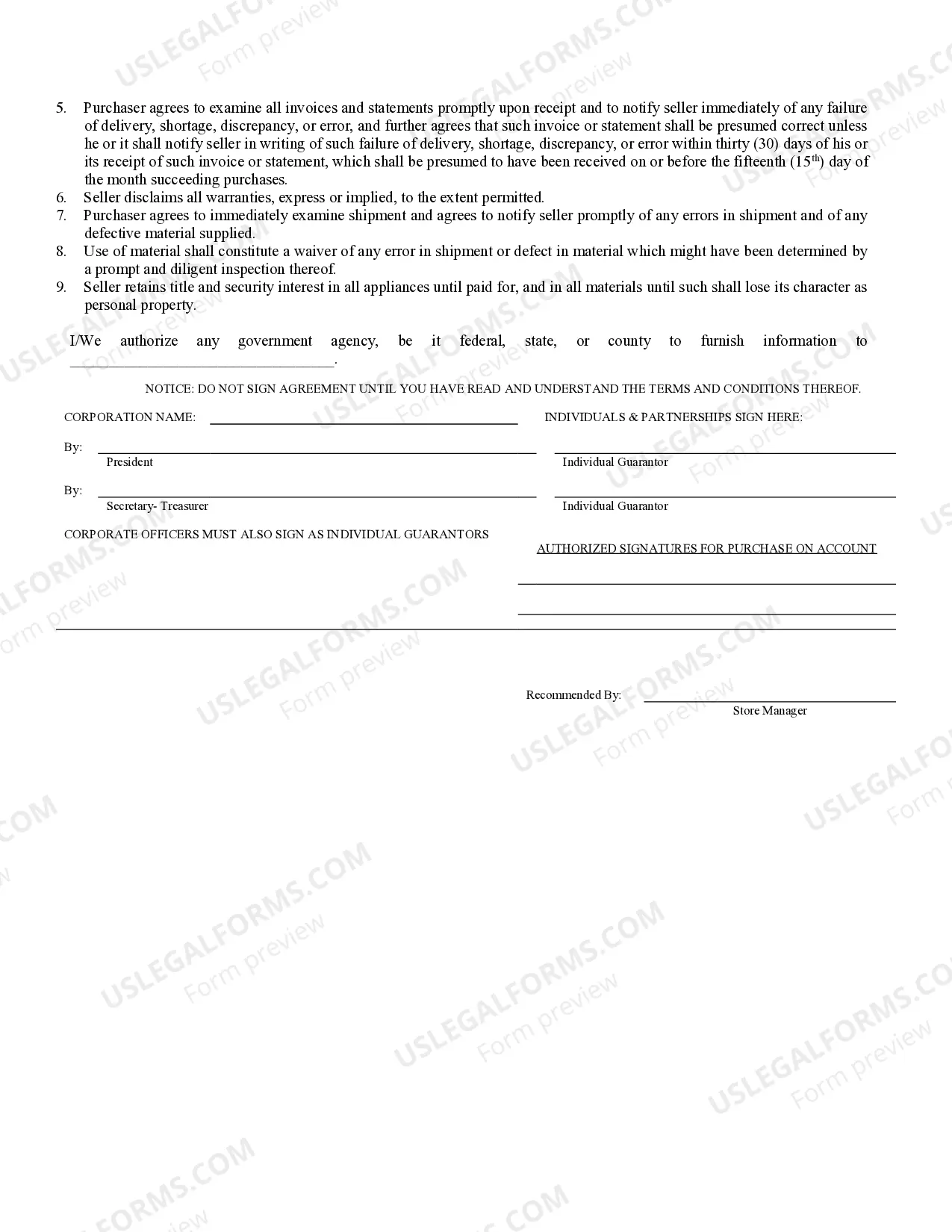

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Wisconsin Business Credit Application

Description

How to fill out Wisconsin Business Credit Application?

Out of the large number of platforms that offer legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing forms before buying them. Its complete catalogue of 85,000 templates is categorized by state and use for efficiency. All of the documents on the platform have been drafted to meet individual state requirements by qualified lawyers.

If you already have a US Legal Forms subscription, just log in, search for the form, click Download and access your Form name from the My Forms; the My Forms tab holds all of your saved forms.

Stick to the tips listed below to get the document:

- Once you discover a Form name, make sure it is the one for the state you really need it to file in.

- Preview the form and read the document description prior to downloading the template.

- Search for a new template using the Search field if the one you’ve already found is not proper.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

When you have downloaded your Form name, you are able to edit it, fill it out and sign it with an online editor of your choice. Any form you add to your My Forms tab might be reused multiple times, or for as long as it remains to be the most updated version in your state. Our platform provides fast and easy access to templates that suit both legal professionals and their clients.

Form popularity

FAQ

The Lottery and Gaming Credit is a credit that provides direct property tax relief to qualifying taxpayers on their property tax bills. Lottery proceeds are paid into a separate segregated state fund. The lottery credit is displayed on tax bills as a reduction of property taxes due.

A simple Credit Account Application Form can be used to obtain information, and to set out, on the reverse, the supplier's Terms of Trading. By signing the completed Form, the customer provides the information and agrees the Terms.

Customer's Name. Customer's Address and Telephone Number. Customer's Employer Identification Number (EIN) Customer's Bank Information and Credit References. Guarantor's Name, Address, Telephone, Social Security Number, Etc. Signature Line. Interest and Attorney's Fees. Confirm that the Customer's Name is Correct.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.These reports and business credit scores are used to decide not only if your business should be approved, but also what the terms of the loan or credit line will be if approved.

A credit application is an application filed by a prospective borrower and submitted to a credit lender. A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.If your business is not listed with any of the business credit reporting agencies then a lender will only have personal credit reports to assess credit risk.

Incorporate your business. Obtain a federal tax identification number (EIN). Open a business bank account. Establish a business phone number. Open a business credit file. Obtain business credit card(s). Establish a line of credit with vendors or suppliers.

Legal business name. Business address. Type of business. Business phone number. Tax identification number. Annual business revenue. Years in business. Monthly business expenses.