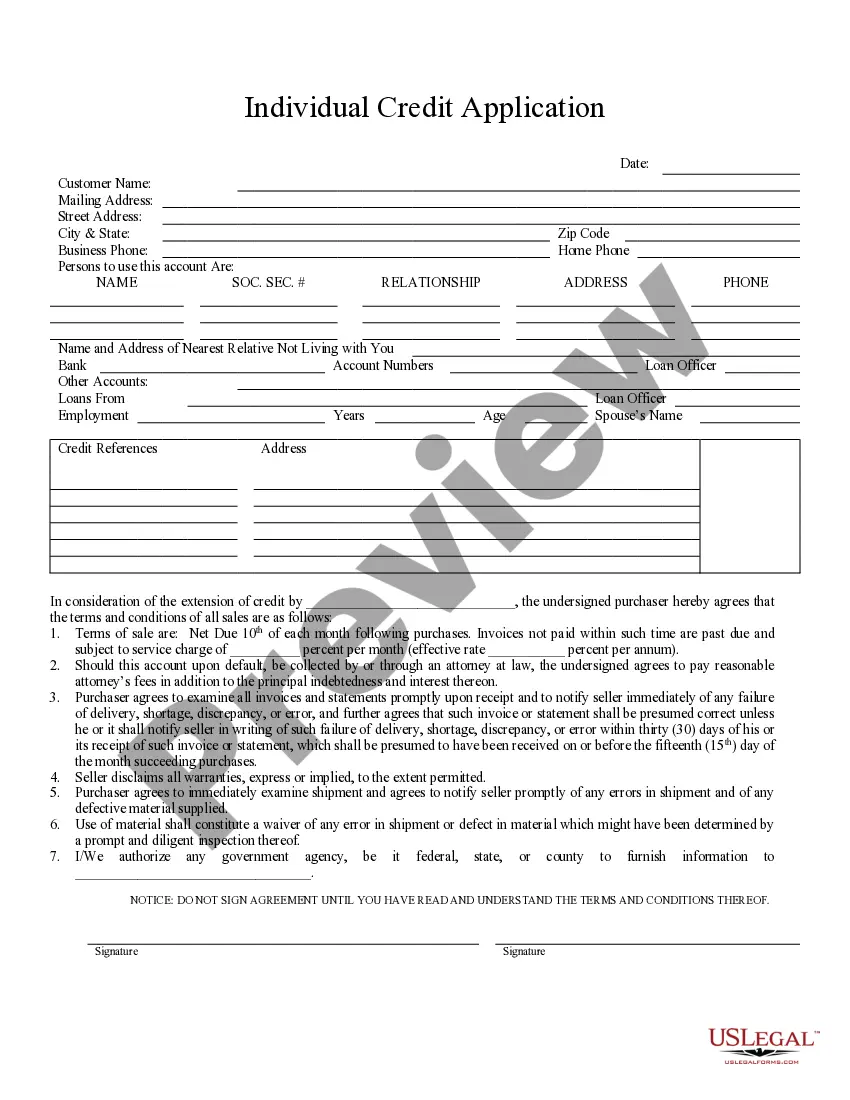

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Wisconsin Individual Credit Application

Description

How to fill out Wisconsin Individual Credit Application?

Out of the large number of services that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms before buying them. Its extensive library of 85,000 templates is grouped by state and use for efficiency. All of the forms available on the service have already been drafted to meet individual state requirements by accredited legal professionals.

If you have a US Legal Forms subscription, just log in, look for the template, hit Download and access your Form name from the My Forms; the My Forms tab keeps your downloaded forms.

Stick to the tips listed below to get the form:

- Once you discover a Form name, make certain it is the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the template.

- Search for a new template via the Search field if the one you have already found is not appropriate.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the template.

Once you’ve downloaded your Form name, it is possible to edit it, fill it out and sign it in an web-based editor of your choice. Any document you add to your My Forms tab can be reused multiple times, or for as long as it continues to be the most up-to-date version in your state. Our service provides easy and fast access to templates that suit both legal professionals as well as their clients.

Form popularity

FAQ

If you have a Wisconsin income tax filing requirement, you may use WI e-file to electronically file your 2020 Wisconsin income tax return and homestead credit claim together. Select Form 1 on the WI e-file selection page and then select Schedule H.

To qualify for homestead credit for 2020 you must meet the following requirements: You are a legal resident of Wisconsin for all of 2020, from January 1 through December 31. You are 18 years of age or older on December 31, 2020. You have less than $24,680 in household income for 2020.

The Lottery and Gaming Credit is a credit that provides direct property tax relief to qualifying taxpayers on their property tax bills. Lottery proceeds are paid into a separate segregated state fund. The lottery credit is displayed on tax bills as a reduction of property taxes due.

If you have a Wisconsin income tax filing requirement, you may use WI e-file to electronically file your 2020 Wisconsin income tax return and homestead credit claim together. Select Form 1 on the WI e-file selection page and then select Schedule H.

The credit value is $17,000 for the 2018-19 property tax year. If the market value of a qualifying owner's home is more than the credit value, a full credit is paid. If the market value is less than the credit value, the credit is paid on the actual value. The average credit for 2018-19 is $160.

The Wisconsin homestead exemption allows a debtor to exempt as much as $75,000 of equity in a homestead that the debtor occupies. If a person owns a $275,000 homestead and has a $200,000 mortgage, then $75,000 of equity in the homestead is fully exempt.

To qualify for homestead credit for 2020 you must meet the following requirements: You are a legal resident of Wisconsin for all of 2020, from January 1 through December 31. You are 18 years of age or older on December 31, 2020. You have less than $24,680 in household income for 2020.

You may be able to claim homestead credit if: You occupied and owned or rented a home, apartment, or other dwelling that is subject to Wisconsin property taxes during 2020. You are a legal resident of Wisconsin for all of 2020. You are 18 years of age or older on December 31, 2020.

You may be able to claim homestead credit if: You occupied and owned or rented a home, apartment, or other dwelling that is subject to Wisconsin property taxes during 2020. You are a legal resident of Wisconsin for all of 2020.o You (or your spouse, if married) are 62 years of age or older at the end of 2020.