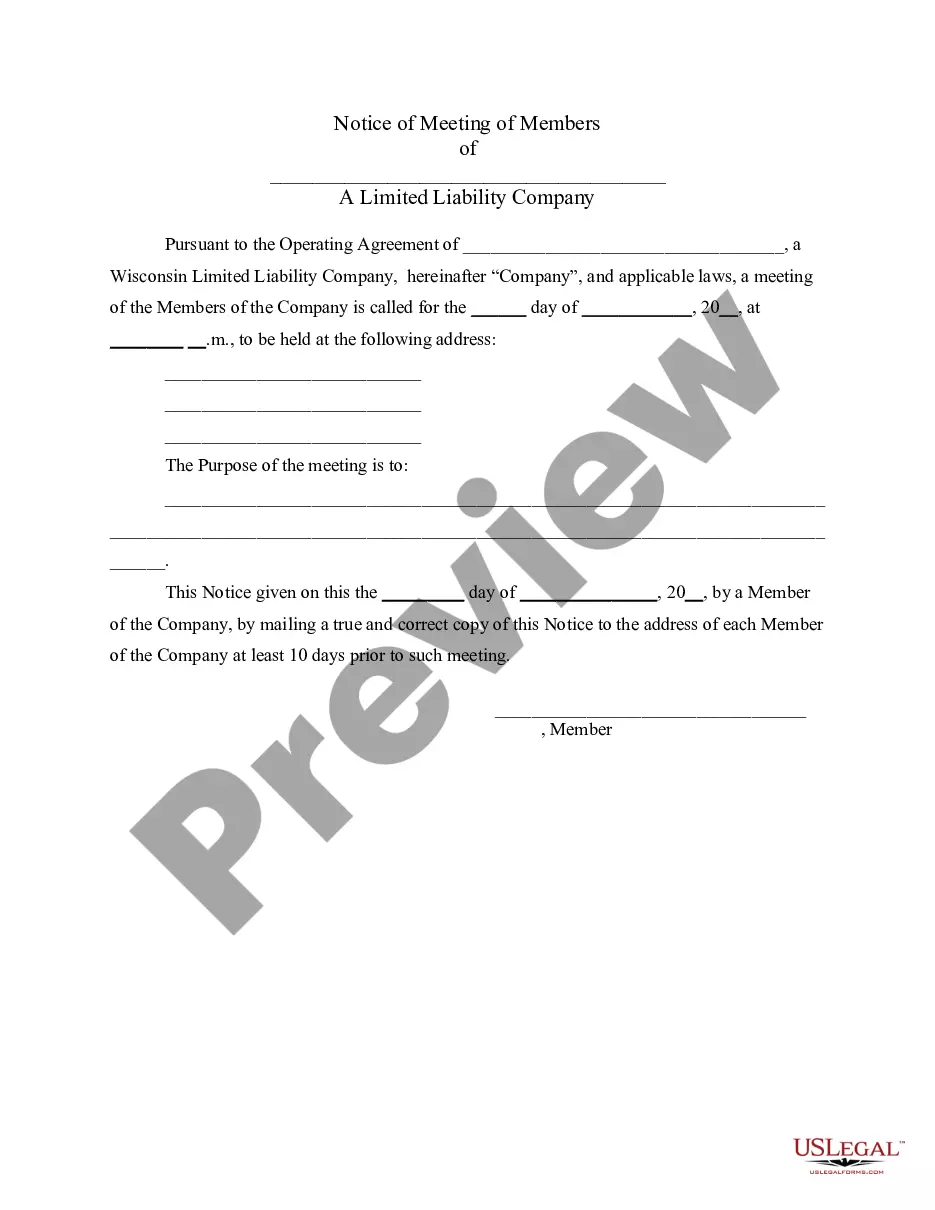

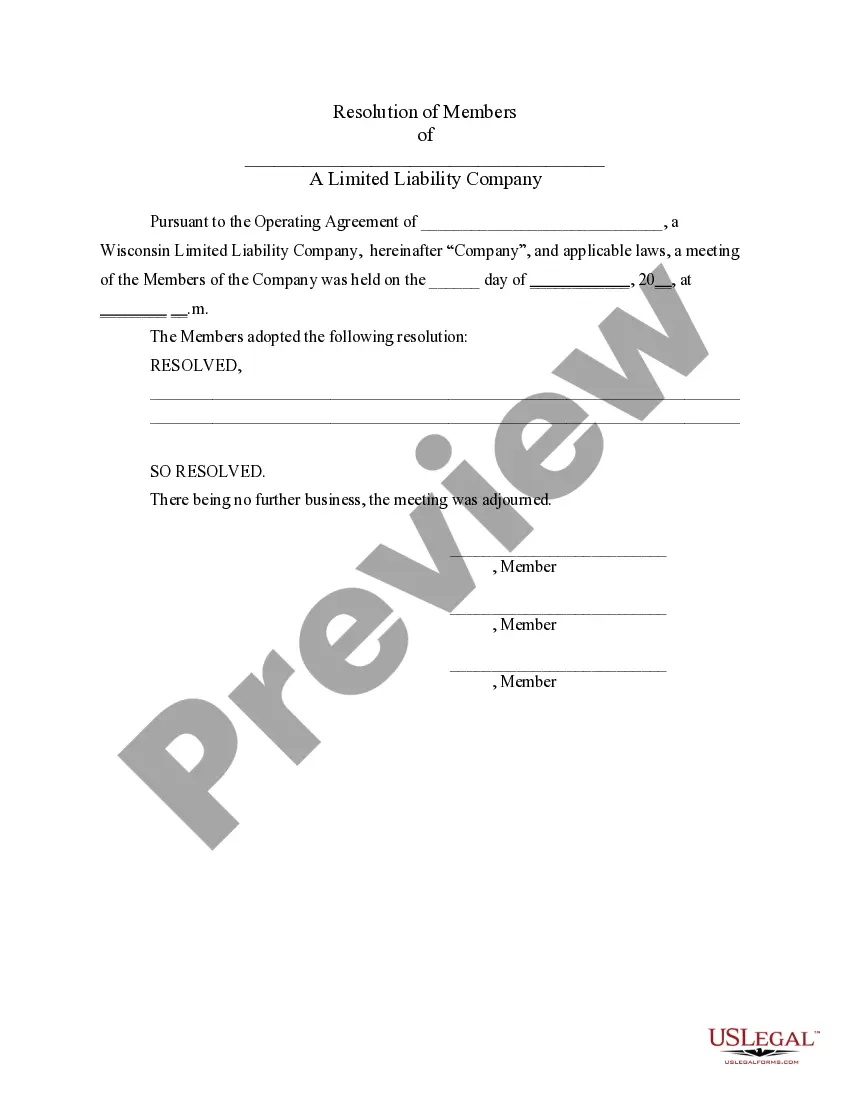

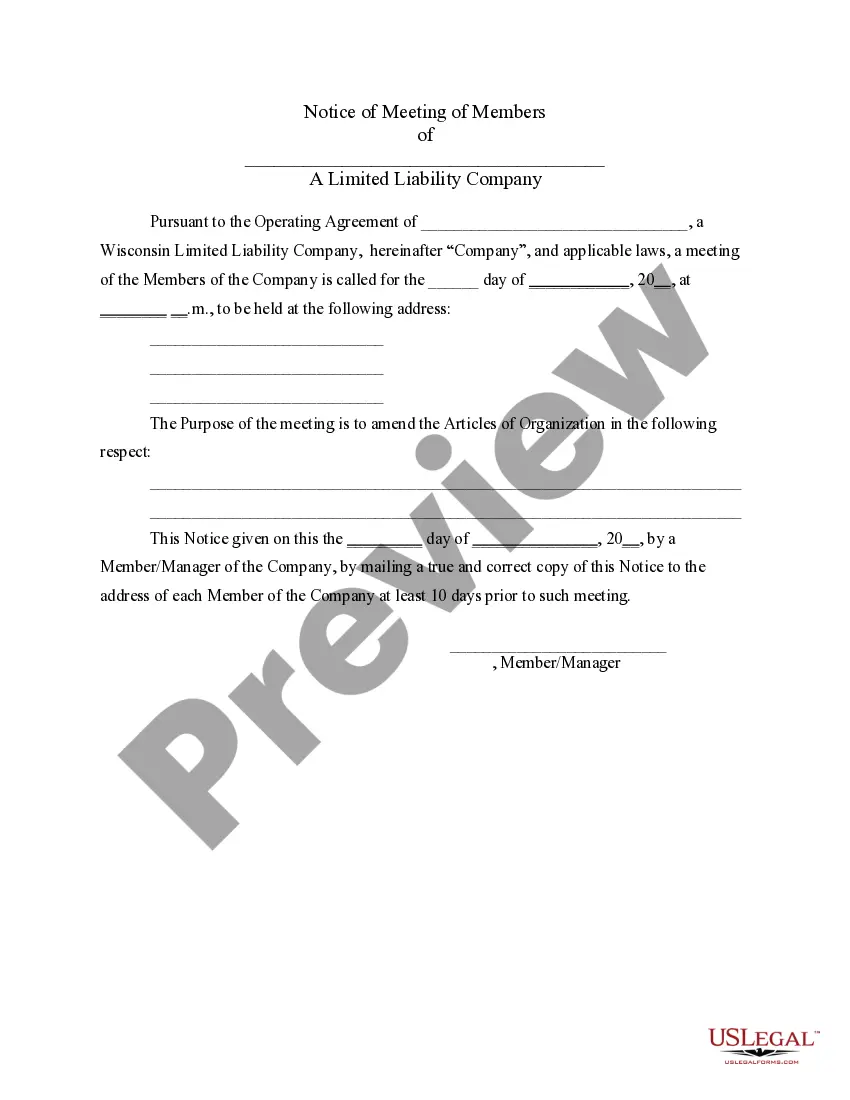

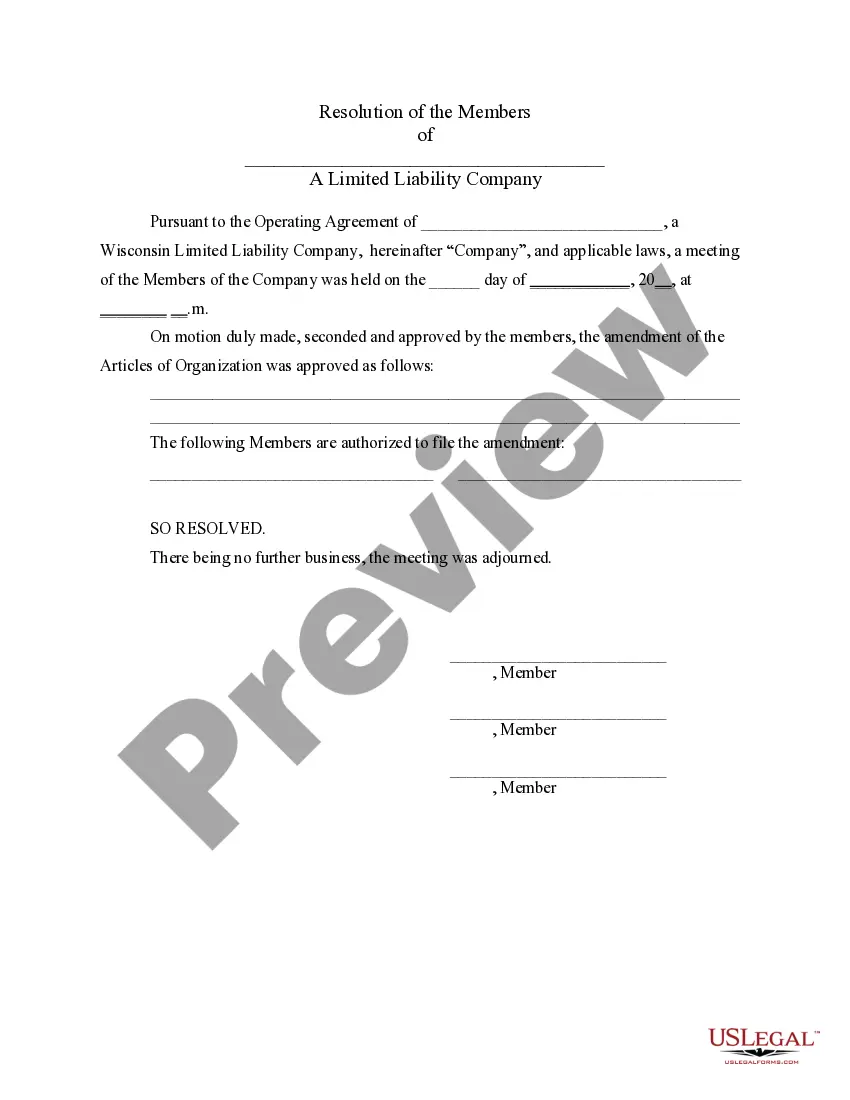

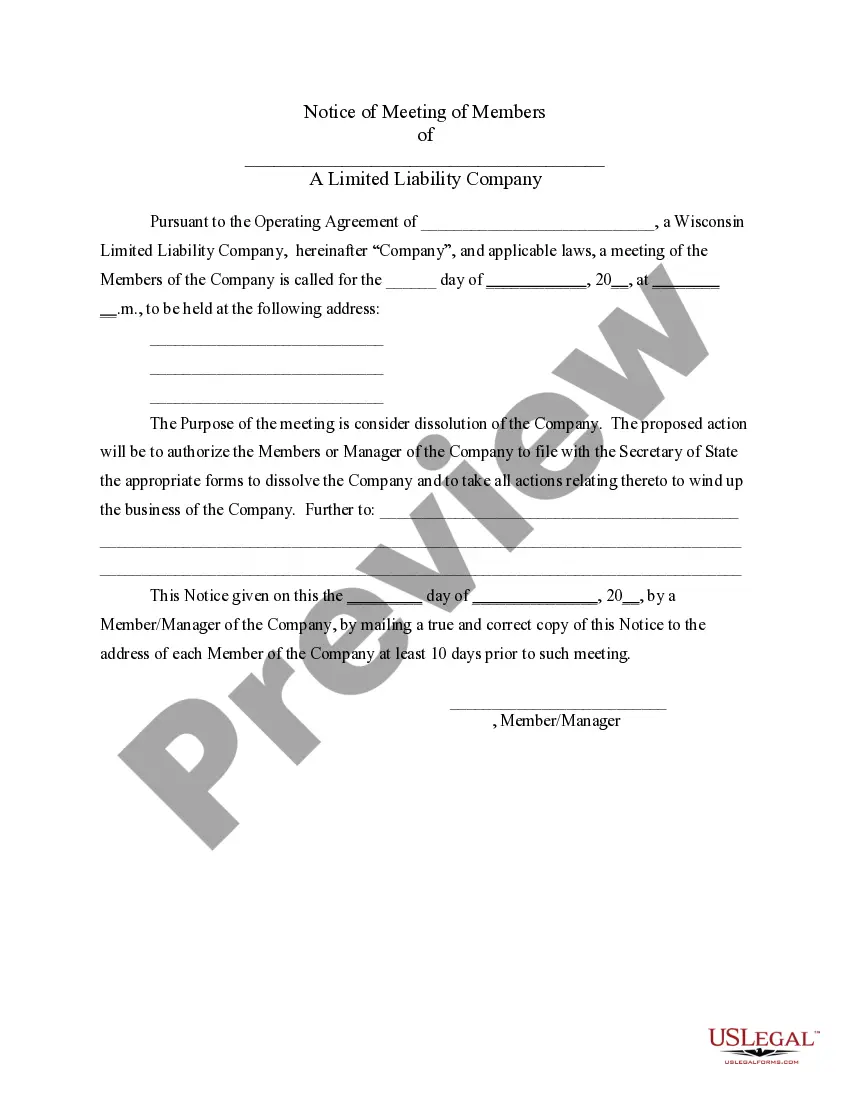

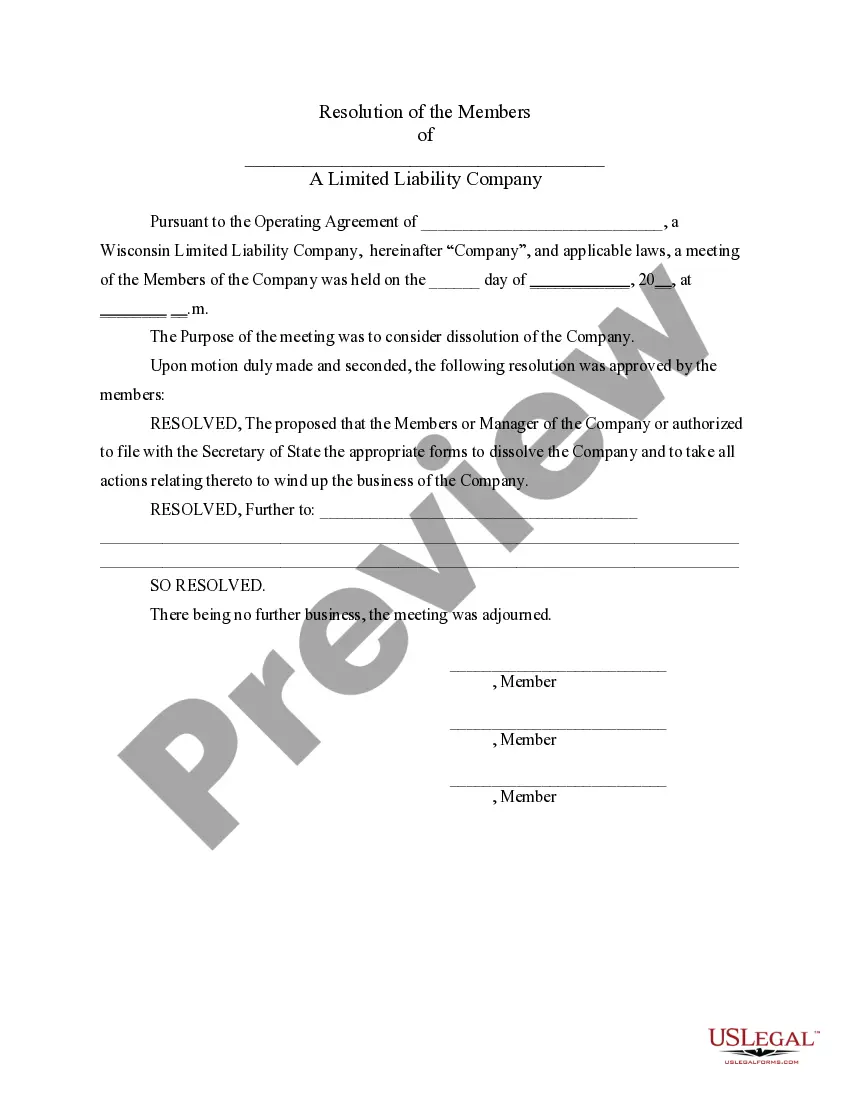

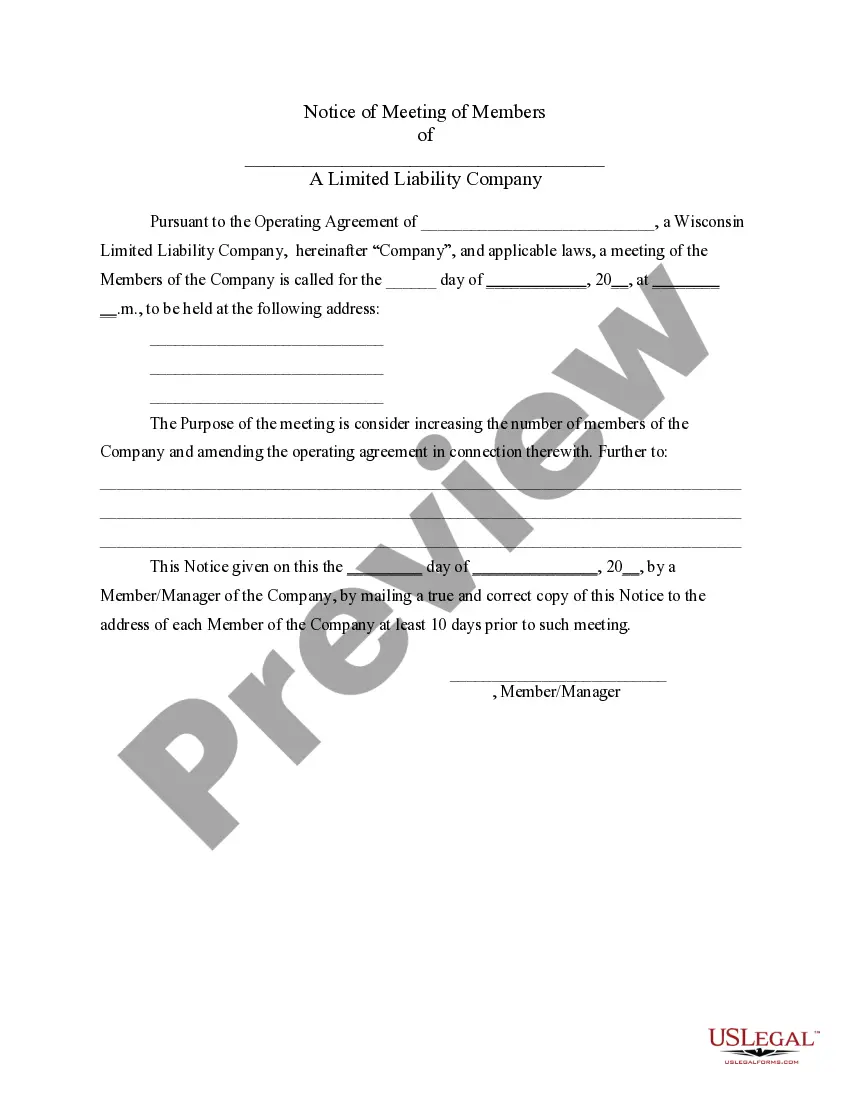

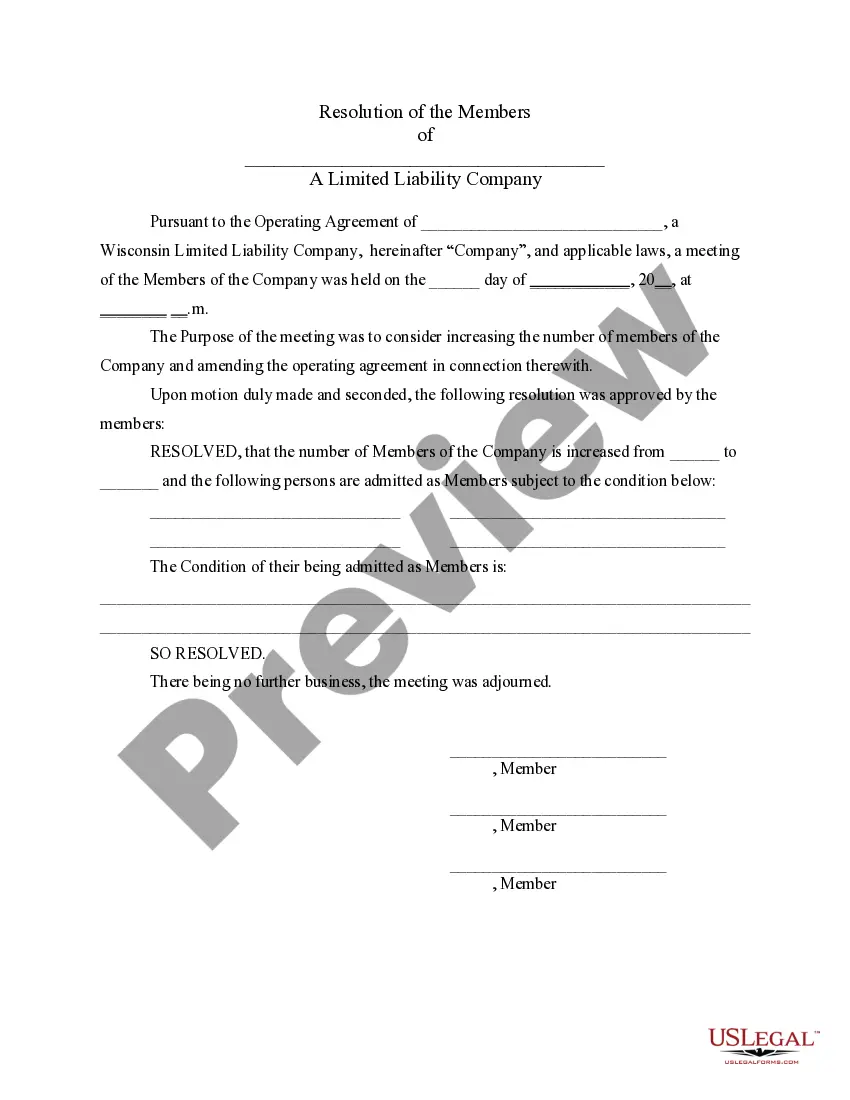

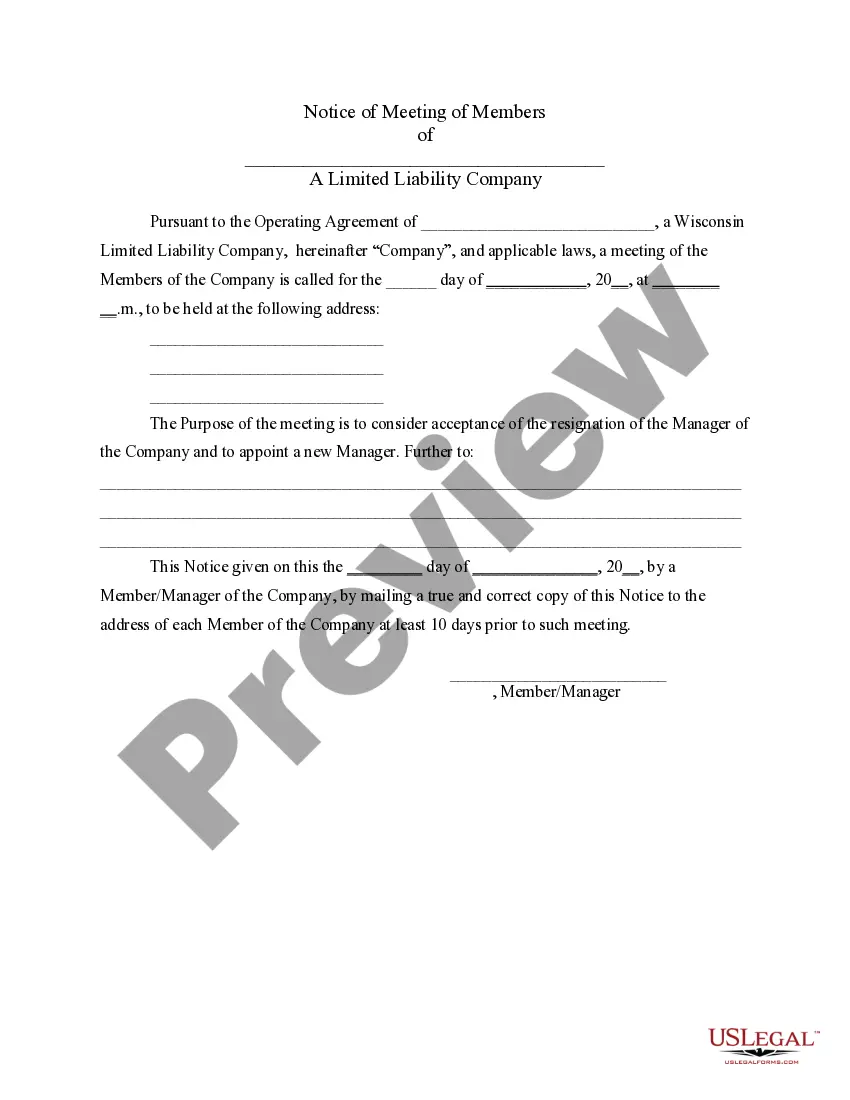

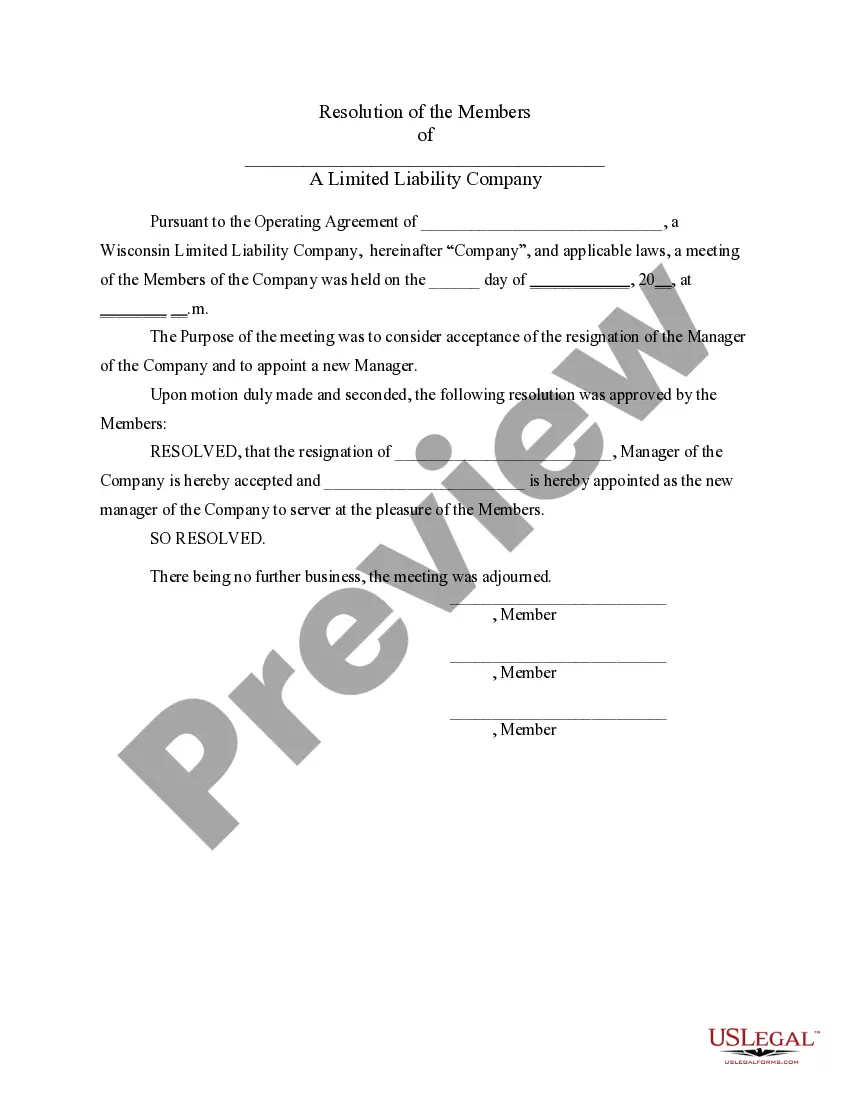

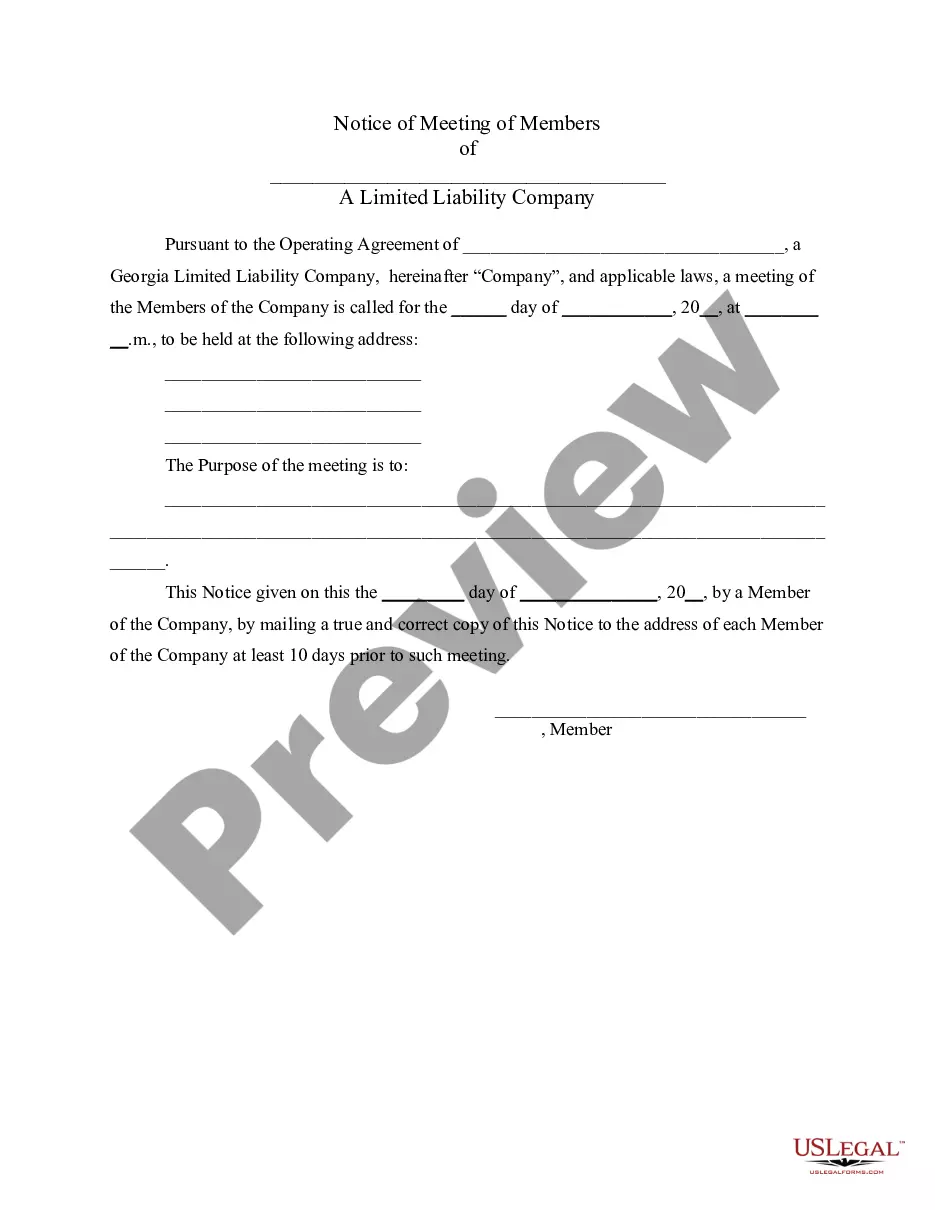

This LLC Notices, Resolutions and other Operations Forms Package contains over 15 forms for use in connection with the operation of a LLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, (16) Demand for Indemnity by Member/Manager and (17) Application for Tax Identification Number.

Wisconsin LLC Notices, Resolutions and other Operations Forms Package

Description Wisconsin Llc Forms

How to fill out Llc Forms Pack?

Out of the large number of services that provide legal templates, US Legal Forms provides the most user-friendly experience and customer journey when previewing forms before purchasing them. Its complete catalogue of 85,000 samples is categorized by state and use for simplicity. All the documents available on the platform have been drafted to meet individual state requirements by licensed legal professionals.

If you have a US Legal Forms subscription, just log in, look for the template, hit Download and get access to your Form name in the My Forms; the My Forms tab holds all your downloaded documents.

Stick to the guidelines listed below to obtain the document:

- Once you discover a Form name, make certain it’s the one for the state you really need it to file in.

- Preview the form and read the document description before downloading the template.

- Search for a new sample via the Search engine in case the one you have already found is not appropriate.

- Click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

When you’ve downloaded your Form name, you can edit it, fill it out and sign it in an online editor of your choice. Any document you add to your My Forms tab might be reused multiple times, or for as long as it remains the most up-to-date version in your state. Our service provides quick and easy access to samples that suit both lawyers as well as their customers.

Wi Llc Other Form popularity

Dissolution Of Llc Wisconsin Other Form Names

Wisconsin Llc Resolutions FAQ

No, you do not need an attorney to form an LLC. You can prepare the legal paperwork and file it yourself, or use a professional business formation service, such as .In all states, only one person is needed to form an LLC.

How much does it cost to form an LLC in Wisconsin? The Wisconsin Department of Financial Institutions charges a $170 fee to file the Articles of Organization by mail and $130 to file online.

STEP 1: Name your Wisconsin LLC. STEP 2: Choose a Registered Agent in Wisconsin. STEP 3: File the Wisconsin LLC Articles of Organization. STEP 4: Create a Wisconsin LLC Operating Agreement. STEP 5: Get a Wisconsin LLC EIN.

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

The least expensive way to form your LLC is filing the forms yourself, although it will depend on the filing fees in your state. Incorporation statements for LLCs are typically the Articles of Organization.

Sole proprietors can incorporate themselves, and there are a number of benefits to doing so.When you learn how to incorporate yourself, it becomes easier to manage income, separate your personal income from business income, and legally distance yourself from the corporation, making tax time less of an issue.

Time to process your corporation or LLC formation varies by state with routine processing taking 4 - 6 weeks or even more in the slowest states. Expedited Processing will reduce that time to about 10 business days or less with the exception of just a few states.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.